|

|

大众远东产业及旅游业基金(PFEPRF)的前景!(英文版)

[复制链接]

|

|

|

楼主 |

发表于 20-7-2007 12:03 AM

|

显示全部楼层

Property Market Outlook

l Malaysia

l Singapore

l Hong Kong

l China

l Japan

l Indonesia

l Australia |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 12:04 AM

|

显示全部楼层

Malaysia Property Market Outlook

Positive measures for the M’sian property market:

- Addressing supply side constraints

Ø A one-stop centre will be set up to shorten the approval time

for developers to construct buildings from the current processing time of 1-2 years to 4-6 months.

Ø Certificate of completion and compliance issued by professionals will replace the certificate of fitness for occupation currently issued by local governments

2. Demand side incentives

a) Removing Real Property Gains Tax (RPGT) for all classes of investors.

| Previous RPGT

| New RPGT

| | Individuals

| Corporations

| Foreigners

| All

| 1st

Year

| 30%

| 30%

| 30%

| 0%

| 2nd

Year

| 30%

| 30%

| 30%

| 0%

| 3rd

Year

| 20%

| 20%

| 30%

| 0%

| 4th

Year

| 15%

| 15%

| 30%

| 0%

| 5th

Year

|

5%

|

5%

| 30%

| 0%

| 6th

year onwards

|

0%

|

5%

|

5%

| 0%

|

b) Relaxation of foreign property ownership eg.

• foreigners are no longer required to seek FIC approval for purchase of residential properties over RM250k

• unlimited purchase of residential properties

• unlimited number of loans on residential or commercial properties.

3) Other incentives: Removing the 30% low cost requirement for developers who build-and-sell thus promoting quality properties & greater buyer protection.

[ 本帖最后由 Takumi 于 20-7-2007 12:09 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 12:10 AM

|

显示全部楼层

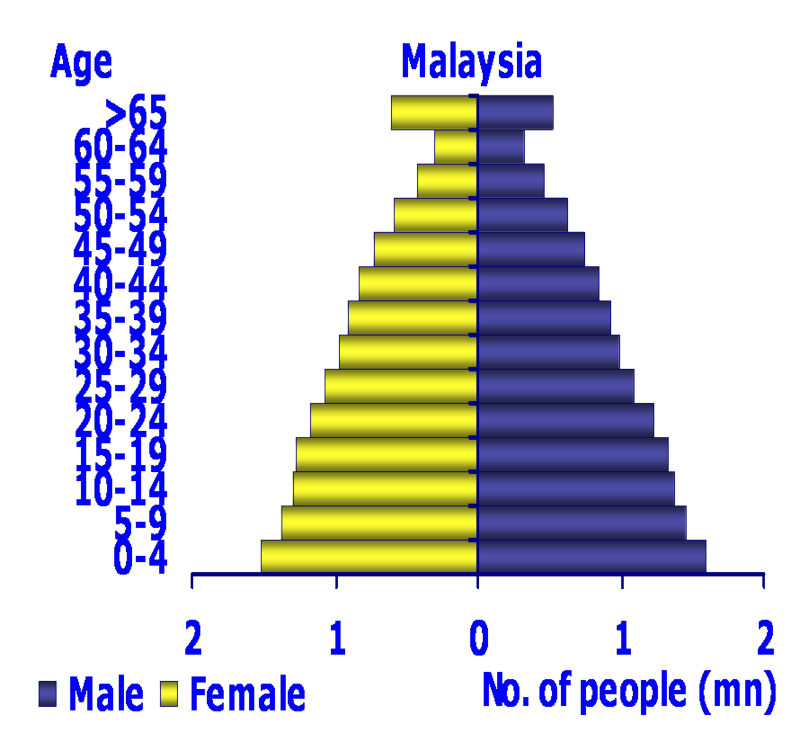

Malaysia Demographics

- Malaysia’s housing market is supported by positive demographics.

- 48% of population in ages between 15 to 34 years are prospective home buyers in the next 10 years.

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 12:16 AM

|

显示全部楼层

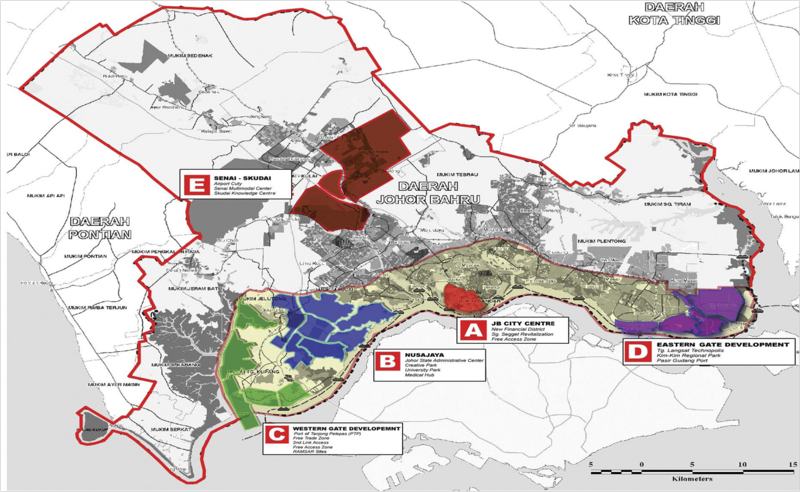

Johor Iskandar Region in South Johor

l The government plans to develop the Iskandar Development Region (IDR) in South Johor into an “emerging special economic zone (SEZ)”, similar to Shenzhen, Dubai and Mumbai to do business in a global growth centre.

l The IDR is projected to attract RM50 bil of investment in the next 5 years and RM370bil in 20 years. Under the 9th Malaysian Plan, the government has committed to invest RM12.2bil.

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 12:20 AM

|

显示全部楼层

IDR Strategically Located Near Singapore

From Gelang Palah Interchange

| To

| Distance

| Johor Bahru City Centre

| 25km

| 25min

| Pasir Gudang

| 45km

| 45min

| Sultan Ismail Airport (Senai)

| 25km

| 25min

| Tg. Pelepas Port

| 15km

| 15min

| Kuala Lumpur

| 320km

| 3 hrs

| | | | Singapore City Centre

| 40km

| 45min

| Changi Intl. Airport

| 50km

| 55min

| Jurong Port

| 20km

| 20min

|

Land Price Appreciation at Special Economic Zones.

Land prices have appreciated between 30% and 60% in the region’s special economic zones (SEZs).

| Land Price (US$’000/acre)

| Johor Discount to Other SEZs (%)

| 4-year CAGR (%)

| Johor

|

373*

| -

| -

| Bangalore

| 2,015

| 81

| 45

| Dubai

| 2,966

| 87

| 62

| Shenzhen

| 4,705

| 92

| 61

| Mumbai

| 6,953

| 95

| 37

| Average

| | | 51

|

RM30psf (assuming 300% increase from current RM7.50psf)

[ 本帖最后由 Takumi 于 20-7-2007 12:23 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 12:21 AM

|

显示全部楼层

Singapore Property Market Outlook

The following factors will sustain long term prospects for the Singapore property market:

- Benign interest rates environment

- Sustainable GDP growth driven by financial service & tourism

- The upcoming Integrated Resorts projects

- Conducive migration policies

- Limited land supply

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 12:25 AM

|

显示全部楼层

Migration To Singapore

Country

| Immigration as % of population

| Singapore

| 26.0

| Australia

| 23.0

| Switzerland

| 20.0

| Canada

| 19.0

| U.S.

| 12.5

| UK

|

8.0

|

Conducive migration policies by the Singapore government will help to sustain the uptrend in property prices. Singapore targets to increase its population from 4.5 million to 6.5 million in the next 50 years largely through skilled migration. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 12:26 AM

|

显示全部楼层

Hong Kong Property Market Outlook

Prospects for the Hong Kong property market remains well supported by:

- Hong Kong being a leading financial services & transportation hub servicing the Southern China region

- Spillover wealth effect from a prospering mainland China

- Limited land supply

- Benign interest rates environment

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 12:28 AM

|

显示全部楼层

China Property Market Outlook

l Residential market outlook in China is positive given that home ownership is

low.Mortgage financing only started a few years after the Housing Reform was initiated in 1998.

l Rising urbanisation & increased wealth with rising GDP per capita will continue to sustain the domestic property market.

l The number of Chinese earning above US$5,000 per annum is expected to rise by nearly tenfold from 59 million in 2006 to 540 million by 2016.

l In the commercial property front, the outlook is equally strong as the Chinese government shifts to private pension funds to fund its pension fund obligations.

l Private pension funds investing in local commercial property to secure long term returns from rental income, is expected to drive commercial properties prices higher.

l Commercial property prices in Chinese cities are significantly below similar assets in Hong Kong.

[ 本帖最后由 Takumi 于 20-7-2007 12:32 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 12:31 AM

|

显示全部楼层

Japan Residential Property Market Outlook

l The reversal of years of low interest rates has triggered pent up demand from property buyers buying ahead of further

interest rate rises.

l This has turned out to be positive for residential property developers.

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 12:32 AM

|

显示全部楼层

Japan Commercial Property Market Outlook

l An ageing population looking for investments that offer stable income in the long run, provides a ready market for investment instruments such as REITs.

l The activities of such trusts buying commercial property for long term rental income, has helped move prices up after a long period of deflation.

l Going forward, a low interest rate environment with a gradually recovering economy will sustain the positive outlook for the Japanese

property market. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 12:34 AM

|

显示全部楼层

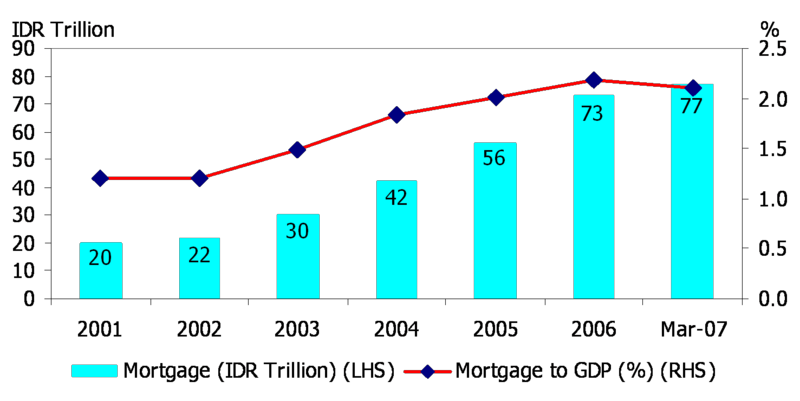

Indonesia Property Market Outlook

Likewise in Indonesia, commercial banks had focused on corporate lending.

It was only after the Asian Financial Crisis in 1998/1999 that commercial banks started offering attractive consumer loans (including mortgages). Therefore home ownership is still at its infancy in Indonesia and the outlook is promising.

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 12:34 AM

|

显示全部楼层

Australia Property Market Outlook

l Prospects for Australia property market are sustained by:

Ø A buoyant economic environment due to robust commodity prices

Ø Record low unemployment rate (lowest in 33 years)

Ø Stable interest rate environment

Ø Rising rents that caused individuals to buy property instead of renting

l Going forward, a sustainable commodities market globally should underpin the strength of the Australian economy and hence the local property market. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 12:35 AM

|

显示全部楼层

Property Market Outlook:Summary of Key Factors

| | | | | | | a)

Resilient GDP growth

| | | | | | | b)

Rising income

| | | | | | | c)

High savings rate

| | | | | | | d)

Benign interest rate

| | | | | | |

| | | | | | | e)

Availability of housing loan

| | | | | | | f)

Foreign buyer

| | | | | | | g)

Urbanisation

| | | | | | | h)

Migration

| | | | | | |

[ 本帖最后由 Takumi 于 20-7-2007 12:38 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 12:39 AM

|

显示全部楼层

Definition of REITs

• Funds which invest in real estate assets such as commercial buildings, retail malls, office, hotels, service apartments and industrial properties.

• Net rental income is distributed to unit holders.

• The yield of the REIT is measured by dividing distribution income over the selling price.

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 12:41 AM

|

显示全部楼层

Listed REITs In Regional Markets

| No. of REITs*

| Total Mkt Cap*

(US$ Bil)

| Australia

| 31

| 109.5

| Japan

| 27

|

44.9

| Singapore

| 13

|

17.8

| Hong Kong

|

5

|

7.3

| Malaysia

|

5

|

0.8

| Total

| 81

| 180.3

|

*Only includes component stocks of the Public Far-East Property Index

There are a number of REITs listed on the regional markets.

[ 本帖最后由 Takumi 于 20-7-2007 12:44 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 12:43 AM

|

显示全部楼层

Yields of REITs

| Avg. Yield of REITs* (%)

| 10-Yr Govt Bond (%)

| Yield Differential

| Malaysia

| 5.2

| 3.7

|

1.5%

| Singapore

| 3.7

| 2.8

|

0.9%

| Hong Kong

| 5.4

| 4.7

|

0.7%

| Japan

| 1.9

| 1.9

|

0.0%

| Australia

| 5.7

| 6.2

| -0.5%

|

*Based on the component stocks of Public Far-East Property Index

The yield of REITs are compared with bond yields. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 12:47 AM

|

显示全部楼层

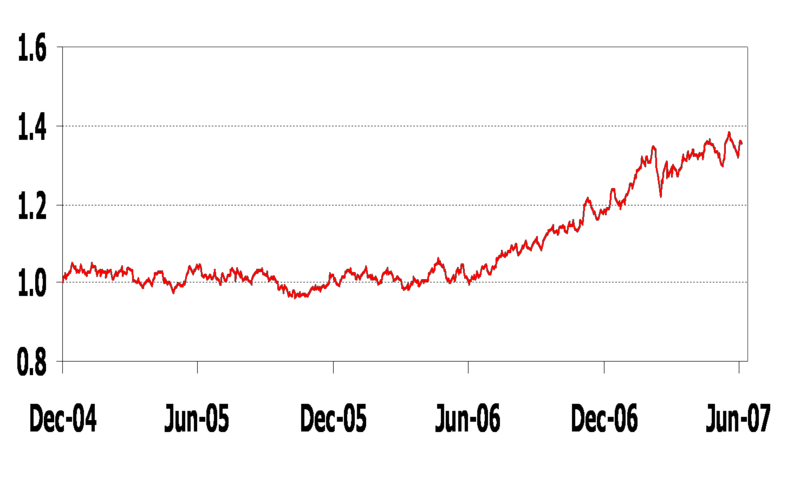

Returns of Regional REITs Index

Dow Jones Asia Pacific REITs Index

*31/12/06-31/05/07

^31/12/04-31/05/07 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 12:51 AM

|

显示全部楼层

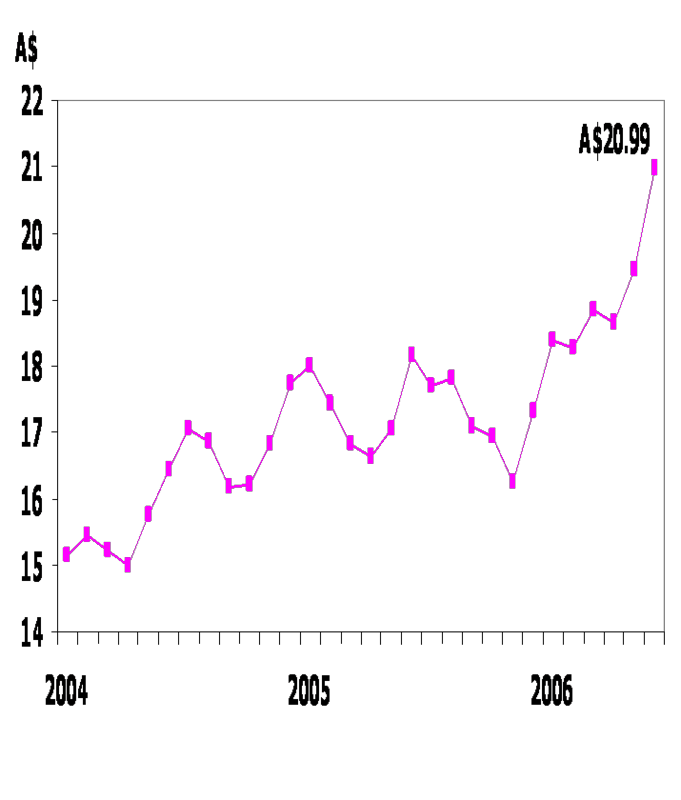

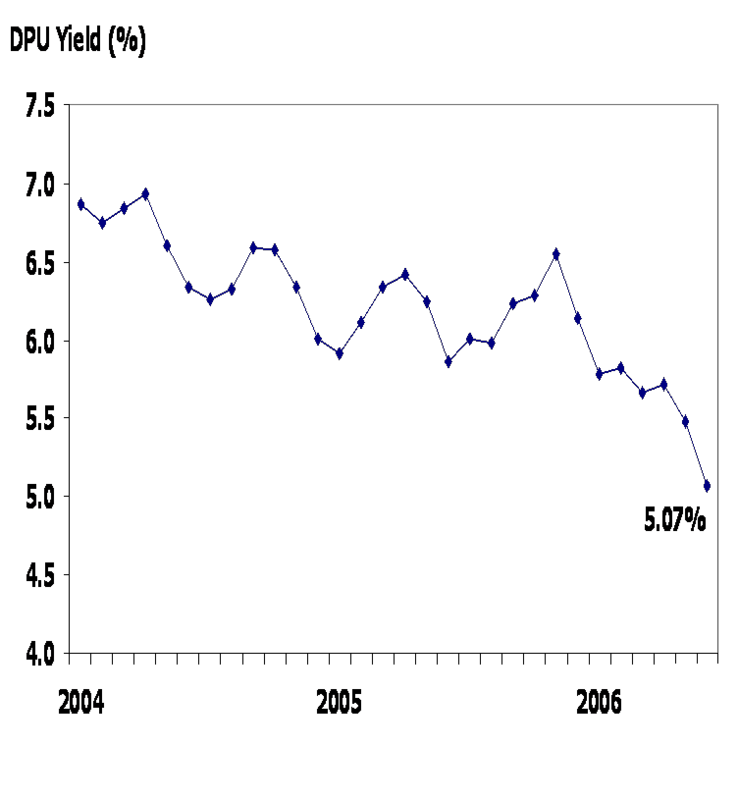

Westfield Group (Australia)

Westfield is the largest REIT in Australia as measured by market capitalisation and it offers an attractive yield of 5%.

Share Price

Yield

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2007 12:54 AM

|

显示全部楼层

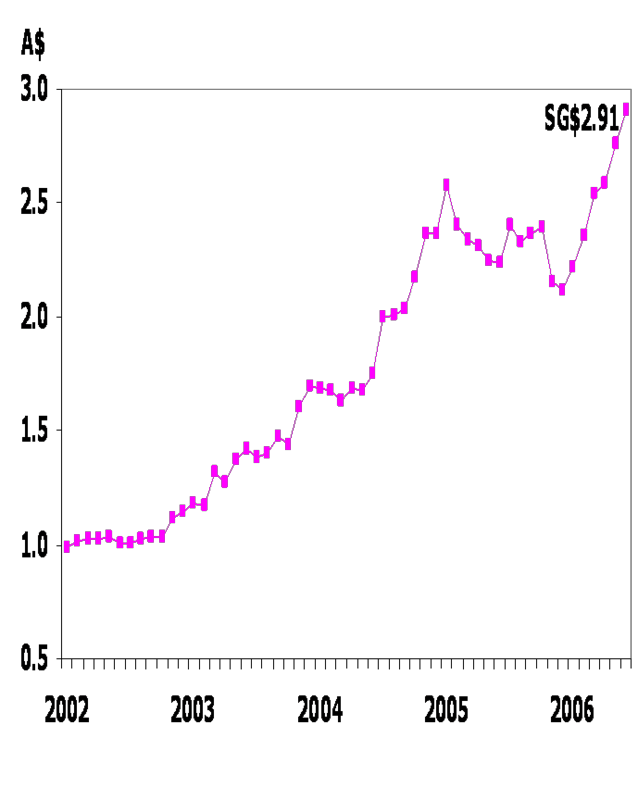

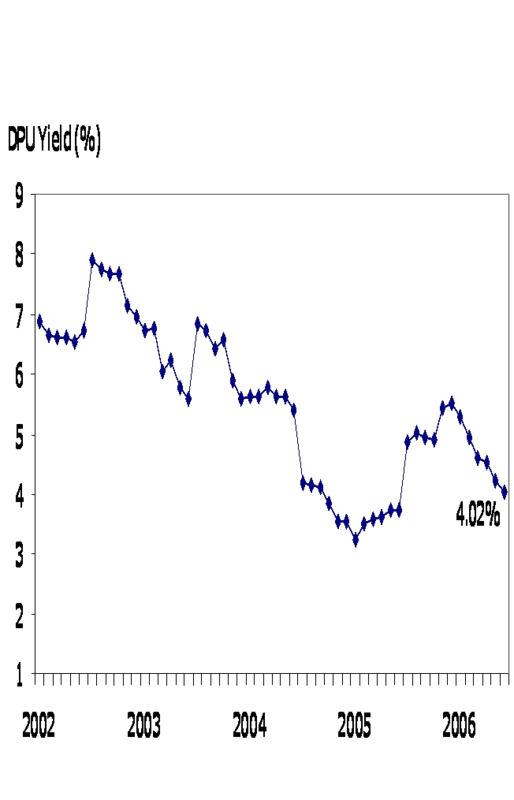

CapitaMall Trust Management Ltd. (Singapore)

CapitaMall is the largest REIT in Singapore, offering a yield of 4.02%.

Share Price

Yield

[ 本帖最后由 Takumi 于 20-7-2007 12:56 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|