|

|

【EKOVEST 8877 交流专区】怡克伟士

[复制链接]

[复制链接]

|

|

|

发表于 26-12-2017 05:03 AM

|

显示全部楼层

发表于 26-12-2017 05:03 AM

|

显示全部楼层

林景清看好前景 怡克伟士明年更旺

財经 最后更新 2017年12月23日

(吉隆坡22日讯)怡克伟士(EKOVEST,8877,主板建筑股)董事经理丹斯里林景清看好公司前景,认为2018財政年公司业绩表现將比2017年优异。

「我们手持大笔建筑订单,加上位於蕉赖的EkoCheras综合项目也將在明年完工。基础建设业务將继续成为我们主要的盈利来源。」

这项由怡克伟士发展的EkoCheras综合发展计划佔地12英亩,涵盖服务式公寓、商业办公大楼、酒店套房及购物中心。

另外,林景清透露该公司目前正在竞標总值约50亿的建筑项目,得標率大约为50%。

他也表示, 自己是一个乐观的人,「我认为明年市况將好转,因为负面的市况不会永远持续。」

续专注可负担市场

他指出, 一旦完成全面收购依海城(IWCITY,1589,主板產业股),怡克伟士手持的土地將大增,不过,林景清也表示关注,房產市场供应过剩的问题。

「怡克伟士將继续专注於可负担市场,我们明年首季会探討是否推出新项目。」

林景清今日是在EkoCheras的U转高架天桥通车仪式后对媒体发表谈话。怡克伟士邀请政府首席秘书丹斯里阿里韩沙主持通车仪式。

林景清说,全新U转天桥在道路扩充和防洪方面进行提升,结合了交通管理、便利与安全3大利好元素。並预期將惠及360万名公路使用者。

林景清强调,EkoCheras其中一个独特卖点就是直接衔接珍珠花园捷运站购物广场的天桥,设有超过4000个停车位,足以应付住户、消费者及上班一族所需的

泊车空间。

隨著高架U 转天桥开放通车,所有车辆可直接通往第二中环大道,相信將进一步舒缓当地繁忙车流量。【东方网财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 9-2-2018 07:00 AM

|

显示全部楼层

发表于 9-2-2018 07:00 AM

|

显示全部楼层

140亿合约在手.大道收入稳定.怡克伟士盈利看涨

(吉隆坡8日讯)大马投行认为,怡克伟士(EKOVEST,8877,主板建筑组)手握140亿令吉合约,且大道收入稳定,也可能纳入海滨城市(IWCITY,1589,主板产业组)销售,盈利未来有望成长62%。

大马投行表示,怡克伟士内外部合约分别为7亿零300万令吉及129亿8900万令吉,合约类型包括大道、生命之河、大学建筑等。

与政府关系良好

可攫更多巨型基建

大马投行预期,怡克伟士与政府关系良好,预期未来可攫取更多巨型基建行业,预期2018至2020年,每年可攫取10亿令吉合约。

产业方面,怡克伟士在巴生河流域、柔佛及关丹握有相当策略性地点,大部份地库位于吉隆坡,可发展至2023年,仅巴生河流域的地库,发展总值已高达78亿令吉。

不过,基于产业市场放缓,大马投行预期柔佛及关丹短期内不会发展。

收购海滨城市

可能出现3种状况

有关怡克伟士收购海滨城市一事,大马投行认为将可能出现3种状况:第一种情况,怡克伟士以每股1令吉50仙全面收购海滨城市,届时前者债务将从23亿令吉增加至32亿令吉,净负债比从0.97倍提高至1.38倍。

不过,撇除大使路-淡江大道(Duke)融资债务不算在内,怡克伟士净债务将从3亿5800万令吉提高至13亿令吉,净负债比从0.15倍提高至0.56倍。

第二种情况,现金及发新股收购方式,那么怡克伟士只需4亿令吉完成,而32%的股东接受怡克伟士发售新股,那么怡克伟士股本额外增加12%至23亿9000万股,净负债比从0.97倍提高至1.05倍。

第三种情况,假设38%的股东愿意接受新股,那么怡克伟士股本将增加15%至24亿6000万股,怡克伟士只需支付1亿6500万令吉予其他股东,而净负债比从0.97倍下滑至0.93倍。

大马投行认为,以第三种情况最为合适,因怡克伟士无需支付太多现金,且收购海滨城市后,怡克伟士的财务依旧稳健。

丹斯里林刚河是怡克伟士及海滨城市共同大股东。

大马投行补充,海滨城市在柔佛拥有1100英亩地库,是当地领先的发展商。

有关经常性收入方面,大马投行预期,怡克伟士可从大使路-淡江大道获得更多收入,且每5年可调高租金,其中淡江大道3的收费预期为3令吉50仙。

综合上述看法,大马投行认为,怡克伟士拥有强劲持有能力,无需担忧柔佛产业市场放缓,以综合估值法估值后,给予怡克伟士“买进”评级及1令吉35仙目标价。

文章来源:

星洲日报‧财经‧报道:谢汪潮‧2018.02.08 |

|

|

|

|

|

|

|

|

|

|

|

发表于 1-3-2018 06:28 AM

|

显示全部楼层

发表于 1-3-2018 06:28 AM

|

显示全部楼层

本帖最后由 icy97 于 3-3-2018 02:40 AM 编辑

怡克偉士 次季獲利收入均揚升

2018年2月27日

(吉隆坡27日訊)怡克偉士(EKOVEST,8877,主要板建築)截至12月底次季淨利攀升33.9%,從4103萬令吉增至5493萬令吉,營業額按年起8.3%,達2億9788萬令吉。

該公司向馬證交所報備指出,房產發展業務的銷售表現攀升,帶動營業額和淨利有較高的表現。

怡克偉士上半年淨利增33.9%,錄得5493萬令吉;營業額起10.5%,至5億2852萬令吉。

但該公司建築領域營業額和淨利表現減少,主要是已完成第二階段淡江大使大道工程,因此在本季實現較低的建築工作。

至于大道收費業務表現下滑是基于2017財年次季有高達799萬令吉一次性大道賠償形成高比較基礎影響。不過,DUKE 2在去年10月開始啟用,亦貢獻本季營業額表現。【中国报财经】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 297,876 | 274,956 | 528,516 | 478,502 | | 2 | Profit/(loss) before tax | 74,039 | 55,448 | 129,923 | 109,629 | | 3 | Profit/(loss) for the period | 55,460 | 41,031 | 96,608 | 81,125 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 54,925 | 41,032 | 54,925 | 41,032 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.57 | 1.92 | 4.43 | 3.79 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9400 | 0.9000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-3-2018 06:34 AM

|

显示全部楼层

发表于 14-3-2018 06:34 AM

|

显示全部楼层

本帖最后由 icy97 于 15-3-2018 07:16 AM 编辑

怡克伟士获9989万合约

2018年3月13日

(吉隆坡12日讯)怡克伟士(EKOVEST,8877,主板建筑股)旗下的EkoRiver建筑获得吉隆坡市政厅(DBKL)颁发,扣除消费税后总值达9988万8888令吉的合约。

怡克伟士向马交所报备,该合约是“生命之河”(River of Life)第二期的项目,负责配套2,即吉隆坡帝帝旺沙花园的提升和美化工作。

该公司指出,整项合约为期78周。

较早前,怡克伟士董事经理拿督斯里林景清在“投资大马大会”上接受本报访问时曾透露,预计今年内会再获总值1亿令吉的“生命之河”项目合约。 【e南洋】

Type | Announcement | Subject | OTHERS | Description | EKOVEST BERHAD (Ekovest)RECEIPT OF LETTER OF ACCEPTANCE FROM DEWAN BANDARAYA KUALA LUMPUR (DBKL) FOR IMPROVEMENT AND BEAUTIFICATION WORKS AT PACKAGE 2: TAMAN TITIWANGSA, KUALA LUMPUR, FOR THE RIVER OF LIFE PROJECT (PHASE 2) | Ekovest is pleased to announce that our wholly-owned subsidiary, EkoRiver Construction Sdn Bhd (“ERCSB”), had on 12 March 2018, received a letter of acceptance from DBKL for the improvement and beautification works at Package 2 – Taman Titiwangsa, Kuala Lumpur, Federal Territory of Kuala Lumpur for the River of Life Project (Phase 2) (“Works”).

The total contract sum for the Works is RM99,888,888.00 (excluding 6% Goods and Service Tax (“GST”)) (Contract sum including 6% GST is RM105,882,221.28) and the completion period for the Works is for seventy-eight (78) weeks.

The Works is expected to contribute positively to the future revenue and earnings of Ekovest Berhad and its subsidiaries (“Ekovest Group”).

The Works is subject to normal construction risks in which the Ekovest Group are already exposed to. Nonetheless, the construction risks will be managed and mitigated with the experience and expertise of the Ekovest Group to complete construction projects.

None of the directors or substantial shareholders of the Company, or persons connected with them, has any interest, direct or indirect, in the Works.

This announcement is dated 12 March 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-3-2018 01:34 AM

|

显示全部楼层

发表于 16-3-2018 01:34 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 30-3-2018 01:20 AM

|

显示全部楼层

发表于 30-3-2018 01:20 AM

|

显示全部楼层

本帖最后由 icy97 于 31-3-2018 05:39 AM 编辑

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | EKOVEST BERHAD ("EKOVEST" OR THE "COMPANY")CONDITIONAL VOLUNTARY TAKE-OVER OFFER TO ACQUIRE ALL THE ORDINARY SHARES IN ISKANDAR WATERFRONT CITY BERHAD ("IWCITY") | (For consistency, the abbreviations used throughout this announcement shall have the same meanings as those defined in the announcement dated 18 December 2017 in relation to the Proposed Offer unless stated otherwise or defined herein.)

We refer to the announcements dated 18 December 2017, 22 December 2017, 8 January 2018, 9 March 2018 and 12 March 2018 in relation to the Proposed Offer.

As set out in the Offer Document dated 12 March 2018, the Proposed Offer is conditional upon, amongst others, the approval being obtained from the shareholders of Ekovest.

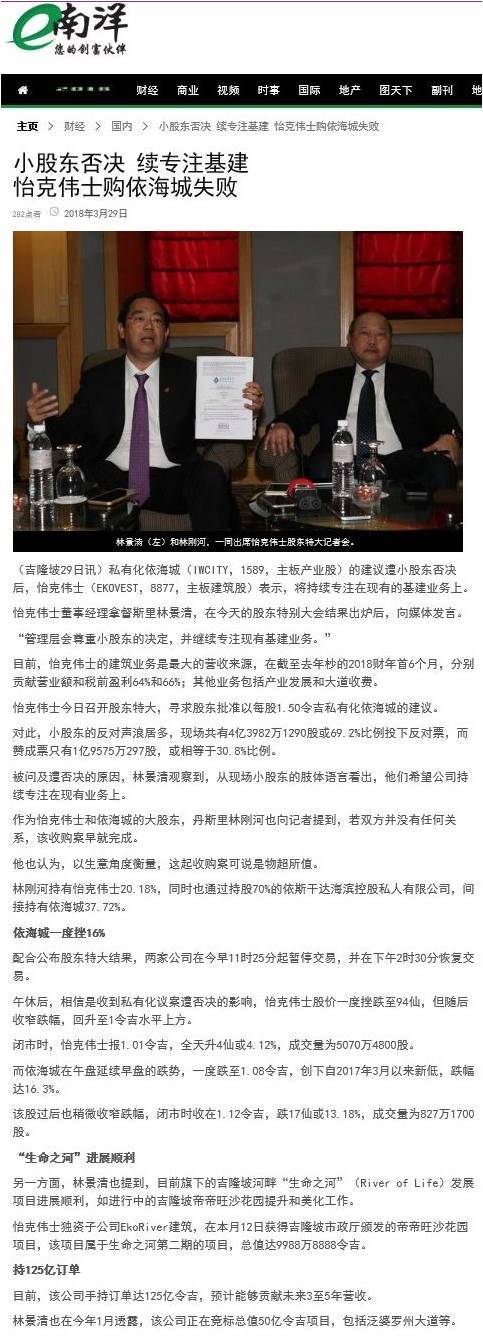

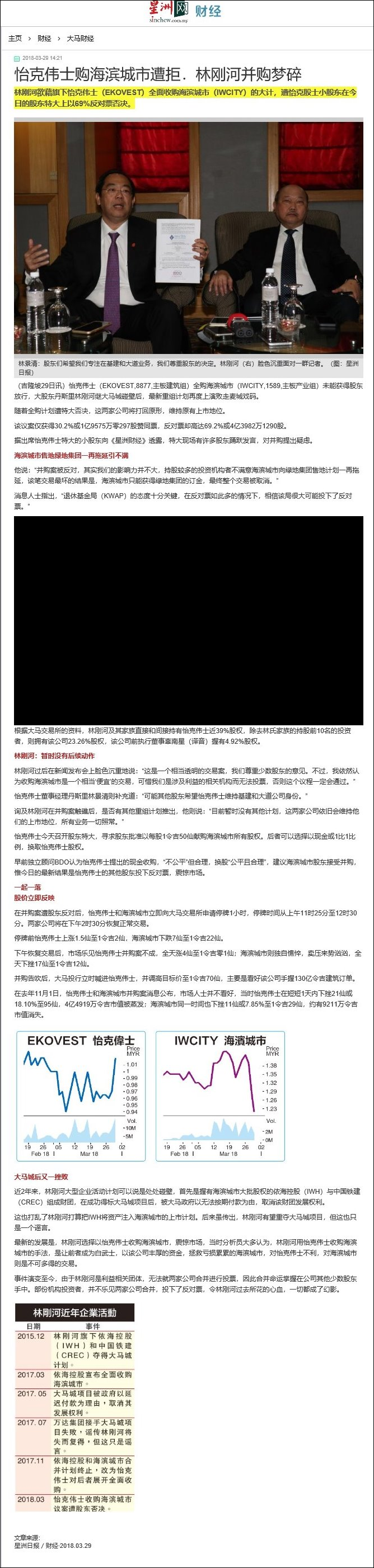

On behalf of the Board, Mercury Securities and Astramina wish to announce that the shareholders of the Company have not approved the resolution pertaining to the Proposed Offer (including the purchase of 53,595,267 IWCity Shares from KPRJ) at the EGM of Ekovest today.

In view of the above:-

(i) the KPRJ SSA has been terminated on even date; and

(ii) the Proposed Offer has lapsed and all acceptances received pursuant to the Proposed Offer will be returned to the respective shareholders of IWCity.

This announcement is dated 29 March 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-4-2018 12:10 AM

|

显示全部楼层

发表于 3-4-2018 12:10 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 11-4-2018 03:24 AM

|

显示全部楼层

发表于 11-4-2018 03:24 AM

|

显示全部楼层

Date of change | 10 Apr 2018 | Name | MR LIM CHEN HERNG | Age | 31 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Alternate Director | New Position | Executive Director | Directorate | Executive | Qualifications | Mr. Lim Chen Herng graduated with a Degree in Business Management from Royal Holloway, University of London in 2008. | Working experience and occupation | Mr. Lim Chen Herng has been with the family business since 2008, with management exposure into the property development, construction, finance and oil and gas industry. Currently he is an Executive Director of Knusford Berhad and an Alternate Director in Iskandar Waterfront City Berhad. He also sits on the board of several private limited companies, most notably the master developer, Iskandar Waterfront Holdings Sdn Bhd. | Family relationship with any director and/or major shareholder of the listed issuer | Mr. Lim Chen Herng is a son to Tan Sri Dato' Lim Kang Hoo, nephew to Dato' Lim Hoe, cousin to Tan Sri Datuk Seri Lim Keng Cheng and Mr. Wong Khai Shiang. He is a brother to Mr. Lim Chen Thai and an uncle to Mr. Lim Ding Shyong. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-4-2018 03:24 AM

|

显示全部楼层

发表于 11-4-2018 03:24 AM

|

显示全部楼层

Date of change | 10 Apr 2018 | Name | MR LIM CHEN THAI | Age | 24 | Gender | Male | Nationality | Malaysia | Designation | Alternate Director | Directorate | Non Independent and Non Executive | Type of change | Appointment | Qualifications | Mr. Lim Chen Thai holds a Bachelor of Banking and Finance from Monash University (Caulfield Campus). | Working experience and occupation | Mr. Lim Chen Thai has served the Iskandar Waterfront Holdings Sdn Bhd ("IWH") Group in various capacities since November 2015 and was appointed as Director of IWH on 7 March 2017. Prior to this, he was interned with Lincolns Lawyer Melbourne in 2013.He is currently a Non Independent and Non Executive Director of PLS Plantations Berhad. Mr. Lim also holds directorships in several private limited companies which include amongst others, Konsortium Lebuhraya Utara-Timur (KL) Sdn Bhd. | Directorships in public companies and listed issuers (if any) | PLS Plantations Berhad | Family relationship with any director and/or major shareholder of the listed issuer | Mr. Lim Chen Thai is a son to Tan Sri Dato' Lim Kang Hoo, nephew to Dato' Lim Hoe, cousin to Tan Sri Datuk Seri Lim Keng Cheng and Mr. Wong Khai Shiang. He is a brother to Mr. Lim Chen Herng and an uncle to Mr. Lim Ding Shyong. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-6-2018 06:07 AM

|

显示全部楼层

发表于 9-6-2018 06:07 AM

|

显示全部楼层

本帖最后由 icy97 于 15-6-2018 06:03 AM 编辑

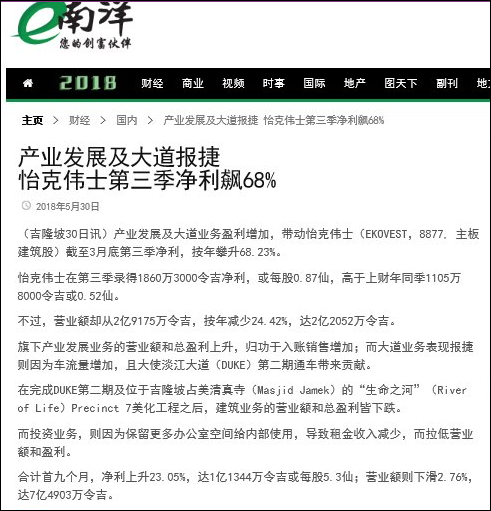

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 220,516 | 291,754 | 749,032 | 770,256 | | 2 | Profit/(loss) before tax | 21,549 | 21,255 | 151,472 | 130,885 | | 3 | Profit/(loss) for the period | 15,666 | 11,382 | 112,274 | 92,508 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 18,603 | 11,058 | 113,435 | 92,185 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.87 | 0.52 | 5.30 | 4.31 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9300 | 0.9000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-6-2018 01:35 AM

|

显示全部楼层

发表于 13-6-2018 01:35 AM

|

显示全部楼层

本帖最后由 icy97 于 16-6-2018 04:02 AM 编辑

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | EKOVEST BERHAD (EKOVEST OR THE COMPANY)JOINT VENTURE AND SHAREHOLDERS AGREEMENT BETWEEN EKOVEST CONSTRUCTION SDN BHD AND SAMLING RESOURCES SDN BHD | (all definitions and terms used below shall be consistent with the announcement dated 6 January 2017)

We make reference to our announcement in relation to the above matter dated 6 January 2017.

The Board wish to announce that ECSB, our wholly owned subsidiary, had, on 4 June 2018, received a letter from SRSB informing that Lebuhraya Borneo Utara Sdn Bhd (“LBU”), the Project Delivery Partner for the Project, have not consented for the Project to be sub-contracted to the JV Company. As such, SRSB is claiming that the JV Company cannot carry out the Project and that the JVA is now void.

We are reserving our rights in relation to the above matter and are seeking advise and will take all necessary action as may be required.

Nonetheless, the above is not expected to have any material effect on the operations and financials of the Ekovest Group.

Further announcement will be made on this matter, if required, in line with the requirements of the Main Market Listing Requirement.

This announcement is dated 5 June 2018.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-9-2018 05:12 AM

|

显示全部楼层

发表于 2-9-2018 05:12 AM

|

显示全部楼层

本帖最后由 icy97 于 4-9-2018 02:41 AM 编辑

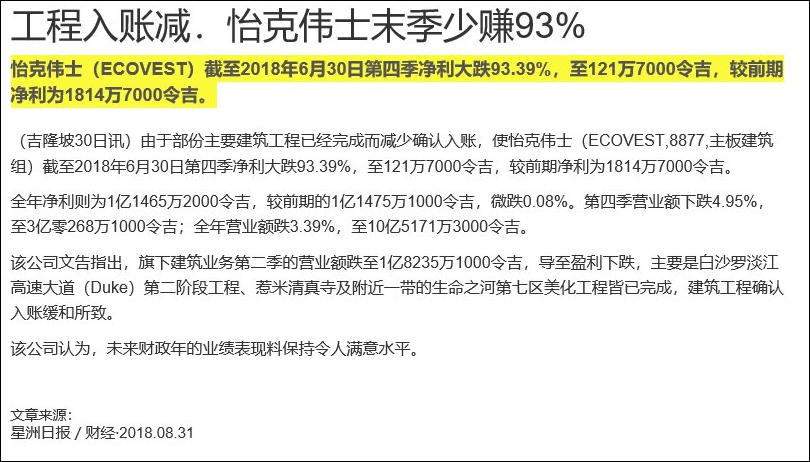

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 302,681 | 318,453 | 1,051,713 | 1,088,703 | | 2 | Profit/(loss) before tax | 1,453 | 50,835 | 152,925 | 176,705 | | 3 | Profit/(loss) for the period | -8,687 | 20,733 | 103,587 | 115,241 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,217 | 18,417 | 114,652 | 114,751 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.06 | 0.86 | 5.36 | 5.37 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.00 | 2.00 | 1.00 | 2.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9300 | 0.9000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-9-2018 06:52 AM

|

显示全部楼层

发表于 7-9-2018 06:52 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | INCORPORATION OF NEW SUBSIDIARY COMPANY | The Board of Directors of Ekovest Berhad (“Ekovest” or “the Company”) wishes to announce that the Company had incorporated a new wholly-owned subsidiary known as DUKE Dinings Sdn Bhd.

DUKE Dinings Sdn Bhd (“DDSB”) was incorporated on 4 September 2018 under the Companies Act, 2016 with an issued share capital of RM2.00 comprising of 2 ordinary shares.

The intended principal activity of DDSB is dealing in food and beverage related business.

The incorporation of DDSB does not have any effect on the share capital or substantial shareholders’ shareholdings and are not expected to have any material effect on the earnings per share, net assets per share and gearing of the Ekovest group for the financial year ending 30 June 2019. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-9-2018 03:44 AM

|

显示全部楼层

发表于 14-9-2018 03:44 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | ACQUISITION OF SUBSIDIARIES | The Board of Directors of Ekovest Berhad (“the Company”) wishes to announce that DUKE Dinings Sdn Bhd, a wholly-owned subsidiary of the Company had on 13 September 2018 acquired the entire issued and paid-up share capital of the following two (2) companies at a total purchase consideration of Ringgit Malaysia: Two Only (RM2.00); 1) Gama Mewah Sdn Bhd

2) Sinarmega Kapital Sdn Bhd

Gama Mewah Sdn Bhd was incorporated on 7 August 2018 with an issued and paid-up share capital of RM1.00.

Sinarmega Kapital Sdn Bhd was incorporated on 11 August 2018 with an issued and paid-up share capital of RM1.00.

Both companies are currently dormant. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-10-2018 05:47 AM

|

显示全部楼层

发表于 30-10-2018 05:47 AM

|

显示全部楼层

EX-date | 27 Dec 2018 | Entitlement date | 31 Dec 2018 | Entitlement time |

| | Entitlement subject | First and Final Dividend | Entitlement description | First and Final Single Tier Dividend of 1 sen per share | Period of interest payment | to | Financial Year End | 30 Jun 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SECTRARS MANAGEMENT SDN BHDLot 9-7, Menara Sentral VistaNo. 150, Jalan Sultan Abdul SamadBrickfields50470 Kuala LumpurTel: 03-2276 6138Fax: 03-2276 6131 | Payment date | 22 Jan 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 31 Dec 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-11-2018 08:20 PM

|

显示全部楼层

发表于 30-11-2018 08:20 PM

|

显示全部楼层

本帖最后由 icy97 于 7-1-2019 02:42 AM 编辑

核心业务稳健--怡克伟士首季赚4387万

http://www.enanyang.my/news/20181201/核心业务稳健-br-怡克伟士首季赚4387万/

| 8877 EKOVEST EKOVEST BHD | | Quarterly rpt on consolidated results for the financial period ended 30/09/2018 | | Quarter: | 1st Quarter | | Financial Year End: | 30/06/2019 | | Report Status: | Unaudited | | Submitted By: |

|

| | | Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period | | | 30/09/2018 | 30/09/2017 | 30/09/2018 | 30/09/2017 | | | RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 304,885 | 229,157 | 304,885 | 229,157 | | 2 | Profit/Loss Before Tax | 59,380 | 54,812 | 59,380 | 54,812 | | 3 | Profit/(loss) attributable to ordinary equity holders of the parent | 43,867 | 38,835 | 43,867 | 38,835 | | 4 | Net Profit/Loss For The Period | 40,914 | 40,076 | 40,914 | 40,076 | | 5 | Basic Earnings/Loss Per Shares (sen) | 2.05 | 1.82 | 2.05 | 1.82 | | 6 | Dividend Per Share (sen) | 0.00 | 0.00 | 0.00 | 0.00 | | | | | As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) | | | 0.9600 | 0.9400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-12-2018 07:53 AM

|

显示全部楼层

发表于 12-12-2018 07:53 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 12-12-2018 08:15 AM

|

显示全部楼层

发表于 12-12-2018 08:15 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 26-1-2019 06:45 AM

|

显示全部楼层

发表于 26-1-2019 06:45 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | INCORPORATION OF NEW SUBSIDIARY COMPANY | The Board of Directors of Ekovest Berhad (“the Company”) wishes to announce that Ekovest Capital Sdn Bhd, a wholly-owned subsidiary of the Company had on 28 December 2018 incorporated a new wholly-owned subsidiary, known as DUKE Hotels Sdn Bhd (“DHSB”) under the Companies Act, 2016 with an issued and paid-up share capital of RM2.00 comprising of 2 ordinary shares.

The intended principal activity of DHSB is to carry on the business as hoteliers.

The incorporation of DHSB does not have any effect on the share capital or substantial shareholders’ shareholdings and are not expected to have any material effect on the earnings per share, net assets per share and gearing of the Ekovest group for the financial year ending 30 June 2019. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-3-2019 07:12 AM

|

显示全部楼层

发表于 5-3-2019 07:12 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 361,181 | 295,568 | 666,066 | 524,725 | | 2 | Profit/(loss) before tax | 59,802 | 72,219 | 119,182 | 127,031 | | 3 | Profit/(loss) for the period | 41,191 | 53,640 | 82,105 | 93,716 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 43,909 | 53,105 | 87,776 | 91,940 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.05 | 2.48 | 4.10 | 4.30 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9800 | 0.9400

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|