|

|

发表于 28-7-2018 04:41 AM

|

显示全部楼层

发表于 28-7-2018 04:41 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | KIP Real Estate Investment Trust ("KIP REIT" or the "Fund") | ANNOUCEMENT FOR PUBLIC RELEASE KIP REAL ESTATE INVESTMENT TRUST (KIP REIT) – REVALUATION OF INVESTMENT PROPERTIES

The Board of Directors of KIP Reit Management Sdn Bhd, the Manager of KIP REIT wishes to announce that KIP REIT had undertaken a revaluation of its investment properties as below:- - KiP Mart Tampoi

- KiP Mart Kota Tinggi

- KiP Mart Masai

- KiP Mart Lavender Senawang

- KiP Mart Melaka

- KiP Mall Bangi

- PURPOSE OF THE REVALUATION

The purpose was to comply with Clause 10.02 of the Securities Commission’s (SC) Guidelines on Real Estate Investment Trust (REIT Guidelines) where the investment properties of KIP REIT were required to be revalued once every year. The Revaluation was not subject to the approval of the SC.

- REVALUATION SURPLUS/ (DEFICIT)

The detail of the Revaluation are set out below: Investment Property | Date of Last Valuation | Date of Latest Valuation | Net Book Value as at 30/6/2018 (‘000) |

Valuation as at 30/6/2018 (‘000) | Surplus/ (Deficit) as at 30/6/2018 (‘000) | KiP Mart Tampoi | 18 July 2017 | 26 July 2018 | 151,666 | 159,000 | 7,334 | KiP Mart Kota Tinggi | 18 July 2017 | 26 July 2018 | 55,017 | 56,000 | 983 | KiP Mart Masai | 18 July 2017 | 26 July 2018 | 157,000 | 160,000 | 3,000 | KiP Mart Lavender Senawang | 18 July 2017 | 26 July 2018 | 38,000 | 30,000 | (8,000) | KiP Mart Melak | 18 July 2017 | 26 July 2018 | 50,000 | 50,000 | - | KiP Mall Bangi | 18 July 2017 | 26 July 2018 | 130,000 | 130,000 | - | Total | 581,683 | 585,000 | 3,317 |

The Revaluation was undertaken by CBRE|WTW, an independent firm of professional valuer, registered with the Board of Valuers, Appraisers & Estate Agents Malaysia.

- EFFECTS OF THE NET ASSET VALUE (NAV)

The NAV per unit of KIP REIT will be RM1.0033 upon incorporation of the revaluation surplus of RM3.317 million of the unaudited results for the fourth quarter ended 30 June 2018.

- DOCUMENTS AVAILABLE FOR INSPECTION

The valuation reports in relation to the Revaluation are available for inspection for 3 months from the date of this announcement during normal business hours at the Manager’s registered office at Level 33A, Menara 1MK, Kompleks 1 Mont Kiara, No. 1 Jalan Kiara, Mont Kiara, 50480 Kuala Lumpur. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 02:39 AM

|

显示全部楼层

发表于 31-8-2018 02:39 AM

|

显示全部楼层

本帖最后由 icy97 于 4-9-2018 04:40 AM 编辑

KIP产托斥2.08亿收购怡保近打城永旺广场

theedgemarkets.com

August 29, 2018 13:35 pm +08

(吉隆坡29日讯)KIP产托(KIP Real Estate Investment Trust)豪掷2亿800万令吉现金,收购位于霹雳怡保的近打城永旺广场(Aeon Mall Kinta City)。这栋4层建筑物的面积为6万230平方米。

KIP产托指出,此拟议收购符合其投资策略,并预计将为其单位持有者提供长期收益增长,因为该广场的租金收益率已经缩减直至2025年。

根据文告,KIP产托已经接受Pacific Trustees Bhd的献购函。

21年楼龄的近打城永旺广场拥有永久商用地契,总租赁面积为53万181平方尺。根据C H Williams Talhar & Wong私人有限公司(WTW)在今年8月17日进行的估值,该产业的市值为2亿2000万令吉。截至2017年12月31日,其净账面价值为2亿5300万令吉。

KIP产托表示,目前该产业是由大租客永旺(AEON Co (M) Bhd)100%租赁,每年租金为1631万令吉,根据2亿800万令吉收购价,这意味着总收益率为7.8%。

租赁期为期10年,从2015年9月29日至2025年9月28日,并可选择续约5年。与永旺的租赁协议将改为KIP产托。

KIP产托说:“这份长期租约将可提供稳定收入,而且还可增加租金。”

该集团预计,将通过银行贷款及/或内部融资筹资。

上述交易必须获得KIP产托的股东及霹雳州监管当局的批准。KIP产托期望在2019年首季完成交易。

KIP产托说:“一旦完成收购活动,我们管理的资产总值将从截至今年6月30日的6亿1620万令吉,增至8亿2710万令吉,而净租赁总面积则将从93万6000平方尺,提高至147万平方尺。”

(编译:魏素雯)

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | KIP REAL ESTATE INVESTMENT TRUST ("KIP REIT")PROPOSED ACQUISITION OF A FOUR-STOREY BUILDING KNOWN AS AEON MALL KINTA CITY SHOPPING CENTRE FOR A CASH PURCHASE CONSIDERATION OF RM208,000,000 (PROPOSED ACQUISITION) | The Board of Directors (“Board”) of KIP REIT Management Sdn Bhd ("Manager") wishes to announce that Kinta City Sdn Bhd (“Vendor”) had on 28 August 2018 accepted the offer letter from Pacific Trustees Berhad (as trustee of KIP REIT) (“Purchaser”) dated 28 August 2018 (“Offer Letter”) for the Proposed Acquisition.

Please refer to the attachment for the full announcement in relation to the Proposed Acquisition.

This announcement is dated 28 August 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5898173

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-9-2018 03:19 AM

|

显示全部楼层

发表于 19-9-2018 03:19 AM

|

显示全部楼层

Date of change | 30 Sep 2018 | Name | MR CHIN SUAN YONG | Age | 48 | Gender | Male | Nationality | Malaysia | Type of change | Resignation | Designation | Chief Financial Officer | Reason | End of contract term |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-9-2018 03:27 AM

|

显示全部楼层

发表于 19-9-2018 03:27 AM

|

显示全部楼层

Date of change | 18 Sep 2018 | Name | MISS HII WEI BING | Age | 44 | Gender | Female | Nationality | Malaysia | Type of change | Appointment | Designation | Chief Financial Officer | Qualifications | Association of Chartered Certified Accountants ("ACCA") | Working experience and occupation | She started her career as a Senior Manager with Berjaya Group Berhad in 1998 and has over 20 years of experience in accounting and finance in various industries. She was a Group Accountant in Emas Kiara Industries Berhad from 2006-2007. Subsequently, she joined Asian Agri Group of Companies 2007 as Group Accountant until 2010 . She then moved to Courts (Malaysia) Sdn Bhd as Head of Reporting and was a Finance Director when she left in August 2018. Thereafter, she is appointed as Chief Financial Officer ("CFO") of KIP REIT Management Sdn Bhd. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-10-2018 04:41 AM

|

显示全部楼层

发表于 2-10-2018 04:41 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 16-10-2018 01:14 AM

|

显示全部楼层

发表于 16-10-2018 01:14 AM

|

显示全部楼层

本帖最后由 icy97 于 16-10-2018 05:09 AM 编辑

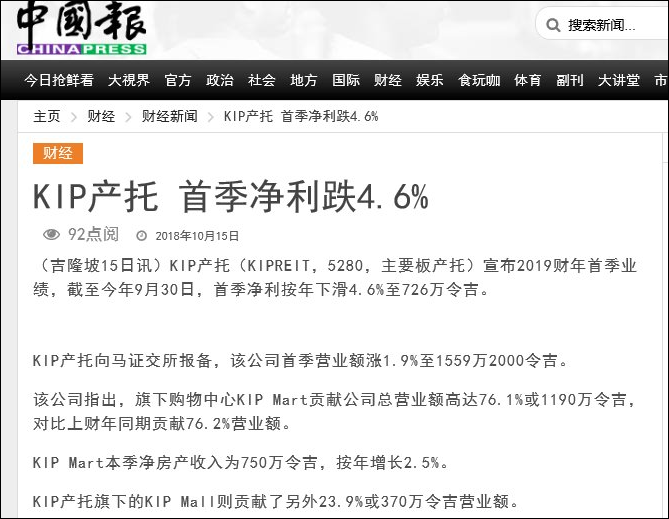

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 15,592 | 15,301 | 15,592 | 15,301 | | 2 | Profit/(loss) before tax | 7,260 | 7,611 | 7,260 | 7,611 | | 3 | Profit/(loss) for the period | 7,260 | 7,611 | 7,260 | 7,611 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 7,260 | 7,611 | 7,260 | 7,611 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.44 | 1.51 | 1.44 | 1.51 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9996 | 1.0033

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-10-2018 01:20 AM

|

显示全部楼层

发表于 16-10-2018 01:20 AM

|

显示全部楼层

EX-date | 29 Oct 2018 | Entitlement date | 31 Oct 2018 | Entitlement time | 04:00 PM | Entitlement subject | Income Distribution | Entitlement description | First Interim Income Distribution of 1.45 sen per unit for the 1st Quarter of 2019 (from 1 July 2018 to 30 September 2018) comprising (1) 1.414 sen per unit - taxable (2) 0.036 sen per unit - non-taxable | Period of interest payment | 01 Jul 2018 to 30 Sep 2018 | Financial Year End | 30 Jun 2019 | Share transfer book & register of members will be | 31 Oct 2018 to 31 Oct 2018 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 13 Nov 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 31 Oct 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit | 31 Oct 2018 | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0145 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-10-2018 01:21 AM

|

显示全部楼层

发表于 16-10-2018 01:21 AM

|

显示全部楼层

本帖最后由 icy97 于 17-10-2018 02:46 AM 编辑

Type | Announcement | Subject | OTHERS | Description | KIP Real Estate Investment Trust ("KIP REIT" or the "Fund") | KIP REIT is pleased to attach a Press Release entitled "KIP REIT continues momentum - declares 1.45 sen distribution per unit for Q1FY2019".

This announcement is dated 15 October 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5942617

Type | Announcement | Subject | OTHERS | Description | KIP Real Estate Investment Trust ("KIP REIT" or the "Fund") | We refer to the announcement dated 15 October 2018 on the Press Release entitled "KIP REIT continues momentum - declares 1.45 sen distribution per unit for Q1FY2019".

We wish to inform that there is an amendment made to page 1, second line of paragraph 3 where the total interim distribution should read as "RM7.327 million" instead of "RM7,327 million". The amended Press Release is attached for your reference.

This announcement is dated 16 October 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5943813

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-1-2019 07:39 AM

|

显示全部楼层

发表于 1-1-2019 07:39 AM

|

显示全部楼层

本帖最后由 icy97 于 8-1-2019 06:06 AM 编辑

icy97 发表于 31-8-2018 02:39 AM

KIP产托斥2.08亿收购怡保近打城永旺广场

theedgemarkets.com

August 29, 2018 13:35 pm +08

(吉隆坡29日讯)KIP产托(KIP Real Estate Investment Trust)豪掷2亿800万令吉现金,收购位于霹雳怡保的近打城永旺 ...

kip产讬逾2亿购-近打城永旺购物中心

http://www.chinapress.com.my/20181130/kip产讬逾2亿购-近打城永旺购物中心/

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | KIP REAL ESTATE INVESTMENT TRUST ("KIP REIT")PROPOSED ACQUISITION OF A FOUR-STOREY BUILDING KNOWN AS AEON MALL KINTA CITY SHOPPING CENTRE FOR A CASH PURCHASE CONSIDERATION OF RM208,000,000 ("PROPOSED ACQUISITION") | Reference is made to the announcement on 28 August 2018 in relation to the Proposed Acquisition (“Prior Announcement”). Unless otherwise stated, the defined terms used herein shall have the same meanings as given to them in the Prior Announcement.

CIMB Investment Bank Berhad, on behalf of the Board of Directors of KIP REIT Management Sdn Bhd, wishes to announce that Pacific Trustees Berhad (as trustee of KIP REIT) ("Purchaser") had on 30 November 2018 entered into a conditional sale and purchase agreement with Kinta City Sdn Bhd ("Vendor"), for the Proposed Acquisition.

Please refer to the attachment for further details to the above.

This announcement is dated 30 November 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5991621

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-1-2019 07:18 AM

|

显示全部楼层

发表于 2-1-2019 07:18 AM

|

显示全部楼层

Date of change | 30 Nov 2018 | Name | MISS ONG PUI SHAN | Age | 30 | Gender | Female | Nationality | Malaysia | Designation | Director | Directorate | Non Independent and Non Executive | Type of change | Appointment |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Masters | Master of Marketing and Branding | UNIVERSITY OF WEST OF ENGLAND | | | 2 | Degree | Bachelor of Business and Politics | UNIVERSITY OF MELBOURNE | |

Working experience and occupation | 2012 - PresentMs. Ong Pui Shan is the Group Chief Executive Officer of KIP Group of companies and also serves as Director of Corporate Operations. KIP Group of companies involves in property development, retail management as well as hospitality sectors. She directs the companys goals and vision, partnering with top management to grow and strengthen the companys position in the industry and sustainability and monitors the progress of development, operational and financial performance. Thus far, she has completed projects valued at a total gross development value (GDV) of RM420 million with an additional RM1.5 billion GDV currently under construction. 2011 - 2012Ms. Ong joined Summit Holidays, a travel agency as the marketing and branding manager, responsible for the promotion and strategies to establish and grow the brand presence in the market by developing and improving products and services through marketing strategies, monitoring competition, performing market research, analyzing market data and collaborating with media departments. She also involved in a rebranding exercise and thus implemented e-commerce systems and social media to the company.2007Ms. Ong participated in an internship with Mercatus, branding and consumer public relation agency for three months, where she was involved in securing interviews for clients with national publications by cold-calling contacts, calculating reach and drafting client reports on the publication of clients campaigns, reporting findings on segments of consumer product industry including education, oil and gas, property development and beauty, and attending client meetings to update client on the status of the campaign. | Directorships in public companies and listed issuers (if any) | NIL | Family relationship with any director and/or major shareholder of the listed issuer | DATO' ONG KOOK LIONG (FATHER) | Any conflict of interests that he/she has with the listed issuer | NIL | Details of any interest in the securities of the listed issuer or its subsidiaries | 100,000 units in KIP REIT |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-1-2019 07:20 AM

|

显示全部楼层

发表于 2-1-2019 07:20 AM

|

显示全部楼层

ate of change | 30 Nov 2018 | Name | MR CHEW KHENG KAI | Age | 35 | Gender | Male | Nationality | Malaysia | Designation | Director | Directorate | Non Independent and Non Executive | Type of change | Appointment |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Masters | Masters of Architecture | University of California, Los Angeles | | | 2 | Degree | Bachelor of Fine Arts | Academy of Art University, San Francisco CA | | | 3 | Professional Qualification | LEED Building Design + Construction | LEED AP | | | 4 | Professional Qualification | LEED New Construction v3.0 | LEED AP | |

Working experience and occupation | May 2008 - PresentFounding Partner of ALLTHATISSOLID, LOS ANGELES CA and KUALA LUMPUR;May 2010 - PresentFounding Partner of SOLIDBUILT, LOS ANGELES CAMay 2010 - PresentFounder & Director of BENTOBOX HOLDINGSSep 2010 - Sep 2011Architectural Engineer of LEAD DAO TECHNOLOGY AND ENGINEERING LTD., TAIPEISep 2008 - Aug 2010Architectural Designer of AMERICAN APPAREL RETAIL INC., LOS ANGELES CAJune 2006 - Oct 2006Intern Architect of NMDA-INC., LOS ANGELES CAJan 2005 - June 2005Intern Architect of HUANG IBOSHI ARCHITECTURE, SAN FRANCISCO CA | Directorships in public companies and listed issuers (if any) | NIL | Family relationship with any director and/or major shareholder of the listed issuer | DATO' CHEW LAK SEONG (FATHER) | Any conflict of interests that he/she has with the listed issuer | NIL | Details of any interest in the securities of the listed issuer or its subsidiaries | 100,000 units in KIP REIT |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-2-2019 08:24 AM

|

显示全部楼层

发表于 1-2-2019 08:24 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 15,625 | 15,675 | 31,217 | 30,976 | | 2 | Profit/(loss) before tax | 7,896 | 8,753 | 15,156 | 16,364 | | 3 | Profit/(loss) for the period | 7,896 | 8,753 | 15,156 | 16,364 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 7,896 | 8,753 | 15,156 | 16,364 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.56 | 1.73 | 3.00 | 3.24 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.0008 | 1.0033

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-2-2019 08:29 AM

|

显示全部楼层

发表于 1-2-2019 08:29 AM

|

显示全部楼层

EX-date | 29 Jan 2019 | Entitlement date | 31 Jan 2019 | Entitlement time | 04:00 PM | Entitlement subject | Income Distribution | Entitlement description | Second Interim Income Distribution of 1.55 sen per unit for the 2nd Quarter of 2019 (from 1 October 2018 to 31 December 2018) comprising :- (1) 1.518 sen per unit - taxable (2) 0.032 sen per unit - non-taxable | Period of interest payment | 01 Oct 2018 to 31 Dec 2018 | Financial Year End | 30 Jun 2019 | Share transfer book & register of members will be | 31 Jan 2019 to 31 Jan 2019 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 14 Feb 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 31 Jan 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0155 | Par Value (if applicable) | Malaysian Ringgit (MYR) |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-2-2019 08:34 AM

|

显示全部楼层

发表于 1-2-2019 08:34 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | KIP Real Estate Investment Trust ("KIP REIT" or the "Fund") | KIP REIT is pleased to attach a Press Release entitled "KIP REIT reports continuous stable earnings with an increased average occupancy rate - declares 1.55 sen distribution translating to a yield of 8.2%".

This announcement is dated 15 January 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6036937

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-4-2019 05:48 PM

|

显示全部楼层

发表于 4-4-2019 05:48 PM

|

显示全部楼层

| KIP REAL ESTATE INVESTMENT TRUST |

Particulars of substantial Securities HolderName | LANDASAN PRIMAMAJU SDN BHD | Address | Unit B-6, Block B, Tingkat 6, Menara KIP, No. 1, Jalan Seri Utara 1, Sri Utara Off Jalan Ipoh

Kuala Lumpur

68100 | Company No. | 1089643-P | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Units in KIP Real Estate Investment Trust ("KIP REIT") |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 15 Mar 2019 | 12,000,000 | Disposed | Direct Interest | Name of registered holder | Landasan Primamaju Sdn Bhd (held under Maybank Nominees (Tempatan) Sdn Bhd | Address of registered holder | 8th Floor, Menara Maybank, 100, Jalan Tun Perak, 50050 Kuala Lumpur | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Direct Interest -Disposal of -12,000,000 units by Landasan Primamaju Sdn Bhd vide "off market deal" (-direct) | Nature of interest | Direct Interest | Direct (units) | 42,462,137 | Direct (%) | 8.403 | Indirect/deemed interest (units) | 35,000,000 | Indirect/deemed interest (%) | 6.927 | Total no of securities after change | 77,462,137 | Date of notice | 18 Mar 2019 | Date notice received by Listed Issuer | 18 Mar 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-5-2019 06:26 AM

|

显示全部楼层

发表于 19-5-2019 06:26 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 15,643 | 15,670 | 46,860 | 46,646 | | 2 | Profit/(loss) before tax | 7,366 | 8,847 | 22,522 | 25,211 | | 3 | Profit/(loss) for the period | 7,366 | 8,847 | 22,522 | 25,211 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 7,366 | 8,847 | 22,522 | 25,211 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.46 | 1.75 | 4.46 | 4.99 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9998 | 1.0033

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-5-2019 06:28 AM

|

显示全部楼层

发表于 19-5-2019 06:28 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 19-5-2019 06:29 AM

|

显示全部楼层

发表于 19-5-2019 06:29 AM

|

显示全部楼层

EX-date | 02 May 2019 | Entitlement date | 06 May 2019 | Entitlement time | 04:00 PM | Entitlement subject | Income Distribution | Entitlement description | Third Interim Income Distribution of 1.51 sen per unit for the 3rd Quarter of 2019 (from 1 January 2019 to 31 March 2019) comprising :- (1) 1.482 sen per unit - taxable (2) 0.028 sen per unit - non-taxable | Period of interest payment | 01 Jan 2019 to 31 Mar 2019 | Financial Year End | 30 Jun 2019 | Share transfer book & register of members will be | 06 May 2019 to 06 May 2019 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BOARDROOM SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 17 May 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 06 May 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0151 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-7-2019 05:00 AM

|

显示全部楼层

发表于 2-7-2019 05:00 AM

|

显示全部楼层

Name | LANDASAN PRIMAMAJU SDN BHD | Address | Unit B-6, Block B, Tingkat 6, Menara KIP, No. 1, Jalan Seri Utara 1, Sri Utara Off Jalan Ipoh

Kuala Lumpur

68100 | Company No. | 1089643-P | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Units in KIP Real Estate Investment Trust ("KIP REIT") |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 24 May 2019 | 16,000,000 | Disposed | Direct Interest | Name of registered holder | Landasan Primamaju Sdn Bhd (held under M & A Nominee (Tempatan) Sdn Bhd | Address of registered holder | Unit B-6, Block B, Tingkat 6 Menara KIP, No. 1, Jalan Seri Utara 1, Sri Utara Off Jalan Ipoh, 68100 Kuala Lumpur | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Direct Interest -Declaration and distribution of dividend in specie by Landasan Primamaju Sdn Bhd to Kip Development Sdn Bhd (8,160,000 units) and Scotsville Sdn Bhd (7,840,000 units) | Nature of interest | Direct Interest | Direct (units) | 26,462,137 | Direct (%) | 5.237 | Indirect/deemed interest (units) | 35,000,000 | Indirect/deemed interest (%) | 6.927 | Total no of securities after change | 61,462,137 | Date of notice | 28 May 2019 | Date notice received by Listed Issuer | 28 May 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-7-2019 05:01 AM

|

显示全部楼层

发表于 2-7-2019 05:01 AM

|

显示全部楼层

Name | SCOTSVILLE SDN. BHD. | Address | Unit B-6, Block B, Tingkat 6, Menara KIP, No. 1, Jalan Seri Utara 1, Sri Utara Off Jalan Ipoh

Kuala Lumpur

68100 | Company No. | 501818-U | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Units in KIP Real Estate Investment Trust ("KIP REIT") |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 24 May 2019 | 7,840,000 | Acquired | Direct Interest | Name of registered holder | Scotsville Sdn Bhd (M&A Nominee (Tempatan) Sdn Bhd | Address of registered holder | Unit B-6. Block B Tingkat 6, Menara KIP No. 1, Jalan Seri Utara 1 Sri Utara, Off Jalan Ipoh 68100 Kuala Lumpur | Description of "Others" Type of Transaction | | | 2 | 24 May 2019 | 16,000,000 | Disposed | Indirect Interest | Name of registered holder | Landasan Primamaju Sdn Bhd (held under M&A Nominee (Tempatan) Sdn Bhd | Address of registered holder | Unit B-6, Block B, Tingkat 6 Menara KIP, No. 1 Jalan Seri Utara 1, Sri Utara Off Jalan Ipoh, 68100 Kuala Lumpur | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Direct Interest :-Declaration of dividend in specie by Landasan Primamaju Sdn Bhd to Kip Development Sdn Bhd (8,160,000 units) and Scotsville Sdn Bhd (7,840,000 units)Deemed Interest -Declaration and distribution of dividend in specie by Landasan Primamaju Sdn Bhd to Kip Development Sdn Bhd (8,160,000 units) and Scotsville Sdn Bhd (7,840,000 units) | Nature of interest | Direct and Indirect Interest | Direct (units) | 7,840,000 | Direct (%) | 1.552 | Indirect/deemed interest (units) | 26,462,137 | Indirect/deemed interest (%) | 5.237 | Total no of securities after change | 34,302,137 | Date of notice | 28 May 2019 | Date notice received by Listed Issuer | 28 May 2019 |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|