|

|

发表于 14-3-2018 05:17 AM

|

显示全部楼层

发表于 14-3-2018 05:17 AM

|

显示全部楼层

本帖最后由 icy97 于 16-3-2018 02:10 AM 编辑

Type | Announcement | Subject | OTHERS | Description | MANAGEPAY SYSTEMS BERHAD ("MPay" or "the Company")- Acceptance of Letter of Proposal by ASEAN Cooperative Organization ("ACO") for a Joint Venture Business on the Provision of End-to-End Digital Economy Ecosystem by MPay powered Fintech-as-a-Service (FaaS) to the entire ACOs cooperative communities amongst ASEAN countries | The Board of Directors of the Company wishes to announce that ASEAN Cooperative Organization (“ACO”) had on 8 March 2018 formally accepted a proposal made by MPay on 20 February 2018 for an ACO Digital Economy EcoSystem in the development of cashless community for the entire ACO’s cooperative communities totaling 60 million individual cooperative members, inclusive of 8 million Malaysian amongst ASEAN countries to be powered by MPay end-to-end FaaS (“Proposal”). This Proposal is subject to a formal joint venture agreement to be agreed upon and executed by between MPay Mobile Sdn Bhd (“MPay Mobile”) and MyANGKASA Holdings Sdn Bhd (“MyANGKASA”) parties.

Information on MPay Mobile MPay Mobile is the ASP Class Licence–ASP(C) licence holder awarded from Malaysian Communications and Multimedia Commission since 11 October 2017, and renewable yearly (“ASP Licence”). With the ASP Class Licence, MPay Mobile has become a Mobile Virtual Network Operator (“MVNO”) in Malaysia supporting a wide spectrum of services to the public nationwide, including GSM, GPRS, 3G and 3.5G and the latest high speed broadband 4G network. MPay Mobile has launched the MVNO mobile package by end of the year 2017, equipped with secure FinTech solution to provide each subscriber with a 3-in-1 Mobile Starter Package consists of MPay eMoney banking account access and MPay MasterCard Prepaid Card payment capability. The 3-in-1 package brings more convenience and accessibility for customers who are located at remote area with difficulty to access to bank branches or who intended to move away from traditional banking at branches toward online and mobile banking.

Information on ACO ACO membership comprises of the Co-operative Apex or Holding Co-operative from ASEAN countries. ACO was set up to lead and improve the strategic relations between Co-operative movements in ASEAN countries. These strategy will help in the implementation of a wide range of activities that benefit all Co-operative. In addition to the strong network and cooperation between Co-operative members from ASEAN countries, ACO also played its important role as an entity that represents the Co-operative movements either at the national and international level, in order to support and fulfil its objective in line with Bangkok Declaration on 8 August 1967 creating equality based on vision, mission and identity of ASEAN. ACO will play its role in implementing Co-operative transformation strategies for the Co-operative movement in ASEAN in terms of identifying issues faced by co-operatives as well as acting its role as the entities representing co-operatives in ASEAN.

Information on MyANGKASA MyANGKASA is a wholly-owned subsidiary of ANGKATAN KOPERASI KEBANGSAAN MALAYSIA BERHAD (ANGKASA). MyANGKASA's role among others are to assists, guide, provide and create business opportunities for the Cooperative Movement.

Rationale of the Proposal With the ACO’s cooperative communities totaling 60 million individual cooperative members, inclusive of 8 million Malaysian, MPay foresees this joint venture business will become the driving force for MPay Group to roll out MPay complete fintech products and services to widespread Malaysian cooperative communities as well as exposure and eventual export of MPay fintech solutions to the balance 9 ASEAN countries.

The MPay fintech products and services to be adopted by ACO includes but not limited to the following:- - A Private Label MPay Wallet;

- A MPay co-branded MasterCard Prepaid Virtual Card Number (“VCN”) comes with every Wallet;

- MPay powered Lending platform;

- MPay Pro Card and Mobile payment acceptance system for the entire ACO Business Communities;

- MPay co-branded Mobile SIM Pack; and

- BuyMalaysia.com Powered Marketplace for ACO.

Effects of the Proposal The Proposal is not expected to have any material effect on the gearing, share capital and substantial shareholders’ shareholding of the Company for the financial year ending 31 December 2018. The Proposal will contribute to revenue and bottom line of the Company in year 2018.

Directors’ and major shareholders’ interest None of the Directors and/or major shareholders of MPay and/or persons connected with them have any interests, direct or indirect, in the Proposal.

Statement by Directors The Board of MPay, having taken into consideration all aspects of the Agreement, is of the opinion that the Proposal is in the best interest of the Company and its subsidiaries.

Approvals required The Proposal is not subject to approval of the shareholders of MPay and any relevant government authorities.

This announcement is dated 12 March 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-5-2018 04:43 AM

|

显示全部楼层

发表于 29-5-2018 04:43 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 3,610 | 1,423 | 3,610 | 1,423 | | 2 | Profit/(loss) before tax | -2,407 | -2,324 | -2,407 | -2,324 | | 3 | Profit/(loss) for the period | -2,407 | -2,343 | -2,407 | -2,343 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -2,377 | -2,343 | -2,377 | -2,343 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.34 | -0.33 | -0.34 | -0.33 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0800 | 0.0800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-7-2018 12:05 AM

|

显示全部楼层

发表于 10-7-2018 12:05 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | MANAGEPAY SYSTEMS BERHAD ("MPay" or "the Company")- Incorporation of a New Subsidiary | Further to the Company’s announcement dated 26 December 2017 on the Collaboration between Malaysia External Trade Development Corporation (“MATRADE”) and ManagePay Marketing Sdn. Bhd. (“MMSB”), a wholly-owned subsidiary of the Company, to provide services through MPay’s e-marketplace platform BuyMalaysia.com to Malaysian SMEs, who are registered under eTRADE Programme offered by MATRADE.

The Board of Directors of MPay wishes to announce that MMSB, a wholly-owned subsidiary of the Company had on 4 July 2018 incorporated a new 80%-owned subsidiary known as ManagePay BuyMalaysia Sdn. Bhd. (“BuyMalaysia”) in Malaysia under the Companies Act 2016 (“Incorporation”) and having its registered office at 16-A (1st Floor), Jalan Tun Sambanthan 3, Brickfields, 50470 Kuala Lumpur, Malaysia.

The total issued share capital of BuyMalaysia is Ringgit Malaysia One Hundred (RM100.00) only comprising One Hundred (100) ordinary shares of which 80% owned by MMSB and the remaining 20% owned by NOVA Newlook Sdn. Bhd..

The Directors of BuyMalaysia are Dato’ Chew Chee Seng and Mr Soon Kian Heng.

The intended activity of BuyMalaysia are to provide Business-to-Business-to-Customers (B2B2C) e-commerce platform engaged in the business of online shopping portal for sale and distribution of various products under various categories to the public at large to Malaysian as well as international customers or buyers. BuyMalaysia also provides the merchant with services like product upload, product update, marketing, logistics and customer service.

The Incorporation will not have any material effect on the earning per share, net assets per share, gearing, share capital and substantial shareholders’ shareholding of the Company and its subsidiaries (the “Group”) for the financial year ending 31 December 2018.

The Incorporation is in line with the long term strategic plans of the Group.

None of the Directors and/or major shareholders of MPay and/or persons connected with them have any interests, direct or indirect, in the Incorporation. The Incorporation does not require approval from the shareholders of MPay or any other relevant authorities.

Having considered the rationale and the effects of the Incorporation, the Board of Directors of MPay is of the opinion that the Incorporation is in the best interest of the Company.

This announcement is dated 9 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2018 03:42 AM

|

显示全部楼层

发表于 28-8-2018 03:42 AM

|

显示全部楼层

本帖最后由 icy97 于 29-8-2018 03:00 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 2,993 | 1,607 | 5,781 | 3,030 | | 2 | Profit/(loss) before tax | -1,789 | -2,068 | -4,196 | -4,392 | | 3 | Profit/(loss) for the period | -1,789 | -2,091 | -4,196 | -4,434 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -1,752 | -2,090 | -4,129 | -4,433 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.25 | -0.29 | -0.59 | -0.62 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0800 | 0.0800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2018 03:46 AM

|

显示全部楼层

发表于 28-8-2018 03:46 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | MANAGEPAY SYSTEMS BERHAD ("MPay" or "the Company")- Collaborative Agreement entered into between Samurai Fintech (Singapore) Pte Ltd ("BCoin") and MPay | Announcement Details: The Board of Directors (“Board”) of MPay wishes to announce that MPay had on 27 August 2018 entered into a Collaborative Agreement with Samurai Fintech (Singapore) Pte Ltd (“BCoin”) (“the Agreement”) to work together to explore and develop fiat-crypto exchange business in Malaysia via a joint venture company to be set up subject to the regulatory approval. This collaborative also allows BCoin to integrate the proposed fiat-crypto exchange business in both Singapore and Malaysia with MPay’s existing digital payment capabilities subject to the terms and conditions as stipulated in the Agreement.

Information on BCoin BCoin is a global all-encompassing cryptocurrency exchange platform for the new tokenized economy. BCoin provides a one-stop hub for all enthusiasts, innovators and investors in Singapore. With a wealth of experience in the cryptocurrency and financial space, BCoin adopts advanced risk control technology including Secure Sockets Layer (SSL), multi-signature cryptocurrency wallets, offline capital management as well as multiple layers of security measures to secure customers’ digital assets. BCoin exchange platform has launched 12 major digital assets – namely Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Ethereum Classic (ETC), Litecoin (LTC), Dash, EOS, OmiseGO (OMG), NEO, XEM, QTUM and Ripple (XRP).

Details of the Agreement The duration of this Agreement shall be for a period of one (1) year from the date of the Agreement (“Initial Term”) and may be extended through unanimous agreement by MPay and BCoin.

Effects of the Agreement The Agreement is not expected to have any material effect on the earnings per share, net assets per share, gearing, share capital and substantial shareholders’ shareholding of the Company and its subsidiaries (the “Group”) for the financial year ending 31 December 2018.

Directors’ and major shareholders’ interest None of the Directors and/or major shareholders of MPay and/or persons connected with them have any interests, direct or indirect, in the Agreement.

Approvals required The Agreement does not require approval from the shareholders of MPay or any relevant government authorities.

Statement by Directors Having considered all aspects of the Agreement, the Board of Directors of MPay is of the opinion that the Agreement is in the best interest of the Group.

Document available for inspection The Agreement is available for inspection at the registered office at Lot 6.05, Level 6, KPMG Tower, 8 First Avenue, Bandar Utama, 47800 Petaling Jaya, Selangor Darul Ehsan, Malaysia during ordinary business hours from Mondays to Fridays (except public holidays) for a period of three (3) months from the date of this announcement.

This announcement is dated 27 August 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-9-2018 01:08 AM

|

显示全部楼层

发表于 8-9-2018 01:08 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PRESS RELEASE ON MANAGEPAY SYSTEMS BERHAD INTRODUCES "JELAJAHI NEGARAKU MALAYSIA", INNOVATIVE TRAVEL CARD SOLUTION | |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-9-2018 06:23 AM

|

显示全部楼层

发表于 9-9-2018 06:23 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 24-10-2018 07:05 AM

|

显示全部楼层

发表于 24-10-2018 07:05 AM

|

显示全部楼层

本帖最后由 icy97 于 26-10-2018 05:21 AM 编辑

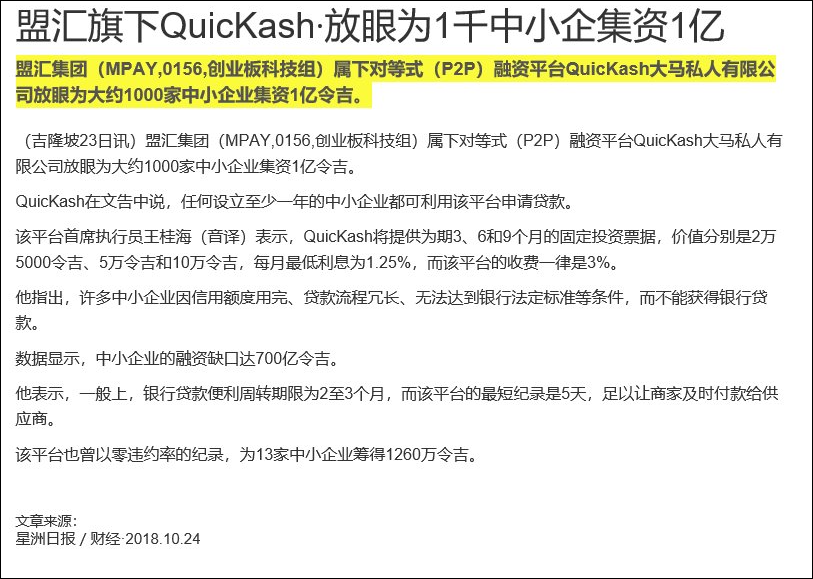

Type | Announcement | Subject | OTHERS | Description | PRESS RELEASE ON PEER-TO-PEER FINANCING PLATFORM QUICKASH MALAYSIA AIMS TO CLOSE THE FINANCING GAP FOR UNDERBANKED SMALL AND MEDIUM ENTERPRISES ("SMEs"). | |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-12-2018 07:12 AM

|

显示全部楼层

发表于 25-12-2018 07:12 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 3,512 | 1,461 | 9,293 | 4,491 | | 2 | Profit/(loss) before tax | -2,741 | -2,730 | -6,938 | -7,121 | | 3 | Profit/(loss) for the period | -2,744 | -2,730 | -6,941 | -7,163 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -2,621 | -2,711 | -6,773 | -7,143 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.39 | -0.38 | -0.98 | -1.01 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1200 | 0.1300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-1-2019 04:07 AM

|

显示全部楼层

发表于 4-1-2019 04:07 AM

|

显示全部楼层

本帖最后由 icy97 于 11-1-2019 07:31 AM 编辑

盟汇为东协开发数码经济系统

http://www.chinapress.com.my/20181207/盟汇为东协开发数码经济系统/

Type | Announcement | Subject | OTHERS | Description | MANAGEPAY SYSTEMS BERHAD ("MPay" or "the Company")- Joint Venture and Shareholders' Agreement between ManagePay BuyMalaysia Sdn. Bhd. and MyAngkasa Holdings Sdn. Bhd. to set up a joint venture company ("JVC") to leverage on MPay Affiliates skill, expertise and know-how to develop an Asean Cooperative Organisation ("ACO") Digital Economy Ecosystem ("Proposed JV") | Further to the Company’s announcement dated 12 March 2018 on the Acceptance of Letter of Proposal by ACO for a Joint Venture Business on the Provision of End-to-End Digital Economy Ecosystem by MPay powered Fintech-as-a-Service to the entire ACOs cooperative communities amongst ASEAN countries.

The Board of Directors (the “Board”) of the Company wishes to announce that ManagePay BuyMalaysia Sdn. Bhd. (“BuyMalaysia”), a 80%-owned subsidiary of ManagePay Marketing Sdn. Bhd., which in turn a wholly-owned subsidiary of the Company, had on 6 December 2018 entered into a JV and Shareholders’ Agreement (“Agreement”) with MyAngkasa Holdings Sdn. Bhd. (“MyAngkasa”) to set up a JVC to leverage on MPay Affiliates’ skill, expertise and know-how to develop an ACO Digital Economy Ecosystem which will include ACO Wallet coupled with a co-branded MasterCard Prepaid VCN, a lending platform, MPay Pro Card and mobile payment acceptance system, MPay co-branded mobile SIM pack and a marketplace.

Please refer to the attached file for further details of the Proposed JV.

This announcement is dated 7 December 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5999385

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-1-2019 06:16 AM

|

显示全部楼层

发表于 16-1-2019 06:16 AM

|

显示全部楼层

Notice of Interest Sub. S-hldr (Section 137 of CA 2016)Particulars of Substantial Securities HolderName | MR CHIN SHEA FONG | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares | Name & address of registered holder | Chin Shea Fong31, Jalan Ubin U8/19B, Bukit Jelutong, 40150 Shah Alam, Selangor Darul Ehsan, Malaysia |

| Date interest acquired & no of securities acquired | Date interest acquired | 20 Dec 2018 | No of securities | 35,710,516 | Circumstances by reason of which Securities Holder has interest | Acquisition of Shares | Nature of interest | Direct Interest |  | | Total no of securities after change | Direct (units) | 35,710,516 | Direct (%) | 5.026 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Date of notice | 21 Dec 2018 | Date notice received by Listed Issuer | 21 Dec 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-1-2019 05:17 AM

|

显示全部楼层

发表于 29-1-2019 05:17 AM

|

显示全部楼层

本帖最后由 icy97 于 30-1-2019 08:13 AM 编辑

Type | Announcement | Subject | OTHERS | Description | MANAGEPAY SYSTEMS BERHAD ("MPay" or "the Company")- MPay Digi Co-Branded Mastercard Prepaid Physical Card and Virtual Card Number ("VCN") Agreement entered into between ManagePay Services Sdn. Bhd., a wholly-owned subsidiary of the Company and Digi Telecommunications Sdn. Bhd. | Introduction

The Board of Directors (“Board”) of MPay wishes to announce that ManagePay Services Sdn. Bhd. (“MPay Services”), a wholly-owned subsidiary of MPay, had on 3 January 2019 entered into a MPay Digi Co-Branded Mastercard Prepaid Physical Card and VCN (“Co-Branded Card”) Agreement (“Agreement”) with Digi Telecommunications Sdn. Bhd. (“Digi”) to leverage on each other’s resource, customer base, skill, expertise, know-how and general strength in their respective field and collaborate and work together for greater effective and efficient solutions in supporting each other’s business objectives for enhanced mutual benefit and profits. MPay is confident that with Digi’s large customer base, this partnership will serve to increase the MPay Mastercard user base. MPay shall focus on acquiring retailers and e-tailers to provide them the ability to accept Digi’s new digital card payments. This includes providing merchants with access to a suite of merchant tools for improved customer retention, which will in turn translate into a more engaging and efficient in-app cashless experience for cardholders.

Information of MPay Services

MPay Services is a Fintech company engaged in the business of development, provision and management of payment services, privilege and loyalty programmes, card issuing and acquiring business and its related payment technology, business know-how and security requirements thereto, and provision of logistics support.

Information on Digi

Digi is a company incorporated in Malaysia and having its principal place of business at Lot 10, Jalan Delima 1/1, Subang Hi-Tech Industrial Park, 40000 Subang Jaya, Selangor Darul Ehsan, Malaysia. Digi is a licensed telecommunications service provider in Malaysia and is in the business of providing mobile communications and digital solutions and related products and services to end-users.

Financial Effects of the Agreement

The Agreement is not expected to have any material effect on the earnings per share, net assets per share, gearing, share capital and substantial shareholders’ shareholding of the Company and its subsidiaries (“the Group”) for the financial year ending 31 December 2019.

Directors’ and major shareholders’ interest

None of the Directors and/or major shareholders of MPay and/or persons connected with them have any interests, direct or indirect, in the Agreement.

Statement by Directors

Having considered all aspects of the Agreement, the Board of Directors of MPay is of the opinion that the Agreement is in the best interest of the Group.

Approvals required

The Agreement does not require approval of the shareholders of MPay and any relevant regulatory bodies.

Document available for inspection

The Agreement is available for inspection at the registered office at Lot 6.05, Level 6, KPMG Tower, 8 First Avenue, Bandar Utama, 47800 Petaling Jaya, Selangor Darul Ehsan, Malaysia during office hours from Mondays to Fridays (except public holidays) for a period of three (3) months from the date of this announcement.

This announcement is dated 3 January 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-2-2019 05:40 AM

|

显示全部楼层

发表于 9-2-2019 05:40 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | MANAGEPAY SYSTEMS BERHAD ("MPay" or "the Company")- Incorporation of a New Subsidiary | The Board of Directors of MPay wishes to announce that ManagePay BuyMalaysia Sdn. Bhd. (“BuyMalaysia”), a 80%-owned subsidiary of ManagePay Marketing Sdn. Bhd., which in turn a wholly-owned subsidiary of the Company, had on 25 January 2019 incorporated a new wholly-owned subsidiary known as MPay Angkasa Sdn. Bhd. (“MPay Angkasa”) in Malaysia under the Companies Act 2016 (“Incorporation”) and having its registered office at 16-A (1st Floor), Jalan Tun Sambanthan 3, Brickfields, 50470 Kuala Lumpur, Malaysia.

The total issued share capital of MPay Angkasa is Ringgit Malaysia One (RM1.00) only comprising One Hundred (100) ordinary shares.

The Director of MPay Angkasa is Dato’ Chew Chee Seng.

The intended activities of MPay Angkasa are issue emoney payment instrument, operate B2B2C, E-commerce including content development and management services, provide merchant acquisition services and deploy connectivity infrastructure and payment acceptance devices for merchants.

The Incorporation will not have any material effect on the earning per share, net assets per share, gearing, share capital and substantial shareholders’ shareholding of the Company and its subsidiaries (the “Group”) for the financial year ending 31 December 2019.

The Incorporation is in line with the long term strategic plans of the Group.

The Incorporation does not require approval from the shareholders of MPay or any other relevant authorities.

None of the Directors and/or major shareholders of MPay and/or persons connected with them have any interests, direct or indirect, in the Incorporation.

This announcement is dated 28 January 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-2-2019 08:05 AM

|

显示全部楼层

发表于 24-2-2019 08:05 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | MANAGEPAY SYSTEMS BERHAD ("MPay" or "the Company")- Second Addendum to existing Agreement, namely Outsourcing Services Agreement entered into between ManagePay International Pte. Ltd., a wholly-owned subsidiary of the Company and Oversea-Chinese Banking Corporation Limited | Introduction

Further to the Company’s announcement dated 30 November 2015, ManagePay International Pte. Ltd. (“MPay International”), a wholly-owned subsidiary of the Company had on 19 May 2016 entered into the Outsourcing Services Agreement which Oversea-Chinese Banking Corporation Limited (“OCBC”)(“Agreement dated 19 May 2016”).

The Board of Directors (“Board”) of MPay wishes to announce that MPay International had on 18 February 2019 entered into a Second Addendum with OCBC (“Second Addendum”) to the Agreement dated 19 May 2016 (together with all appendices, addendums and schedules) in light of the intended services to be provided by MPay International to OCBC and for OCBC to allocate 2,800 Terminals to MPay International within forty-eight (48) months from the date of first Terminal roll-out upon signing the Second Addendum, subject to the terms and conditions as stipulated in the Second Addendum.

Financial Effects of the Second Addendum

The Second Addendum is not expected to have any material effect on the earnings per share, net assets per share, gearing, share capital and substantial shareholders’ shareholding of the Company and its subsidiaries (“the Group”) for the financial year ending 31 December 2019 (“FYE 2019”). The Second Addendum will contribute positively to revenue and bottom line of the Company for FYE 2019.

Directors’ and major shareholders’ interest

None of the Directors and/or major shareholders of MPay and/or persons connected with them have any interests, direct or indirect, in the Second Addendum.

Statement by Directors

Having considered all aspects of the Second Addendum, the Board of Directors of MPay is of the opinion that the Second Addendum is in the best interest of the Group.

Approvals required

The Second Addendum does not require approval of the shareholders of MPay and any relevant regulatory bodies.

Document available for inspection

The Second Addendum is available for inspection at the registered office at Lot 6.05, Level 6, KPMG Tower, 8 First Avenue, Bandar Utama, 47800 Petaling Jaya, Selangor Darul Ehsan, Malaysia during office hours from Mondays to Fridays (except public holidays) for a period of three (3) months from the date of this announcement.

This announcement is dated 21 February 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-3-2019 07:48 AM

|

显示全部楼层

发表于 1-3-2019 07:48 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 2,813 | 3,693 | 12,106 | 8,184 | | 2 | Profit/(loss) before tax | -1,238 | 340 | -8,371 | -6,768 | | 3 | Profit/(loss) for the period | -1,378 | 740 | -8,514 | -6,411 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -1,221 | 691 | -8,312 | -6,351 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.17 | 0.10 | -1.17 | -0.90 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1300 | 0.1400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-4-2019 05:56 AM

|

显示全部楼层

发表于 7-4-2019 05:56 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | MANAGEPAY SYSTEMS BERHAD ('MPay' or 'the Company')- Acceptance of Letters of Offer by GCH Retail (Malaysia) Sdn Bhd ('GCH'), Jutaria Gemilang Sdn Bhd ('Jutaria') and Guardian Health And Beauty Sdn Bhd ('Guardian') from ManagePay Services Sdn. Bhd., a wholly-owned subsidiary of MPay, as the sole integrator to collaborate in facilitating all QR payment acceptance via 2D scanner or other banks payment devices. | Details of the Announcement

The Board of Directors of MPay wishes to announce that ManagePay Services Sdn. Bhd., a wholly-owned subsidiary of the Company ('MPSB'), had on 26 March 2019 received the Acceptance of the Letters of Offer from GCH, Jutaria and Guardian, accepting MPSB as the sole integrator to collaborate in facilitating all QR payment acceptance on GCH’s, Jutaria’s and Guardian’s existing Cash Registers/ POS Solution via 2D scanner or other bank’s payment devices (the 'Project'). Under the Project, MPSB will be appointed as the sole integrator to provide payment acceptance services including the following:-

(a) supply the 2D scanners; (b) undertakes the cost of POS Solution integration and deployment of 2D hand scanners or other bank’s payment devices; (c) collaborate payment devices with respective banks; and (d) facilitating the routing and provide daily settlement report.

Financial Effects

The Project will not have any material effect on the earnings per share, net assets per share and gearing of the Company and its subsidiaries (the 'Group') for the financial year ending 31 December 2019 ('FY2019'). However, it is expected to contribute positively to the Group's revenue for FY2019.

Directors’ and Major Shareholders’ Interest

None of the Directors and/or major shareholders of MPay and/or persons connected with them have any interests, direct or indirect, in the Project.

Statement by Directors

Having considered all aspects of the Project, the Board of Directors of MPay is of the opinion that the Project is in the best interest of the Group.

Approvals required

The Project does not require approval of the shareholders of MPay and any relevant regulatory bodies.

Risk Factors

The risk factors may include, but not limited to, execution risks such as delay in supplying of 2D scanners and shortage of manpower resources. However, MPay has throughout the years, established its track record and expertise to undertake such services. As such, the Board of Directors believes that the Group is able to mitigate the aforesaid risk factors.

This announcement is dated 26 March 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-4-2019 06:42 AM

|

显示全部楼层

发表于 9-4-2019 06:42 AM

|

显示全部楼层

Type | Reply to Query | Reply to Bursa Malaysia's Query Letter - Reference ID | IQL-27032019-00003 | Subject | Acceptance of Letters of Offer by GCH Retail (Malaysia) Sdn Bhd ('GCH'), Jutaria Gemilang Sdn Bhd and Guardian Health And Beauty Sdn Bhd from ManagePay Services Sdn. Bhd., a wholly-owned subsidiary of Managepay Systems Berhad, as the sole integrator to collaborate in facilitating all QR payment acceptance via 2D scanner or other banks payment devices (Contract) | Description | MANAGEPAY SYSTEMS BERHAD ('MPay' or 'the Company')- Acceptance of Letters of Offer by GCH Retail (Malaysia) Sdn Bhd ('GCH'), Jutaria Gemilang Sdn Bhd ('Jutaria') and Guardian Health And Beauty Sdn Bhd ('Guardian') from ManagePay Services Sdn. Bhd., a wholly-owned subsidiary of MPay, as the sole integrator to collaborate in facilitating all QR payment acceptance via 2D scanner or other banks payment devices. | Query Letter Contents | We refer to your Company’s announcement dated 26 March 2019 in respect of the aforesaid matter.

In this connection, kindly furnish Bursa Securities with the following additional information for public release:- - The value of the Contract.

- Duration of the Contract.

- Whether the Contract is renewable. If so, for how many years.

| We refer to the Company’s announcement dated 26 March 2019 and query letter from Bursa Malaysia Securities Berhad to Company dated 27 March 2019 pertaining to the above matter.

The terms herein shall bear the same meaning as defined in the said announcement.

The Board of Directors of the Company wishes to provide the following additional information:- - The contract is not based on the value but on the number of devices. MPSB would supply a total of 3,000 units of devices with a combination of 2D scanners or other banks payment devices;

- The duration of contract is for a period of two (2) + two (2) years; and

- The contract is renewable and would continue to apply at the end of each renewal period.

This announcement is dated 28 March 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-6-2019 03:44 AM

|

显示全部楼层

发表于 6-6-2019 03:44 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | ManagePay Systems Berhad ("MPay" or the "Company")- Joint Venture and Licensing Agreement with MYTV Broadcasting Sdn. Bhd. to collaborate in creating a sustainable future for Digital Terrestrial Television Broadcasting ("DTTB") platform and Engagement with Coship Technology (HK) Co. Limited ("CoShip Technology") for the design, supply, assembly, testing and acceptance of Set Top Boxes ("STB") for the DTTB system ("MYTV System") | The Board of Directors (the “Board”) of the Company wishes to announce that the Company had on 25 April 2019 entered into a Joint Venture and Licensing Agreement (“MYTV Agreement”) with MYTV Broadcasting Sdn. Bhd. (“MYTV”) to collaborate in creating a sustainable future for the Digital Terrestrial Television Broadcasting ("DTTB") platform in Malaysia where both parties are desirous to leverage on MPay’s skills and experience in the areas of Information, Communication and Finance technology and MYTV’s know-how in DTTB, Hybrid Broadband Broadcasting Television (“HbbTV”) and other network facilities and technology platforms (“Project”).

Please refer to the attached file for further details.

This announcement is dated 26 April 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6141121

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-6-2019 05:01 AM

|

显示全部楼层

发表于 9-6-2019 05:01 AM

|

显示全部楼层

Date of change | 01 May 2019 | Name | DATO' CHEW CHEE SENG | Age | 51 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Managing Director | New Position | Group Managing Director | Directorate | Executive |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information |

Working experience and occupation | N/A | Family relationship with any director and/or major shareholder of the listed issuer | N/A | Any conflict of interests that he/she has with the listed issuer | N/A | Details of any interest in the securities of the listed issuer or its subsidiaries | Direct Interest - 158,514,238 ordinary shares Indirect Interest - 150,000 ordinary shares |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-6-2019 05:04 AM

|

显示全部楼层

发表于 9-6-2019 05:04 AM

|

显示全部楼层

Date of change | 01 May 2019 | Name | MR TAN YEW LOONG | Age | 43 | Gender | Male | Nationality | Malaysia | Type of change | Appointment | Designation | Group Chief Executive Officer |

Qualifications| No | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Others | Microsoft Office Applications | Informatics School of Technology | |

| | | Working experience and occupation | - Team Manager, Central Region at American Express Sdn Bhd (1995-1999);- Sales Manager, Merchant Acquiring at American Express Sdn Bhd (1999-2001);- Team Manager - Merchant Acquiring & Loyalty at Standard Chartered Bank Malaysia Berhad (2002-2003);- Merchant Relationship Manager- Acquiring Sales at OCBC Bank (Malaysia) Berhad (2003-2005);- Manager-Sales, Corporate Commercial at Proton Edar (M) Sdn Bhd (2005-2007);- Senior Manager - Acquiring Sales (Key Accounts & Service Providers Segments) at MBF Cards Malaysia Sdn Bhd (2007-2010);- AVP - Central Card Sales at Citibank Berhad (2010-2011);- Senior Manager - Merchant Sales at Diners Club Malaysia Sdn Bhd (2011-2016);- General Manager at ManagePay Cards Sdn Bhd (2016-2017); and- Chief Executive Officer at ManagePay Cards Sdn Bhd (2017-present). |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|