|

|

【MAG 0095 交流专区】(前名 XINGHE )

[复制链接]

[复制链接]

|

|

|

发表于 7-3-2018 07:56 AM

|

显示全部楼层

发表于 7-3-2018 07:56 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 43,145 | 308,605 | 357,460 | 768,057 | | 2 | Profit/(loss) before tax | -4,618 | 22,595 | 8,853 | 38,722 | | 3 | Profit/(loss) for the period | -17,302 | 16,855 | -6,780 | 26,881 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -16,425 | 15,180 | -6,686 | 23,626 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.70 | 0.65 | -0.29 | 1.01 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.2190 | 0.2350

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-3-2018 06:18 AM

|

显示全部楼层

发表于 21-3-2018 06:18 AM

|

显示全部楼层

本帖最后由 icy97 于 26-3-2018 01:16 AM 编辑

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | XINGHE HOLDINGS BERHAD ("XINGHE" OR "COMPANY")JOINT VENTURE AND SHAREHOLDERS AGREEMENT BETWEEN XINGHE-JEFI SDN. BHD. (FORMERLY KNOWN AS XINGHE MARKETING SDN. BHD.) ["XINGHE-JEFI"] AND MY OCEAN VENTURE SDN. BHD. ["MYO"] AND VC MARINE SDN. BHD. ["VCM"] [COLLECTIVELY "JV PARTNERS"] | Reference is made to the Company’s announcements of 16 and 19 October 2017, 29 November 2017 and 4 December 2017 in relation to the Collaboration Agreement between the Company and Jefi Aquatech Resources Sdn. Bhd. [“Jefi”] to explore business opportunities in tuna and other seafood processing.

The Board of Directors of XingHe [“Board”], wishes to announce that its subsidiary company, XingHe-Jefi has on 20 March 2018, entered into a Joint Venture and Shareholders Agreement [“JVSA”] with the JV Partners to jointly establish a company under the name “Sea Tuna Industry Sdn. Bhd.” [“JVC”] to undertake the business of tuna and other seafood processing and trading [“Proposed Joint Venture”].

The details of the announcement are set out in the attached file.

This announcement is dated 20th March 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5730117

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-5-2018 03:54 AM

|

显示全部楼层

发表于 27-5-2018 03:54 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | XINGHE HOLDINGS BERHAD ("XINGHE" OR "THE COMPANY")INCORPORATION OF SUBSIDIARY | The Board of Directors of XingHe wishes to announce that the Company had on 23 May 2018 incorporated a wholly-owned subsidiary, XJ Marine Sdn. Bhd. (“XJM”) under the Company Act 2016. The present issued share capital of XJM is RM1 comprising 1 ordinary share.

The intended principal activity of XJM is marine food trading.

This announcement is dated 23 May 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-6-2018 12:55 AM

|

显示全部楼层

发表于 12-6-2018 12:55 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 13,914 | 203,782 | 13,914 | 203,782 | | 2 | Profit/(loss) before tax | 2,884 | 23,000 | 2,884 | 23,000 | | 3 | Profit/(loss) for the period | 2,884 | 17,252 | 2,884 | 17,252 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,042 | 15,718 | 3,042 | 15,718 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.12 | 0.67 | 0.12 | 0.67 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.2010 | 0.2190

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-6-2018 01:58 AM

|

显示全部楼层

发表于 22-6-2018 01:58 AM

|

显示全部楼层

本帖最后由 icy97 于 23-6-2018 04:11 AM 编辑

Type | Announcement | Subject | OTHERS | Description | XINGHE HOLDINGS BERHAD ("XINGHE" OR "COMPANY")SUBSCRIPTION OF AN EQUITY INTEREST OF 52% IN SEA TUNA INDUSTRY SDN BHD (1265947-M) BY THE COMPANYS SUBSIDIARY COMPANY, XINGHE-JEFI SDN. BHD. (FORMERLY KNOWN AS XINGHE MARKETING SDN. BHD.) ("XINGHE-JEFI") | Reference is made to the Company’s announcements of 20 March 2018 and 21 May 2018 in relation to the Joint Venture and Shareholders Agreement between XingHe-Jefi and MY Ocean Venture Sdn. Bhd, (1265586-D) and VC Marine Sdn Bhd. (1265726-X) to jointly establish a company under the name “Sea Tuna Industry Sdn. Bhd.” to undertake the business of tuna and other seafood processing and trading.

The Board of Directors of XingHe wishes to announce that XingHe-Jefi has on 18 June 2018 subscribed for 3.12 million ordinary shares representing an equity interest of 52% in Sea Tuna Industry Sdn. Bhd. (“STI”) for a total cash consideration of RM3.12 million.

STI is a private limited company incorporated in Malaysia on 26 January 2018 and having its registered address at Suite 13.03, 13th Floor, Menara Tan & Tan, 207 Jalan Tun Razak, 50400 Kuala Lumpur, Malaysia. Its issued ordinary share capital as at 18 June 2018 is RM100 of which 90% is held by Mr Ng Min Lin and the balance 10% held by Dato’ Tan Beng Jeen. The intended principal activity of STI is tuna and other seafood processing and trading.

Mr Ng and Dato’ Tan, the directors of STI as of 18 June 2018 are also directors of XingHe-Jefi.

Mr Ng is also the Chairman of the Board of XingHe.

Mr Ng’s and Dato’ Tan’s shareholdings and directorships in STI arose as a consequence of them acting as promoters for the sole purpose of incorporating STI. Save as otherwise disclosed above, none of the Directors and/or major shareholders of XingHe and/or persons connected to them have any interest, direct and indirect in the above subscription.

This announcement is dated 18 June 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-7-2018 06:29 AM

|

显示全部楼层

发表于 19-7-2018 06:29 AM

|

显示全部楼层

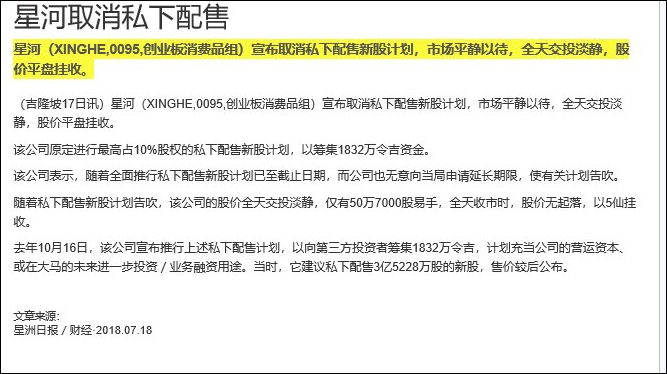

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

FUND RAISING | Description | XINGHE HOLDINGS BERHAD ("XINGHE" OR THE "COMPANY")PRIVATE PLACEMENT OF UP TO 10% OF THE ISSUED SHARE CAPITAL OF XINGHE ("PRIVATE PLACEMENT") | We refer to the announcements made on 16 October 2017, 19 October 2017, 7 November 2017, 16 January 2018, 17 January 2018, 18 January 2018, 25 January 2018 and 6 February 2018 in relation to the Private Placement (“Announcements”). Unless otherwise defined, the definitions set out in the Announcements shall apply herein.

On behalf of the Board, TA Securities wishes to announce that the deadline for the Company to fully implement the Private Placement has lapsed today. The Company does not wish to seek any extension of time for the Private Placement.

This announcement is dated 16 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-9-2018 05:11 AM

|

显示全部楼层

发表于 2-9-2018 05:11 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 15,058 | 78,220 | 28,972 | 282,002 | | 2 | Profit/(loss) before tax | -9,459 | 106 | -6,575 | 23,106 | | 3 | Profit/(loss) for the period | -9,469 | 106 | -6,585 | 17,358 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -9,186 | 148 | -6,144 | 15,866 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.38 | 0.01 | -0.24 | 0.68 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1990 | 0.2190

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-11-2018 07:47 AM

|

显示全部楼层

发表于 4-11-2018 07:47 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | XINGHE HOLDINGS BERHAD ("XINGHE" OR "COMPANY")ACQUISITION OF EQUITY INTEREST OF 10% IN XINGHE MARINE FOOD SDN. BHD. (FORMERLY KNOWN AS XINGHE-JEFI SDN. BHD.) ("XINGHE MARINE") | The Board of Directors of XingHe wishes to announce that the Company had on 31 October 2018 acquired 10,000 ordinary shares representing the balance equity interest of 10% not owned by the Company in its subsidiary company, XingHe Marine for a total cash consideration of RM10,000, thereby making XingHe Marine a wholly-owned subsidiary company of the Company.

None of the Directors and/or major shareholders of XingHe and/or persons connected to them have any interest, direct and indirect in the above acquisition.

This announcement is dated 31 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-12-2018 08:03 AM

|

显示全部楼层

发表于 30-12-2018 08:03 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 11,814 | 32,313 | 40,786 | 314,315 | | 2 | Profit/(loss) before tax | -7,898 | -9,635 | -14,473 | 13,471 | | 3 | Profit/(loss) for the period | -7,904 | -6,836 | -14,489 | 10,522 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -7,539 | -6,127 | -13,683 | 9,739 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.29 | -0.26 | -0.54 | 0.41 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1960 | 0.2190

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-1-2019 03:32 AM

|

显示全部楼层

发表于 27-1-2019 03:32 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | XINGHE HOLDINGS BERHAD ("XINGHE" OR "COMPANY")PROPOSED ACQUISITION OF A PRAWN FARM AND RELATED FACILITIES AND ASSETS FROM PEGAGAU AQUACULTURE SDN BHD (525571-V) ("PEGAGAU" OR "VENDOR") FOR A TOTAL CASH CONSIDERATION OF RM100 MILLION ("PROPOSED ACQUISITION") | The Board of Directors of XingHe (“Board”) wishes to announce that the Company’s wholly-owned subsidiary company, XW Aquaculture Sdn. Bhd. (formerly known as XJ Marine Sdn. Bhd.) (1281252-U) (“Purchaser”) had, on 31 December 2018 entered into a Sale and Purchase Agreement (“SPA”) and an Assets Sale and Purchase Agreement (“ASPA”) with Pegagau for the purpose of acquiring:

(a) a piece of land held under a 99-years Country Lease 105466466, District of Tawau, Locality of Kg Wakuba, Sabah measuring 97.9 hectares, with a lease period from 1 January 1990 to 31 December 2088 at a price of RM12.5 million (“Farm Land”);and

(b) all ponds, other land improvements, buildings, plant and machinery, equipment, motor vehicles, livestock and consumables for an aggregate sum of RM87.5 million (“Farm Assets”);

(Farm Land and Farm Assets are collectively referred to as “Assets”) for a total cash consideration of RM100 million (“Purchase Consideration”) subject to the terms and conditions as stipulated in the ASPA and SPA.

The details of the announcement are set out in the attached file.

This announcement is dated 2 January 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6023965

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-1-2019 08:43 AM

|

显示全部楼层

发表于 29-1-2019 08:43 AM

|

显示全部楼层

Type | Reply to Query | Reply to Bursa Malaysia's Query Letter - Reference ID | IQL-03012019-00001 | Subject | PROPOSED ACQUISITION OF A PRAWN FARM AND RELATED FACILITIES AND ASSETS FROM PEGAGAU AQUACULTURE SDN BHD (525571-V) ("PEGAGAU" OR "VENDOR") FOR A TOTAL CASH CONSIDERATION OF RM100 MILLION ("PROPOSED ACQUISITION") | Description | XINGHE HOLDINGS BERHAD ("XINGHE" OR "COMPANY")PROPOSED ACQUISITION OF A PRAWN FARM AND RELATED FACILITIES AND ASSETS FROM PEGAGAU AQUACULTURE SDN BHD (525571-V) ("PEGAGAU" OR "VENDOR") FOR A TOTAL CASH CONSIDERATION OF RM100 MILLION ("PROPOSED ACQUISITION") | Query Letter Contents | We refer to your Company’s announcement dated 2 January 2019, in respect of the aforesaid matter.

In this connection, kindly furnish Bursa Securities with the following additional information for public release:-

1. The net book value of the Farm Land based and Farm Assets based on the latest audited financial statements of Pegagau. 2. Any arrangement for balance purchase consideration payment on a deferred basis. 3. The quantification of the market value for the Farm Assets, including the date and method of valuation. | We refer to our announcement dated 2 January 2019 (Ref No: GA1-02012019-00039) in relation to the Proposed Acquisition. Unless otherwise stated, the defined terms used in this announcement shall carry the same meaning as defined in the earlier announcement made.

Please refer to the attachment for further details.

This announcement is dated 4 January 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6027869

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-2-2019 04:39 AM

|

显示全部楼层

发表于 12-2-2019 04:39 AM

|

显示全部楼层

Name | NG MIN LIN | Descriptions(Class) | Ordinary shares of RM0.10 each |

Details of changesNo | Date of change | No of securities | Type of transaction | Nature of Interest | | 1 | 31/01/2019 | 71,000,000 | Acquired | Direct Interest | Name of registered holder | AMSEC NOMINEES (TEMPATAN) SDN. BHD. PLEDGED SECURITIES ACCOUNT FOR NG MIN LIN | Description of "Others" Type of Transaction | | Consideration (if any) | |

Circumstances by reason of which change has occurred | Acquisition via open market | Nature of interest | Direct Interest |

| Total no of securities after change | Direct (units) | 98,140,500 | Direct (%) | 3.813 | Indirect/deemed interest (units) |

| | Indirect/deemed interest (%) |

| | Date of notice | 31/01/2019 | Date notice received by Listed Issuer | 31/01/2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-2-2019 06:33 AM

|

显示全部楼层

发表于 12-2-2019 06:33 AM

|

显示全部楼层

Name | TESTA HOLDINGS LIMITED | Address | Suite A, 5/F, Centre Mark II, 305-313 Queen's Road Central, Hong Kong | Company No. | 1629848 | Nationality/Country of incorporation | Virgin Islands, British | Descriptions (Class) | Ordinary shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 31 Jan 2019 | 100,000,000 | Disposed | Direct Interest | Name of registered holder | Mercsec Nominees (Asing) Sdn. Bhd. Testa Holdings Limited | Address of registered holder | 3rd Floor Wisma UMNO Lorong Bagan Luar Dua 12000 Butterworth Pulau Pinang | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Disposal via direct business transaction | Nature of interest | Direct Interest | Direct (units) | 1,073,555,000 | Direct (%) | 41.716 | Indirect/deemed interest (units) |

| | Indirect/deemed interest (%) |

| | Total no of securities after change | 1,073,555,000 | Date of notice | 31 Jan 2019 | Date notice received by Listed Issuer | 04 Feb 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-2-2019 06:49 AM

|

显示全部楼层

发表于 23-2-2019 06:49 AM

|

显示全部楼层

Expiry/Maturity of the securities

Instrument Category | Securities of PLC | Instrument Type | Warrants | Type Of Expiry | Expiry/Maturity of the securities | Mode of Satisfaction of Exercise/Conversion price | Cash | Exercise/ Strike/ Conversion Price | Malaysian Ringgit (MYR) 0.1000 | Exercise/ Conversion Ratio | 1:1 | Settlement Type / Convertible into | Physical (Shares) | Last Date & Time of Trading | 06 Mar 2019 05:00 PM | Date & Time of Suspension | 07 Mar 2019 09:00 AM | Last Date & Time for Transfer into Depositor's CDS a/c | 15 Mar 2019 04:00 PM | Date & Time of Expiry | 22 Mar 2019 05:00 PM | Date & Time for Delisting | 25 Mar 2019 09:00 AM |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6067469

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-3-2019 07:14 AM

|

显示全部楼层

发表于 12-3-2019 07:14 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 274,215 | 43,145 | 315,001 | 357,460 | | 2 | Profit/(loss) before tax | -11,500 | -4,618 | -25,973 | 8,853 | | 3 | Profit/(loss) for the period | -10,361 | -17,302 | -24,850 | -6,780 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -9,253 | -16,425 | -22,936 | -6,686 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.36 | -0.70 | -0.90 | -0.29 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1920 | 0.2190

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-6-2019 03:24 AM

|

显示全部楼层

发表于 9-6-2019 03:24 AM

|

显示全部楼层

Notice of Interest Sub. S-hldr (Section 137 of CA 2016)Particulars of Substantial Securities HolderName | ECLUB INTERACTIVE SDN. BHD. | Address | B2-12-1, Midfields Square East

Jalan Besi Kawi 1, Dataran Niaga Sg Besi

Off Lebuhraya Sungai Besi

Kuala Lumpur

57100 Wilayah Persekutuan

Malaysia. | Company No. | 1044901-M | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares | Name & address of registered holder | ECLUB INTERACTIVE SDN. BHD. B2-12-1, Midfields Square EastJalan Besi Kawi 1, Dataran Niaga Sg BesiOff Lebuhraya Sungai Besi57100 Kuala Lumpur |

| Date interest acquired & no of securities acquired | Date interest acquired | 26 Apr 2019 | No of securities | 15,999,700 | Circumstances by reason of which Securities Holder has interest | Acquisition of shares | Nature of interest | Direct Interest |  | | Total no of securities after change | Direct (units) | 134,697,700 | Direct (%) | 5.23 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Date of notice | 30 Apr 2019 | Date notice received by Listed Issuer | 30 Apr 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-6-2019 07:05 AM

|

显示全部楼层

发表于 16-6-2019 07:05 AM

|

显示全部楼层

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

FUND RAISING | Description | XINGHE HOLDINGS BERHAD ("XINGHE" OR "COMPANY")(I) PROPOSED DIVERSIFICATION;(II) PROPOSED SHARE CONSOLIDATION; AND(III) PROPOSED NOTES ISSUE(COLLECTIVELY REFERRED TO AS THE "PROPOSALS") | On behalf of the Board of Directors of XingHe (“Board”), Kenanga Investment Bank Berhad (“Kenanga IB”) wishes to announce that the Company proposes to undertake the following: - diversification of the principal activities of XingHe and its subsidiaries (“Group”) to include the business of prawn aquaculture and processing of marine seafood (“Proposed Diversification”);

- consolidation of every eight (8) existing ordinary shares in XingHe (“XingHe Share(s)”) into one (1) new ordinary XingHe Share (“Consolidated Share(s)”) (“Proposed Share Consolidation”); and

- issuance of redeemable convertible notes (“Notes”) with an aggregate principal amount of up to RM120 million (“Proposed Notes Issue”).

(Collectively, referred to as the “Proposals”)

Please refer to the attachment for further details on the Proposals.

This announcement is dated 6 May 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6152837

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-7-2019 08:32 AM

|

显示全部楼层

发表于 8-7-2019 08:32 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 268,456 | 13,914 | 268,456 | 13,914 | | 2 | Profit/(loss) before tax | 4,284 | 2,884 | 4,284 | 2,884 | | 3 | Profit/(loss) for the period | 3,540 | 2,884 | 3,540 | 2,884 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,472 | 3,042 | 3,472 | 3,042 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.14 | 0.12 | 0.14 | 0.12 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1940 | 0.1920

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-9-2019 03:51 AM

|

显示全部楼层

发表于 1-9-2019 03:51 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Others | Details of corporate proposal | Conversion of Redeemable Convertible Notes | No. of shares issued under this corporate proposal | 50,000,000 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.2000 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 371,774,865 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 306,763,184.000 | Listing Date | 03 Sep 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-9-2019 08:47 AM

|

显示全部楼层

发表于 2-9-2019 08:47 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2019 | 30 Jun 2018 | 30 Jun 2019 | 30 Jun 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 172,270 | 15,058 | 440,726 | 28,972 | | 2 | Profit/(loss) before tax | -1,808 | -9,459 | 2,476 | -6,575 | | 3 | Profit/(loss) for the period | -2,356 | -9,469 | 1,184 | -6,585 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -2,520 | -9,186 | 952 | -6,144 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.10 | -0.36 | 0.04 | -0.24 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1921 | 0.1919

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|