|

查看: 19151|回复: 184

|

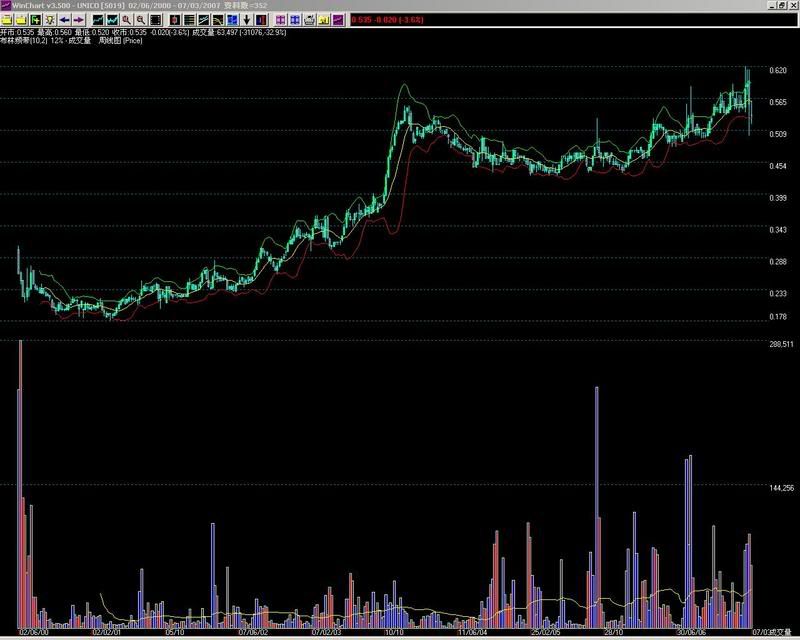

【UNICO 5019 交流专区】商联帝沙种植

[复制链接]

|

|

|

本帖最后由 icy97 于 11-5-2012 01:31 AM 编辑

我越来越看好这支股,不知道各位对他有何高见?

之前不杀兄也大力推荐过

[ 本帖最后由 Mr.Business 于 5-12-2007 01:58 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-3-2007 06:43 AM

|

显示全部楼层

SummaryUnico-Desa Plantations Berhad is engaged in the cultivation of oil palm, palm oil milling and distribution of crude palm oil and palm kernel. The Company is organized into two main business segments: Plantations, which is engaged in the cultivation of oil palm, palm oil milling and distribution of palm oil and palm kernel, and Hire purchase financing and related activities, which includes hire purchase financing for motor vehicles and insurance agency. Other operations of the Company include investment holding. As of March 9, 2007, Unico Holdings Berhad held 29.27% in the Company

Key Stats & Ratios | Quarterly

(Dec '06) | Annual

(2006) | Annual

(TTM) | | Net Profit Margin | 18.64% | 16.43% | 13.68% | | Operating Margin | 28.02% | 23.32% | 20.32% | | EBITD Margin | - | 27.44% | 23.81% | | Return on Average Assets | 8.43% | 5.83% | 5.30% | | Return on Average Equity | 12.68% | 7.80% | 7.67% | | Employees | 1,952 | - | - |

[ 本帖最后由 Tricky 于 21-3-2007 06:57 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-3-2007 06:44 AM

|

显示全部楼层

13-Mar-07

Investment Research - Plantation Sector - 13-Mar-07

Fllat Feb 07 inventory – lower production and exports Unchanged inventory level and sustained high CPO prices: Despite lower exports (-15.3% mom, -13.6% yoy), Malaysia’s Feb-07 palm oil inventory was relatively unchanged at 1.48m mt (+0.2% mom, -10.2% yoy) – a result of lower productions. Meanwhile, CPO prices have sustained at an average of RM1,920/mt, supported by strong local demand and lower productions (-11.4% mom, -6% yoy). YTD local CPO demand is strong, averaging 180k mt/month from 130k mt/month in 2006. With the commissioning of the first wave of biodiesel plants in mid-07, we expect local demand of palm oil to grow to 200k mt/month for 2007. Weaker production on shorter month and Chinese New Year holidays: Malaysia’s Feb-07 palm oil production was weak at 0.99m mt (FFB yield was 1.28mt/Ha) due to the shorter month of February and Chinese New Year festive holidays, which fell in Feb for 2007 against Jan in 2006. YTD, palm oil production was however upped by a moderate +5.8% yoy to 2.1m mt due partly to the low base effect. Nonetheless, compared to the first 2 months of 2005, YTD-07 palm oil production was lower by 4.4%. Lower exports due to high CPO prices: Feb-07 palm oil exports declined by 15.3% mom, -13.6% yoy to 0.81m mt due to the sustained high CPO price. While exports to China were notably lower at 227k mt (-17% mom, +18.9% yoy), we believe this is temporary, as the decline in exports was largely due to the Chinese New Year holidays. Elsewhere, most of the other major palm oil importers also imported less, with the exception of US, which imported 90k mt of palm oil (>+100% mom/yoy). Exports are to pick up as palm oil is still the cheaper choice: We remain positive on the plantation sector, as we believe the decline in exports is temporary. We expect exports to pick up over the next few months, as palm oil is still a cheaper choice among competing vegetable oils. In the tight edible oil market, prices of most major edible oils had risen in tandem - 36% increment for palm oil, soybean oil +34%, sunflower oil +20%, tallow +30% and rapeseed oil +8%. Maintain OVERWEIGHT on the plantation sector:: We are maintaining our CY07 average CPO price projection of RM1,950/mt (+28% yoy) and OVERWEIGHT stance on the plantation sector. Our top pick for the sector is Asiatic Plantation (BUY, TP RM5.70). Unico-Desa is also a BUY with target price RM0.79. For big cap exposure, we now prefer IOI Corp (ADD, TP RM20.20) to KL Kepong (ADD, TP RM10.90) as valuation of KL Kepong has caught up with that of IOI Corp’s. We maintain our view that IOI Corp will continue a valuation premium for its efficient plantation management. Meanwhile, we are upgrading PPB Oil to an ADD (TPRM12.10) following the recent correction in its share price. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-3-2007 06:51 AM

|

显示全部楼层

| | | Prev | Open | High | Low | Last | Change | % chg | Volume | | | 0.555 | 0.555 | 0.555 | 0.54 | 0.545 | -0.01 | -1.80 | 11053 |

[td=1,1,1] | |

Bullish CPO price forecasts

By Zaidi Isham Ismail

zydee@nsp.com.my

March 15 2007

2007 PALM AND LAURIC OILS CONFERENCE AND EXHIBITION

CRUDE palm oil (CPO) prices are expected to average between RM2,000 and RM2,200 a tonne this year against an average of RM1,510 last year, some of the industry's most influential figures said.

Their bullish projections came amid continued robust demand from the food, oleochemical and biodiesel industries as well as a possible La Nina weather condition, which will be advantageous for CPO prices. Their bullish projections came amid continued robust demand from the food, oleochemical and biodiesel industries as well as a possible La Nina weather condition, which will be advantageous for CPO prices.

At the conclusion of the annual 2007 Palm and Lauric Oils Conference & Exhibition in Kuala Lumpur yesterday, eight industry players consisting of producers and consumers agreed that

CPO prices will at least average at RM2,100 a tonne in 2007.

"Provided there are no sudden weather disruptions, strong biodiesel demand of 10 million tonnes by 2010 and friendly government policies, CPO prices may touch RM2,250 by year-end," said Thomas Mielke director of Hamburg-based Oil World magazine.

Others sharing similar bullish projections were Cognis Deutschland GmbH & Co's Harald Sauthoff, United Plantations Bhd's vice-chairman Carl Bek-Nielsen, Frost & Sullivan's Chris de Lavigne and FPG Oleochemical's Martin Herrington, LMC International Ltd's Dr James Fry, China National Cereals, Oils and Foodstuffs Corp's Xu Xiaochun and Godrej International Ltd's Dorab Mistry.

The panel discussion was chaired by Malaysian Palm Oil Council chief executive officer Tan Sri Dr Yusof Basiron.

Dorab was even more bullish predicting CPO prices to hit RM2,400 a tonne by year-end depending on the extent of how far South American farmers switch from soyabean to corn to make the more lucrative biofuel, ethanol.

|

[ 本帖最后由 Tricky 于 21-3-2007 07:07 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-3-2007 07:26 AM

|

显示全部楼层

发表于 21-3-2007 07:26 AM

|

显示全部楼层

该股这6年来都不断的往上爬,创造了不少的新高。

是一个不错长期投资的老人股。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-3-2007 08:17 AM

|

显示全部楼层

发表于 21-3-2007 08:17 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 21-3-2007 08:25 AM

|

显示全部楼层

发表于 21-3-2007 08:25 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 21-3-2007 08:44 AM

|

显示全部楼层

发表于 21-3-2007 08:44 AM

|

显示全部楼层

原帖由 colorwind 于 21-3-2007 08:25 AM 发表

但,最近的它很静吧! |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-3-2007 09:26 AM

|

显示全部楼层

发表于 21-3-2007 09:26 AM

|

显示全部楼层

慢慢爬,总好过那些跌跌起起的。。

放着长期投资。。。应该不错 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-3-2007 10:31 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 21-3-2007 08:37 PM

|

显示全部楼层

发表于 21-3-2007 08:37 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 21-3-2007 08:50 PM

|

显示全部楼层

发表于 21-3-2007 08:50 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 22-3-2007 12:11 AM

|

显示全部楼层

发表于 22-3-2007 12:11 AM

|

显示全部楼层

|

稳 定 股, 可 以 长 期 持 有, dividend 高。 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 27-3-2007 02:41 PM

|

显示全部楼层

这几天买盘多了,volume也多了。。。。

应该是年报要出了?3月31 |

|

|

|

|

|

|

|

|

|

|

|

发表于 27-3-2007 03:34 PM

|

显示全部楼层

发表于 27-3-2007 03:34 PM

|

显示全部楼层

Unico有建议分库存股

General Announcement

Reference No UP-070316-4EF41

Company Name : UNICO-DESA PLANTATIONS BERHAD

Stock Name : UNICO

Date Announced : 16/03/2007

Type : Announcement

Subject : PROPOSED DISTRIBUTION OF ONE (1) TREASURY SHARE FOR EVERY FIFTEEN (15) EXISTING ORDINARY SHARES OF RM0.25 EACH HELD IN UNICO-DESA PLANTATIONS BERHAD ("SHARE DIVIDEND")

Contents :

The Board of Directors of Unico-Desa Plantations Berhad is pleased to declare a distribution of One (1) Treasury Share for every Fifteen (15) existing ordinary shares of RM0.25 each held in the Company in respect of financial year ending 31 March 2007 subject to the approval of Bursa Malaysia Depository Sdn Bhd. Any fractions arising thereof will be disregarded.

The date of Book Closure and Entitlement Date will be announced later. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 27-3-2007 03:42 PM

|

显示全部楼层

原帖由 hezhudao 于 27-3-2007 03:34 PM 发表

Unico有建议分库存股

General Announcement

Reference No UP-070316-4EF41

Company Name : UNICO-DESA PLANTATIONS BERHAD

Stock Name : UNICO

Date Announced : 16/03/2007

Type : Announ ...

什么是库存股呢?和普通的股息有什么不同? |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 28-3-2007 05:20 PM

|

显示全部楼层

想知道unico是不是今天给divident?我从质料上看到的

[ 本帖最后由 Tricky 于 28-3-2007 05:29 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 28-3-2007 06:14 PM

|

显示全部楼层

发表于 28-3-2007 06:14 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 28-3-2007 07:20 PM

|

显示全部楼层

|

那编写paid on 28March,应该是已经收到对吗? |

|

|

|

|

|

|

|

|

|

|

|

发表于 1-4-2007 01:09 AM

|

显示全部楼层

发表于 1-4-2007 01:09 AM

|

显示全部楼层

原帖由 Tricky 于 21-3-2007 06:42 AM 发表

我越来越看好这支股,不知道各位对他有何高见?

之前不杀兄也大力推荐过

请问上图资料是那里得到的? |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|