|

|

发表于 8-5-2018 06:36 PM

|

显示全部楼层

发表于 8-5-2018 06:36 PM

|

显示全部楼层

本帖最后由 icy97 于 13-5-2018 05:01 AM 编辑

icy97 发表于 23-2-2015 10:35 PM

MISC与现代重工打造新LNG运输船

财经 2015年02月23日

(吉隆坡23日讯)MISC公司(MISC,3816,主板贸服股)与国家石油(PETRONAS)和韩国现代重工业有限公司达成转承合约(Novation Agreement),打造新的液化天 ...

Type | Announcement | Subject | OTHERS | Description | MISC BERHAD ("MISC" or "the Company")- Delivery of New Liquefied Natural Gas ("LNG") Carrier known as Seri Cemara and Incorporation of New Subsidiary | We refer to our announcement of 23 February 2015 relating to the novation agreement between Petroliam Nasional Berhad (“PETRONAS”), Hyundai Heavy Industries Co. Ltd (“HHI”) and the Company, for the novation of Shipbuilding Contracts between PETRONAS and HHI to the Company, for the construction and delivery of five (5) new LNG Carriers (“Newbuild LNGCs”).

We wish to announce that the Company has today received the delivery of Seri Cemara, which is the fifth and final of the five (5) Newbuild LNGCs, from HHI. Seri Cemara will be chartered to PETRONAS for the next 15 years upon delivery.

Pursuant to the delivery of Seri Cemara, MISC Tankers Sdn Bhd, a wholly-owned subsidiary of MISC has incorporated Seri Cemara (L) Private Limited, a Labuan company under the Labuan Companies Act, 1990, as its wholly-owned subsidiary, to own and operate Seri Cemara. The issued and paid-up capital of Seri Cemara (L) Private Limited is USD10 divided into 10 ordinary shares.

This announcement is dated 30 April 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-5-2018 12:49 AM

|

显示全部楼层

发表于 16-5-2018 12:49 AM

|

显示全部楼层

本帖最后由 icy97 于 20-5-2018 03:56 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 2,020,800 | 2,984,900 | 2,020,800 | 2,984,900 | | 2 | Profit/(loss) before tax | 319,200 | 696,600 | 319,200 | 696,600 | | 3 | Profit/(loss) for the period | 309,000 | 693,900 | 309,000 | 693,900 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 310,600 | 676,200 | 310,600 | 676,200 | | 5 | Basic earnings/(loss) per share (Subunit) | 7.00 | 15.10 | 7.00 | 15.10 | | 6 | Proposed/Declared dividend per share (Subunit) | 7.00 | 7.00 | 7.00 | 7.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 7.4100 | 7.8100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-5-2018 12:53 AM

|

显示全部楼层

发表于 16-5-2018 12:53 AM

|

显示全部楼层

EX-date | 24 May 2018 | Entitlement date | 28 May 2018 | Entitlement time | 04:00 PM | Entitlement subject | Interim Dividend | Entitlement description | First Tax Exempt Dividend of 7 sen per ordinary share | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 12 Jun 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 28 May 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-5-2018 05:00 AM

|

显示全部楼层

发表于 20-5-2018 05:00 AM

|

显示全部楼层

本帖最后由 icy97 于 21-5-2018 06:40 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-5-2018 06:06 AM

|

显示全部楼层

发表于 28-5-2018 06:06 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | MISC BERHAD ("MISC" or "the Company")- Award of Contract | The Board of Directors of MISC wishes to announce that its wholly-owned subsidiary, AET Tanker Holdings Sdn Bhd (“AET”), through its vessel-owning entity, has been awarded long-term charter contract(s) to own and operate four (4) specialist DP2 Suezmax size Shuttle Tankers from Petróleo Brasileiro S.A. – Petrobras of Rio de Janeiro, Brazil (“Petrobras”) for operations in international and Brazilian waters (“the Contract”).

The firm charter period is ten (10) years and is expected to commence in 2020. These new vessels will be in addition to the two (2) AET DP2 ships currently on charter in the Brazilian Basin for Petrobras.

AET is the petroleum shipping unit of MISC and specialises in the global ocean transport of petroleum.

Petrobras is headquartered in Rio de Janeiro, Brazil and is an international energy company and present in the oil exploration and production, refining, natural gas, electric energy, logistics, trade, distribution, petrochemicals, fertilizers, and biofuel segments.

The Contract does not have any effect on the issued and paid up share capital and substantial shareholding in MISC. The Contract is also not expected to have any material impact to the earnings per share, gearing and net assets per share of the MISC Group for the financial year ending 31 December 2018.

The risk factors affecting the Contract includes changes in economic, political and regulatory environment and operational risks which the MISC Group will take appropriate measures to mitigate.

None of the directors or substantial shareholders of MISC or persons connected to them has any interest, direct or indirect, in the Contract.

This announcement is dated 25 May 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-6-2018 03:51 AM

|

显示全部楼层

发表于 15-6-2018 03:51 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 16-6-2018 06:04 AM

|

显示全部楼层

发表于 16-6-2018 06:04 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | MISC BERHAD ("MISC" or "the Company")- Award of Contract | We refer to the announcement dated 25 May 2018, whereby MISC’s wholly-owned subsidiary, AET Tanker Holdings Sdn Bhd, through its vessel-owning entity, has been awarded long-term charter contract(s) to own and operate four (4) specialist DP2 Suezmax size Shuttle Tankers from Petróleo Brasileiro S.A. – Petrobras of Rio de Janeiro, Brazil for operations in international and Brazilian waters (“Award of Contract”).

MISC wishes to announce that the estimated contract value over the firm charter period of 10 years is USD 645 million.

This announcement is dated 8 June 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-6-2018 05:27 AM

|

显示全部楼层

发表于 17-6-2018 05:27 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 18-6-2018 12:49 AM

|

显示全部楼层

发表于 18-6-2018 12:49 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 21-6-2018 03:06 AM

|

显示全部楼层

发表于 21-6-2018 03:06 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 23-6-2018 07:17 AM

|

显示全部楼层

发表于 23-6-2018 07:17 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 29-6-2018 05:45 AM

|

显示全部楼层

发表于 29-6-2018 05:45 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 5-7-2018 05:24 AM

|

显示全部楼层

发表于 5-7-2018 05:24 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 7-7-2018 12:53 AM

|

显示全部楼层

发表于 7-7-2018 12:53 AM

|

显示全部楼层

本帖最后由 icy97 于 7-7-2018 03:26 AM 编辑

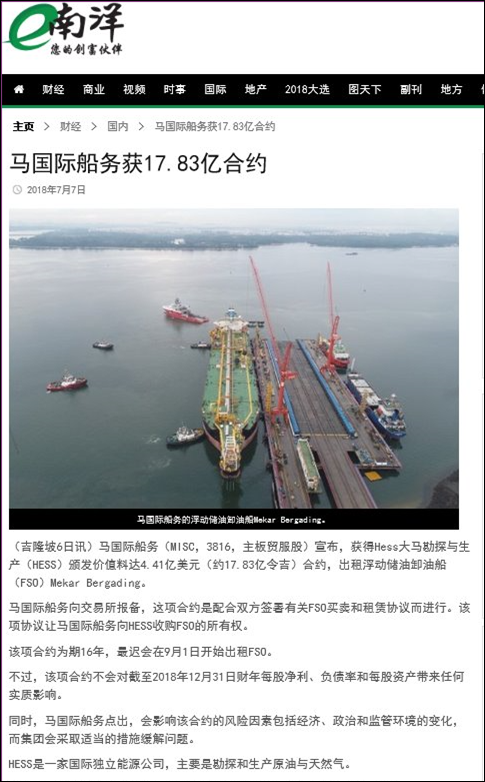

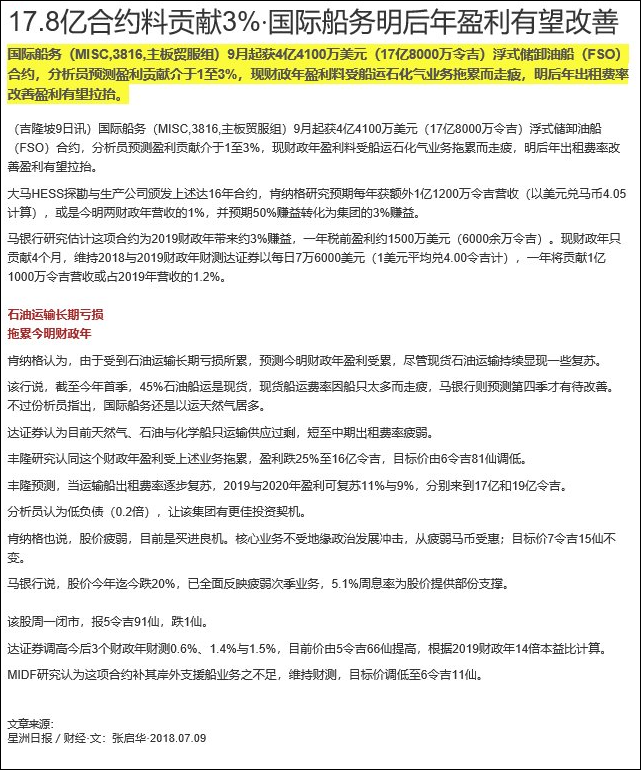

Type | Announcement | Subject | OTHERS | Description | MISC BERHAD ("MISC" or "the Company")- Award of Contract | The Board of Directors of MISC wishes to announce that the Company has signed a long-term charter contract with Hess Exploration and Production Malaysia B.V. (“HESS”) for the lease of a floating, storage and offloading facility (“FSO”) known as FSO Mekar Bergading on a bareboat basis (“the Contract”). The Contract is pursuant to a sale and charter agreement in respect of the FSO between HESS and MISC, which resulted in MISC acquiring ownership of the FSO from HESS.

Pursuant to the Contract, the FSO will be leased by HESS for a period of sixteen (16) years with an estimated contract value of USD 441 million. The charter will commence latest by 1 September 2018.

HESS, a company incorporated in the Netherlands, is a global independent energy company engaged in the exploration and production of crude oil and natural gas.

The Contract does not have any effect on the issued and paid up share capital and substantial shareholding in MISC. The Contract is also not expected to have any material impact to the earnings per share, gearing and net assets per share of the MISC Group for the financial year ending 31 December 2018.

The risk factors affecting the Contract includes changes in economic, political and regulatory environment which the MISC Group will take appropriate measures to mitigate.

None of the directors or substantial shareholders of MISC or persons connected to them have any interest, direct or indirect, in the Contract.

This announcement is dated 6 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-7-2018 03:56 AM

|

显示全部楼层

发表于 7-7-2018 03:56 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 10-7-2018 01:08 AM

|

显示全部楼层

发表于 10-7-2018 01:08 AM

|

显示全部楼层

本帖最后由 icy97 于 10-7-2018 01:34 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-7-2018 05:11 AM

|

显示全部楼层

发表于 26-7-2018 05:11 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | MISC BERHAD (MISC or the Company)- Incorporation of New Subsidiary | The Board of Directors of MISC wishes to announce that the Company has incorporated a new subsidiary, namely AET Labuan One Limited ("AETL1") for purpose of owning, chartering and operating of vessels.

AETL1 is incorporated in Labuan under the Labuan Companies Act 1990 with an issued capital of USD20,000.00 divided into 20,000 ordinary shares and it is wholly-owned by AET Inc. Ltd., an indirect wholly-owned subsidiary of MISC.

The incorporation of AETL1 is not expected to have any material effect on the earnings or net assets of MISC for the financial year ending 31 December 2018.

None of the directors or substantial shareholders of MISC or persons connected to them have any interest, direct or indirect, in the incorporation of AETL1.

This announcement is dated 25 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-8-2018 01:27 AM

|

显示全部楼层

发表于 8-8-2018 01:27 AM

|

显示全部楼层

本帖最后由 icy97 于 8-8-2018 02:23 AM 编辑

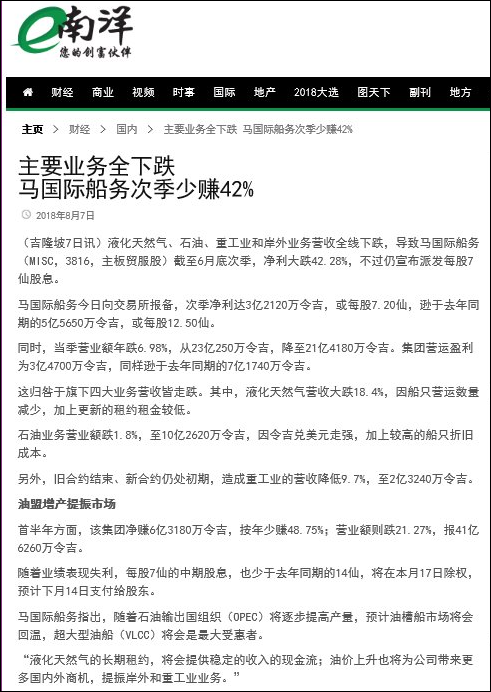

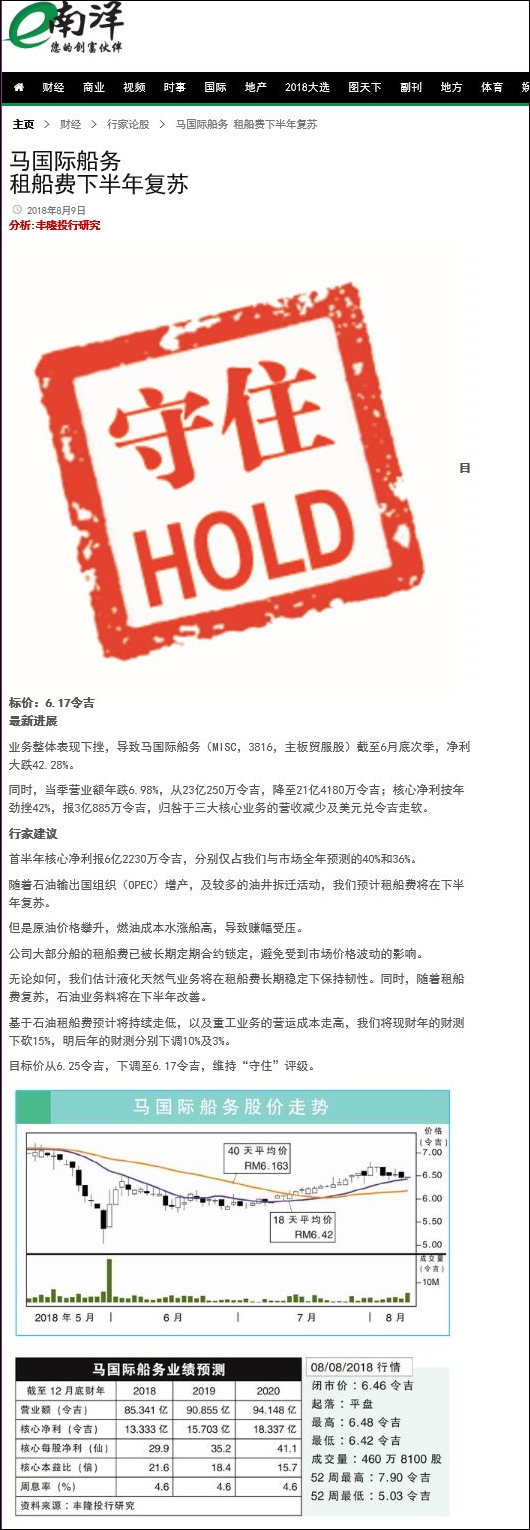

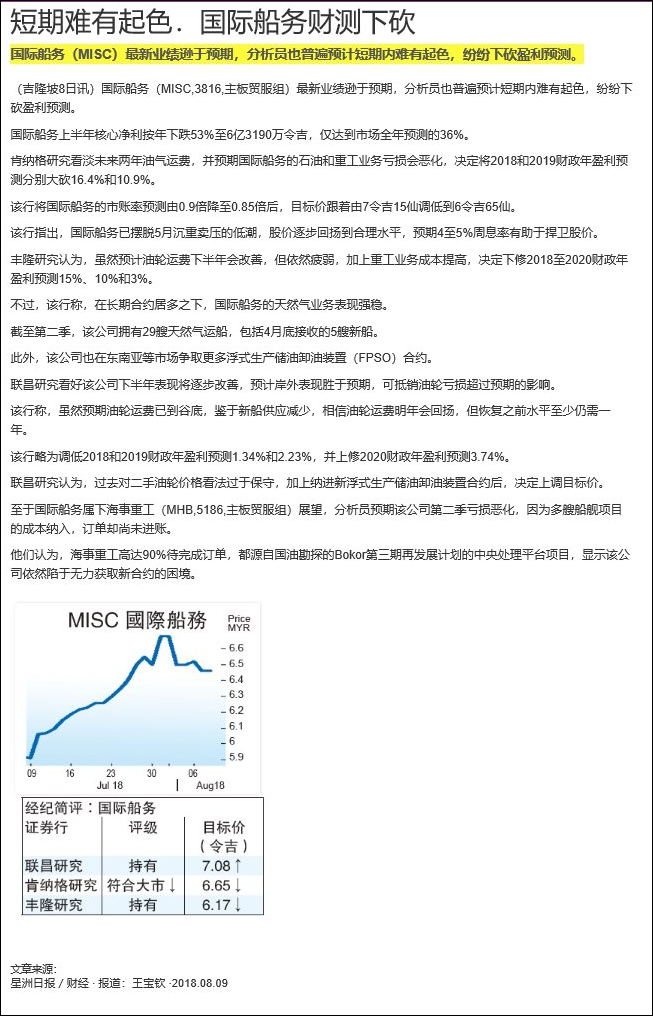

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 2,141,800 | 2,302,500 | 4,162,600 | 5,287,400 | | 2 | Profit/(loss) before tax | 318,500 | 558,700 | 637,700 | 1,255,300 | | 3 | Profit/(loss) for the period | 309,200 | 553,800 | 618,200 | 1,247,700 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 321,200 | 556,500 | 631,800 | 1,232,700 | | 5 | Basic earnings/(loss) per share (Subunit) | 7.20 | 12.50 | 14.20 | 27.60 | | 6 | Proposed/Declared dividend per share (Subunit) | 7.00 | 7.00 | 14.00 | 14.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 7.7500 | 7.8000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-8-2018 01:28 AM

|

显示全部楼层

发表于 8-8-2018 01:28 AM

|

显示全部楼层

EX-date | 17 Aug 2018 | Entitlement date | 21 Aug 2018 | Entitlement time | 04:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Second Tax Exempt Dividend of 7 sen per ordinary share | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 14 Sep 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 21 Aug 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-8-2018 04:08 AM

|

显示全部楼层

发表于 9-8-2018 04:08 AM

|

显示全部楼层

本帖最后由 icy97 于 10-8-2018 04:42 AM 编辑

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|