|

|

发表于 28-4-2011 10:33 PM

|

显示全部楼层

发表于 28-4-2011 10:33 PM

|

显示全部楼层

|

金价今晚再创历史新高.........MDW和TIV发飙.....!!! |

|

|

|

|

|

|

|

|

|

|

|

发表于 28-4-2011 11:23 PM

|

显示全部楼层

发表于 28-4-2011 11:23 PM

|

显示全部楼层

回复 5757# 葉芬

谢谢芬姐,我也上来留个脚印,大家加油....加油...YES!!! |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-4-2011 12:32 AM

|

显示全部楼层

发表于 29-4-2011 12:32 AM

|

显示全部楼层

葉芬 发表于 28-4-2011 10:02 PM

芬姐,TIV现在走势不错哦。还有什么股可以分享吗? |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-4-2011 09:04 AM

|

显示全部楼层

发表于 29-4-2011 09:04 AM

|

显示全部楼层

Tri-Valley Corporation Completes Expanded Phase 1 Claflin Drilling ProgramFont size: A | A | A6:30 AM ET 4/28/11 | BusinessWire

RELATED QUOTES

3:59 PM ET 4/28/11

Symbol Last % Chg

TIV 0.83 11.14%

Quotes delayed at least 15 minutes

Tri-Valley Corporation (NYSE Amex: TIV) today announced that it has completed an expanded Phase 1 development drilling program at its Claflin oil project, located in the Edison Oil Field near Bakersfield, California. The Company has drilled eight new wells, up from the six wells initially planned. These new wells are part of Tri-Valley's overall plan to drill a total of 22 new wells at Claflin during 2011 to convert 2.1 million barrels of net proved undeveloped oil reserves ("PUDs") on the property to proved developed and producing ("PDP") status and to increase oil production. The net proved undeveloped reserves were included in the reserves disclosed in the Company's Annual Report on Form 10-K for the year ended December 31, 2010, and filed with the U.S. Securities and Exchange Commission on March 22, 2011.

Tri-Valley is currently completing the installation of well-site production equipment and tie-in of the new wells to existing production facilities at Claflin. The Company expects to commence an initial steam injection cycle on the first well in early May and that the new wells will have received an initial steam injection cycle by the end of July; however, new steam generating capacity being installed at Claflin could accelerate completion of this initial steam injection work on the new wells. First oil production is anticipated from some of the new wells by June. Following first production from these new wells, there will be a 90-day evaluation period during which Tri-Valley will analyze the performance of the new wells prior to commencement of the second phase of the Claflin development to complete the remaining 14 new wells by the end of the year.

"We are ahead of schedule on our plans to develop the Claflin property to drive increased oil production in 2011," said Maston N. Cunningham, President and CEO of Tri-Valley Corporation. "Our plan calls for a total of 13 new vertical wells and nine new horizontal wells to be drilled on the property this year. If we are successful, we expect to exit 2011 with gross daily production of about 800 barrels of oil from the property."

"With the closing of our recent private placement financing, we raised nearly five million dollars in new capital that will allow us to pursue our development plans at Claflin," continued Mr. Cunningham. "We would like to welcome Ironman Energy Master Fund, an experienced oil and gas investment fund and major participant in our recent financing, as a significant new shareholder of Tri-Valley Corporation."

"Negotiations with adjacent land and mineral owners to secure permits for the 3-D seismic acquisition area for the Claflin and adjoining Brea properties have taken more time than originally planned, but we believe that seismic acquisition work should start by the end of May," added Mr. Cunningham. "This new 3-D data will useful for our exploitation plans for Claflin and Brea, including better geologic control during horizontal drilling operations later this year in the second phase of Claflin development."

About Tri-Valley

Tri-Valley Corporation explores for and produces oil and natural gas in California and has two exploration-stage gold properties in Alaska. Tri-Valley is incorporated in Delaware and is publicly traded on the NYSE Amex exchange under the symbol "TIV." Our Company website, which includes all SEC filings, is www.tri-valleycorp.com.

Forward-Looking Statements

All statements contained in this press release that refer to future events or other non-historical matters are forward-looking statements. By way of example, statements contained in this press release related to the expected timeline for well-drilling completion, first oil production, installation of facility upgrades and seismic study results, as well as the anticipated number of wells to be drilled, gross barrel production and production rates, and such other future events, business plans and objectives of management for future operations, are forward-looking statements. Although the Company does not make forward-looking statements unless it believes it has a reasonable basis for doing so, the Company cannot guarantee their accuracy. These statements are only predictions based on management's expectations as of the date of this press release, and involve known and unknown risks, uncertainties and other factors, including: the Company's ability to obtain additional funding; imprecise estimates of oil reserves; drilling hazards such as equipment failures, fires, explosions, blow-outs, and pipe failure; shortages or delays in the delivery of drilling rigs and other equipment; problems in delivery to market; adverse weather conditions; compliance with governmental and regulatory requirements; fluctuations in oil prices; and such other risks and factors that are discussed in the Company's filings with the Securities and Exchange Commission from time to time, including under "Item 1A. Risk Factors" and "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations," contained in the Company's Annual Report on Form 10-K for the year ended December 31, 2010. Except as required by law, the Company undertakes no obligation to update or revise publicly any of the forward-looking statements after the date of this press release to conform such statements to actual results or to reflect events or circumstances occurring after the date of this press release.

SOURCE: Tri-Valley Corporation |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-4-2011 09:05 AM

|

显示全部楼层

发表于 29-4-2011 09:05 AM

|

显示全部楼层

Dejour Enterprises extends credit facilityFont size: A | A | A2:58 PM ET 4/28/11 | Briefing.com

RELATED QUOTES

3:59 PM ET 4/28/11

Symbol Last % Chg

DEJ 0.37 -7.08%

Quotes delayed at least 15 minutes

Co announced that it signed a Commitment Letter with the lender to extend the credit facility that is due on April 30, 2011 to October 31, 2011. This facility can be further extended to January 31, 2012, subject to the approval of the lender. Co reduced the outstanding balance of the credit facility to $4.5 mln as a result of payments equaling $400,000 (including $300,000 subsequent to the year ended December 31, 2010). |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-4-2011 09:06 AM

|

显示全部楼层

发表于 29-4-2011 09:06 AM

|

显示全部楼层

Dejour Extends Credit FacilityFont size: A | A | A2:57 PM ET 4/28/11 | BusinessWire

RELATED QUOTES

3:59 PM ET 4/28/11

Symbol Last % Chg

DEJ 0.37 -7.08%

Quotes delayed at least 15 minutes

Dejour Energy, Inc. (NYSE Amex: DEJ / TSX: DEJ) ("Dejour") Dejour announces today that it signed a Commitment Letter with the lender to extend the credit facility that is due on April 30, 2011 to October 31, 2011. This facility can be further extended to January 31, 2012, subject to the approval of the lender.

The Company reduced the outstanding balance of the credit facility to $4,500,000 as a result of payments equaling $400,000 (including $300,000 subsequent to the year ended December 31, 2010). This facility is used to support the development of its oil and gas properties in the Drake/Woodrush area.

Dejour intends to refinance this facility with a conventional lender upon completion of a new engineering evaluation targeted for the second quarter of 2011. This will allow greater financial flexibility and access to lower cost capital going forward.

The Independent Auditor's Report of the financial statements for the fiscal year-ended Dec 31, 2010, filed on March 31, 2011, contained disclosure of a going concern in the 'Emphasis of Matter' paragraph. Dejour expects that the extension of this credit facility and equity raised subsequent to Dec 31, 2010 are sufficient to maintain operations throughout 2011.

About Dejour

Dejour Energy Inc. is an independent oil and natural gas company operating multiple exploration and production projects in North America's Piceance Basin (107,000 net acres) and Peace River Arch regions (15,000 net acres). Dejour's seasoned management team has consistently been among early identifiers of premium energy assets, repeatedly timing investments and transactions to realize their value to shareholders' best advantage. Dejour maintains offices in Denver, USA, Calgary and Vancouver, Canada. The company is publicly traded on the New York Stock Exchange Amex (NYSE Amex: DEJ) and Toronto Stock Exchange (TSX: DEJ).

Statements Regarding Forward-Looking Information: This news release contains statements about oil and gas production and operating activities that may constitute "forward-looking statements" or "forward-looking information" within the meaning of applicable securities legislation as they involve the implied assessment that the resources described can be profitably produced in the future, based on certain estimates and assumptions. Forward-looking statements are based on current expectations, estimates and projections that involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those anticipated by Dejour and described in the forward-looking statements. These risks, uncertainties and other factors include, but are not limited to, adverse general economic conditions, operating hazards, drilling risks, inherent uncertainties in interpreting engineering and geologic data, competition, reduced availability of drilling and other well services, fluctuations in oil and gas prices and prices for drilling and other well services, government regulation and foreign political risks, fluctuations in the exchange rate between Canadian and US dollars and other currencies, as well as other risks commonly associated with the exploration and development of oil and gas properties. Additional information on these and other factors, which could affect Dejour's operations or financial results, are included in Dejour's reports on file with Canadian and United States securities regulatory authorities. We assume no obligation to update forward-looking statements should circumstances or management's estimates or opinions change unless otherwise required under securities law.

The TSX does not accept responsibility for the adequacy or accuracy of this news release.

Follow Dejour Energy's latest developments on Facebook:

http://facebook.com/dejourenergy

SOURCE: Dejour Energy, Inc. |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-4-2011 09:06 AM

|

显示全部楼层

发表于 29-4-2011 09:06 AM

|

显示全部楼层

Voyager Oil & Gas provides operations update and guidance; sees drilling production in-line with guidanceFont size: A | A | A8:49 AM ET 4/20/11 | Briefing.com

RELATED QUOTES

4:00 PM ET 4/28/11

Symbol Last % Chg

VOG 4.10 -3.53%

Quotes delayed at least 15 minutes

Co announces it has spud 27 gross wells in 2011 bringing the total well count to 45 wells targeting the Bakken/Three Forks formations. Co has also spud 3 gross Niobrara wells in 2011 targeting the Niobrara formation. Currently, 1.72 net Bakken/Three Forks wells are drilling, completing or producing and 2.5 net Niobrara wells are producing or waiting on completion. Co expects to participate in 70 gross wells and 6.0 net wells in 2011 targeting the Bakken/Three Forks. Based on our current and forecasted drilling activity, co expects to average 700 barrels of oil equivalent "BOE" per day by the end of 2011. This drilling and production guidance is in line with previous estimates. In 2011 co expects to spend $42 mln in drilling capital expenditures targeting the Bakken and Three Forks. Co expects to devote the additional capital to strategic acreage acquisition targeting the Bakken and Three Forks using cash-on-hand of ~$47 mln and cash flow from operations. |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-4-2011 09:07 AM

|

显示全部楼层

发表于 29-4-2011 09:07 AM

|

显示全部楼层

LDV Capital Management and the Stock & Bond Club of South Florida Finish First Quarter 2011 With Dinner Presentations by: BB&T, General Electric, Lexington Realty Trust, and StatoilFont size: A | A | A4:32 PM ET 4/26/11 | GlobeNewswire

RELATED QUOTES

3:38 PM ET 4/28/11

Symbol Last % Chg

AABVF 0.91 1.94%

ANX 2.65 2.32%

AVGCF 1.66 -0.60%

BBX 0.90 0.00%

BBT 26.65 1.80%

DCTH 6.91 -1.85%

SDDDF 2.03 3.82%

GE 20.60 -0.24%

Quotes delayed at least 15 minutes

LDV Capital Management's Spring Break for Wall Street Dinner Conference, along with the Stock and Bond Club of South Florida Dinner Association completed first quarter 2011 on a solid note. Over a 90 day period, more than 790 money manager's, investment advisor's, and private equity investor's, attended a total of nine dinner meetings, and heard corporate power-point presentations by 14 publicly traded companies.

Participating presenting companies included, but were not limited to: BB&T Corporation (NYSE:BBT); General Electric Co. (NYSE:GE); Lexington Realty Trust (NYSE: LXP); NovaGold Resources Inc. (AMEX:NG); Statoil (NYSE:STO); Bank Atlantic Bancorp (NYSE:BBX); Delcath Systems Inc. (Nasdaq CTH); ADVENTRX Pharmaceuticals, Inc. (AMEX:ANX); Hemispherx Biopharma, Inc. (AMEX: HEB); Infusytem Holdings, Inc. (AMEX CTH); ADVENTRX Pharmaceuticals, Inc. (AMEX:ANX); Hemispherx Biopharma, Inc. (AMEX: HEB); Infusytem Holdings, Inc. (AMEX NFU); Aberdeen International, Inc. (TSX:AAB); Avion Gold Corporation (TSX:AVR); Sulliden Gold Corporation, Ltd. (TSX:SUE). NFU); Aberdeen International, Inc. (TSX:AAB); Avion Gold Corporation (TSX:AVR); Sulliden Gold Corporation, Ltd. (TSX:SUE).

LDV Capital Management is a Registered Investment Advisory firm licensed with the state of Florida, specializing in Financial Advisory, Mergers & Acquisitions, Fairness Opinions, Capital Formation, Corporate Restructuring and Financial Statement Analysis for Publicly Traded Companies Preparing for Audit. Its President/Founder, James DePelisi, is also the President of the 45 year old Stock and Bond Club of South Florida, one of the largest and most established investment advisory associations in Florida.

Mr. DePelisi stated, "We definitely had a busy three months, led by presentations from five relevant New York Stock Exchange (NYSE) listed companies, and a cadre of several small cap companies." For more than 10 years, both LDV Capital Management and the Stock and Bond Club of South Florida have hosted more than 170 companies, in similar due diligence dinner forums. DePelisi remarked, "It was impressive to see the degree of information and industry insight rendered by the 14 presenting companies during the 2011 first quarter; and also at how well the companies were received by the 790+ investment professionals in attendance."

Heading into the second quarter of 2011, DePelisi hopes that the overall markets will continue to develop and take shape. "Our phone is certainly ringing more, as of late; but we make it clear to companies wishing to present….that we uphold a certain set of standards and criteria for seeking presenting companies….and it is these standards and criteria which makes our assembly so preferred," says DePelisi.

ABOUT LDV CAPITAL MANAGEMENT: Based in Fort Lauderdale, Florida, LDV Capital Management (www.LdvCapitalManagement.com) is a Registered Investment Advisory firm licensed with the state of Florida specializing in Financial Advisory, Mergers & Acquisitions, Fairness Opinions, Capital Formation, Corporate Structuring/Restructuring and Succession Planning. LDV's services encompass: 1) Asset Management; 2) Financial Statement Analysis for Publicly Traded Companies Preparing for Audit; 3) Financial Advisory, Analysis and Preparation of SEC Registration Statements (S-1, S-3, Form 10); 4) Financial Advisory, Analysis and Preparation of Private Placement Memorandums (PPM).

ABOUT SPRING BREAK FOR WALL STREET: Hosted by LDV Capital Management, for three years running, Spring Break for Wall Street has branded itself as one of the premiere annual South Florida conferences during the month of March. Over 70 companies have presented, including popular New York Stock Exchange (NYSE) companies: Aflac (http://www.aflac.com); Agnico-Eagle Mines Ltd. (http://www.agnico-eagle.com); Brandywine Realty Trust (http://www.brandywinerealty.com); Chico's FAS (http://www.chicosfas.com); Fidelity National Information Services (http://www.fisglobal.com) and Petrobras (http://www.petrobras.com.br). Other smaller cap companies have included: ATP Oil & Gas Corp. (http://www.atpog.com); Aurizon Mines Ltd. (http://www.aurizon.com); and Dreams, Inc. (http://www.dreamscorp.com). See: http://www.ldvcapitalmanagement.com/conferences.htm.

ABOUT THE STOCK AND BOND CLUB OF SOUTH FLORIDA: The 45 year old Stock & Bond Club of South Florida (www.SBCSF.org) Dinner Association is one of the largest and most established investment advisory associations in the state of Florida. Over 150 companies have presented before its assembly in the past 16 years, including NYSE listed companies: Aflac (http://www.aflac.com); BB&T Corporation (www.bbandt.com); Cemex (http://www.cemex.com); Colgate--Palmolive Company (www.colgate.com); Equity One, Inc. (http://www.equityone.net); Enerplus Corporation (http://www.enerplus.com); General Electric Co. (www.ge.com); General Motors Company (www.gm.com); Gold Corp, Inc. (http://www.goldcorp.com); McDonald's Corp (http://www.mcdonalds.com); Nokia Corporation (http://www.nokia.com); Novartis (http://www.novartis.com); Occidental Petroleum Corporation (http://www.oxy.com); SAP AG (http://www.sap.com); Statoil (www.statoil.com); Tsakos Energy Navigation Ltd. (www.tenn.gr); Tyson Foods, Inc. (http://www.tyson.com); Watsco, Inc. (www.watsco.com); and Yum! Brands, Inc. (http://www.yum.com).

DISCLAIMER: LDV Capital Management (LDV) is a Registered Investment Advisory firm licensed with the State of Florida. The Stock and Bond Club of South Florida is only an industry dinner association and is not registered with any state or federal securities regulatory authority. The information herein is not an endorsement, suggestion or solicitation to invest, but simply a summarization of recent and standard past dinner events. Information herein is public data, compiled from Yahoo Finance, a presenting company press release and/or a presenting company's web site. Information is believed to be reliable, but makes no representation to its accuracy or completeness. LDV does not recommend, warrant, or guarantee the success of any action taken in reliance on statements made in this news release or by any company presentations at any Conference or Dinner. Due-diligence and professional advice should be sought before making any investment decisions regarding information mentioned in this press release or discussed at any dinner or conference. LDV and its principals DO own shares of stock in both General Electric (NYSE:GE) and Watsco (NYSE:WSO).

This news release was distributed by GlobeNewswire, www.globenewswire.com

SOURCE: LDV Capital Management |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-4-2011 09:26 AM

|

显示全部楼层

发表于 29-4-2011 09:26 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 29-4-2011 09:28 AM

|

显示全部楼层

发表于 29-4-2011 09:28 AM

|

显示全部楼层

芬姐,TIV现在走势不错哦。还有什么股可以分享吗?

samloh315 发表于 29-4-2011 12:32 AM

呵呵 別貪心。慢慢來。

P/s: 可以參考我之前的帖子,都有提到多只的好油股了。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-4-2011 09:35 AM

|

显示全部楼层

发表于 29-4-2011 09:35 AM

|

显示全部楼层

西瓜小弟,謝謝分享。

P/s: 給有買DEJ的網友們,要記住哦DEJ的Resistance 0.50 好多次了都突破不了。

要是不明白芬姐所講的,請參考Citigroups圖表。C也是一樣Resistance在 $5, 站不穩在$5. |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-4-2011 10:37 PM

|

显示全部楼层

发表于 29-4-2011 10:37 PM

|

显示全部楼层

好久没来这里了,我上来留个脚印,大家继续加油....加油 |

|

|

|

|

|

|

|

|

|

|

|

发表于 30-4-2011 12:48 AM

|

显示全部楼层

发表于 30-4-2011 12:48 AM

|

显示全部楼层

Timberline Resources reports highest grade intersect to date at Butte Highlands Gold Project

Shares in dual listed Timberline Resources (CVE:TBR, AMEX:TLR) were on the move this morning after the company announced additional results from underground drilling at its Butte Highlands Gold Project in Montana.

In early deals, shares in the company were trading just over 5% higher, bolstered by a headline grabbing intersect in drill hole BHUG11-022 which returned 14.5 feet grading 6.77 ounces per ton gold, including a bonanza 3.5 feet grading 27.6 opt gold. Timberline noted that this was the highest-grade gold assay ever reported at Butte Highlands.

"We are very excited and encouraged with results from our underground drill program at Butte Highlands. The bonanza gold grades reported today support our expectation that Butte Highlands will be a robust profit generator for the Company,” Paul Dircksen, Timberline's President and CEO, stated this morning.

Timberline holds a 50% stake in the Butte Highlands Joint Venture, with the remaining 50% held by Highland Mining (“Highland”). Highland is funding all project development costs, with Timberline's 50% share of costs to be paid out of proceeds from future mine production.

The JV is currently planning to drill 15,000 meters at the project, with gold production expected to commence in “early 2012”.

Drilling has been focused on the upper part of the Old Mill Block, but Timberline further noted that the high grade zone contacted in drill hole BHUG11-022 likely came from the structural boundary of the Only Chance Block, where the drill hole began, before it moved into the Old Mill Block.

“The high-grade interval was extracted at or near the contact between the Meagher dolomite and the skarn altered Wolsey formation. The interval is from within the fault gouge at the contact while the remainder of the intercept is within highly altered, faulted skarn material.” |

|

|

|

|

|

|

|

|

|

|

|

发表于 30-4-2011 01:41 PM

|

显示全部楼层

发表于 30-4-2011 01:41 PM

|

显示全部楼层

|

芬姐有投机吗?我的钱都套在ssn其他油股都嗅价起舞,唯独ssn原风不动,想止损了 |

|

|

|

|

|

|

|

|

|

|

|

发表于 30-4-2011 01:43 PM

|

显示全部楼层

发表于 30-4-2011 01:43 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 30-4-2011 02:52 PM

|

显示全部楼层

发表于 30-4-2011 02:52 PM

|

显示全部楼层

芬姐有投机吗?我的钱都套在ssn其他油股都嗅价起舞,唯独ssn原风不动,想止损了

christophere_85 发表于 30-4-2011 01:41 PM

我也是套了在那里,不过一开始就打算放长久,没打算那么快卖的,也不希望到止损的地步... |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 3-5-2011 08:35 AM

|

显示全部楼层

Precious Metals and Mining Stocks: An Update Part 2

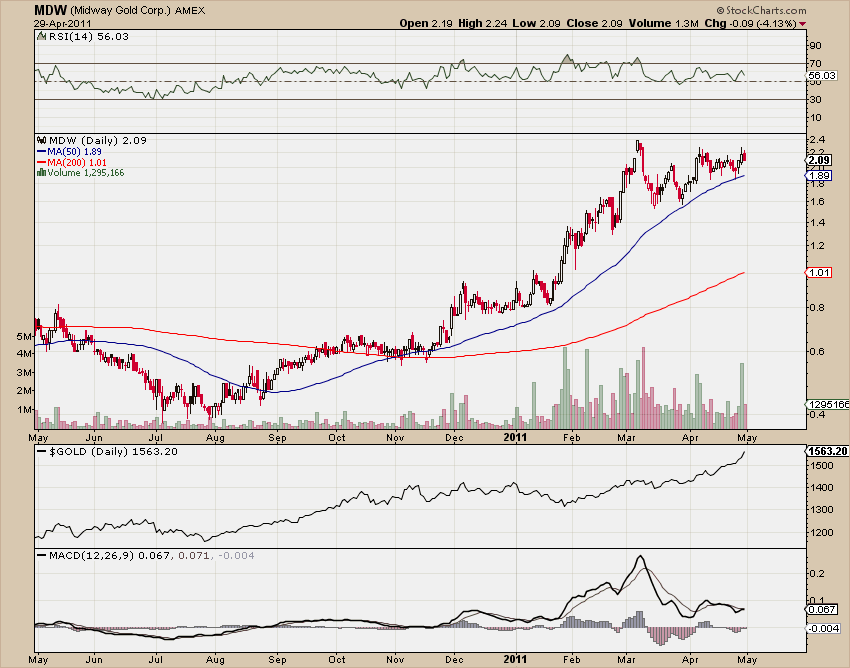

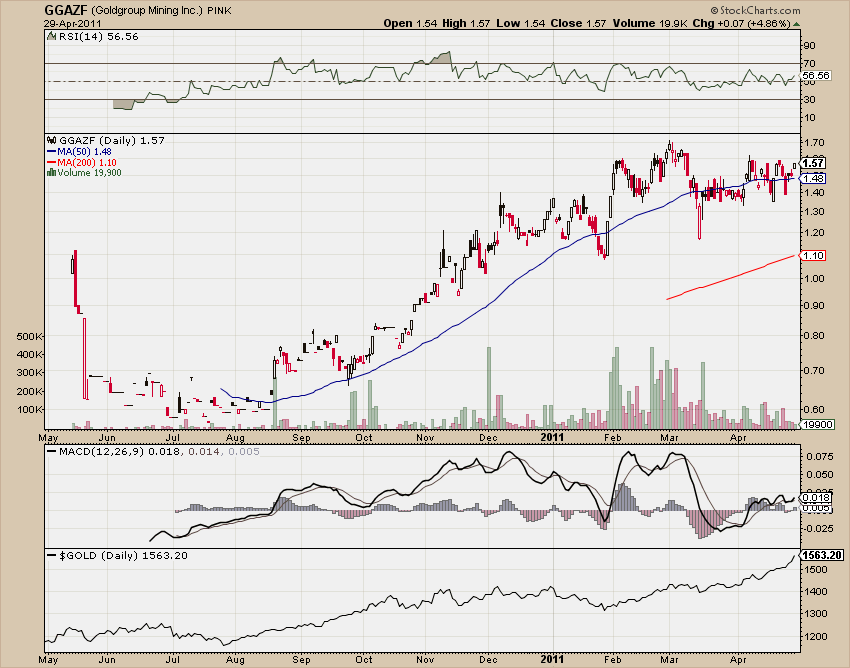

Two smaller exploration stocks that have caught our eye are Midway Gold (MDW) and Goldgroup Mining (GGAZF.PK). What piqued our interest is that insiders are holding fairly large stakes in both companies, both have had some exciting exploration news in recent months and their charts look strong – usually an ideal combination of factors.

One must of course caution that all these stocks have already advanced quite a bit and within the gold sector the exploration sub-sector is certainly the most risky. The higher risk is however compensated by higher potential reward.

Midway Gold – insiders hold about 15% of the company, it has been quite successful with exploration – mainly in Nevada - and the chart looks strong.

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 3-5-2011 08:36 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 3-5-2011 08:46 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 3-5-2011 08:53 AM

|

显示全部楼层

http://messages.finance.yahoo.com/Stocks_%28A_to_Z%29/Stocks_H/threadview?m=te&bn=27001&tid=24579&mid=24579&tof=1&frt=2#24579

HERO beat on 1Q earnings and revenues. 2Q already more favorable. EBITDA continues to power forward at $49M for 1Q, annualized at about $200M. Tack on another $40M for the Seahawk deal, this pushes HERO's run rate to about $240M.

-CHK bought BRNC for 10x EBITDA.

-Noble (NE) trades at 10x EBITDA.

-RIG trades at 8.5x EBITDA with the BP disaster overhang surrounding it.

For HERO, 10x EBITDA is $2.4B, less $690M net debt (long term debt less cash), on 137.2M shares, that's $12.50 a share!

And that's at current activity levels. The SEC issue is a $.10-.15 cents per share issue.

And what does a 5% improvement in day rates make? 5% x 170M quarterly revenue is $8.5M per quarter, $34M EBITDA annually, times 10 gives $2.50 per share. So to get into the low $20's per share, day rates would have to go up 20% (from say $35K to $41K).

Nat gas act is coming, the GOM is going to re-open, PEMEX and Brazil will have stepped up demand, competition in the GOM is consolidating.

Get on board, we are heading to $12.50 near term, and $20 per share by year end. |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|