|

|

【MMAG 0034 交流专区】 (前名 INGENCO)

[复制链接]

[复制链接]

|

|

|

发表于 13-9-2018 04:40 AM

|

显示全部楼层

发表于 13-9-2018 04:40 AM

|

显示全部楼层

Date of change | 12 Sep 2018 | Name | DATO DATO JOHARI BIN YAHYA | Age | 65 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Chairman | New Position | Independent Director | Directorate | Independent and Non Executive | Qualifications | He holds a Diploma in Police Sciences from the National University of Malaysia, having graduated in 1997. | Working experience and occupation | He has more than 33 years of working experience in the Royal Malaysia Police Force (RMPF). He currently heads DJ Protective Consultancy Services providing protection and security services. His early years in the RMPF was in the Special Action Force (UTK - Unit Tindakhas) where he remained for nearly 18 years and rose up to the position of Deputy Commander. His specialized professional experience in Security and Policing was developed from his years in this Department where he performed various challenging roles in protective security services to VVIPs. He was subsequently promoted to Head, Serious Crimes Division, Kuala Lumpur Police. He was promoted to Assistant Commissioner of Police and was transferred to Johor Baru as OCPD in 2006 where he actively pursued the concept of Community Policing and forged better Community - Police cooperation. Soon after he was sent to manage the Police District of Central Malacca as OCPD and Community Policing was once again a priority as part of crime management as well amongst other duties, he was also involved in commercial crimes.In 2008 he returned to Bukit Aman Kuala Lumpur as Principal Assistant Director, Serious Crimes Division (D9) CID where he played an action role in managing commercial hijacking crimes. He retired on 11 July 2011. Currently, as the CEO of DJ Protective Consultancy Services, Dato Johari brings a sound foundation of unique and extensive knowledge and experience together with specialist expertise in solution-based approaches. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-9-2018 04:19 AM

|

显示全部楼层

发表于 19-9-2018 04:19 AM

|

显示全部楼层

本帖最后由 icy97 于 20-9-2018 07:20 AM 编辑

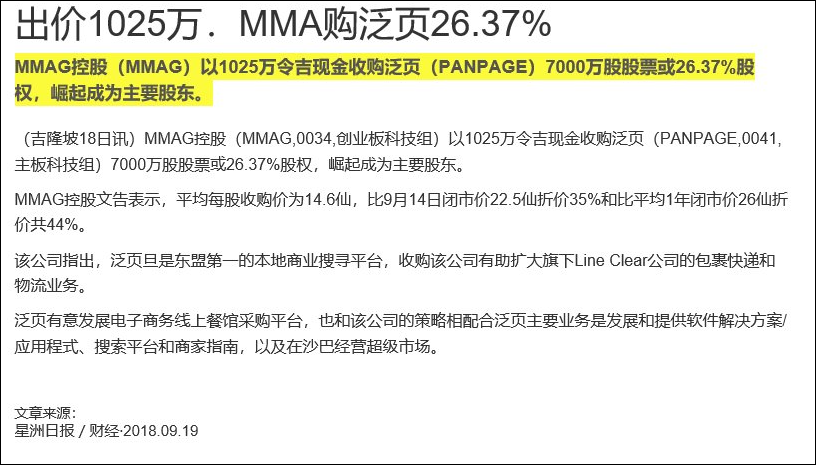

Type | Announcement | Subject | OTHERS | Description | ACQUISITION OF 26.37% EQUITY INTEREST IN PANPAGES BERHAD | The Board of Directors of MMAG Holdings Berhad wishes to announce that the Company had on 18 September 2018 purchased 26.37% equity interest in PanPages Berhad (“Acquisition”) comprising 70,000,000 ordinary shares via Kenanga Investment Bank Berhad for a cash consideration of RM10,250,000.00 or approximately at an average price RM0.146 per share.

Please refer to attachment for details of the announcement.

This announcement is dated 18th September 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5915693

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-10-2018 07:26 AM

|

显示全部楼层

发表于 6-10-2018 07:26 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Conversion of Preference Shares | Details of corporate proposal | Irredeemable Convertible Preference Shares ("ICPS") | No. of shares issued under this corporate proposal | 9,730,000 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.2000 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 599,444,663 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 122,150,157.300 | Listing Date | 08 Oct 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-10-2018 12:46 AM

|

显示全部楼层

发表于 16-10-2018 12:46 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Conversion of Preference Shares | Details of corporate proposal | Irredeemable Convertible Preference Shares ("ICPS") | No. of shares issued under this corporate proposal | 10,764,000 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.2000 | Par Value($$) (if applicable) | Malaysian Ringgit (MYR) | | Latest issued share capital after the above corporate proposal in the following | Units | 610,208,663 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 130,360,712.300 | Listing Date | 16 Oct 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-10-2018 05:10 AM

|

显示全部楼层

发表于 18-10-2018 05:10 AM

|

显示全部楼层

Name | MR KENNY KHOW CHUAN WAH | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 15 Oct 2018 | 7,134,000 | Others | Direct Interest | Name of registered holder | Kenanga Nominees (Tempatan) Sdn. Bhd. (For Kenny Khow Chuan Wah) | Address of registered holder | Level 15, Kenanga Tower, 237 Jalan Tun Razak, 50400 Kuala Lumpur. | Description of "Others" Type of Transaction | Conversion |

Circumstances by reason of which change has occurred | Conversion of Irredeemable Convertible Preference Shares to Ordinary Shares. | Nature of interest | Indirect Interest | Direct (units) | 7,134,000 | Direct (%) | 1.17 | Indirect/deemed interest (units) | 71,208,500 | Indirect/deemed interest (%) | 11.66 | Total no of securities after change | 78,342,500 | Date of notice | 17 Oct 2018 | Date notice received by Listed Issuer | 17 Oct 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-10-2018 05:01 AM

|

显示全部楼层

发表于 23-10-2018 05:01 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Conversion of Preference Shares | Details of corporate proposal | Irredeemable Convertible Preference Shares ("ICPS") | No. of shares issued under this corporate proposal | 12,790,000 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.2000 | Par Value($$) (if applicable) | Malaysian Ringgit (MYR) | | Latest issued share capital after the above corporate proposal in the following | Units | 622,998,663 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 132,918,712.300 | Listing Date | 23 Oct 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-10-2018 03:58 AM

|

显示全部楼层

发表于 26-10-2018 03:58 AM

|

显示全部楼层

本帖最后由 icy97 于 26-10-2018 05:33 AM 编辑

MMAG以1046万在依斯干达公主城购仓库

Amir Ridzwan Ismail/theedgemarkets.com

October 24, 2018 19:04 pm +08

(吉隆坡24日讯)MMAG控股(MMAG Holdings Bhd)以1046万令吉在柔佛依斯干达公主城(Iskandar Puteri)购买4套一层半的现成半独立式工厂。

根据今日向大马交易所报备,该集团通过独资子公司Ingenuity Microsystems私人有限公司向Liangsiang Capital私人有限公司购买上述物业。

MMAG表示,将通过转换不可赎回优先股所得款项,全额支付收购金额。

该集团说,这些物业将被子公司Line Clear Express & Logistics私人有限公司用于快递与物流的未来存储额仓储需求。

文告补充,拟议收购预计不会对截至明年3月杪2019财政年的综合收益有任何实质影响。

(编译:陈慧珊)

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | Proposed acquisition of four(4) of one and a half storey (1 ½) semi detached factory from Liangsiang Capital Sdn. Bhd. by Ingenuity Microsystems Sdn. Bhd. | The Board of Directors of MMAG Holdings Berhad wishes to annouce that its wholly-owned subsidiary, Ingenuity Microsystems Sdn. Bhd. had entered into a Sale and Purchase Agreement ("SPA") with Liangsiang Capital Sdn. Bhd. for the acquisition of four (4) units of one and a half (1 ½) storey semi-detached factory at Empire Park, Iskandar Puteri, Johor Darul Takzim for a total cash consideration of RM10,456,500.00.

Please refer to the attachment for further details of the announcement.

This announcement is dated 24th October 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5951997

| Attachments MMAG HOLDG - Anouncement Purchase Properties - Liangsiang.pdf

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-10-2018 06:52 AM

|

显示全部楼层

发表于 28-10-2018 06:52 AM

|

显示全部楼层

Type | Reply to Query | Reply to Bursa Malaysia's Query Letter - Reference ID | IQL-25102018-00001 | Subject | Proposed acquisition of 4 units of 1 ½ storey semi-detached factory from Liangsiang Capital Sdn Bhd (Proposed Acquisition) | Description | Further to the announcement made on 24 October 2018 and the query letter from Bursa Malaysia Securities Berhad (Bursa Securities") dated 25 October 2018, please find attached herewith our response for the additional information requested by Bursa Securities. | Query Letter Contents | We refer to your Company’s announcement dated 24 October 2018 in respect of the aforesaid matter. In this connection, kindly furnish Bursa Securities with the following additional information for public release:- - The salient features of the Sale and Purchase Agreement.

- The names of LCSB’s directors and substantial shareholders together with their respective shareholdings.

- The terms of any arrangement for payment for the Purchase Consideration on a deferred basis.

- Whether the transaction is subject to the relevant government authorities’ approval.

- The time and place where the valuation report may be inspected.

| This announcement is dated 26 October 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5956169

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-11-2018 02:06 AM

|

显示全部楼层

发表于 18-11-2018 02:06 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Conversion of Preference Shares | Details of corporate proposal | Irredeemable Convertible Preference Shares ("ICPS") | No. of shares issued under this corporate proposal | 7,104,100 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.2000 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 634,753,563 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 135,269,692.300 | Listing Date | 08 Nov 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-11-2018 02:11 AM

|

显示全部楼层

发表于 18-11-2018 02:11 AM

|

显示全部楼层

Date of change | 07 Nov 2018 | Name | DATUK KHAN BIN MOHD AKRAM KHAN | Age | 48 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Non Executive Chairman | New Position | Executive Chairman | Directorate | Executive |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Degree | Communications | Infrastructure University Kuala Lumpur | |

Working experience and occupation | Datuk Haji Khan Bin Mohd Akram Khan, aged 48, is a strategist and a serial entrepreneur in the filed of Big Data Analytics, Automotive, Logistics and Trading, and other related products. As the founder of AGA Group, Datuk Khans journey into Big Data Analytics started back in 2001, during the time when he was still involved in the Automotive Industry. Being an advocator towards a sustainable data management and governance, his National Data Ocean framework has been renowned and accepted by MAMPU and MDEC in pursuing Beyond 2020 Roadmap.Datuk Khan has almost 30 years of experience in the areas of Strategic Planning, Branding and Communication, Marketing, Digital Transformation and Data Analytics. Being a prominent figure in Big Data arena, Datuk Khan has been featured in many events such as HACKATHON and forums as a speaker in order to share his views on how businesses can capitalize data as the game changer to win deals. Armed with vast experience in various industries where he strongly believes that is the primary component in transforming and optimizing business best practices, Datuk Khan has been proactively promoting the idea of Big Data Analytics based on his principles, methodology and architecture.His strong passion and deep understanding in data management and analytics and how it can assist businesses in making better and clearer decisions has led Datuk Khan to acquire an Australia based company, Clarity Private Limited in 2014. As a result of his acquisition which later changed the company's name to CLARITY OSS (MALAYSIA) SDN. BHD. For the past almost 20 years, besides CLARITY OSS (MALAYSIA) SDN. BHD., Datuk Khan has been building his business network under AGA Group of Companies; ONE STOP DOT COM, AGA ZONE and AGA GEMILANG. | Family relationship with any director and/or major shareholder of the listed issuer | Nil | Any conflict of interests that he/she has with the listed issuer | Nil | Details of any interest in the securities of the listed issuer or its subsidiaries | 75,140,000 preference shares (17.55%) - Indirect Interest |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-11-2018 07:28 AM

|

显示全部楼层

发表于 18-11-2018 07:28 AM

|

显示全部楼层

Notice of Interest Sub. S-hldr (Section 137 of CA 2016)Particulars of Substantial Securities HolderName | CYPRESS VALLEY SDN. BHD. | Address | Unit 30-01, Level 30, Tower A Vertical Business Suite, Avenue 3 Bangsar South , 8 Jalan Kerinchi,

Kuala Lumpur

59200 Wilayah Persekutuan

Malaysia. | Company No. | 989064T | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary shares | Name & address of registered holder | CYPRESS VALLEY SDN. BHD.Unit 30-01, Level 30, Tower A Vertical Business Suite, Avenue 3 Bangsar South , 8 Jalan Kerinchi, 59200 Kuala Lumpur. |

| Date interest acquired & no of securities acquired | Date interest acquired | 08 Nov 2018 | No of securities | 124,860,000 | Circumstances by reason of which Securities Holder has interest | Acquisition of shares via off market. | Nature of interest | Direct Interest |  | | Total no of securities after change | Direct (units) | 124,860,000 | Direct (%) | 19.671 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Date of notice | 08 Nov 2018 | Date notice received by Listed Issuer | 08 Nov 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-11-2018 07:29 AM

|

显示全部楼层

发表于 18-11-2018 07:29 AM

|

显示全部楼层

Notice of Person Ceasing (Section 139 of CA 2016)Particulars of Substantial Securities HolderName | GRANDSTEAD SDN BHD | Address | C-01-1, Block C, Plaza Glomac, No. 6, Jalan SS7/19, Kelana Jaya,

Petaling Jaya.

47301 Selangor

Malaysia. | Company No. | 1039261P | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary shares | Date of cessation | 08 Nov 2018 | Name & address of registered holder | GRANDSTEAD SDN BHDC-01-1, Block C, Plaza Glomac, No. 6, Jalan SS7/19, Kelana Jaya, 47301 Petaling Jaya. Selangor Darul Ehsan. |

No of securities disposed | 124,860,000 | Circumstances by reason of which a person ceases to be a substantial shareholder | Disposal of shares via off market. | Nature of interest | Direct Interest |  | Date of notice | 08 Nov 2018 | Date notice received by Listed Issuer | 08 Nov 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-12-2018 02:34 AM

|

显示全部楼层

发表于 1-12-2018 02:34 AM

|

显示全部楼层

本帖最后由 icy97 于 17-12-2018 07:53 AM 编辑

拓展快递物流业务-mmag控股1267万加埔买地

http://www.enanyang.my/news/20181121/拓展快递物流业务br-mmag控股1267万加埔买地/

Type | Announcement | Subject | OTHERS | Description | PROPOSED ACQUISITION OF ENTIRE EQUITY INTEREST IN ACTIVE TRIO DELUXE SDN. BHD. (1275391-A) | The Board of Directors of MMAG Holdings Berhad wishes to announce that Ingenuity Microsystems Sdn. Bhd., a wholly-owned subsidiary of the Company, had on 19th November 2018 entered into a Share Sale Agreement for the proposed acquisition of the entire equity interest in ACTIVE TRIO DELUXE SDN. BHD. comprising one(1) ordinary share from Yong Mong Huay(100%) for a total cash consideration of RM12,670,000.00.

Please refer to attachment for details of the announcement.

This announcement is dated 19th November 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5977429

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-12-2018 03:05 AM

|

显示全部楼层

发表于 5-12-2018 03:05 AM

|

显示全部楼层

Type | Reply to Query | Reply to Bursa Malaysia's Query Letter - Reference ID | IQL-22112018-00001 | Subject | Proposed acquisition of the entire equity interest in Active Trio Deluxe Sdn Bhd (Proposed Acquisition) | Description | Further to the announcement made on 19 November 2018 and the query letter from Bursa Malaysia Securities Berhad ("Bursa Securities") dated 22 November 2018, please find attached herewith our response for the additional information requested by Bursa Securities. | Query Letter Contents | We refer to your Company’s announcement dated 21 November 2018 in respect of the aforesaid matter.

In this connection, kindly furnish Bursa Securities with the following additional information for public release:-

- The terms of any arrangement for payment of the Purchase Consideration on a deferred basis.

- The salient features of the SSA.

- Contingent liabilities and guarantees to be assumed by MMAG Holding Berhad (“MMAG”) group, arising from the Proposed Acquisition.

- The sources of funding by MMAG group for the Proposed Acquisition, and the breakdown thereof.

- The prospects of the Property/Active Trio Deluxe Sdn Bhd.

- The risks in relation to the Proposed Acquisition.

| This announcement is dated 23 November 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5983041

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-12-2018 06:49 AM

|

显示全部楼层

发表于 28-12-2018 06:49 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 11,120 | 39,810 | 19,314 | 88,268 | | 2 | Profit/(loss) before tax | -2,885 | -1,962 | -6,542 | -3,320 | | 3 | Profit/(loss) for the period | -2,885 | -1,989 | -6,542 | -3,368 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -2,836 | -2,012 | -6,493 | -3,670 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.54 | -0.75 | -1.32 | -1.45 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.2091 | 0.2407

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-1-2019 05:20 AM

|

显示全部楼层

发表于 29-1-2019 05:20 AM

|

显示全部楼层

Date of change | 03 Jan 2019 | Name | MR DIRK JOHANN QUINTEN | Age | 50 | Gender | Male | Nationality | Germany | Designation | Alternate Director | Directorate | Executive | Type of change | Appointment |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Masters | Electrical Engineering & Automation | SMDP Harvard Business School | |

Working experience and occupation | Dirk started his career in 1995 with MNC where he became a material handling systems authority and sought after commissioning expert around the globe.Dirk came to Malaysia in 2000 and shifted his focus towards corporate and project management. In the course of his career he worked with companies including FLSmidth, Conoco, Thyssenkrupp, Siemens, Alstom, TNB, GE, Wartsila, Rolls Royce, SMS, Hatch, SNC-Lavalin, Vale, Integrax, Ferrostaal, Petronas, Caterpillar, Melewar, Pertamina and made a name for himself in delivering complex projects, corporate turnarounds and capital market structures.With his ability to engage teams and to merge various company departments into a cohesive organisation, Dirk excels in improving corporate governance and business structures in order to achieve stability and growth.Dirk believes in transparent and ethical business conduct and has an extraordinary ability to build trust with stakeholders. He is a member of the Harvard Alumni Club as well as of the German Embassy's Round Table business forum in Malaysia. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-2-2019 03:49 AM

|

显示全部楼层

发表于 9-2-2019 03:49 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Incorporation of a wholly-owned subsidiary, MMANTAP SDN. BHD. | The Board of Directors of MMAG Holdings Berhad (the "Company") wishes to announce that the Company had on 24th January 2019 incorporated a wholly-owned subsidiary, namely MMANTAP SDN. BHD. with an initial share capital of RM2.00 comprising 2 ordinary shares.

MMANTAP SDN. BHD. will be principally engaged in providing fulfilment services, courier services, delivery services and payment gateway services.

The said incorporation is not expected to have any material impact on the earnings per share, net assets per share, share capital and substantial shareholders’ shareholdings of the Company for the financial year ending 31 March 2019.

The said incorporation is not subjected to the approval of the Company’s shareholders.

None of the directors and/or major shareholders of the Company and/or persons connected with them have any interest, whether direct or indirect, in the said incorporation.

The Board of Directors of the Company is of the opinion that the said incorporation is in the best interest of the Company.

This announcement is dated 25th January 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-2-2019 02:46 AM

|

显示全部楼层

发表于 10-2-2019 02:46 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Conversion of Preference Shares | Details of corporate proposal | Irredeemable Convertible Preference Shares ("ICPS") | No. of shares issued under this corporate proposal | 46,666,000 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.2000 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 682,419,563 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 144,802,892.300 | Listing Date | 31 Jan 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-2-2019 05:11 AM

|

显示全部楼层

发表于 11-2-2019 05:11 AM

|

显示全部楼层

Name | CYPRESS VALLEY SDN BHD | Address | Unit 30-01, Level 30, Tower A Vertical Business Suite, Avenue 3, Bangsar South, 8 Jalan Kerinchi,

Kuala Lumpur

59200 Wilayah Persekutuan

Malaysia. | Company No. | 989064T | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 29 Jan 2019 | 46,666,000 | Others | Direct Interest | Name of registered holder | Cypress Valley Sdn Bhd | Address of registered holder | Unit 30-01, Level 30, Tower A Vertical Business Suite, Avenue 3, Bangsar South, 8 Jalan Kerinchi, 59200 Kuala Lumpur. | Description of "Others" Type of Transaction | Conversion |

Circumstances by reason of which change has occurred | Conversion of Irredeemable Convertible Preference Shares to Ordinary Shares. | Nature of interest | Direct Interest | Direct (units) | 171,526,000 | Direct (%) | 25.13 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Total no of securities after change | 171,526,000 | Date of notice | 31 Jan 2019 | Date notice received by Listed Issuer | 31 Jan 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-3-2019 08:00 AM

|

显示全部楼层

发表于 9-3-2019 08:00 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 17,216 | 31,135 | 36,530 | 119,403 | | 2 | Profit/(loss) before tax | -6,510 | -4,384 | -13,052 | -7,704 | | 3 | Profit/(loss) for the period | -6,542 | -4,405 | -13,084 | -7,773 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -6,485 | -4,405 | -12,978 | -8,075 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.03 | -1.23 | -2.41 | -2.80 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1945 | 0.2407

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|