|

|

发表于 9-10-2017 04:31 AM

|

显示全部楼层

发表于 9-10-2017 04:31 AM

|

显示全部楼层

每年收购1资產 KIP產托瞄准柔商场

財经 最后更新 2017年10月8日

• 报导:纪锋佑

KIP產托(KIPREIT,5280,主板房產信託股)冀望接下来每年將收购一项新资產,而今年的目標將会瞄向柔佛州其他与KIP商场有相似经营模式的商场。

KIP產托日前召开上市以来首次股东大会,现场的小股东积极发问,使得大会歷经2句钟之久。

与其他上市產托不同,KIP產托的资產主要位于巴生谷以外的其他州属,所以大部份居住在巴生谷的投资者,並不能完全了解相关资產的生意状况,因此股东们在大会上,耐心地听管理层讲解资產的经营状况。

等待时机注入新资產KIP產托旗下的6项资產,分別是位于淡杯的KIPMart、哥打丁宜KIPMart、马西KIPMart、新那旺KIPMartLavender、马六甲KIPMart和万宜KIPMall。

同时,KIP集团位于KotaWarisan的商场竣工后,目前已非正式推出。

KIP產托拥有KIP集团5项资產的优先购买权(First of Right Refusal),一旦时机成熟,KIP產托有意將这些资產一一注入產托组合。

询及何时才是注入新资產的最佳时机,KIP集团创办人兼KIP產托执行董事拿督周乐森向《东方投资》记者表示,一旦商场的出租率稳定,並且每年能够捎来6至7%的回酬,便將考虑注入。

目前,该公司的KotaWarisan商场已竣工,接下来可能注入的新资產预期是该商场。不过,周氏指出,现財政年还不是最佳时机,应该会在一年后,待一切商场营运稳定后,才会展开收购。

「我们目前的借贷率为14%左右,仍有空间举债收购,除了KIP集团的资產,我们將寻找同样商业模式的商场进行收购。」

他也补充说,虽然类似KIP商场经营模式的例子如凤毛麟角,但在柔佛州还是可以找到几家类似模式的商场。【东方网财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 19-10-2017 09:29 AM

|

显示全部楼层

发表于 19-10-2017 09:29 AM

|

显示全部楼层

朋友去了AGM拿到了voucher,刚好马六甲朋友结婚顺路到马六甲Kip Mart看看与用它的voucher,怎么知道去了几间店买东西counter都不收这voucher 我们打算到help desk问,但那边空空没人 ==“ 我朋友说在AGM问registration counter时,他们说每间店都可以用,哈哈。只好对我朋友说算了吧,反正免费的。 我们打算到help desk问,但那边空空没人 ==“ 我朋友说在AGM问registration counter时,他们说每间店都可以用,哈哈。只好对我朋友说算了吧,反正免费的。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 31-10-2017 05:35 AM

|

显示全部楼层

发表于 31-10-2017 05:35 AM

|

显示全部楼层

| KIP REAL ESTATE INVESTMENT TRUST |

EX-date | 09 Nov 2017 | Entitlement date | 13 Nov 2017 | Entitlement time | 04:00 PM | Entitlement subject | Income Distribution | Entitlement description | First interim income distribution of 1.50 sen per unit for the 1st Quarter of 2018 (from 1 July 2017 to 30 September 2017), comprising the following:- 1) 1.460 sen per unit - taxable 2) 0.040 sen per unit - non-taxable | Period of interest payment | to | Financial Year End | 30 Jun 2018 | Share transfer book & register of members will be | 13 Nov 2017 to 13 Nov 2017 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 28 Nov 2017 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 13 Nov 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.015 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-10-2017 05:37 AM

|

显示全部楼层

发表于 31-10-2017 05:37 AM

|

显示全部楼层

本帖最后由 icy97 于 3-11-2017 05:47 AM 编辑

KIP产托首季赚761万

2017年11月2日

(吉隆坡1日讯)KIP产托(KIPREIT,5280,主板产业信托股)截至9月杪首季,净赚761万1000令吉或每股1.51仙。

营业额则报1530万1000令吉;净产业收入达962万令吉。

KIP产托日前向交易所报备,由于该公司在2月6日已完成收购产业,即KIP产托的上市日期,因此首季无法进行比较。

同时,该公司宣布派发每股1.5仙每单位股息,总值约758万令吉,将在11月28日支付。

比较上季度营业额1604万令吉,当季营业额略低74万令吉或4.6%,因为当季没有节庆日,平均占用率微幅下跌;而净产业收入也比上季度少124万令吉。

董事经理拿督周乐森在文告中指出,尽管当季没有节庆日,但公司仍交出稳定的财绩,这反映出公司的稳定和防御能力。

“随着我们逐步加强现有产业,及寻求新资产融入KIP产托的机会,我们乐观看待公司增长前景保持。”【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 15,301 | 0 | 15,301 | 0 | | 2 | Profit/(loss) before tax | 7,611 | 0 | 7,611 | 0 | | 3 | Profit/(loss) for the period | 7,611 | 0 | 7,611 | 0 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 7,611 | 0 | 7,611 | 0 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.51 | 0.00 | 1.51 | 0.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9942 | 0.9982

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-10-2017 05:39 AM

|

显示全部楼层

发表于 31-10-2017 05:39 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 26-1-2018 04:38 AM

|

显示全部楼层

发表于 26-1-2018 04:38 AM

|

显示全部楼层

本帖最后由 icy97 于 26-1-2018 07:06 AM 编辑

KIP产托每单位派息1.75仙

Wong Ee Lin/theedgemarkets.com

January 25, 2018 20:25 pm +08

(吉隆坡25日讯)KIP产托(KIP Real Estate Investment Trust)在截至2017年12月31日止次季(2018财年次季),获得1082万令吉净产业收入,归功于租赁率提高、佳节及开支降低。

2018财年次季净利为875万令吉,营业额达1568万令吉,每股盈利1.73仙。

KIP产托宣布,派发每单位1.75仙第二次中期股息,相等于875万令吉,将于2月28日过账。

公司把次季业绩表现转佳,归功于租赁率上扬(从2018财年首季的82.3%,提高至2018财年次季的85%),以及该季适逢“重返校园”季节。

同时,公司也相信降低建筑和营销与广告费用,是推高盈利的关键因素之一。

公司在现财年首半年获得2044万令吉净产业收入,并净赚1636万令吉,营业额则达3098万令吉。

KIP REIT Management私人有限公司联合创办人兼执行董事拿督翁国良表示,KIP产托自去年2月6日上市以来,共派息3116万令吉,相等于8%按年分配收益。

“我们的收益是众产托之冠,根据现有价格持续给予8%分配收益。”

他指出,KIP产托的资产迎合大众市场,确保收益可见度,与巴生谷购物广场不在同一类别。

KIP REIT Management联合创办人兼董事经理拿督周乐森说:“在任何无可预见的情况下,我们预计产托将会持续改善表现,因为我们不断采取资产增值措施,确保产业对租户更具吸引力。”

他续称,管理人将会继续探讨以合理价格收购第三方产业,并注入KIP产托,以推动该产托继续增长。

KIP产托投资组合共有5个KIP Mart产业,分别位于淡杯(Tampoi)、哥打丁宜(Kota Tinggi)、马塞(Masai)、新那旺(Senawang)及马六甲,并在万宜拥有1间KIP广场,总净租赁面积超过93万6000平方尺。截至去年12月31日,该产托的总资产值达6亿1120万令吉。

(编译:魏素雯)

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 15,675 | 0 | 30,976 | 0 | | 2 | Profit/(loss) before tax | 8,753 | 0 | 16,364 | 0 | | 3 | Profit/(loss) for the period | 8,753 | 0 | 16,364 | 0 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 8,753 | 0 | 16,364 | 0 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.73 | 0.00 | 3.24 | 0.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9965 | 0.9982

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-1-2018 04:51 AM

|

显示全部楼层

发表于 26-1-2018 04:51 AM

|

显示全部楼层

EX-date | 12 Feb 2018 | Entitlement date | 14 Feb 2018 | Entitlement time | 04:00 PM | Entitlement subject | Income Distribution | Entitlement description | Second interim income distribution of 1.75 sen per unit for the 2nd Quarter of 2018 (from 1 October 2017 to 31 December 2017), comprising of the following:- 1) 1.711 sen per unit - taxable; and 2) 0.039 sen per unit - non-taxable. | Period of interest payment | 01 Oct 2017 to 31 Dec 2017 | Financial Year End | 30 Jun 2018 | Share transfer book & register of members will be | 14 Feb 2018 to 14 Feb 2018 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 28 Feb 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 14 Feb 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0175 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-1-2018 04:53 AM

|

显示全部楼层

发表于 26-1-2018 04:53 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 31-1-2018 01:42 AM

|

显示全部楼层

发表于 31-1-2018 01:42 AM

|

显示全部楼层

本帖最后由 icy97 于 1-2-2018 02:51 AM 编辑

KIP产托林汉义退休

2018年2月1日

(吉隆坡31日讯)KIP产托(KIPREIT,5280,主板产业信托股)宣布,总执行长林汉义因为合约到期而选择退休,这项人事变动从今天起生效。

该产托向交易所报备,今年60岁的林汉义,合约是在今天到期。

与此同时,KIP产托也宣布,委任财务总监曾庆华为代总执行长,并从2月1日起生效。

曾庆华暂代

不过公司强调,曾庆华最终将会担任总执行长,目前仍在等待大马证券监督委员会的批准。

曾庆华在KIP集团工作超过10年,是KIP产托上市活动中的主要成员之一。

他在企业策划、税务、资金管理、金融、会计、产业发展、度假村管理等拥有超过20年经验。

配合这项管理层变动,KIP产托也宣布委任陈轩勇(译音)为代财务总监。

在2011年至2015年之间,陈轩勇曾担任IOI集团(IOICORP,1961,主板种植股)内部审计主管;而2015至至2017年之间,担任马联工业(MUIIND,3891,主板贸服股)的财务总监。

之后,则担任绿野集团(CHHB,5738,主板产业股)的财务总监。【e南洋】

Date of change | 31 Jan 2018 | Name | MR LIM HAN GIE | Age | 60 | Gender | Male | Nationality | Malaysia | Type of change | Retirement | Designation | Others |

| Remarks : | | Mr Lim's contract as Chief Executive Officer will expire on 31 January 2018 and he has opted for retirement. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-1-2018 01:42 AM

|

显示全部楼层

发表于 31-1-2018 01:42 AM

|

显示全部楼层

Date of change | 01 Feb 2018 | Name | MR CHAN HENG WAH | Age | 62 | Gender | Male | Nationality | Malaysia | Type of change | Appointment | Designation | Others | Qualifications | Master of Business Administration (MBA) in Finance and AccountancyAssociate Member of the Canadian Chartered Institute of Finance & Accountancy | Working experience and occupation | He has been with the KIP Group of Companies for more than 10 years and has been one of the key members during KIP REITs IPO exercise.He also brings to KIP REIT Management Sdn Bhd more than 20 years of financial exposure in corporate planning, taxation, treasury, finance, accounting, stand-alone credit card operations, timesharing, resort management, business operations management and property development. | Directorships in public companies and listed issuers (if any) | None | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | 125,000 units in KIP REIT |

| Remarks : | | Mr Chan will be appointed as Acting Chief Executive Officer with effect from 1 February 2018 He will assume the position of Chief Executive Officer, pending the approval by the Securities Commission. A further announcement will be made in due course. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-1-2018 01:43 AM

|

显示全部楼层

发表于 31-1-2018 01:43 AM

|

显示全部楼层

Date of change | 01 Feb 2018 | Name | MR CHIN SUAN YONG | Age | 48 | Gender | Male | Nationality | Malaysia | Type of change | Appointment | Designation | Others | Qualifications | Malaysian Institute of Accountants (MIA)Member (C.A., Chartered Accountant) (2002) - No. 20021Malaysian Institute of Certified Public Accountants (MICPA)Member (CPA, Certified Public Accountant) (2002) - No. 3886The Institute of Internal Auditors Malaysia (IIAM) Chartered Member (CMIIA) (2011) - No. 209338 | Working experience and occupation | He started his career as an external auditor with Arthur Andersen, Kuala Lumpur in 1990 and has more than 25 years of experience in external audit, internal audit, accounting and finance in various industries. He was the Head of Group Internal Audit in IOI Corporation Berhad from 2011 to 2015. Subsequently, he joined Malayan United Industries Berhad (MUI Group) in 2015 as Group Financial Controller until 2017. Thereafter, he was appointed as the Chief Financial Officer (CFO) of Country Heights Holdings Berhad prior to his appointment with KIP REIT Management Sdn Bhd. | Directorships in public companies and listed issuers (if any) | None | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | None |

| Remarks : | | Mr Chin will be appointed as Acting Chief Financial Officer with effect from 1 February 2018. A further announcement will be made in due course. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-3-2018 02:52 AM

|

显示全部楼层

发表于 5-3-2018 02:52 AM

|

显示全部楼层

本帖最后由 icy97 于 8-3-2018 04:56 AM 编辑

曾庆华升KIP产托CEO

2018年3月3日

(吉隆坡2日讯)KIP产托(KIPREIT,5280,主板产业信托股)宣布,擢升财务总监曾庆华为总执行长。

该产托向交易所报备,上述人事变动已在昨日起生效。

曾庆华是在前总执行长林汉义于2月1日退休后,暂代总执行长一职。如今获得了证券会批准,曾庆华将会坐正。

曾庆华在KIP集团工作超过10年,是KIP产托上市活动中的主要成员之一。

他在企业策划、税务、资金管理、金融、会计、产业发展、度假村管理等,拥有超过20年经验。

配合这项管理层变动,KIP产托也宣布代财务总监陈轩勇(译音)正式坐正。

在2011年至2015年之间,陈轩勇曾担任IOI集团(IOICORP,1961,主板种植股)内部审计主管;而2015至至2017年之间,担任马联工业(MUIIND,3891,主板贸服股)的财务总监。之后,则担任绿野集团(CHHB,5738,主板产业股)的财务总监。【e南洋】

Date of change | 01 Mar 2018 | Name | MR CHAN HENG WAH | Age | 63 | Gender | Male | Nationality | Malaysia | Type of change | Appointment | Designation | Chief Executive Officer | Qualifications | Master of Business Administration (MBA) in Finance and AccountancyAssociate Member of the Canadian Chartered Institute of Finance & Accountancy | Working experience and occupation | He has been with the KIP Group of Companies for more than 10 years and has been one of the key members during KIP REITs IPO exercise.He also brings to KIP REIT Management Sdn Bhd more than 20 years of financial exposure, accounting, stand-alone credit card operations, timesharing, resort management, business operations management and property development. | Directorships in public companies and listed issuers (if any) | None | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | 125,000 units in KIP REIT |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-3-2018 04:57 AM

|

显示全部楼层

发表于 8-3-2018 04:57 AM

|

显示全部楼层

Date of change | 01 Mar 2018 | Name | MR CHIN SUAN YONG | Age | 47 | Gender | Male | Nationality | Malaysia | Type of change | Appointment | Designation | Chief Financial Officer | Qualifications | MALAYSIAN INSTITUTE OF ACCOUNTANTS ("MIA") - Member (C.A. Chartered Accountant) (2002) - No. 20021MALAYSIAN INSTITUTE OF CERTIFIED PUBLIC ACCOUNTANTS ("MICPA") - Member (CPA, Certified Public Accountant (2002) - No. 3886THE INSTITUTE OF INTERNAL AUDITORS MALAYSIA ("IIAM") - Chartered Member (CMIIA) (2011) - No. 209338 | Working experience and occupation | He started his career as an external auditor with Arthur Anderson, Kuala Lumpur in 1990 and has over 25 years of experience in external audit, internal audit, accounting and finance in various industries.He was Head of Group Internal Audit in IOI Corporation Berhad from 2011 to 2015. Subsequently, he joined Malayan United Industries Berhad in 2015 as Group Financial Controller until 2017. Thereafter, he was appointed as the Chief Financial Officer (CFO) of Country Heights Holdings Berhad prior to his this appointment with KIP REIT Management Sdn Bhd. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-4-2018 01:19 AM

|

显示全部楼层

发表于 27-4-2018 01:19 AM

|

显示全部楼层

本帖最后由 icy97 于 10-5-2018 07:21 PM 编辑

| KIP REAL ESTATE INVESTMENT TRUST |

EX-date | 07 May 2018 | Entitlement date | 14 May 2018 | Entitlement time | 04:00 PM | Entitlement subject | Income Distribution | Entitlement description | Third interim income distribution of 1.780 sen per unit for the 3rd Quarter (from 1 Jan 2018 to 31 March 2018) comprising (1) 1.739 sen per unit - taxable (2) 0.041 sen per unit - non-taxable. | Period of interest payment | 01 Jan 2018 to 31 Mar 2018 | Financial Year End | 30 Jun 2018 | Share transfer book & register of members will be | 10 May 2018 to 10 May 2018 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRATION SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaTel: 03-78490777 | Payment date | 25 May 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 10 May 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0178 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-4-2018 01:21 AM

|

显示全部楼层

发表于 27-4-2018 01:21 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 15,670 | 10,308 | 46,646 | 10,308 | | 2 | Profit/(loss) before tax | 8,847 | 5,526 | 25,211 | 5,526 | | 3 | Profit/(loss) for the period | 8,847 | 5,526 | 25,211 | 5,526 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 8,847 | 5,526 | 25,211 | 5,526 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.75 | 1.09 | 4.99 | 1.09 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9965 | 0.9982

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-4-2018 01:57 AM

|

显示全部楼层

发表于 27-4-2018 01:57 AM

|

显示全部楼层

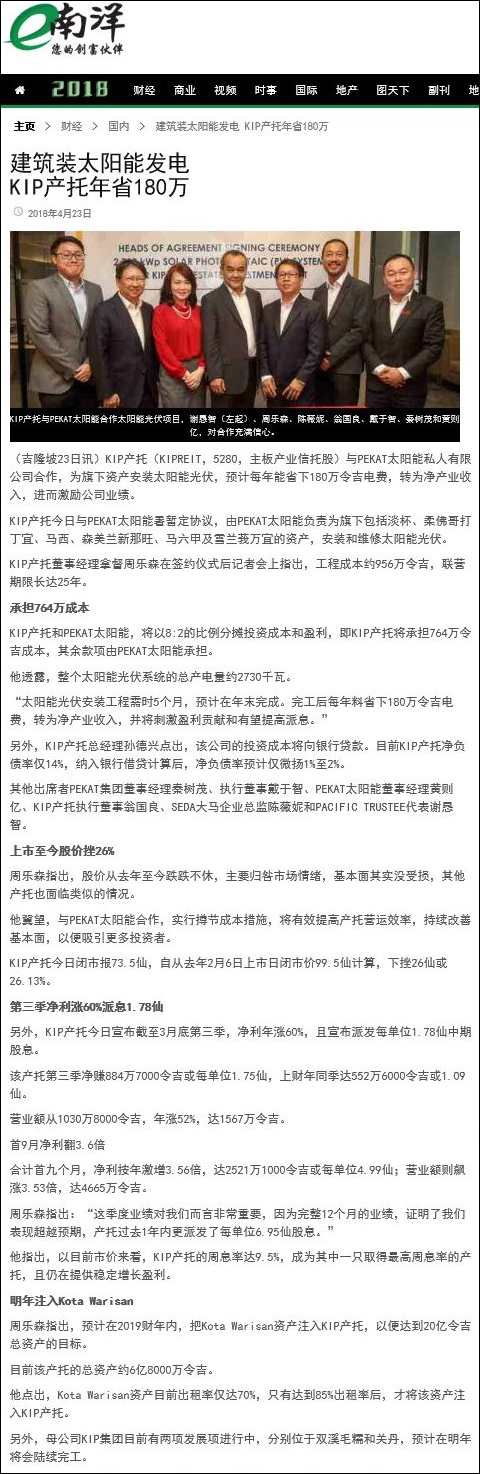

Type | Announcement | Subject | OTHERS | Description | KIP Real Estate Investment Trust ("KIP REIT" or the "Fund") | KIP REIT is pleased to attach a Press Release entitled "KIP REIT goes green by installing 2.730 kilowatt peak Solar Photovoltaic System - a 25-year initiative with RM26.4 million of electricity cost savings" on KIP REIT's assets.

This announcement is dated 23 April 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5768613

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-4-2018 02:00 AM

|

显示全部楼层

发表于 27-4-2018 02:00 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 27-4-2018 04:02 AM

|

显示全部楼层

发表于 27-4-2018 04:02 AM

|

显示全部楼层

本帖最后由 icy97 于 4-5-2018 03:17 AM 编辑

Type | Announcement | Subject | OTHERS | Description | KIP REAL ESTATE INVESTMENT TRUST ("KIP REIT" OR THE "FUND")HEADS OF AGREEMENT BETWEEN PACIFIC TRUSTEES BERHAD (COMPANY NO. 317001-A), ACTING AS TRUSTEE FOR KIP REAL ESTATE INVESTMENT TRUST (KIP REIT) AND PEKAT SOLAR SDN BHD (COMPANY NO. 922788-W) | We refer to the Company’s announcement dated 23 April 2018 (Ref No. GA1-23042018-00156) on the press release entitled “KIP REIT goes green by installing 2,730KW of Solar Photovoltaic System” and wish to further announce on the Heads of Agreement entered between Pacific Trustee Berhad, acting as Trustee for KIP REIT and Pekat Solar Sdn Bhd.

Please refer to Appendix attached.

This announcement is dated 24 April 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5770321

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-7-2018 01:00 AM

|

显示全部楼层

发表于 27-7-2018 01:00 AM

|

显示全部楼层

本帖最后由 icy97 于 28-7-2018 07:05 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 16,127 | 16,042 | 62,773 | 26,350 | | 2 | Profit/(loss) before tax | 12,399 | 9,132 | 37,610 | 14,660 | | 3 | Profit/(loss) for the period | 12,399 | 9,132 | 37,610 | 14,660 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 12,399 | 9,132 | 37,610 | 14,660 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.45 | 1.81 | 7.44 | 2.90 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.0033 | 0.9982

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-7-2018 01:01 AM

|

显示全部楼层

发表于 27-7-2018 01:01 AM

|

显示全部楼层

EX-date | 08 Aug 2018 | Entitlement date | 10 Aug 2018 | Entitlement time | 04:00 PM | Entitlement subject | Income Distribution | Entitlement description | Final Income Distribution of 1.80 sen per unit for the 4th Quarter of 2018 (from 1 April 2018 to 30 June 2018) comprising (1) 1.759 sen per unit - taxable (2) 0.041 sen per unit - non-taxable. | Period of interest payment | 01 Apr 2018 to 30 Jun 2018 | Financial Year End | 30 Jun 2018 | Share transfer book & register of members will be | 10 Aug 2018 to 10 Aug 2018 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 23 Aug 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 10 Aug 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.018 |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|