|

|

发表于 27-4-2018 05:22 AM

|

显示全部楼层

发表于 27-4-2018 05:22 AM

|

显示全部楼层

本帖最后由 icy97 于 4-5-2018 04:09 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 266,114 | 250,100 | 266,114 | 250,100 | | 2 | Profit/(loss) before tax | 46,457 | 42,103 | 46,457 | 42,103 | | 3 | Profit/(loss) for the period | 34,230 | 31,921 | 34,230 | 31,921 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 34,230 | 31,921 | 34,230 | 31,921 | | 5 | Basic earnings/(loss) per share (Subunit) | 53.50 | 49.90 | 53.50 | 49.90 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.1600 | 1.6300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-5-2018 02:26 AM

|

显示全部楼层

发表于 5-5-2018 02:26 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 7-5-2018 12:53 AM

|

显示全部楼层

发表于 7-5-2018 12:53 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 22-8-2018 05:10 AM

|

显示全部楼层

发表于 22-8-2018 05:10 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 25-8-2018 07:06 AM

|

显示全部楼层

发表于 25-8-2018 07:06 AM

|

显示全部楼层

Date of change | 01 Sep 2018 | Name | MISS MIRJAM JOANNA GHISLAINE VAN THIEL | Age | 40 | Gender | Female | Nationality | Netherlands | Type of change | Resignation | Designation | Chief Financial Officer | Reason | Ms Mirjam van Thiel has been reassigned by Royal FrieslandCampina N.V., the ultimate holding company of the Company to assume the role of Finance Director in FrieslandCampina in the Philippines with effect from 1 September 2018. | Details of any disagreement that he/she has with the Board of Directors | No | Whether there are any matters that need to be brought to the attention of shareholders | No | Qualifications | Graduate from Hogeschool van Utrecht in the Netherlands, specialising in Management, Economics and Law, with a Masters in Financial Management from the Netherlands Business School, Nyenrode University and Executive Masters of Finance & Control from Nivra - Nyenrode Business School, the Netherlands. | Working experience and occupation | Ms Mirjam Joanna Ghislaine van Thiel has 15 years experience in various finance and business development positions within HJ Heinz Group of Companies, having been based in Europe, Australia and Indonesia amongst others.She was the Chief Financial Officer for HJ Heinz with responsibility for Australia, New Zealand and Papua New Guinea, a role which she assumed in February 2014.She was appointed as the Finance Director for Dutch Lady Milk Industries Berhad with effect from 16 March 2015. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-8-2018 07:06 AM

|

显示全部楼层

发表于 25-8-2018 07:06 AM

|

显示全部楼层

Date of change | 01 Sep 2018 | Name | MR JURIAN DUIJVESTIJN | Age | 43 | Gender | Male | Nationality | Netherlands | Type of change | Appointment | Designation | Chief Financial Officer | Qualifications | Graduate from 'Hogeschool voor Economische Studies (HES) Rotterdam, specialising in Propaedeutic Logistics Management, with Business Economics (Master of Science) from the Erasmus University of Rotterdam (EUR) and Certified Practicing Accountant (CPA), CPA Australia. | Working experience and occupation | Mr Jurian Duijvestijn has 13.5 years experience in various finance and business development positions within FrieslandCampina, H.J. Heinz, KPMG Transaction Services, Geodis Wilson Asia Pacific, TNT Group of Companies and TPG Post, having been based in Singapore, Netherlands and Hong Kong amongst others.He is currently the Commercial Finance Director Specialized Nutrition for FrieslandCampina with responsibility for Singapore, a role which he assumed in August 2016.He is appointed as the Finance Director for Dutch Lady Milk Industries Berhad with effect from 1 September 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-8-2018 07:23 AM

|

显示全部楼层

发表于 30-8-2018 07:23 AM

|

显示全部楼层

本帖最后由 icy97 于 4-9-2018 01:22 AM 编辑

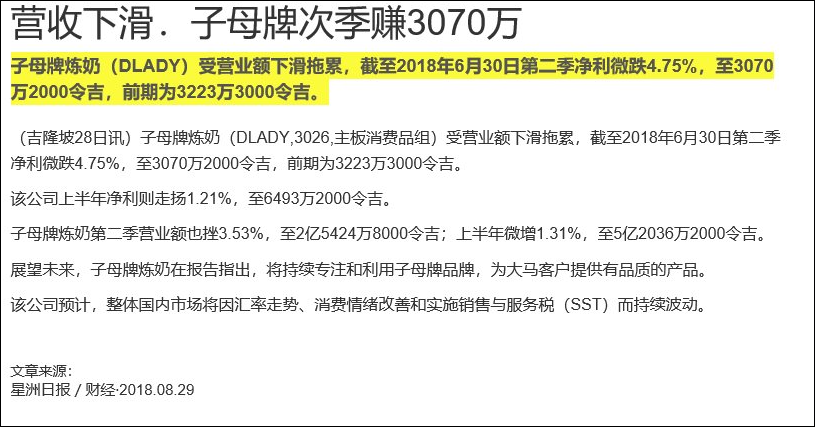

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 254,248 | 263,540 | 520,362 | 513,640 | | 2 | Profit/(loss) before tax | 40,428 | 42,686 | 86,885 | 84,790 | | 3 | Profit/(loss) for the period | 30,702 | 32,233 | 64,932 | 64,155 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 30,702 | 32,233 | 64,932 | 64,155 | | 5 | Basic earnings/(loss) per share (Subunit) | 48.00 | 50.35 | 101.50 | 100.20 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.5400 | 1.6300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-11-2018 07:06 AM

|

显示全部楼层

发表于 21-11-2018 07:06 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 27-12-2018 06:10 AM

|

显示全部楼层

发表于 27-12-2018 06:10 AM

|

显示全部楼层

| DUTCH LADY MILK INDUSTRIES BERHAD |

EX-date | 10 Dec 2018 | Entitlement date | 12 Dec 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | A standard single-tier interim dividend of RM0.50 per ordinary share and a special single-tier interim dividend of RM0.40 per ordinary share for the financial year ending 31 December 2018. | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | 12 Dec 2018 to 12 Dec 2018 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaSelangorTel:0378490777Fax:0378418151 | Payment date | 21 Dec 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 12 Dec 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.9 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-12-2018 06:16 AM

|

显示全部楼层

发表于 27-12-2018 06:16 AM

|

显示全部楼层

本帖最后由 icy97 于 8-1-2019 06:14 AM 编辑

第3季净赚3421万-子母牌牛奶派息90仙

http://www.chinapress.com.my/20181127/第3季净赚3421万-子母牌牛奶派息90仙/

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 257,052 | 281,836 | 777,414 | 795,476 | | 2 | Profit/(loss) before tax | 45,555 | 42,752 | 132,441 | 127,541 | | 3 | Profit/(loss) for the period | 34,213 | 32,583 | 99,147 | 96,737 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 34,213 | 32,583 | 99,147 | 96,737 | | 5 | Basic earnings/(loss) per share (Subunit) | 53.50 | 50.90 | 154.90 | 151.20 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.0700 | 1.6300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-3-2019 07:06 AM

|

显示全部楼层

发表于 5-3-2019 07:06 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 271,154 | 269,060 | 1,048,568 | 1,064,536 | | 2 | Profit/(loss) before tax | 38,852 | 29,979 | 171,292 | 157,519 | | 3 | Profit/(loss) for the period | 30,303 | 20,980 | 129,449 | 117,717 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 30,303 | 20,980 | 129,449 | 117,717 | | 5 | Basic earnings/(loss) per share (Subunit) | 47.35 | 32.80 | 202.30 | 183.90 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.6500 | 1.6300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-6-2019 07:26 AM

|

显示全部楼层

发表于 2-6-2019 07:26 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 264,986 | 266,114 | 264,986 | 266,114 | | 2 | Profit/(loss) before tax | 43,265 | 46,457 | 43,265 | 46,457 | | 3 | Profit/(loss) for the period | 33,897 | 34,230 | 33,897 | 34,230 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 33,897 | 34,230 | 33,897 | 34,230 | | 5 | Basic earnings/(loss) per share (Subunit) | 53.00 | 53.50 | 53.00 | 53.50 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.1800 | 1.6500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-6-2019 07:53 AM

|

显示全部楼层

发表于 2-6-2019 07:53 AM

|

显示全部楼层

| DUTCH LADY MILK INDUSTRIES BERHAD |

EX-date | 10 May 2019 | Entitlement date | 13 May 2019 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | A standard single-tier interim divedend of RM0.50 per ordinary share for the financial year ending 31 December 2019 | Period of interest payment | to | Financial Year End | 31 Dec 2019 | Share transfer book & register of members will be | 13 May 2019 to 13 May 2019 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BOARDROOM SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1,Jalan PJU 1A/4647301 Petaling JayaTel : 03-78418088Fax : 03-78418100 | Payment date | 17 May 2019 | a.Securities transferred into the Depositor's Securities Account before 4:30 pm in respect of transfers | 13 May 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.5 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2019 07:34 AM

|

显示全部楼层

发表于 28-8-2019 07:34 AM

|

显示全部楼层

本帖最后由 icy97 于 28-8-2019 09:45 AM 编辑

婴儿配方奶粉市场放缓 子母牌次季净利跌44%

Ahmad Naqib Idris/theedgemarkets.com

August 27, 2019 18:58 pm +08

https://www.theedgemarkets.com/article/婴儿配方奶粉市场放缓-子母牌次季净利44

(吉隆坡27日讯)子母牌(Dutch Lady Milk Industries Bhd)截至6月杪第二季净利报1719万令吉,较上财年同期的3070万令吉,按年下降44%。

次季营业额从2亿5425万令吉,下滑4%至2亿4361万令吉。

根据今日向大马交易所的报备,该集团将业绩下跌归咎于婴幼儿配方奶粉市场下滑,部分抵销液体牛奶市场。

除此之外,其他因素包括产品组合结构变化、原料价格上涨以及利淡的汇率影响。

2019财政年首半年的净利跌21%至5109万令吉,一年前为6493万令吉;营业额从5亿2036万令吉,微跌2.3%至5亿859万令吉。

该集团表示,将继续致力于未来发展,提高消费者对牛奶的消费。

“子母牌将继续投资于长期增长,并将提高效率,以减轻原料价格上涨及令吉兑美元汇率走贬的影响。”

“从长远来看,公司前景仍然是乐观的,因为品牌的实力,以及越来越多的大马人需要和意识到牛奶的好处和营养价值及其辅助乳制品。”

(编译:陈慧珊)

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2019 | 30 Jun 2018 | 30 Jun 2019 | 30 Jun 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 243,606 | 254,248 | 508,592 | 520,362 | | 2 | Profit/(loss) before tax | 25,161 | 40,428 | 68,425 | 86,885 | | 3 | Profit/(loss) for the period | 17,190 | 30,702 | 51,086 | 64,932 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 17,190 | 30,702 | 51,086 | 64,932 | | 5 | Basic earnings/(loss) per share (Subunit) | 26.90 | 48.00 | 79.80 | 101.50 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.9500 | 1.6500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-3-2020 06:54 AM

|

显示全部楼层

发表于 10-3-2020 06:54 AM

|

显示全部楼层

| DUTCH LADY MILK INDUSTRIES BERHAD |

EX-date | 12 Dec 2019 | Entitlement date | 13 Dec 2019 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Second single-tier interim dividend of RM0.50 per ordinary share for the financial year ending 31 December 2019 | Period of interest payment | to | Financial Year End | 31 Dec 2019 | Share transfer book & register of members will be | 13 Dec 2019 to 13 Dec 2019 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BOARDROOM SHARE REGISTRARS SDN BHD11th Floor, Menara SymphonyNo. 5, Jalan Prof. Khoo Kay KimSeksyen 1346200 Petaling JayaSelangor MalaysiaTel:0378904700Fax:0378904670 | Payment date | 24 Dec 2019 | a.Securities transferred into the Depositor's Securities Account before 4:30 pm in respect of transfers | 13 Dec 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.5 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-3-2020 08:18 AM

|

显示全部楼层

发表于 13-3-2020 08:18 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2019 | 30 Sep 2018 | 30 Sep 2019 | 30 Sep 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 276,313 | 257,052 | 784,905 | 777,414 | | 2 | Profit/(loss) before tax | 34,865 | 45,555 | 103,290 | 132,441 | | 3 | Profit/(loss) for the period | 25,204 | 34,213 | 76,290 | 99,147 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 25,204 | 34,213 | 76,290 | 99,147 | | 5 | Basic earnings/(loss) per share (Subunit) | 39.40 | 53.50 | 119.20 | 154.90 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.3400 | 1.6500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-4-2020 07:54 AM

|

显示全部楼层

发表于 25-4-2020 07:54 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2019 | 31 Dec 2018 | 31 Dec 2019 | 31 Dec 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 281,757 | 271,154 | 1,066,662 | 1,048,568 | | 2 | Profit/(loss) before tax | 34,309 | 38,852 | 137,600 | 171,292 | | 3 | Profit/(loss) for the period | 26,667 | 30,303 | 102,958 | 129,449 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 26,667 | 30,303 | 102,958 | 129,449 | | 5 | Basic earnings/(loss) per share (Subunit) | 41.70 | 47.35 | 160.90 | 202.30 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.2600 | 1.6500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-5-2020 08:20 AM

|

显示全部楼层

发表于 12-5-2020 08:20 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | Proposed acquisition by DLMI of three (3) parcels of freehold land held under Geran 270934 Lot No. 61320, Geran 270935 Lot No. 61321 and Geran 270936 Lot No. 61322 in Mukim of Bandar Baru Enstek, District of Seremban, State of Negeri Sembilan measuring approximately 40470 square meters, 40570 square meters and 50860 square meters respectively, from Pelaburan Hartanah Berhad ("PHB" or "Vendor") for a total cash consideration of RM56,790,320.00 ("Proposed Acquisition") | The Board of Directors of DLMI wishes to announce that it has on 18 March 2020 entered into a conditional Sale and Purchase Agreement (“SPA”) with PHB for the Proposed Acquisition.

Please refer to the attachment for further details.

This announcement is dated 18 March 2020.

Please refer attachment below. |

https://www.bursamalaysia.com/market_information/announcements/company_announcement/announcement_details?ann_id=3036343

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-5-2020 07:50 AM

|

显示全部楼层

发表于 15-5-2020 07:50 AM

|

显示全部楼层

本帖最后由 icy97 于 1-8-2021 11:10 AM 编辑

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | PROPOSED ACQUISITION BY DLMI OF THREE (3) PARCELS OF FREEHOLD LAND HELD UNDER GERAN 270934 LOT NO. 61320, GERAN 270935 LOT NO. 61321 AND GERAN 270936 LOT NO. 61322 IN MUKIM OF BANDAR BARU ENSTEK, DISTRICT OF SEREMBAN, STATE OF NEGERI SEMBILAN MEASURING APPROXIMATELY 40470 SQUARE METERS, 40570 SQUARE METERS and 50860 SQUARE METERS RESPECTIVELY, FROM PELABURAN HARTANAH BERHAD ("PHB" OR "VENDOR") FOR A TOTAL CASH CONSIDERATION OF RM56,790,320.00 ("PROPOSED ACQUISITION")- FURTHER INFORMATION | Further to the previous announcement made by the Company on 18 March 2020 in relation to the Proposed Acquisition, the Board of Directors of DLMI wishes to provide further information on Basis of the Purchase Price, Termination due to Default of the Vendor and Further Information on the Lands.

Please refer to the attachment for further details.

This announcement is dated 20 March 2020. |

https://www.bursamalaysia.com/market_information/announcements/company_announcement/announcement_details?ann_id=3037597

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | PROPOSED ACQUISITION BY DLMI OF THREE (3) PARCELS OF FREEHOLD LAND HELD UNDER GERAN 270934 LOT NO. 61320, GERAN 270935 LOT NO. 61321 AND GERAN 270936 LOT NO. 61322 IN MUKIM OF BANDAR BARU ENSTEK, DISTRICT OF SEREMBAN, STATE OF NEGERI SEMBILAN MEASURING APPROXIMATELY 40470 SQUARE METERS, 40570 SQUARE METERS and 50860 SQUARE METERS RESPECTIVELY, FROM PELABURAN HARTANAH BERHAD ("PHB" OR "VENDOR") FOR A TOTAL CASH CONSIDERATION OF RM56,790,320.00 ("PROPOSED ACQUISITION") | Further to our announcements of 18 March 2020, 20 March 2020 and 20 October 2020, and the Circular to Shareholders dated 23 June 2020 on the Proposed Acquisition, the Board of Directors of the Company wishes to announce that the Proposed Acquisition has been completed today, in accordance with the terms of the Sale and Purchase Agreement in respect of the Proposed Acquisition.

This announcement is dated 17 December 2020. |

Type | Announcement | Subject | OTHERS | Description | DUTCH LADY MILK INDUSTRIES BERHAD ("DLMI" OR "COMPANY")CONSTRUCTION OF NEW MANUFACTURING FACILITIES IN BANDAR BARU ENSTEK, DISTRICT OF SEREMBAN, STATE OF NEGERI SEMBILAN | Further to the announcement of 17 December 2020 regarding the completion of the acquisition of three (3) parcels of freehold land held under Geran 270934 Lot No. 61320, Geran 270935 Lot No. 61321 and Geran 270936 Lot No. 61322 in Mukim of Bandar Baru Enstek, District of Seremban, State of Negeri Sembilan measuring approximately 40470 square meters, 40570 square meters and 50860 square meters respectively (collectively, “Lands”), the Board of Directors of the Company wishes to announce that new manufacturing facilities will be constructed on the Lands between the years 2021 to 2025 at a total capital investment of RM340 million. This investment is in line with DLMI’s long-term plans of improving its manufacturing capabilities to keep up with the demand for its products and with new consumer trends which will strengthen its ability to provide the goodness and nutritional value of milk to its customers.

Please refer to the attachment for further details.

This announcement is dated 17 December 2020. |

https://www.bursamalaysia.com/market_information/announcements/company_announcement/announcement_details?ann_id=3114641

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-8-2020 08:05 AM

|

显示全部楼层

发表于 26-8-2020 08:05 AM

|

显示全部楼层

| DUTCH LADY MILK INDUSTRIES BERHAD |

Date of change | 01 Sep 2020 | Name | MR JURIAN DUIJVESTIJN | Age | 45 | Gender | Male | Nationality | Netherlands | Type of change | Resignation | Designation | Chief Financial Officer | Reason | Mr Duijvestijn has been reassigned by Royal FrieslandCampina N.V., the ultimate holding company of DLMI, to assume the role of Finance Director in Global Head Office in the Netherlands with effect from 1 September 2020. | Details of any disagreement that he/she has with the Board of Directors | No | Whether there are any matters that need to be brought to the attention of shareholders | No |

Qualifications| No | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Masters | Business Economics (Masters of Science) | Erasmus University of Rotterdam (EUR) | | | 2 | Professional Qualification | Certified Practicing Accountant (CPA) | CPA Australia | |

| | | Working experience and occupation | Mr Jurian Dujivestijn has 15 years experience in various finance and business development positions within FrieslandCampina, H.J. Heinz, KPMG Transaction Services, Geodis Wilson Asia Pacific, TNT Group of Companies and TPG Post, having been based in Singapore, Netherlands and Hong Kong amongst others.He was the Commercial Finance Director Specialized Nutrition for FrieslandCampina with responsibility for Singapore,from August 2016 to August 2018.He was appointed as the Finance Director for Dutch Lady Milk Industries Berhad with effect from 1 September 2018. |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|