|

查看: 11866|回复: 219

|

大众远东产业及旅游业基金(PFEPRF)的前景!(英文版)

[复制链接]

|

|

|

最近很多网友一直问我关于这基金的前景。

可是我本身对房地产没有多大的认识。

所以不敢冒冒然发表这基金的意见。

幸好最后我终于得到这基金最完整的资料了。

所以现在把相关资料发表在这里来让大家好好的参考。

共勉之

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 10:31 PM

|

显示全部楼层

Introduction

lReal Estate investments are increasingly regarded as a separate asset class in addition to equities and bonds.

lThe proposed Public Far-East Property & Resorts Fund will enable investors to participate in this new asset class.

Long Term Potential of Real Estate

l The supply of Real Estate is finite and limited.

l As such, real estate in prime locations will inevitably appreciate over time.

l The stronger the demand, the higher the appreciation in real estate prices.

I. Outlook for Property & Resorts Sector for Regional Markets

- Review of Property Prices

- Property Market Outlook

- Real Estate Investment Trusts (REITs)

- Hotel & Resorts Sector Outlook

[ 本帖最后由 Takumi 于 19-7-2007 10:40 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 10:41 PM

|

显示全部楼层

1. Review of Property Prices

l Malaysia

l Singapore

l Hong Kong

l Shanghai

l Japan

l Australia

l Indonesia |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 10:47 PM

|

显示全部楼层

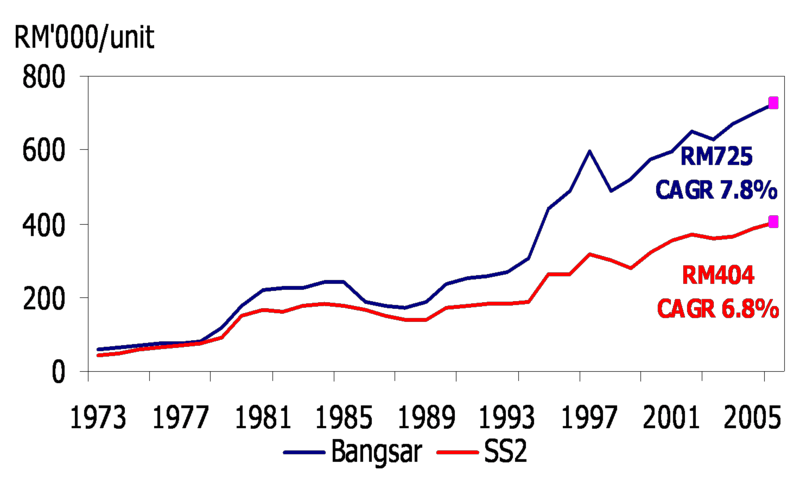

Bangsar & SS2 Double Storey Link House

Properties in strategic locations enjoy long term appreciation.

1986 Recession

1997-98 Asian financial crisis

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 10:50 PM

|

显示全部楼层

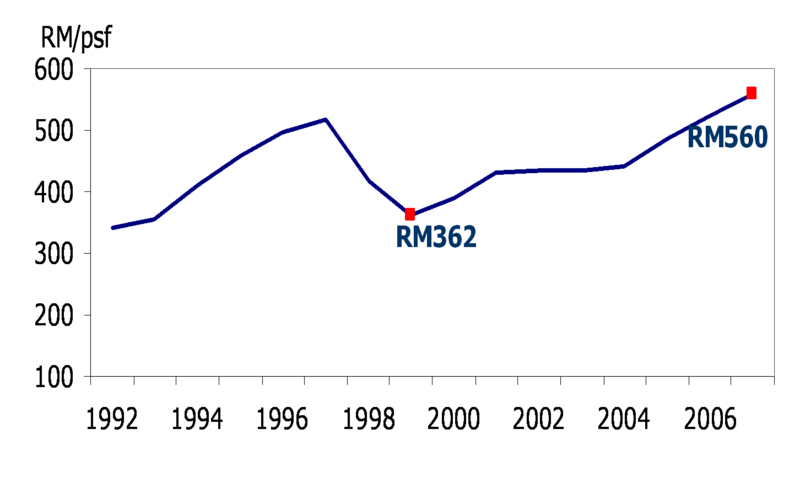

Malaysia: Condominium Capital Values

Prices have recovered by 55% to RM560psf from RM362psf in 1998. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 10:52 PM

|

显示全部楼层

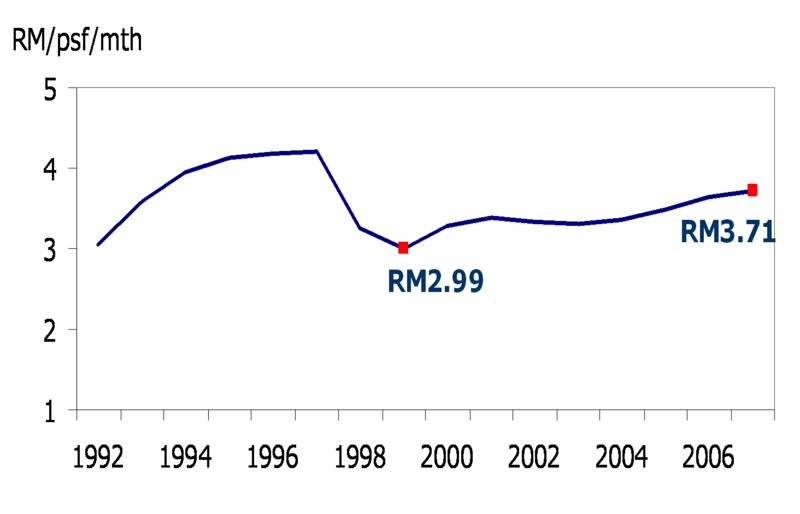

Malaysia: Condominium Rentals

Rentals have recovered but are still below pre-crisis highs. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 10:55 PM

|

显示全部楼层

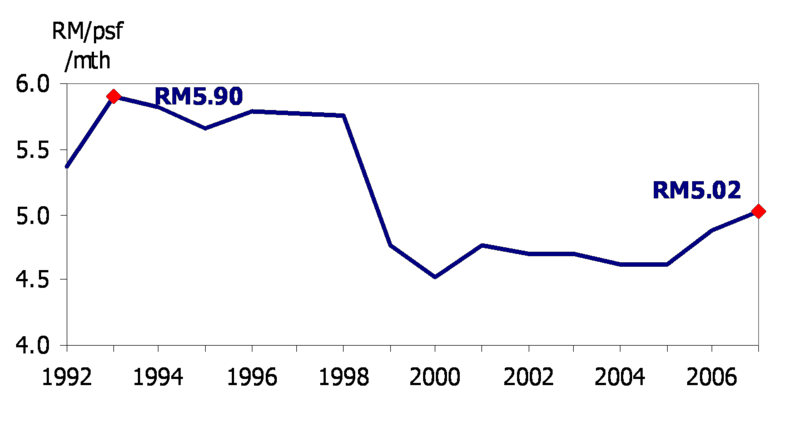

Malaysia: Office Capital Values

Although office prices have recovered, there is further upside potential as prices are still below pre-crisis high. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 10:57 PM

|

显示全部楼层

Malaysia: Office Rentals

Office rentals are 15% below the previous peak. |

|

|

|

|

|

|

|

|

|

|

|

发表于 19-7-2007 10:57 PM

|

显示全部楼层

发表于 19-7-2007 10:57 PM

|

显示全部楼层

可是经济不景的时候,房地产也会跌吧。

可是如果看好经济的话,为何不买股票呢? |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 10:59 PM

|

显示全部楼层

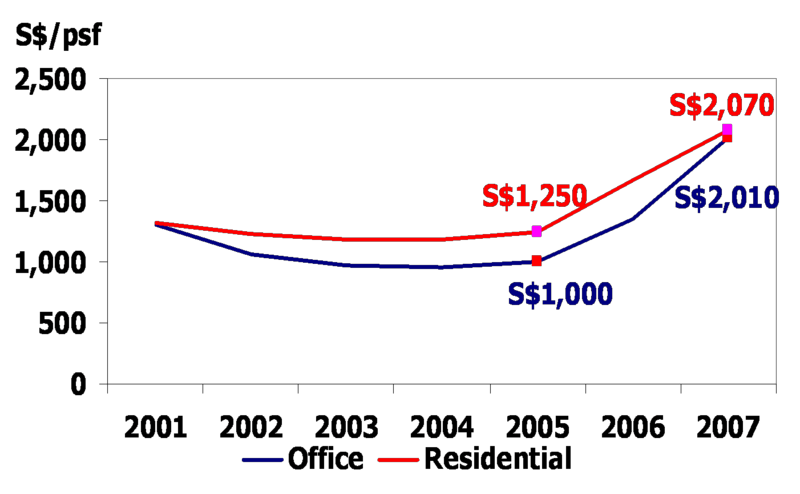

Singapore: Office & Condominium�Capital Values

Residential property prices have increased by over 40% whereas office values have more than doubled since 2005 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 11:01 PM

|

显示全部楼层

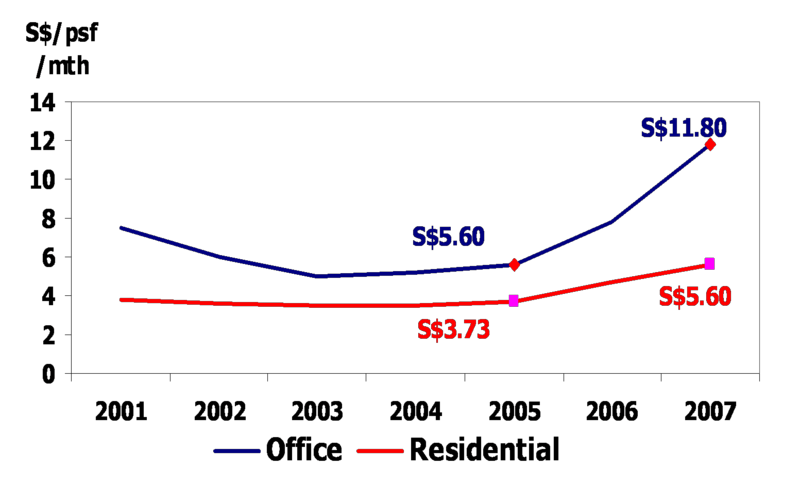

Singapore: Office & Condominium Rentals

Condominium rental rates have increased by 44% whilst office rentals doubled since 2005. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 11:03 PM

|

显示全部楼层

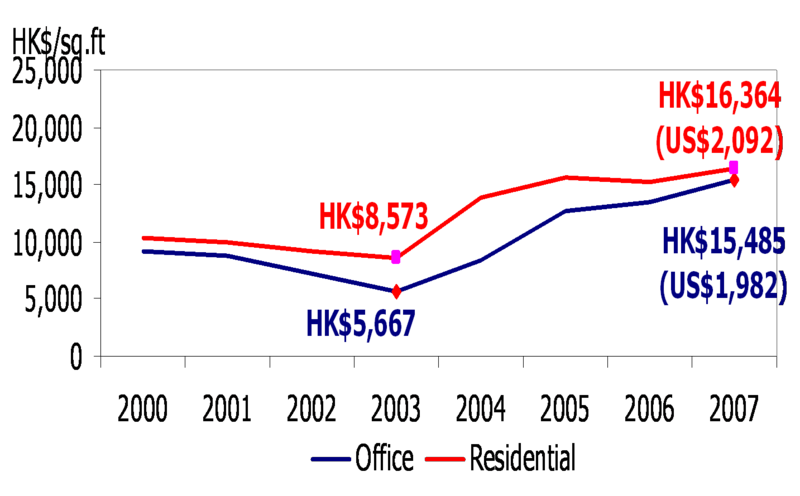

Hong Kong: Office & Condominium Capital Values

Office prices have increased by 170% while condominium prices increased by 90% since

2003. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 11:05 PM

|

显示全部楼层

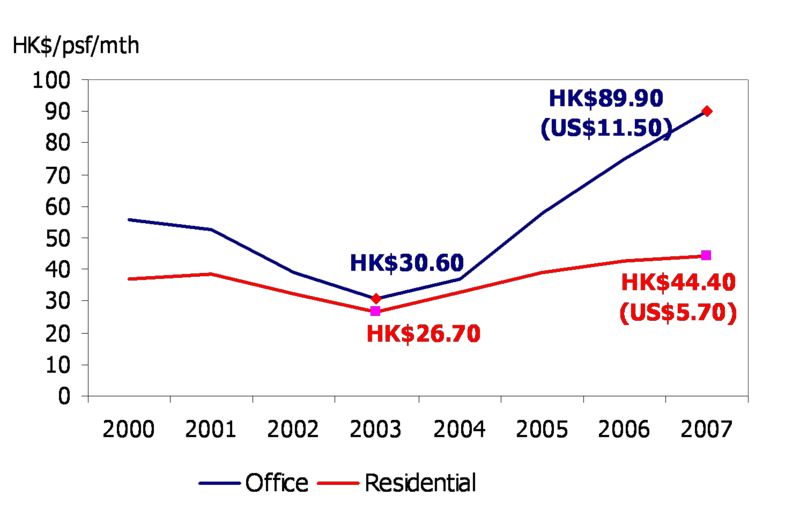

Hong Kong: Office & Condominium Rentals

Office rentals have moved ahead of residential rental |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 11:07 PM

|

显示全部楼层

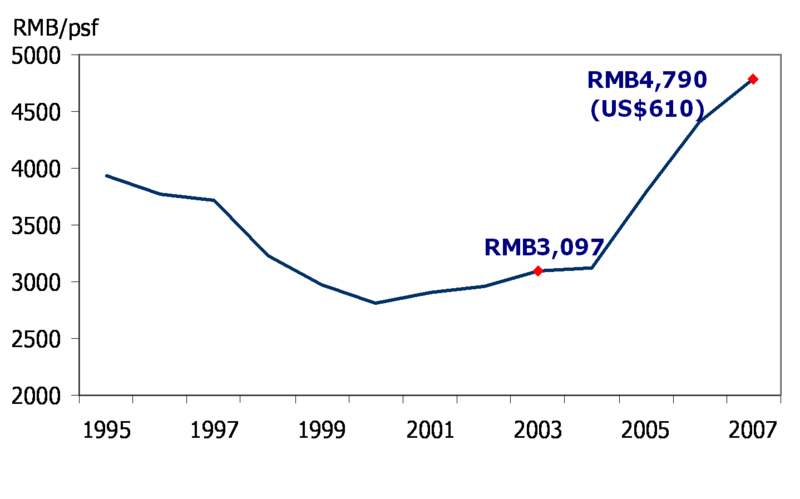

Shanghai: Office Capital Values

Office values have increased by 55% since 2003. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 11:09 PM

|

显示全部楼层

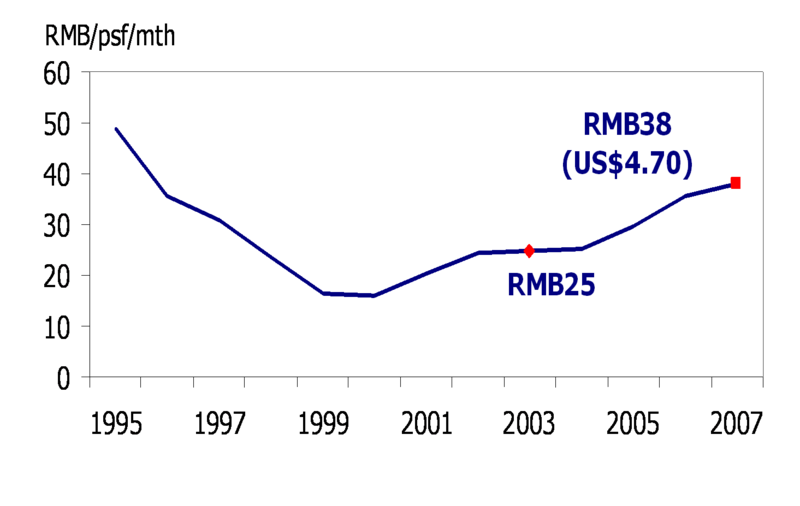

Shanghai: Office Rentals

Office rentals have increased by 52% since 2003. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 11:10 PM

|

显示全部楼层

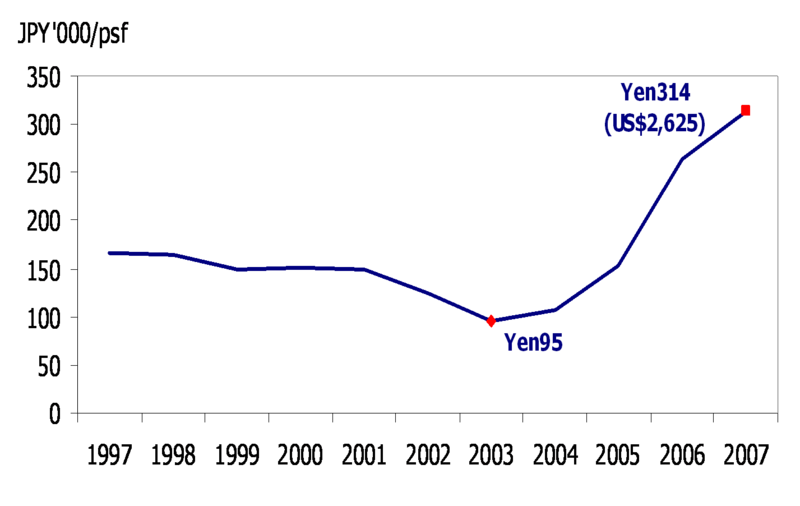

Japan: Office Capital Values

Economic recovery has caused office prices to rise by 231% since 2003. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 11:12 PM

|

显示全部楼层

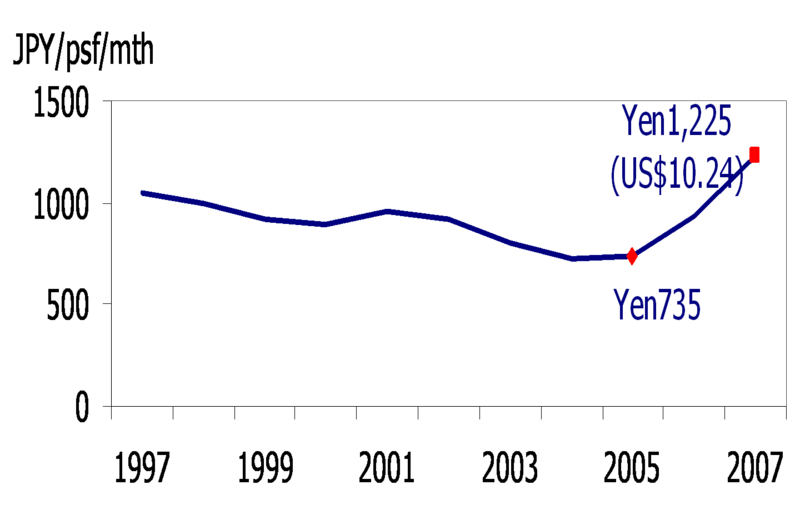

Japan: Office Rentals

Economic recovery has caused rentals to rise by 67% since 2005. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 11:14 PM

|

显示全部楼层

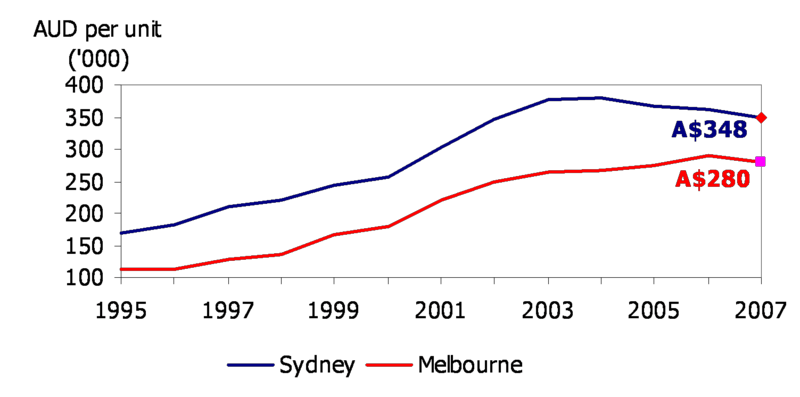

Australia: Residential Capital Values

Prices stabilising in Melbourne while Sydney takes a breather. |

|

|

|

|

|

|

|

|

|

|

|

发表于 19-7-2007 11:15 PM

|

显示全部楼层

发表于 19-7-2007 11:15 PM

|

显示全部楼层

回复 #9 misia 的帖子

不是每个人都敢投资股票的。。。如果敢,我也建议你们投资股票。

信托投资比较平稳,不用每天提心吊胆。。。

还有,这些海外基金投资在很多国家,一个国家经济不好,不会对该基金影响太大,这也是所谓的风险分散。 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 11:16 PM

|

显示全部楼层

Australia: Sydney Residential Rentals

Rental rates on an uptrend. |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|