|

|

发表于 28-8-2018 02:43 AM

|

显示全部楼层

发表于 28-8-2018 02:43 AM

|

显示全部楼层

本帖最后由 icy97 于 29-8-2018 02:17 AM 编辑

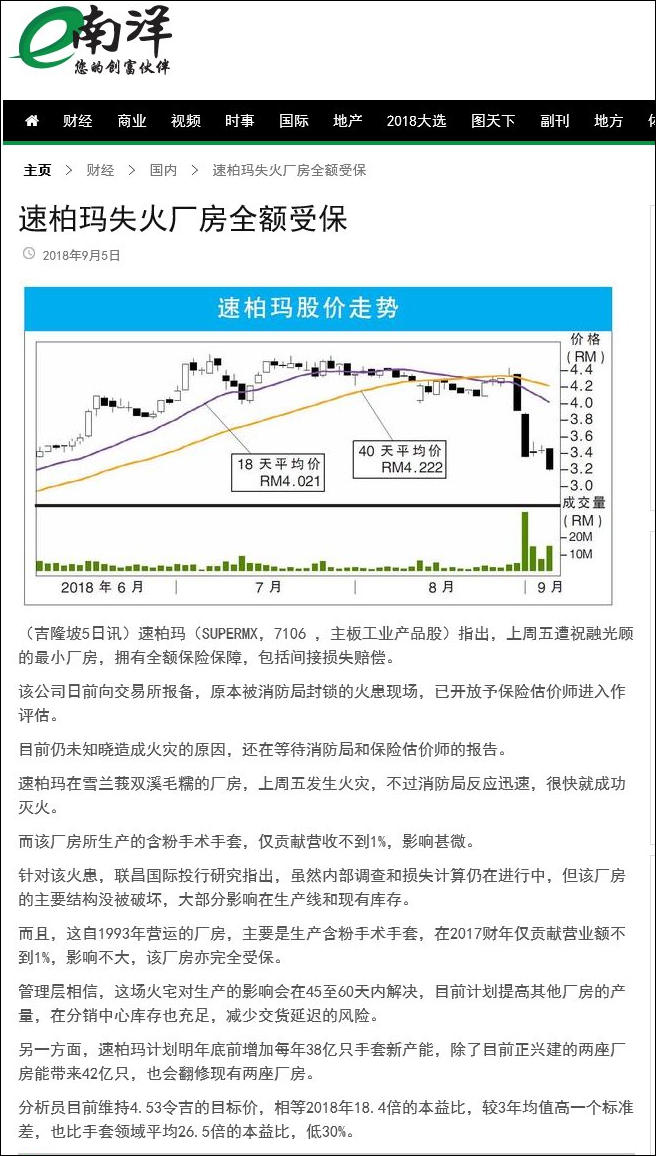

Type | Announcement | Subject | OTHERS | Description | Statement by Supermax Corporation Berhad ("Supermax" or the "Company") - Fire incident | We wish to inform that a fire had occured at our smallest factory in the evening of 24 August 2018. There were no casualties and we wish to thank the Fire Department for their quick response in bringing the fire under control.

The cause of the fire is unknown at this moment. The Company shall restore back the production as soon as possible. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 06:32 AM

|

显示全部楼层

发表于 31-8-2018 06:32 AM

|

显示全部楼层

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

BONUS ISSUES | Description | SUPERMAX CORPORATION BERHAD ("SUPERMAX" OR THE "COMPANY")PROPOSED BONUS ISSUE OF UP TO 680,154,880 NEW ORDINARY SHARES IN SUPERMAX ("SUPERMAX SHARE(S)") ("BONUS SHARE(S)") ON THE BASIS OF 1 BONUS SHARE FOR EVERY 1 EXISTING SUPERMAX SHARE HELD ON AN ENTITLEMENT DATE TO BE DETERMINED LATER("PROPOSED BONUS ISSUE OF SHARES") | On behalf of the Board of Directors of Supermax, UOB Kay Hian Securities (M) Sdn Bhd wishes to announce that Supermax proposes to undertake a bonus issue of up to 680,154,880 new Supermax Shares on the basis of 1 Bonus Share for every 1 existing Supermax Share held on an entitlement date to be determined later.

Please refer to the attachment for further details on the Proposed Bonus Issue of Shares.

This announcement is dated 29 August 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5900049

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 06:54 AM

|

显示全部楼层

发表于 31-8-2018 06:54 AM

|

显示全部楼层

本帖最后由 icy97 于 3-9-2018 02:04 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 329,456 | 312,914 | 1,304,460 | 1,126,879 | | 2 | Profit/(loss) before tax | 23,444 | 33,572 | 167,187 | 107,939 | | 3 | Profit/(loss) for the period | 11,487 | 9,071 | 110,971 | 70,295 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 9,841 | 5,343 | 107,021 | 67,204 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.49 | 0.80 | 16.24 | 10.03 | | 6 | Proposed/Declared dividend per share (Subunit) | 2.00 | 0.00 | 8.00 | 2.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.5600 | 1.5700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 06:55 AM

|

显示全部楼层

发表于 31-8-2018 06:55 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PROPOSED FINAL DIVIDEND | The Board of Directors of Supermax Corporation Berhad ("Company") is pleased to propose a single-tier final dividend of 2 sen per ordinary share in respect of the financial year ended 30 June 2018 for the approval of the shareholders at the forthcoming Company's Twenty-First Annual General Meeting.

The proposed entitlement and payment dates for the final dividend shall be determined at a later date and announced accordingly. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-9-2018 02:42 AM

|

显示全部楼层

发表于 3-9-2018 02:42 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 7-9-2018 05:13 AM

|

显示全部楼层

发表于 7-9-2018 05:13 AM

|

显示全部楼层

本帖最后由 icy97 于 9-9-2018 04:48 AM 编辑

Type | Announcement | Subject | OTHERS | Description | Statement by Supermax Corporation Berhad ("Supermax" or the "Company") - Fire incident - Updates | Further to the Announcement made on 27 August 2018, the Management wishes to inform that the fire which had occured at the Group's smallest plant located in Sungai Bulloh is fully covered by insurance against all risks and including consequential loss claims.

The premises, having been sealed by the Fire Department and inaccessible earlier, was only opened today, Monday 3 September 2018, for the insurance adjustor to conduct his inspection. We are awaiting the Fire Department’s forensic report as well as the adjustor’s report at this point.

At Supermax Group level, the financial and operational impact would be minimal as this plant is dedicated to a specific product which contributes to less than 1% of the Group’s sales turnover. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-10-2018 03:56 AM

|

显示全部楼层

发表于 13-10-2018 03:56 AM

|

显示全部楼层

本帖最后由 icy97 于 14-10-2018 06:29 AM 编辑

Date of change | 19 Oct 2018 | Name | MR ALBERT SAYCHUAN CHEOK | Age | 68 | Gender | Male | Nationality | Australia | Designation | Chairman | Directorate | Independent and Non Executive | Type of change | Appointment |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Degree | Bachelor of Economics | University of Adelaide | | | 2 | Masters | Business Administration | Australian Government School of Management (Mount Eliza) | | | 3 | Professional Qualification | Accountancy | The Australian Society of Accountants | | | 4 | Professional Qualification | Accountancy | Certified Public Accountants of Australia | |

Working experience and occupation | Between May 1979 and February 1982 Mr. Cheok was an Advisor to the Australian Government Inquiry into the Australian Financial System (Campbell Inquiry) which introduced comprehensive reforms to the Australian banking system. He was the Chief Manager at the Reserve Bank of Australia from October 1988 to September 1989 before becoming the Deputy Commissioner of Banking of Hong Kong for about three and half years. He was subsequently appointed as the Executive Director in charge of Banking Supervision at the Hong Kong Monetary Authority from April 1993 to May 1995. Mr. Cheok was the Chairman of Bangkok Bank Berhad in Malaysia from September 1995 to November 2005.Mr. Cheok was the Chairman of Auric Pacific Group of Singapore, a food group listed in Singapore. He was the Chairman of Bowsprit Capital Corporation Limited, the Manager of First REIT, a listed healthcare REIT in Singapore. Mr. Cheok was also the Chairman of LMIR Management, the Manager of Lippo Malls Indonesia Retail Trust, a listed shopping mall REIT in Singapore. Mr Cheok was awarded by Future Times the prestigious award of the Best Performing REIT Fund Manager in Asia for 2016. He is presently the Chairman of Amplefield Limited, listed in Singapore. Mr. Cheok is the Chairman of International Standard Resources Holdings Limited in Hong Kong. Mr. Cheok is a Director and the Chairman of the Nomination Committee at China Aircraft Leasing Group Holdings, awarded the top aircraft leasing company in the world for 2016/2017. Mr Cheok is the inaugural Chairman of the 5G Networks Group, a listed wifi company in Australia of which he is a founder shareholder. | Directorships in public companies and listed issuers (if any) | Mr Cheok is a member of the Board of Governors of the Malaysian Institute of Corporate Governance | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | 37,500 Ordinary Shares |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-10-2018 06:28 AM

|

显示全部楼层

发表于 18-10-2018 06:28 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 19-10-2018 07:11 AM

|

显示全部楼层

发表于 19-10-2018 07:11 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 3-11-2018 05:57 AM

|

显示全部楼层

发表于 3-11-2018 05:57 AM

|

显示全部楼层

| SUPERMAX CORPORATION BERHAD |

EX-date | 28 Nov 2018 | Entitlement date | 30 Nov 2018 | Entitlement time | 05:00 PM | Entitlement subject | Final Dividend | Entitlement description | Final single-tier dividend of 2 sen per share in respect of the financial year ended 30 June 2018. | Period of interest payment | to | Financial Year End | 30 Jun 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 18 Dec 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 30 Nov 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-11-2018 01:27 AM

|

显示全部楼层

发表于 6-11-2018 01:27 AM

|

显示全部楼层

本帖最后由 icy97 于 8-11-2018 07:02 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 367,052 | 312,021 | 367,052 | 312,021 | | 2 | Profit/(loss) before tax | 52,676 | 40,655 | 52,676 | 40,655 | | 3 | Profit/(loss) for the period | 35,969 | 28,094 | 35,969 | 28,094 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 35,942 | 27,901 | 35,942 | 27,901 | | 5 | Basic earnings/(loss) per share (Subunit) | 5.48 | 4.19 | 5.48 | 4.19 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.5600 | 1.5000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-11-2018 08:09 AM

|

显示全部楼层

发表于 10-11-2018 08:09 AM

|

显示全部楼层

净利劲扬 前景看好 速柏玛股价应声涨

財经 最后更新 2018年11月2日 21时34分

(吉隆坡2日讯)速柏玛(SUPERMX,7106,主板保健股)2019財政年首季(截至9月30日)净利按年劲扬近29%,符合国內眾多投行的期望,大多投行亦对其盈利前景保持乐观。

在良好业绩的激励下,速柏玛今日上涨14仙或4.32%,以3.38令吉掛收,是全场第28大上升股,全天成交量为943万股。

MIDF研究分析员指出,速柏玛正在提升全部现有工厂的营运效率。

同时,其巴生12號新厂的建筑工程已在今年6月开始,预计在2019財政年第3季完成。

「我们相信,该公司扩產的努力可支撑其未来盈利增长。」

达证券分析员补充道,年產44亿只手套的12號厂,加上旧厂扩大的產能,速柏玛年產能可从现在的234亿只,提升到2020年时的294亿只。

此外,该分析员称,速柏玛已经推出Aveo Hello这隱形眼镜本地品牌,其中的一次性產品售价和其他市面上商品相近。

他认为,该公司的隱形眼镜业务要至少2年,方能获利。

艾芬黄氏资本分析员表示,速柏玛首季的良好业绩,应可减缓投资者对其管理层执行能力的疑虑。

无论如何,肯纳格研究分析员却反其道而行,继续看淡速柏玛前景。

他指出,速柏玛给出的未来盈利目標较低,加上该公司在產能扩充及產品创新方面落后於同行,所以当前估值比其他手套股低30%。【东方网财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 20-11-2018 01:32 AM

|

显示全部楼层

发表于 20-11-2018 01:32 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 8-1-2019 05:16 AM

|

显示全部楼层

发表于 8-1-2019 05:16 AM

|

显示全部楼层

速柏玛拨4亿扩充手套產能

財经 最后更新 2018年11月30日 21时43分

http://www.orientaldaily.com.my/s/269654

(吉隆坡30日讯)速柏玛(SUPERMX,7 1 0 6,主板保健股)將会拨出3亿9800万令吉的资本开销,以扩充手套业务產能,预计將在2020年达到293亿9500万只手套。

该公司將斥资1亿2800万令吉升级和替换旧生產线,同时也会拨出2亿7000万令吉,用作建设新厂房。这些新厂房將陆续在2020年上半年前竣工。

速柏玛的第12號厂房已在今年7月开始动工,A座和B座预计將分別在明年第3季和后年首季完工。

该公司今日召开股东大会,新上任主席卓盛泉之后向媒体表示,公司的手套和隱形眼镜两大业务具有抗跌性,不管经济好坏,手套和隱形眼镜的需求將持续增长。

隱形眼镜的產能从2016年的4000万片,增长至去年的7000万片。卓盛泉相信,在未来12个月至18个月期间,產能將会增长至2亿5000万片。

「如果能够打进中国市场,隱形眼镜產能有望增至10亿片。」

美国和日本是目前公司隱形眼镜最主要市场。

该公司目前已经推出隱形眼镜的电子商务平台-Aveovision.com,接下来將陆续推出更多新產品,如散光镜片。

与此同时, 卓盛泉也在股东大会上表示,在政府调高最低薪金后,对公司造成的衝击大约是每1000只手套成本增加0.02美元。

他说,目前公司生產的丁月青手套较多,不过,该公司的目標是天然胶手套与丁月青手套的產量比例为50%对50%。卓盛泉也说,该公司的负债率介於20%至30%,仍有举债空间。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 15-1-2019 06:05 AM

|

显示全部楼层

发表于 15-1-2019 06:05 AM

|

显示全部楼层

| SUPERMAX CORPORATION BERHAD |

EX-date | 03 Jan 2019 | Entitlement date | 07 Jan 2019 | Entitlement time | 05:00 PM | Entitlement subject | Bonus Issue | Entitlement description | Bonus issue of up to 680,154,880 new ordinary shares in Supermax Corporation Berhad ("Supermax") ("Supermax Share(s)") ("Bonus Shares(s)") on the basis of 1 Bonus Share for every 1 existing Supermax Share | Period of interest payment | to | Financial Year End | 30 Jun 2019 | Share transfer book & register of members will be | 07 Jan 2019 to 07 Jan 2019 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date |

| | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 07 Jan 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Ratio | Ratio | 1 : 1 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-2-2019 10:30 AM

|

显示全部楼层

发表于 20-2-2019 10:30 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 21-2-2019 05:15 AM

|

显示全部楼层

发表于 21-2-2019 05:15 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 385,101 | 335,914 | 752,153 | 647,935 | | 2 | Profit/(loss) before tax | 54,317 | 57,634 | 106,993 | 98,289 | | 3 | Profit/(loss) for the period | 38,721 | 37,299 | 74,690 | 65,393 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 38,136 | 35,903 | 74,078 | 63,804 | | 5 | Basic earnings/(loss) per share (Subunit) | 5.82 | 5.42 | 11.30 | 9.63 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.50 | 3.00 | 1.50 | 3.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.6000 | 1.5000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-2-2019 05:18 AM

|

显示全部楼层

发表于 21-2-2019 05:18 AM

|

显示全部楼层

EX-date | 18 Mar 2019 | Entitlement date | 20 Mar 2019 | Entitlement time |

| | Entitlement subject | Interim Dividend | Entitlement description | Interim Single-Tier Dividend of 1.5 sen | Period of interest payment | to | Financial Year End | 30 Jun 2019 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BOARDROOM SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaSelangor Darul EhsanTel:0378490777Fax:0378418151 | Payment date | 18 Apr 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 20 Mar 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.015 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-6-2019 06:27 AM

|

显示全部楼层

发表于 22-6-2019 06:27 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 361,199 | 327,069 | 1,113,352 | 975,004 | | 2 | Profit/(loss) before tax | 49,416 | 45,454 | 156,409 | 143,743 | | 3 | Profit/(loss) for the period | 34,963 | 34,091 | 109,653 | 99,484 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 34,617 | 33,376 | 108,695 | 97,180 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.64 | 2.52 | 8.29 | 7.34 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 3.00 | 1.50 | 6.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.8100 | 0.7500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-7-2019 08:37 AM

|

显示全部楼层

发表于 18-7-2019 08:37 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | SUPERMAX CORPORATION BERHAD ("SUPERMAX" OR "THE COMPANY")ACQUISITION OF 100% INTEREST IN CLAYTON DYNAMICS CO LTD | Pursuant to Paragraph 10.05 of the Bursa Malaysia Securities Berhad Main Market Listing Requirements, the Board of Directors of Supermax wishes to announce that Aime Supermax KK (“ASKK”), a 70% subsidiary of the Company had on 28 June 2019 entered into a Share Sale Agreement with Fordham Precision Co. Ltd (“FP”) for the acquisition of 7,800 ordinary shares, representing 100% of the issued and paid-up share capital of Clayton Dynamics Co. Ltd (Company No. 5290001065447) (“CD”) together with CD’s wholly-owned subsidiary, Plan A Co. Ltd (Company No. 9020001085286) (“Plan A”) for a total consideration of JPY100,000,000.00 (equivalent to approximately RM 3,850,000.00) (“Purchase Consideration”) (“Transaction”) .

Please refer to the attachment for further details on the Transaction. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6207321

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|