|

|

大众远东产业及旅游业基金(PFEPRF)的前景!(英文版)

[复制链接]

|

|

|

楼主 |

发表于 19-7-2007 11:17 PM

|

显示全部楼层

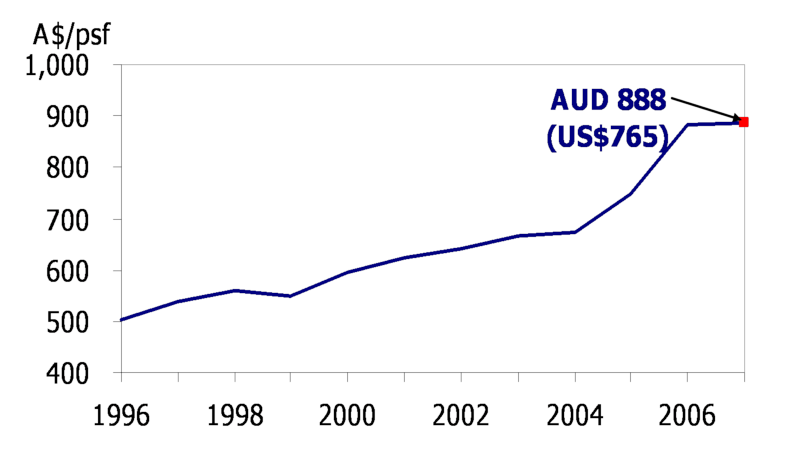

Australia: Sydney Office Capital Values

Property prices on the uptrend in the long term. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 11:19 PM

|

显示全部楼层

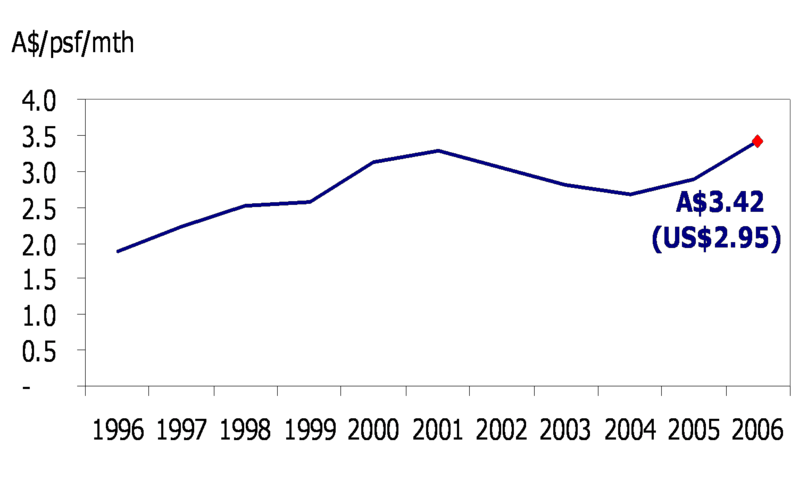

Australia: Sydney Office Rentals

Office rentals resume uptrend. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 11:21 PM

|

显示全部楼层

Indonesia: Office & Residential Capital Values

Property prices on a long term uptrend. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 11:22 PM

|

显示全部楼层

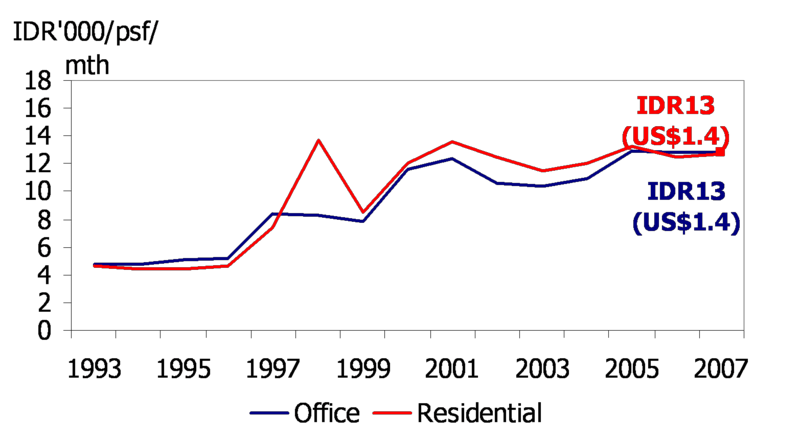

Indonesia: Office & Residential Rental

Rental rates recovering |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 11:25 PM

|

显示全部楼层

Comparison of Office Capital Values

In US$/psf

| Jan 2000

| Apr 2007

| % chg. p.a.

| Japan

| 1,248

| 2,622

| 15.7

| Hong Kong

| 1,134

| 1,982

| 10.7

| Singapore

|

800

| 1,322

| 9.3

| Australia

|

484

|

765

| 5.2

| Shanghai

|

421

|

610

| 6.4

| Malaysia

|

146

|

169

| 2.3

| Indonesia

|

93

|

123

| 4.6

|

There is potential for property prices in selected markets to appreciate further given the large price difference between the above markets |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 11:27 PM

|

显示全部楼层

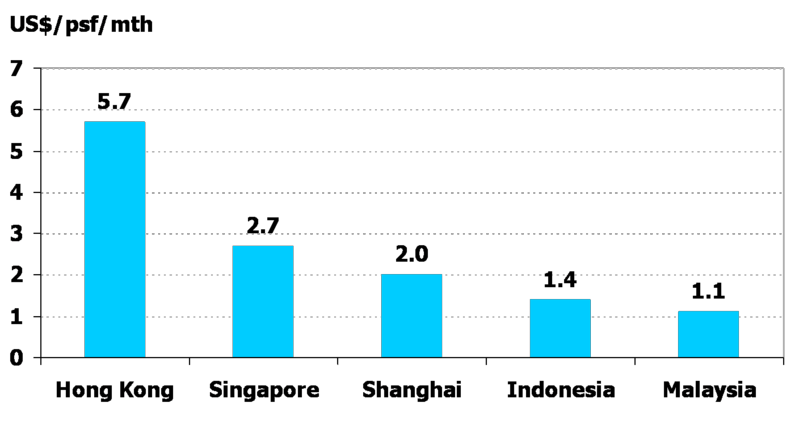

Comparison of Office Rentals

Likewise there is potential for rental rates in selected markets to appreciate. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 11:29 PM

|

显示全部楼层

Comparison of Condominium Capital Values

In US$/psf

| Jan 2000

| Apr 2007

| % chg. p.a.

| Hong Kong

| 1,337

| 2,095

| 8.1

| Singapore

|

900

| 1,361

| 7.3

| Malaysia

|

103

|

152

| 6.8

| Indonesia

|

119

|

125

| 0.7

| Shanghai

| n.a.

|

359

| n.a.

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 11:32 PM

|

显示全部楼层

Comparison of Condominium Rentals

Developing markets are lagging prices in selected cities. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 11:33 PM

|

显示全部楼层

Property Market Outlook: Key Factors

a) Resilient GDP growth

b) Rising disposable income

c) High savings rate

d) Benign interest rate environment amidst strong liquidity

e) Availability of financing/credit for housing

f) Foreign buyers for selected markets

g) Rising trend of urbanisation |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 11:36 PM

|

显示全部楼层

a) Resilient GDP Growth

| | | | China

| | | | Hong Kong

| | | | Singapore

| | | | Malaysia

| | | | Indonesia

| | | | Australia

| | | | Japan

| | | |

f=forecast

Source: Brokers’ Consensus

Sustained GDP growth is positive for the property sector in terms of consumer affordability and sentiment. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 11:38 PM

|

显示全部楼层

b) Rising Disposable Income

| | | | | | | Singapore

| | | | Hong Kong

| | | | Korea

| | | | Taiwan

| | | | Malaysia

| | | | Thailand

| | | | China

| | | | Indonesia

| | | |

Strong growth in disposable income increases the affordability of home ownership. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 11:39 PM

|

显示全部楼层

c) High Savings Rate

Country

| 2005(%)

|

Singapore

| 48.6

|

China

| 47.0

|

Malaysia

| 43.3

|

Korea

| 33.3

|

Hong Kong

| 33.0

|

Thailand

| 29.4

|

India

| 29.1

|

Taiwan

| 23.0

|

Source: Asian Development Bank

Consumers are more likely to invest in property given their high savings rates provide some safety buffer in the event of any economic slowdown.

[ 本帖最后由 Takumi 于 19-7-2007 11:41 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 11:43 PM

|

显示全部楼层

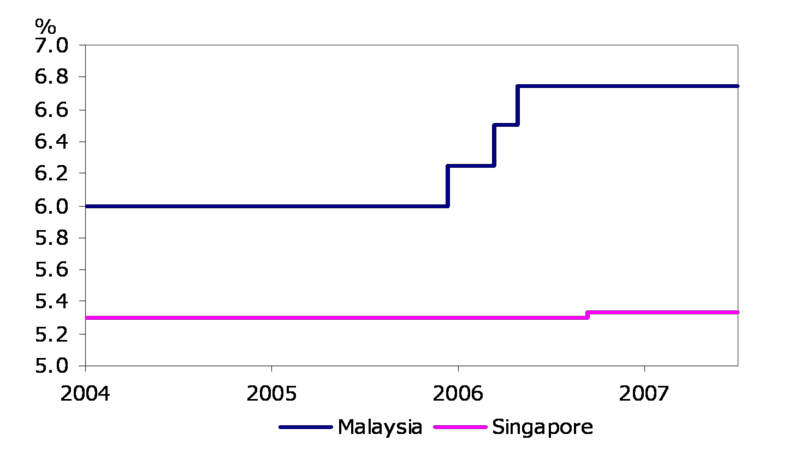

d) Benign Interest Rate Environment

Interest Rates: Malaysia & Singapore

Malaysia: Maybank Base Lending Rate

Singapore: Prime Rate

[ 本帖最后由 Takumi 于 19-7-2007 11:56 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 11:45 PM

|

显示全部楼层

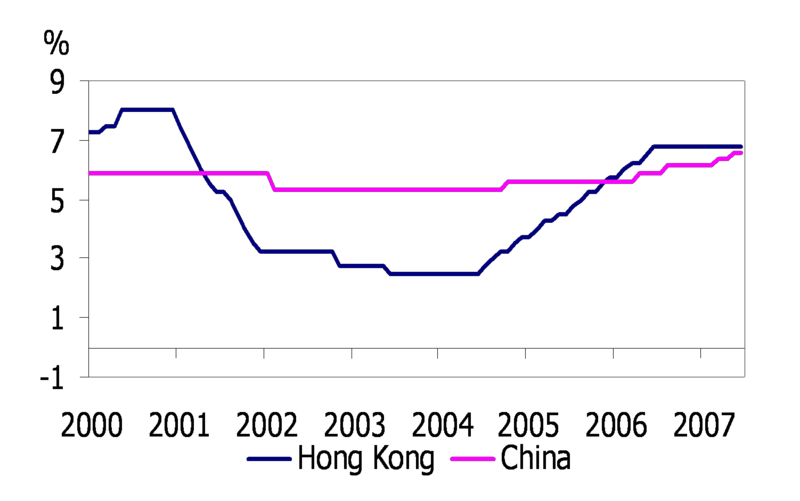

Interest Rates: Hong Kong & China

Hong Kong: HK Base Rate

China: 1-Year Base Lending Rate

Hong Kong interest rates have stabilised while China’s interest rates have been trending up slightly

[ 本帖最后由 Takumi 于 19-7-2007 11:55 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 11:48 PM

|

显示全部楼层

Interest Rates: Japan & Australia

Japan: 10-Year Government Bond

Australia: 10-Year Government Bond

Interest rates have been generally stable in Australia & Japan

[ 本帖最后由 Takumi 于 19-7-2007 11:55 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 11:50 PM

|

显示全部楼层

Strong Liquidity

Foreign Currency Reserves

Country

| US$Bil

| Selected

Total

|

China

| 1,202.0

| 38.7%

|

Japan

| 888.0

| 28.6%

|

Taiwan

| 266.5

| 8.6%

|

South Korea

| 247.3

| 8.0%

|

Singapore

| 137.5

| 4.4%

|

Hong Kong

| 135.4

| 4.4%

|

Malaysia

| 89.5

| 2.9%

|

Thailand

| 70.6

| 2.3%

|

Indonesia

| 49.2

| 1.6%

| Total

| 3,108.7

| 100.0%

|

Source: Central banks, Bloomberg

Strong liquidity in the banking system prompts banks to offer attractive mortgages lending rates & packages.

[ 本帖最后由 Takumi 于 19-7-2007 11:55 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 11:52 PM

|

显示全部楼层

e) Availability of financing/credit for housing

l Ample liquidity and benign interest rate environment is positive for real estate purchasers as financial institutions offer attractive financing packages.

l The opening up of developing markets such as China via the Housing Reform that began in 1998 and took off in 1999/2000 was the catalyst for home ownership in China. Prior to that, buyers have no access to home mortgage financing.

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 11:55 PM

|

显示全部楼层

f) Foreign buyers for selected markets

- Easier foreign ownership rules in some countries encouraged foreign buying of local property, boosting prices further.

- In Singapore foreign share of real estate purchases has increased from 9.9% in 1999-2001 to 28% in 2006.

- In Malaysia, the recent relaxation of foreign real estate ownership rules is expected to be positive for the local property market.

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 11:57 PM

|

显示全部楼层

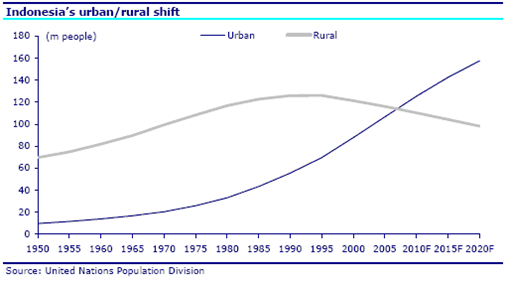

g) Rising Trend Of Urbanisation

Migration to the cities driving up residential prices in cities.

Especially prevalent in China and Indonesia.

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2007 11:58 PM

|

显示全部楼层

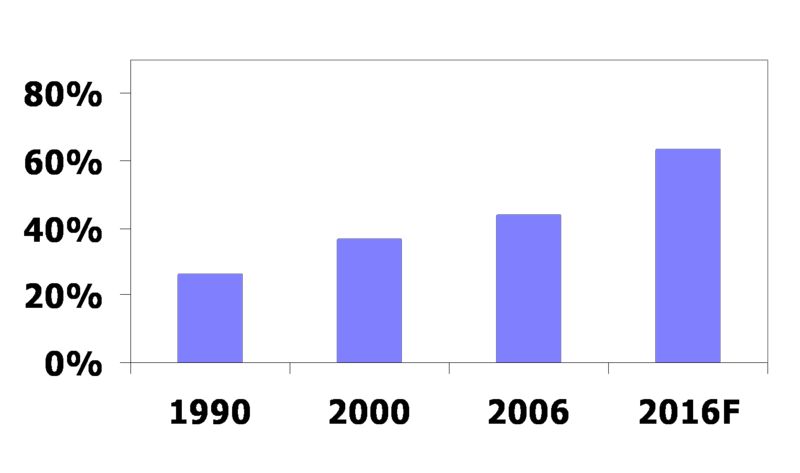

China’s Urban Population

- In 2016, China’s urban population is expected to reach 865mil or 62% of the population.

- Average urban incomes are 3.3 times higher than average rural incomes.

1990 - 302mil 26.4%

2000 - 459mil 36.2%

2006 - 577mil 43.9%

2016F - 865mil 62.0%

[ 本帖最后由 Takumi 于 20-7-2007 12:02 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|