|

|

发表于 6-10-2017 03:16 AM

|

显示全部楼层

发表于 6-10-2017 03:16 AM

|

显示全部楼层

本帖最后由 icy97 于 6-10-2017 06:44 AM 编辑

资本投资首季净利扬37%

2017年10月6日

(吉隆坡5日讯)由于股息收入增加,带动资本投资(ICAP,5108,主板关闭式基金)截至8月31日首季净利,按年增长37.08%。

资本投资首季净赚223万3000令吉,或每股1.6仙,去年同期净利为162万9000令吉,或每股1.16仙。

同时,营业额则从408万4000令吉,按年增长16.26%至474万8000令吉。

该公司首季获得232万3000令吉股息收入,高于去年同期的178万8000令吉,而利息收入也从236万1000令吉,增加至242万5000令吉。

资本投资指出,该公司作为一只封闭式基金,净资产价值(NAV)走势更能够反映出公司的表现。

截至8月31日,资本投资的每股净资产价值达3.38令吉,相比于去年同期的3.10令吉,增长9.03%。

此前,资威资产管理(Capital Dynamics)创办人兼董事经理陈鼎武亦多番强调,衡量封闭式基金表现的唯一方法,是观察资产净值的表现,而非收益。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Aug 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Aug 2017 | 31 Aug 2016 | 31 Aug 2017 | 31 Aug 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 4,748 | 4,084 | 4,748 | 4,084 | | 2 | Profit/(loss) before tax | 2,715 | 2,137 | 2,715 | 2,137 | | 3 | Profit/(loss) for the period | 2,233 | 1,629 | 2,233 | 1,629 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,233 | 1,629 | 2,233 | 1,629 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.60 | 1.16 | 1.60 | 1.16 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.3800 | 3.3100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-10-2017 06:52 AM

|

显示全部楼层

发表于 30-10-2017 06:52 AM

|

显示全部楼层

陈鼎武:长寿年代银弹要足.投资也要抗老化

谈起抗衰老,我们总会将之与医疗保健和美容扯上关系,但你可知道抗衰老也正悄悄对你我的投资认知带来革命性变化。

如果人类可存活至150年,我们的投资策略该如何进行调整呢?资本投资(ICAP,5108,主板封闭式基金组)董事经理陈鼎武洞悉抗老化趋势,赶在本周举行的全球投资者周开讲前先与《投资致富》分享抗衰老与投资的重要和关联性。

陈鼎武说,老年病专家奥布里德格雷(Aubrey de Grey)认为老化是一种可以治疗的疾病,而导致衰老的7大因素是可以避免的,因此可以使得人长期健康地生活,因此抗衰老是一场比人工智能、无人驾驶汽车更为重要的革命。

“500年前,人们认为世界是方的,你说世界是圆的根本没人相信。但是,革命(Revolution)就是一个全新的概念,新到叫人难以相信。没错,生活很艰难,但如果有解决病痛的解决方案,你会拒绝吗?”

他认为,基于科技发展迅速,这不仅仅局限于人工智能、机械领域,生物科技和再生医学也起了剧大变化,因此活得更久已经不再是选择,而是自然而然会发生在你我身上的事。

“无论你喜不喜欢,这都将是难以避免的。”

因此,陈鼎武指出,迎接长寿时代的准备工作非常重要,需要确保自身的财务能保障未来生活。

他说,如果你以1万令吉投资,以3%年均回酬计算,125年后这笔投资将带来40万2295令吉回酬,但若年回酬达到6%和12%,回酬将达到1460万令吉和142亿令吉。

“这样你就不需要担心财务稳定性。”

中国崛起

浮现投资机会

要确保长寿人生无后顾之虑,投资自然是生财的不二法门,不过,在当前似牛非牛,似熊非熊的市况下,对悲观主义的投资者是地狱,但对乐观主义者却是趁低吸纳的天堂,陈鼎武认为,投资者要乐观,不应胆怯,因为只有乐观的人才能看见机会!

那么,机会究竟在那里?就是那苏醒中的东方巨龙——中国。

陈鼎武相信,中国国家主席习近平和前主席毛泽东、邓小平一样优秀,就是中国当前正确的领导人。

“如果中国共产党不能不断选出优秀的领导人,中国的经济增长和发展就会出现问题,这对我们所有人来说都是非常糟糕的结果。但是,中国领导人依旧人才辈出。”

他说,曾担心习近平因过度肃贪,可能树敌太多,导致国家政局动荡,因此不愿投资中国,但现在看来中国政治局势巩固,若中国未来能像新加坡那般清廉,整个国家将会突飞猛进。

“中国在50至100年内将变得异常成功,我希望能存活到那个时候亲眼见证中国的成就。”

不过,中国股市过去多年熊影笼罩,令许多基金投资者却步,但他说,当所有人对市场都有信心时,股市就会大涨,这时你已买在高位了。

“中国股市占MSCI指数比重仍低,一旦MSCI指数提高中国股市比重,到时中国股市将大涨。”

他补充,在30至40年内,中国不仅将超越美国,甚至将拉近与美国和欧洲的距离,因此公司赶在中国股市开放前,通过沪深港通抢占先机。

中股遭低估

“以长期来说,中国股市的前景最好。”

陈鼎武指出。美国股市本益比为20倍,中国股市只有13倍,比马股还低,市值占国内生产总值(GDP)比重仅为60%,远低于美国的约170%,这突显出中国股市遭到低估。

折价卖出赚更多?

股神巴菲特说过,买股票不但要在股价下跌时买入,最好是在整个股市低迷时买入,因为股价高低和整个股市状况是紧密相连的,而“趁低买进”也被投资者视为最重要的投资守则,但陈鼎武认为,折价买进固然是赚,但折价卖出反而赚更多。

此话怎讲?整个概念又是如何运作的?

他以大股东伦敦投资管理公司(Cityof London Investment Management)投资案为例,说当大股东选补持有资本投资5%股权时,股价为2令吉零3仙,但净资产值(NAV)是2令吉69仙,现在两者仍存在折价,可是股价已大幅上涨。

“别忘了,当你以折价卖出时,你也是以折价买进的。”

他解释,假设投资者和伦敦投资管理公司同日买进,并持续持股至现在,若以NAV作为基准,那么实际回酬将比股价来得低,但如果以股价作为基准,届时实际回酬将高出24%。

伦敦投资管理公司是在2011年投资资本投资,但随后在2015、2016和2017年连续3年向公司发出公开信,表达对公司的投资表现,以及股价比NAV出现巨大折价等问题的疑虑。

目前,伦敦投资管理公司持有资本投资17.415%股权。

全球投资者周

11月4举行2天

虽然陈鼎武分享了长寿、中国和折价卖出赚更多等概念,但在联邦储备局即将缩表,并可能对全球经济和金融市场带来更多挑战之时,大马乃至东盟的前景和挑战值得关注。因此,资威将在2017年11月4至5日于城中城会展中心(KLCC)举行为期2日的全球投资者周,并诚邀来自东盟和全球多国的专家为投资者讲解。

全球投资者周票价分为欢迎价(280令吉)、标准价(2500令吉)和客户价(1000令吉)3类。其中,投资者只需参加“资本投资中国基金”,即可享有280令吉的欢迎价优惠,而资本投资订户、股东和资本投资国际价值基金和全球基金的投资者则可以标准价入场。

不过,若投资者只有意参与第二天的活动,只需缴付99令吉即可入场。

文章来源:

星洲日报‧投资致富‧企业故事‧文:洪建文‧2017.10.29 |

|

|

|

|

|

|

|

|

|

|

|

发表于 23-1-2018 03:58 AM

|

显示全部楼层

发表于 23-1-2018 03:58 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Nov 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Nov 2017 | 30 Nov 2016 | 30 Nov 2017 | 30 Nov 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 3,314 | 1,539 | 8,062 | 5,623 | | 2 | Profit/(loss) before tax | -33 | -1,015 | 2,682 | 1,122 | | 3 | Profit/(loss) for the period | -487 | -1,103 | 1,746 | 526 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -487 | -1,103 | 1,746 | 526 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.35 | -0.79 | 1.25 | 0.38 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.5300 | 3.3100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-4-2018 08:28 PM

|

显示全部楼层

发表于 10-4-2018 08:28 PM

|

显示全部楼层

本帖最后由 icy97 于 11-4-2018 07:37 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

28 Feb 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 28 Feb 2018 | 28 Feb 2017 | 28 Feb 2018 | 28 Feb 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 4,220 | 4,251 | 12,282 | 9,874 | | 2 | Profit/(loss) before tax | -731 | 443 | 1,951 | 1,565 | | 3 | Profit/(loss) for the period | -1,453 | 38 | 293 | 563 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -1,453 | 38 | 293 | 563 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.04 | 0.03 | 0.21 | 0.40 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.4800 | 3.3100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-7-2018 04:05 AM

|

显示全部楼层

发表于 31-7-2018 04:05 AM

|

显示全部楼层

本帖最后由 icy97 于 1-8-2018 07:07 AM 编辑

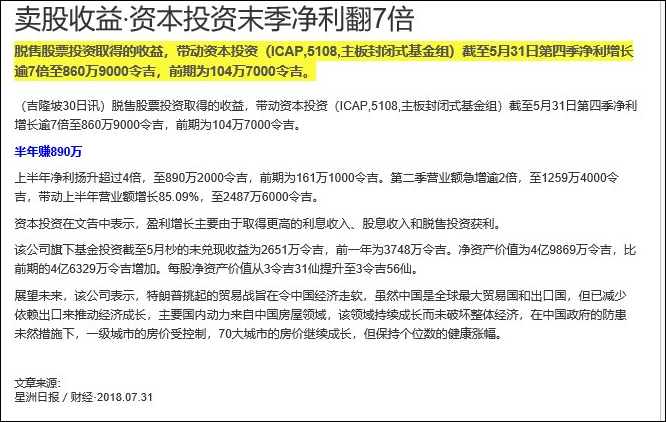

SUMMARY OF KEY FINANCIAL INFORMATION

31 May 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 May 2018 | 31 May 2017 | 31 May 2018 | 31 May 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 12,594 | 3,565 | 24,876 | 13,440 | | 2 | Profit/(loss) before tax | 9,187 | 1,538 | 11,138 | 3,104 | | 3 | Profit/(loss) for the period | 8,609 | 1,047 | 8,902 | 1,611 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 8,609 | 1,047 | 8,902 | 1,611 | | 5 | Basic earnings/(loss) per share (Subunit) | 6.15 | 0.75 | 6.36 | 1.15 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.5600 | 3.3100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-10-2018 05:20 AM

|

显示全部楼层

发表于 18-10-2018 05:20 AM

|

显示全部楼层

本帖最后由 icy97 于 19-10-2018 07:06 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Aug 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Aug 2018 | 31 Aug 2017 | 31 Aug 2018 | 31 Aug 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 4,487 | 4,748 | 4,487 | 4,748 | | 2 | Profit/(loss) before tax | 2,429 | 2,715 | 2,429 | 2,715 | | 3 | Profit/(loss) for the period | 1,912 | 2,233 | 1,912 | 2,233 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,912 | 2,233 | 1,912 | 2,233 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.37 | 1.60 | 1.37 | 1.60 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.5600 | 3.5600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-11-2018 04:32 AM

|

显示全部楼层

发表于 9-11-2018 04:32 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 14-12-2018 04:15 AM

|

显示全部楼层

发表于 14-12-2018 04:15 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 10-2-2019 03:48 AM

|

显示全部楼层

发表于 10-2-2019 03:48 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Nov 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Nov 2018 | 30 Nov 2017 | 30 Nov 2018 | 30 Nov 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 3,534 | 3,314 | 8,020 | 8,062 | | 2 | Profit/(loss) before tax | 1,391 | -33 | 3,820 | 2,682 | | 3 | Profit/(loss) for the period | 895 | -487 | 2,807 | 1,746 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 895 | -487 | 2,807 | 1,746 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.64 | -0.35 | 2.01 | 1.25 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.3700 | 3.5600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-5-2019 02:07 AM

|

显示全部楼层

发表于 21-5-2019 02:07 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

28 Feb 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 28 Feb 2019 | 28 Feb 2018 | 28 Feb 2019 | 28 Feb 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 3,389 | 4,220 | 11,409 | 12,282 | | 2 | Profit/(loss) before tax | 1,133 | -731 | 4,953 | 1,951 | | 3 | Profit/(loss) for the period | 607 | -1,453 | 3,414 | 293 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 607 | -1,453 | 3,414 | 293 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.43 | -1.04 | 2.44 | 0.21 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.2700 | 3.5600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-7-2019 08:48 AM

|

显示全部楼层

发表于 25-7-2019 08:48 AM

|

显示全部楼层

本帖最后由 icy97 于 31-7-2019 09:44 AM 编辑

资本投资末季净利收窄

http://www.enanyang.my/news/20190730/资本投资末季净利收窄/

SUMMARY OF KEY FINANCIAL INFORMATION

31 May 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 May 2019 | 31 May 2018 | 31 May 2019 | 31 May 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 3,317 | 3,931 | 14,726 | 15,855 | | 2 | Profit/(loss) before tax | 1,116 | 1,711 | 6,070 | 6,913 | | 3 | Profit/(loss) for the period | 600 | 1,133 | 4,014 | 4,677 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 600 | 1,133 | 4,014 | 4,677 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.43 | 0.81 | 2.87 | 3.34 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.2200 | 3.5600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-8-2019 06:00 AM

|

显示全部楼层

发表于 9-8-2019 06:00 AM

|

显示全部楼层

Date of change | 08 Aug 2019 | Name | DATUK NG PENG HONG @ NG PENG HAY | Age | 67 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Chairman | New Position | Chairman | Directorate | Non Independent and Non Executive |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-9-2019 06:55 AM

|

显示全部楼层

发表于 18-9-2019 06:55 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 2-10-2019 07:38 AM

|

显示全部楼层

发表于 2-10-2019 07:38 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Aug 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Aug 2019 | 31 Aug 2018 | 31 Aug 2019 | 31 Aug 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 4,581 | 4,487 | 4,581 | 4,487 | | 2 | Profit/(loss) before tax | 2,675 | 2,429 | 2,675 | 2,429 | | 3 | Profit/(loss) for the period | 2,163 | 1,912 | 2,163 | 1,912 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,163 | 1,912 | 2,163 | 1,912 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.55 | 1.37 | 1.55 | 1.37 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.1900 | 3.2200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-11-2019 05:10 AM

|

显示全部楼层

发表于 9-11-2019 05:10 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | ICAPITAL.BIZ BERHAD (the "Fund")- Limit of 20% on the Shareholding of the Total Issued and Paid-up Shares of the Fund ("Maximum Shareholding Limit") | The Board of Directors of icapital.biz Berhad (the "Fund") wishes to inform that City of London Investment Management Company Limited ("CLIM") had on 30 September 2019 and 16 October 2019 acquired further 159,500 shares and 95,500 shares, respectively, in the Fund through DB (Malaysia) Nominee (Asing) Sdn Bhd. The Board is of the view that CLIM had exceeded the 20% Maximum Shareholding Limit stipulated by Securities Commission Guidelines for Public Offerings of Securities of Closed-end Funds, the Main Market Listing Requirements and the Constitution of the Fund. The Board of Directors of the Fund has officially notified CLIM to take immediate action to reduce its shareholding to the requisite Maximum Shareholding Limit.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-4-2020 07:28 AM

|

显示全部楼层

发表于 10-4-2020 07:28 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Nov 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Nov 2019 | 30 Nov 2018 | 30 Nov 2019 | 30 Nov 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 2,954 | 3,534 | 7,534 | 8,020 | | 2 | Profit/(loss) before tax | 864 | 1,391 | 3,538 | 3,820 | | 3 | Profit/(loss) for the period | 400 | 895 | 2,562 | 2,807 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 400 | 895 | 2,562 | 2,807 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.29 | 0.64 | 1.83 | 2.01 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.1800 | 3.2200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-8-2020 08:23 AM

|

显示全部楼层

发表于 11-8-2020 08:23 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

29 Feb 2020 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 29 Feb 2020 | 28 Feb 2019 | 29 Feb 2020 | 28 Feb 2019 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 2,968 | 3,389 | 10,502 | 11,409 | | 2 | Profit/(loss) before tax | -5,787 | 1,133 | -2,249 | 4,953 | | 3 | Profit/(loss) for the period | -6,323 | 607 | -3,761 | 3,414 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -6,323 | 607 | -3,761 | 3,414 | | 5 | Basic earnings/(loss) per share (Subunit) | -4.52 | 0.43 | -2.69 | 2.44 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.0200 | 3.2700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-11-2020 10:01 AM

|

显示全部楼层

发表于 21-11-2020 10:01 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 May 2020 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 May 2020 | 31 May 2019 | 31 May 2020 | 31 May 2019 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 2,258 | 3,317 | 12,760 | 14,726 | | 2 | Profit/(loss) before tax | 520 | 1,116 | -1,729 | 6,070 | | 3 | Profit/(loss) for the period | 163 | 600 | -3,598 | 4,014 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 163 | 600 | -3,598 | 4,014 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.12 | 0.43 | -2.57 | 2.87 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.8200 | 3.2200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-2-2021 05:29 AM

|

显示全部楼层

发表于 15-2-2021 05:29 AM

|

显示全部楼层

本帖最后由 icy97 于 30-8-2021 09:00 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Aug 2020 |

| INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Aug 2020 | 31 Aug 2019 | 31 Aug 2020 | 31 Aug 2019 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 2,852 | 4,581 | 2,852 | 4,581 | | 2 | Profit/(loss) before tax | 1,174 | 2,675 | 1,174 | 2,675 | | 3 | Profit/(loss) for the period | 1,046 | 2,163 | 1,046 | 2,163 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,046 | 2,163 | 1,046 | 2,163 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.75 | 1.55 | 0.75 | 1.55 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.8600 | 2.8200

|

Date of change | 24 Nov 2020 | Name | DATUK NG PENG HONG @ NG PENG HAY | Age | 68 | Gender | Male | Nationality | Malaysia | Designation | Chairman | Directorate | Non Independent and Non Executive | Type of change | Resignation | Reason | Difference in opinion |

Date of change | 25 Nov 2020 | Name | DATO' SERI MD AJIB BIN ANUAR | Age | 70 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Director | New Position | Chairman | Directorate | Independent and Non Executive |

Date of change | 11 Jan 2021 | Name | MISS TAN MUN LIN | Age | 35 | Gender | Female | Nationality | Malaysia | Designation | Director | Directorate | Non Independent and Non Executive | Type of change | Appointment |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Degree | Bachelor of Commerce (Finance) and Bachelor of Laws | University of Sydney | | | 2 | Professional Qualification | Type 9 Licensed Representative | The Hong Kong Securities and Futures Commission | | | 3 | Professional Qualification | Capital Markets Services Representative License | Securities Commission Malaysia | |

Working experience and occupation | Ms Tan Mun Lin currently serves as a fund manager and Executive Director of Capital Dynamics Asset Management Sdn Bhd. Ms Tan holds the Capital Markets Services Representative Licence issued by the Securities Commission of Malaysia (SC) and is licensed as a representative by the Securities and Futures Commission of Hong Kong (SFC), both for the regulated activity of fund management. Ms Tan has more than 11 years of experience in the regulated investment advisory and fund management industry. She possesses extensive experience in local and global research and analysis, legal, regulatory & compliance, marketing/business development, HR, operations, strategy and management.Ms Tan also serves as the deputy group CEO of Capital Dynamics, an investment advisory and fund management group licensed by the SC, the Monetary Authority of Singapore, the Australian Securities and Investment Commission and the SFC.Ms Tan started her career in Capital Dynamics as Executive Assistant to CEO (Investment Research) in September 2009. She graduated from the University of Sydney with a Bachelor of Commerce (Finance) in 2007 and a Bachelor of Laws in 2009. | Directorships in public companies and listed issuers (if any) | Nil | Family relationship with any director and/or major shareholder of the listed issuer | Nil | Any conflict of interests that he/she has with the listed issuer | She is the Executive Director of Capital Dynamics Asset Management Sdn Bhd, the Fund Manager of the Company. | Details of any interest in the securities of the listed issuer or its subsidiaries | Direct Interest - 20,000 shares |

SUMMARY OF KEY FINANCIAL INFORMATION

30 Nov 2020 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Nov 2020 | 30 Nov 2019 | 30 Nov 2020 | 30 Nov 2019 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 1,175 | 2,954 | 4,027 | 7,534 | | 2 | Profit/(loss) before tax | -524 | 864 | 650 | 3,538 | | 3 | Profit/(loss) for the period | -692 | 400 | 354 | 2,562 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -692 | 400 | 354 | 2,562 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.49 | 0.29 | 0.25 | 1.83 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.0100 | 3.1800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-10-2021 08:29 AM

|

显示全部楼层

发表于 12-10-2021 08:29 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Aug 2021 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Aug 2021 | 31 Aug 2020 | 31 Aug 2021 | 31 Aug 2020 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 2,413 | 2,852 | 2,413 | 2,852 | | 2 | Profit/(loss) before tax | 602 | 1,174 | 602 | 1,174 | | 3 | Profit/(loss) for the period | 449 | 1,046 | 449 | 1,046 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 449 | 1,046 | 449 | 1,046 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.32 | 0.75 | 0.32 | 0.75 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.4700 | 3.0400

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|