|

|

大众远东产业及旅游业基金(PFEPRF)的前景!(英文版)

[复制链接]

|

|

|

楼主 |

发表于 20-7-2007 01:32 AM

|

显示全部楼层

Fund Benchmark

The benchmark of the fund is the Public Far-East Property Index (PFEPX). It is the Dow Jones Asia Pacific Real Estate Sector Index customised to the following weights:

20% Japan

20% Australia

20% Malaysia

40% for the rest of the countries within the index universe currently including:

-25.0% Hong Kong

-10.8% Singapore

-1.4% Taiwan

-1.0% Philippines

-0.7% Thailand

- 0.6% New Zealand

-0.5% Indonesia

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:33 AM

|

显示全部楼层

Public Far-East Property Index Sector Index Weights (%)

Real Estate Holding & Development Companies | Real Estate Investment Trust (REITs) | | | | |

The benchmark index comprises 70% property stocks & 30% regional REITs. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:34 AM

|

显示全部楼层

Review of Benchmark Performance

Return (in %)

| | | | | | PFEPX

| | | | | |

REITS

| | | | | |

Property Stocks

| | | | | | KL Property Index

| | | | | | KL Comp Index

| | | | | | MSCI Far East xJP Index

| | | | | |

*31/12/06-31/05/07

^31/12/04-31/05/07 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:37 AM

|

显示全部楼层

Index: PFEPX vs REITS vs Property Stocks

Property Stocks: 1.93

PFEPX: 1.74

REIT: 1.36 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:39 AM

|

显示全部楼层

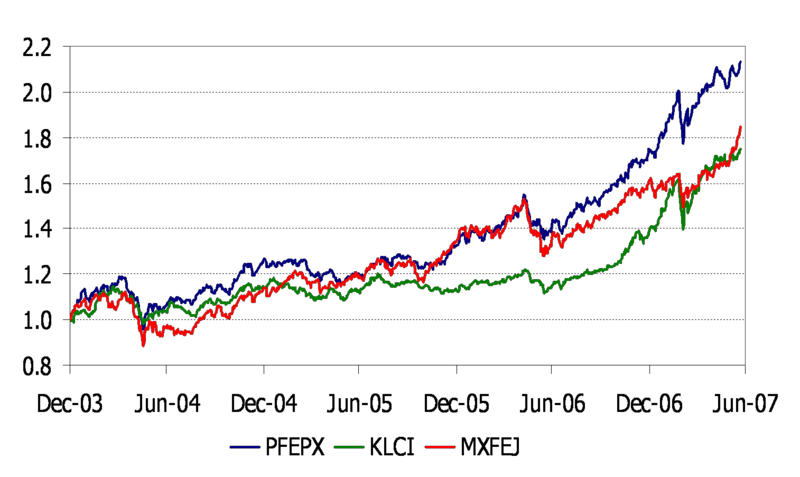

Index: PFEPX vs KLCI vs MXFEJ

PFEPX: 2.13

MXFEJ: 1.84

KLCI: 1.75

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:41 AM

|

显示全部楼层

Investment Strategy for PFEPRF

l The asset allocation of the Fund will be guided by the asset allocation of the benchmark index in terms of countries.

l The Fund Manager will:

Ø Overweight markets where the prospects or valuations are more attractive.

Ø Underweight markets where prospects or valuations are less attractive. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:43 AM

|

显示全部楼层

List of Major Property Stocks in Key Markets

| Stock

| Market

| Mkt. Cap.

(US$bil)

| P/E

(x)

| Dividend Yield

(%)

| 1

| China Vanke Co Ltd

| China

| 16.9

| 25.6

| 1.1

| 2

| Cheung Kong Hldgs Ltd

| Hong Kong

| 30.9

| 13.4

| 2.1

| 3

| Sun Hung Kai Properties

| Hong Kong

| 29.6

| 13.3

| 2.4

| 4

| Hang Lung Properties

| Hong Kong

| 15.1

| 37.9

| 1.8

| 5

| Guangzhou R&F Properties

| Hong Kong

|

9.5

| 23.4

| 1.3

| 6

| Mitsubishi Estate Co Ltd

| Japan

| 39.7

| 52.4

| 0.5

| 7

| Mitsui Fudosan Co Ltd

| Japan

| 26.0

| 34.7

| 0.5

| 8

| SP Setia Bhd

| Malaysia

|

1.8

| 25.6

| 3.1

| 9

| IGB Corporation Bhd

| Malaysia

|

1.2

| 30.6

| 0.9

| 10

| KLCC Property Hldgs Bhd

| Malaysia

|

1.0

| 19.4

| 2.7

|

Valuation as at 20th June 2007 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:45 AM

|

显示全部楼层

List of Major Property Stocks �in Key Markets (cont’d)

| Stock

| | | | | 11

| Ayala Land Inc

| | | | | 12

| Capitaland Ltd

| | | | | 13

| City Developments Ltd

| | | | | 14

| Keppel Land Ltd

| | | | | 15

| Central Pattana Public Co Ltd

| | | | | 16

| Cathay Real Estate Development

| | | | | 17

| Hyundai Development

| | | | |

Valuation as at 20th June 2007 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:48 AM

|

显示全部楼层

List of Major REITS listed in Key Markets

| Stock

| | | | | 1

| Westfield Group

| | | | | 2

| Stockland Corporation Ltd

| | | | | 3

| Macquarie Goodman Group

| | | | | 4

| Nippon Building Fund

| | | | | 5

| Japan Real Estate Corp

| | | | | 6

| Japan Retail Fund Corp

| | | | | 7

| Link REITS

| | | | | 8

| Champion REITS

| | | | |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:49 AM

|

显示全部楼层

List of Major REITS listed in Key Markets(cont’d)

| Stock

| | | | | 9

| Capitamall REITS

| | | | | 10

| Suntec REITS

| | | | | 11

| CapitaRetail REITS

| | | | | 12

| Starhill REITS

| | | | | 13

| Quill Capita Trust

| | | | | 14

| Axis REITS

| | | | | 15

| Hektar REITS

| | | | |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:50 AM

|

显示全部楼层

List of Major Hotels & Resorts Stocks listed in Key Markets

| Stock

| | | | | 1

| Shangri-La Asia Ltd

| | | | | 2

| Galaxy Entertainment

| | | | | 3

| Melco Intl Development

| | | | | 4

| E-Sun Holdings

| | | | | 5

| Genting Bhd

| | | | | 6

| Resorts World Bhd

| | | | | 7

| Genting International

| | | | | 8

| Mandarin Oriental Intl Ltd

| | | | | 9

| Banyan Tree Holdings Bhd

| | | | |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:51 AM

|

显示全部楼层

2. Summary of The Fund's Key Positive Points

a) New asset class

b) Diversified types of properties

c) Diversified markets

d) Ease of transaction

e) Dollar cost average entry into property investments |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:52 AM

|

显示全部楼层

Summary of Key Positive Point

a) New Asset Class: The Fund will enable investors to participate in Real Estate investments which are regarded as a new asset class in addition to stocks and bonds.

b&c) The Fund enables investors to participate in the long term appreciation of a diversified portfolio of property assets in selected Far East markets which is projected to see continued resilient economic growth.

d) Ease of transactions: Investment in the Fund provides greater liquidity than investing in real property assets. Also offers ease of disposal as compared to divestment of real property assets.

e) It is difficult to exercise Dollar Cost Averaging when investing in real properties in comparison to investing in a property fund.

[ 本帖最后由 Takumi 于 20-7-2007 01:54 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:57 AM

|

显示全部楼层

Comparison Of Investing In PFEPRF� vs Real Properties

| | | Diversified investment markets

| | | Diversified property portfolio

| | | Dollar Cost

Averaging

| | | Liquidity in disposal

| | |

Note: *Difficult to achieve with the exception of a large capital investment. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:58 AM

|

显示全部楼层

Dollar Cost Averaging Principle

l Given the strong rally in global and regional markets over the past few months, investors in equity funds should adopt a Dollar Cost Averaging Principle when investing in unit trusts.

l This approach involves investing a fixed amount on a regular basis to maximise the advantage of the averaging process.

l The regular investment amount will buy the investor less units when the market is up and more units when the market is down.

l Thus, the investor will be able to accumulate units at an average cost which is lower than the average NAV per unit over the same period.

Notes: For more information on the Dollar Cost Averaging Principle, please refer to the Fund prospectus.

[ 本帖最后由 Takumi 于 20-7-2007 02:02 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 02:04 AM

|

显示全部楼层

3. Appendix: Potential Investment Stocks

a) 17 Property Stocks

b) 5 Resorts Stocks

c) 15 REITS |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 02:07 AM

|

显示全部楼层

a) Property Stocks

1. China Vanke Co Ltd (China)

• China Vanke is the largest developer in China by sales volume. It is a national developer with more than 20 years of experience specialising in residential development and a brand name that is well recognised across the nation.

• China Vanke has reported more than 50% growth in net profit and an EPS CAGR of 50.54% over the past 3 years.

• China Vanke’s long-term growth is underpinned by its diversified land-bank of about 24.9 million square meters in 22 cities. The company also plans to acquire new project resources totalling approximate 10 million square meter in 2007.

2. Cheung Kong Hldgs Ltd (Hong Kong )

• Cheung Kong (Holdings) is the flagship of the Chueng Kong Group, the leading Hong Kong based multi-national conglomerate.

• Cheung Kong (Holdings) is one of the largest developers in Hong Kong of residential, commercial and industrial properties.

• The Cheung Kong Group operates in 55 countries and employs around 240,000 staffs worldwide.

• The Li family (headed by Mr Li Ka-shing), are the largest shareholders with 39.7% shareholding.

3. Sun Hung Kai Properties (Hong Kong)

• Sun Hung Kai Properties is one of the largest property companies in Hong Kong.

• It specialises in premium-quality residential and commercial projects for sale and investment

• Development projects in China will contribute to the Group’s long-term growth and market position, with an emphasis on landmark commercial and residential projects in selected major cities.

• The Kwok’s brothers, who are also involved in managing the company, are indirectly the largest shareholders with 44.9% shareholding

[ 本帖最后由 Takumi 于 20-7-2007 02:09 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 02:16 AM

|

显示全部楼层

4. Hang Lung Properties (Hong Kong )

• Hang Lung Properties is a top tier property developer in mainland China and Hong Kong, with a recognised commitment to quality.

• The group’s business includes property development for sale and lease of well-planned residential, office and large-scale commercial developments in prominent locations.

• Hang Lung Properties will continue to expand its presence in mainland China, aiming to become the most established property developer both in mainland China and Hong Kong.

• The Chan family, who founded the company back in 1949, are the largest shareholders with 51.4% shareholding.

5. Guangzhou R&F Properties (Hong Kong)

• Guangzhou R&F is the fifth largest residential developer in China, and operates primarily in Guangzhou and Beijing, two of the three largest cities in China.

• The company has a strong management team with a proven track record from land acquisition (good timing and site selection) to strong pre-sales more than 90% of its units are pre-sold prior to completion; with 50% being referrals from previous purchasers).

• Growth in completion volume and an improving margin will drive growth in the next 2 years.

6. Mitsubishi Estate Co Ltd (Japan)

• Mitsubishi Estate owns and manages 31 office buildings in the Marunouchi area of Tokyo; situated in front of Tokyo Station, the most prime commercial district in Japan.

• It also focuses on condo development and other real estate solutions as well as managing recreational facilities like golf courses and tennis courts.

• Mitsubishi Estate also has a portfolio of overseas assets, including properties in New York and London.

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 02:22 AM

|

显示全部楼层

7. Mitsui Fudosan Co Ltd (Japan)

• Japan’s largest real estate company by revenue, with a wide range of real estate operations.

• In addition to real estate leasing and built-for-sale condo business, the company is also involved in the property brokerage business and property management.

• It also manufactures building materials and operates commercial facilities like hotels and golf courses.

8. SP Setia Berhad (Malaysia)

• SP Setia is Malaysia's premier residential property developer. The company has proven its ability to acquire land at the right time and attractive pricing.

• The sales contribution breakdown to-date of 60%: 40% between Klang Valley and Johor will soon narrow, given inclusion of its Penang project.

• SP Setia has built up a strong track record and brand name, especially after its Setia Eco Park was recently voted the World's Best Master Plan Development by the Federation of International Real Estate (FIABCI) in its International Prix d'Excellence Award 2007.

• The Employees Provident Fund (EPF) is the largest shareholder with 7.63% shareholding.

9. IGB Corporation Berhad (Malaysia)

• IGB is a property developer and property holding company. It was among the first developers to bring the concept of condo living and hotel apartments into Malaysia. IGB’s crown jewel is MidValley MegaMall, one of the largest and most successful retail malls in the country.

• Its other developments include Cendana and Sri Maya Condominium projects.

• Goldis Bhd is the largest shareholder with 25.0% shareholding.

[ 本帖最后由 Takumi 于 20-7-2007 02:23 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 02:39 AM

|

显示全部楼层

10. KLCC Property Holdings Bhd (Malaysia)

• KLCCP is a mixed property developer, providing more than 1.6m sq m of commercial, retail and hotel spaces as well as properties located mainly in the KL city centre.

• 60% of profits comes from rental income from 4 builidings namely Petronas Twin Tower, Menara Exxon, Kompleks Dayabumi and Menara Maxis. The balance comes from KLCC Suria Mall, the Mandarin Oriental and from its parking management arm.

• KLCCP also leverages on the Visit Malaysia Year 2007 tourism play.

11. Ayala Land Inc (Philippines)

• Ayala Land is one of the largest property developers in the Philippines focusing on the higher-end of the residential housing market.

• Apart from having the largest land bank of 4,343 hectares in the Philippines, Ayala Land is also the largest landowner in prime areas of Makati and Fort Bonifacio.

• Given its aggressive planned expansion in the residential, office and retail segment, there is potential to upgrade the company’s RNAV in the near term.

12. Capitaland Ltd (Singapore)

• Capitaland Limited and its subsidiaries operate in residential and commercial properties, property management, and serviced residences. The company also manages hotels and other properties.

• Company’s growth will be driven by more residential units launched in Singapore and China, rising office values and residential selling prices.

• Temasek Holding is the major shareholder with 39.9% as of Mar 2007.

[ 本帖最后由 Takumi 于 20-7-2007 02:41 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|