|

|

大众远东产业及旅游业基金(PFEPRF)的前景!(英文版)

[复制链接]

|

|

|

楼主 |

发表于 20-7-2007 12:58 AM

|

显示全部楼层

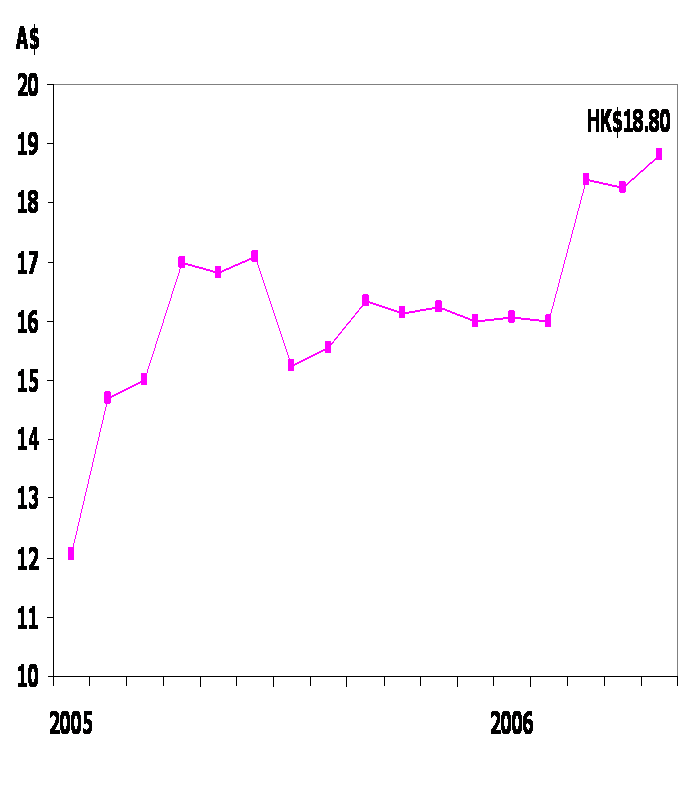

Link REIT (Hong Kong)

Link REIT is the largest REIT in Hong Kong, offering a yield of 3.59%.

Share Price

Yield

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:00 AM

|

显示全部楼层

4) Hotel & Resorts Sector Outlook: Key Factors

Rising Affluence

Country

| 5-Year Per-Capita Income CAGR (2000-05) (%) | China

| | Australia

| | Indonesia

| | Thailand

| | Malaysia

| | Singapore

| | Philippines

| |

Higher income per capita with stable political & economic climate encourages more travel & leisure activities in the region. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:01 AM

|

显示全部楼层

Trend of Integrated Resorts

l Several countries are wooing tourism and resorts income with large investments in resorts projects.

l Macau and Singapore are two cities that have announced major investment plans going forward in this area.

[ 本帖最后由 Takumi 于 20-7-2007 01:02 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:02 AM

|

显示全部楼层

Macau

l Macau’s gaming market was liberalized in February 2002 with the issuing of 3 gaming licences to Hong Kong, Macau and U.S. investors.

l This marked the beginning of Macau’s transformation from a local gaming hub that serves the local population from China and Hong Kong to a global gaming city.

l The projected investment in Macau for 2005 to 2010 is US$15 billion inclusive of new casino developments, residential projects and other projects.

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:03 AM

|

显示全部楼层

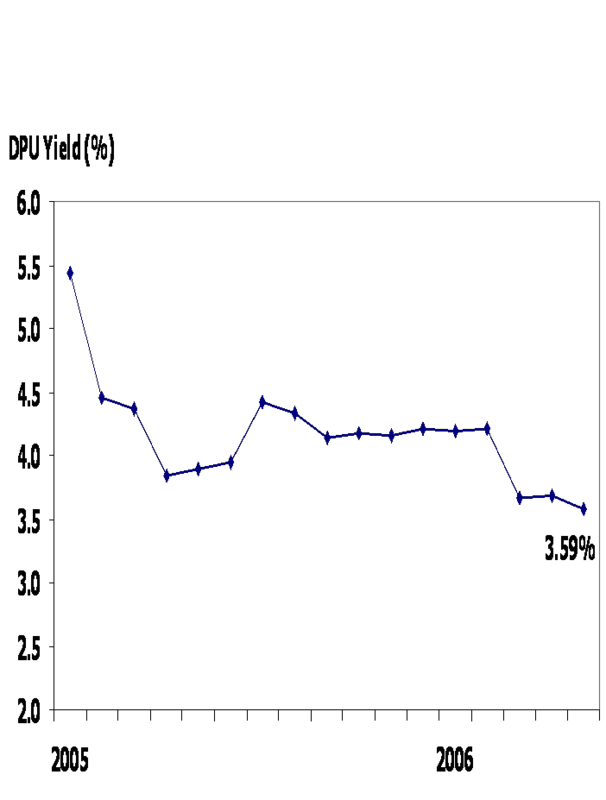

Macau: Total Hotel Rooms

The tripling of rooms in anticipation of huge influx of visitors, especially from China as GDP per capita increases. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:05 AM

|

显示全部楼层

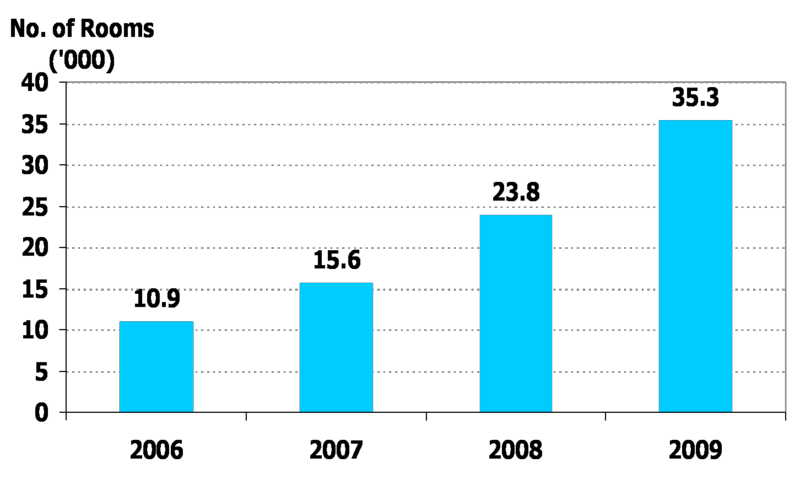

Macau: Total Gaming Tables�& Slot Machines

Number of gaming tables and slot machines are set to increase to 3x and 6x respectively over next 3 years. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:06 AM

|

显示全部楼层

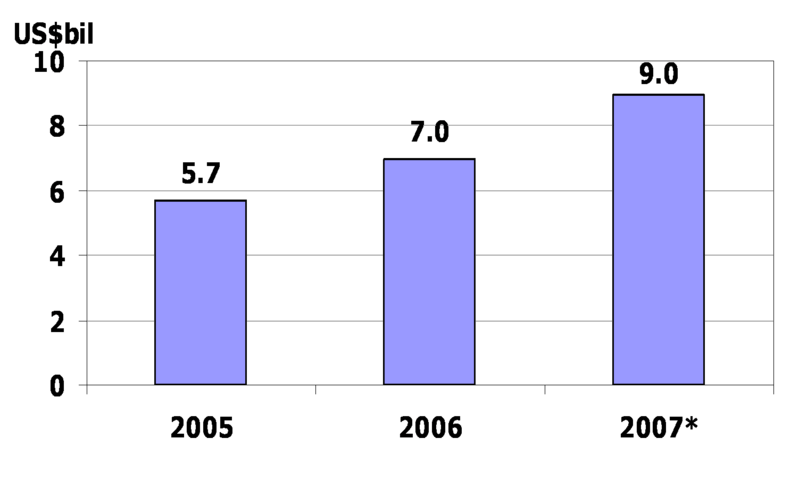

Macau’s Gaming Revenue Has Exceeded �Las Vegas’s Gaming Revenue

* Annualised growth from 1Q2007 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:07 AM

|

显示全部楼层

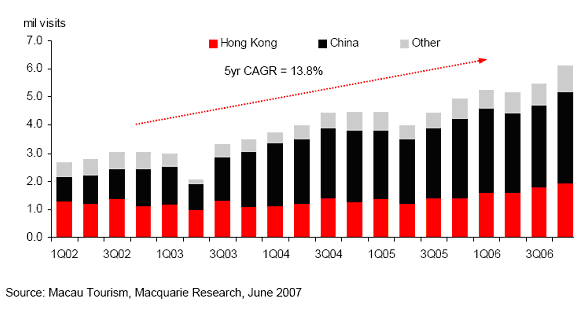

Macau Visitor Arrivals

Macau has seen an average visitor growth of 13.8%p.a. over the last 5 years.

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:10 AM

|

显示全部楼层

Growth Driven By China’s Wealth

Breakdown of Macau’s Visitors

China 54%

Hong Kong 32%

Taiwan 7%

Other7%

l China visitors account for the majority of Macau visitors

l Macau will be a direct beneficiary of China’s strong growth in income per capita.

l Further, positive structural changes such as the opening up of the Individual Visitor Scheme to Macau (by the Chinese Government) by no longer requiring visas from selected cities and provinces in China will boost Macau’s gaming industry. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:13 AM

|

显示全部楼层

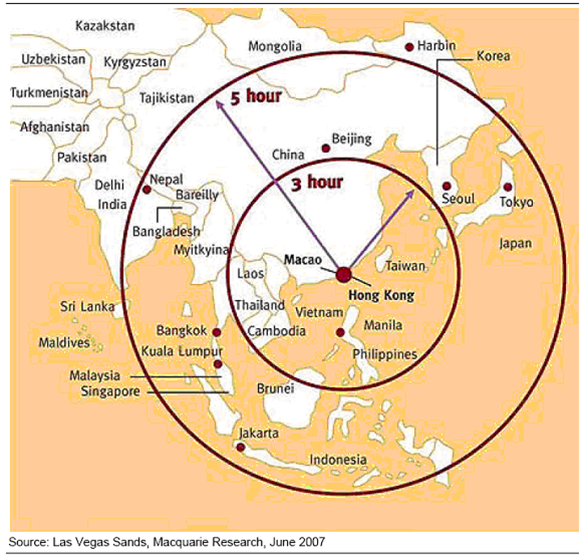

Macau: Proximity To The Region

Most of China’s cities and ASEAN are within 3-5 hours of Macau by flight. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:14 AM

|

显示全部楼层

Singapore

l The Singapore Government will issue two gaming licenses upon the 50% completion of the two Integrated Resorts projects awarded.

l Singapore aims to compete with Macau’s current position as the premier VIP gaming city in the region. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:15 AM

|

显示全部楼层

Singapore: Integrated Resorts Projects

| Projected Investment (S$ bil) | | | | Las Vegas Sands at Marina Bay

| | | | | Resorts World at Sentosa Island

| | | | |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:16 AM

|

显示全部楼层

China’s Hotel Market

China is the world’s largest growth market for hotels with number of hotel rooms projected to triple in 2009.

| | | | Intercontinental

| | | | Starwood

| | | | Shangri-La Asia

| | | | Marriott

| | | | Accor

| | | | Hilton

| | | | Four Seasons

| | | | | | | |

Source UBS Investment Research

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:18 AM

|

显示全部楼层

II) Public Far-East Property & Resorts Fund (PFEPRF)

- Features & Investment Strategy

- Summary of the Funds’ Key positive Points

- Appendix: Potential Investment Stocks

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:19 AM

|

显示全部楼层

Public Far-East Property & Resorts Fund (PFEPRF)

Fund Profile

| Category of Fund

| Equity Fund

| Type of Fund

| Capital Growth & Income

| Equity Range of Fund

| 75% - 90%*

| Distribution Policy

| Annual Income

| Investor Risk Profile

| Moderate

| Investment Assets

| Property, hotel & resorts stocks & Real Estate Investment Trusts

|

* The equity weight of the fund can be lower or higher depending on the outlook for the markets. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:20 AM

|

显示全部楼层

Investor Profile

• Moderate risk-reward temperament.

• Medium to long-term investor.

• Can withstand extended periods of market highs and lows in pursuit of capital growth.

Note: Medium to long term refers to a period of 3 years or more.

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:22 AM

|

显示全部楼层

Investment Assets

An equity fund that seeks to achieve capital growth over the medium to long term period by investing in companies that are principally engaged in:

- Property investment & development

- Hotel and resorts development & Investment

- Real estate investment trusts (REITs) in domestic and regional markets.

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:23 AM

|

显示全部楼层

Fund Investment Assets

• The fund may also invest in companies which have significant property or real estate assets.

• i.e. companies which have at least 70% of their assets comprising of property or real estate assets. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:25 AM

|

显示全部楼层

Investment Markets for PFEPRF

• Up to 80% of the fund’s NAV can be invested in selected regional markets which include:

•

South Korea

| •

Philippines

| •

China

| •

Indonesia

| •

Japan

| •

Singapore

| •

Taiwan

| •

Thailand

| •

Hong Kong

| •

Other approved

| •

Australia

|

markets

| •

New Zealand

| |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 01:27 AM

|

显示全部楼层

Investment Assets

• The balance of the Fund’s NAV will be invested in fixed income securities such as sovereign bonds, corporate debt and money market instruments to help generate interest income.

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|