|

|

【TROP 5401 交流专区】丽阳机构(前名DIJACOR 成隆机构)

[复制链接]

[复制链接]

|

|

|

发表于 11-11-2017 04:58 AM

|

显示全部楼层

发表于 11-11-2017 04:58 AM

|

显示全部楼层

| TROPICANA CORPORATION BERHAD |

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Others | Details of corporate proposal | Dividend Reinvestment Scheme | No. of shares issued under this corporate proposal | 4,655,815 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.8300 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 1,470,417,161 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 1,469,625,672.000 | Listing Date | 13 Nov 2017 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-12-2017 07:26 AM

|

显示全部楼层

发表于 9-12-2017 07:26 AM

|

显示全部楼层

本帖最后由 icy97 于 12-12-2017 01:42 AM 编辑

第3季淨利3549萬 麗陽機構派息2仙

2017年11月30日

(吉隆坡30日訊)受較高的房產項目進度付款金額提振,麗陽機構(TROP,5401,主要板房產)截至9月底第3季淨賺3549萬令吉,按年增2%,公司宣佈每股派發2仙股息。

麗陽機構向馬證交所報備,2017財年第3季營業額亦按年成長30%,報4億6347萬令吉。

該公司首9個月累積淨利從上財年同期的8328萬令吉,按年增長45%至1億2086萬令吉;營業額揚升29%至12億8973萬令吉。

展望未來,儘管房產領域的短期前景仍具挑戰性,但該公司目前在19億令吉未進賬銷售的支持下,將在未來幾年內貢獻公司收益,相信有助公司在不明朗的環境下保持彈性。

另外,麗陽機構將進一步加強其品牌影響力,通過釋放潛在總發展值428億令吉土地儲備中的价值,將股東利益最大化。【中国报财经】

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 463,466 | 357,076 | 1,289,729 | 1,002,080 | | 2 | Profit/(loss) before tax | 49,040 | 53,396 | 177,527 | 127,294 | | 3 | Profit/(loss) for the period | 35,894 | 36,953 | 125,225 | 85,521 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 35,492 | 34,797 | 120,858 | 83,282 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.43 | 2.44 | 8.33 | 5.82 | | 6 | Proposed/Declared dividend per share (Subunit) | 2.00 | 2.50 | 2.00 | 2.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.2200 | 2.1900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-12-2017 07:29 AM

|

显示全部楼层

发表于 9-12-2017 07:29 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 13-1-2018 04:36 AM

|

显示全部楼层

发表于 13-1-2018 04:36 AM

|

显示全部楼层

本帖最后由 icy97 于 14-1-2018 03:31 AM 编辑

丽阳250万购鹰架模板商

2018年1月14日

(吉隆坡13日讯)丽阳机构(TROP,5401,主板产业股)以250万令吉,收购鹰架和模板设备销售商Myxon(马)私人有限公司的全数股权。

丽阳机构今日向交易所报备,该公司是在昨日收购Myxon的100万股普通股,相等于发行和缴足股本的100%。

完成收购后,Myxon将成为丽阳机构的独资子公司。

成立于2013年5月20日的Myxon,主要业务是销售和租赁新旧鹰架和模板设备。

丽阳机构指出,该公司董事拿督唐伟文(译音)已经放弃针对这项收购审议和表决,因为他属于交易相关人士。【e南洋】

Type | Announcement | Subject | OTHERS | Description | TROPICANA CORPORATION BERHAD ("TCB" OR "THE COMPANY")- ACQUISITION OF A NEW SUBSIDIARY, MYXON (M) SDN BHD | Pursuant to Chapter 9, Paragraph 9.19(23) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, the Board of Directors of TCB wishes to announce that the Company has on 11 January 2018, acquired 1,000,000 ordinary shares representing 100% of the issued and paid-up share capital of Myxon (M) Sdn Bhd (Company No. 1046739-D) (“Myxon”) for a total cash consideration of RM2,500,000.00 only (“Acquisition”).

Upon the Acquisition of the entire equity interest in Myxon, Myxon has become a wholly-owned subsidiary of TCB.

Myxon was incorporated in Malaysia on 20 May 2013 as a private limited company. The issued and paid-up share capital of Myxon is RM1,000,000.00 comprising 1,000,000 ordinary shares. Its principal activities are sales and rental of new and used scaffolding and formwork equipment.

Datuk Tang Vee Mun, a director of the Company, being an interested party has abstained from deliberating and voting on the Directors’ Resolution pertaining to the Acquisition.

Save as disclosed above, none of the directors or substantial shareholders of TCB or persons connected with them has any interests, whether direct or indirect in the Acquisition.

This announcement is dated 12 January 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-1-2018 02:45 AM

|

显示全部楼层

发表于 23-1-2018 02:45 AM

|

显示全部楼层

| TROPICANA CORPORATION BERHAD |

EX-date | 07 Feb 2018 | Entitlement date | 09 Feb 2018 | Entitlement time | 05:00 PM | Entitlement subject | First Interim Dividend | Entitlement description | First Interim Single Tier Dividend of 1.6 sen per ordinary share for the financial year ending 31 December 2018 | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 22 Feb 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 09 Feb 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.016 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-3-2018 12:20 AM

|

显示全部楼层

发表于 5-3-2018 12:20 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | TROPICANA CORPORATION BERHAD ("TCB" OR "COMPANY")- VALUATION OF NON-CURRENT ASSETS INCORPORATED INTO FINANCIAL STATEMENTS OF TCB | Pursuant to Chapter 9, Part J, Paragraph 9.19(46) and Part H of Appendix 9A of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, the Board of Directors of TCB (“Board”) wishes to announce that the Board had approved the incorporation of the revaluation surplus, net of deferred tax, of approximately RM24.85 million in the consolidated financial statements of TCB for the financial year ended 31 December 2017.

Further details of the revaluation are set out in the attachment below.

This announcement is dated 27 February 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5705485

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-3-2018 12:20 AM

|

显示全部楼层

发表于 5-3-2018 12:20 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | TROPICANA CORPORATION BERHAD ("TCB" OR "THE COMPANY")- ACQUISITION OF A NEW SUBSIDIARY, MARIVAUX HOLDINGS SDN BHD BY TROPICANA MENTARI DEVELOPMENT SDN BHD, A WHOLLY-OWNED SUBSIDIARY OF THE COMPANY | Pursuant to Paragraph 9.19(23) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, the Board of Directors of TCB wishes to announce that Tropicana Mentari Development Sdn Bhd (“TMDSB”), a wholly-owned subsidiary of the Company has on 27 February 2018 acquired 560,000 ordinary shares of Marivaux Holdings Sdn Bhd (Company No. 289863-A) (“Marivaux”), representing 100% of the issued and paid-up share capital of Marivaux, for a total cash consideration of RM78,254,668.00 only (“Acquisition”).

Upon the completion of the Acquisition of the entire equity interest in Marivaux by TMDSB, Marivaux shall become a wholly-owned subsidiary of TMDSB, which in turn shall become a wholly-owned subsidiary of TCB.

Marivaux was incorporated in Malaysia on 16 February 1994 as a private limited company. The issued and paid-up share capital of Marivaux is RM560,000.00 comprising of 560,000 ordinary shares and its principal activity is property development.

None of the directors or substantial shareholders of TCB or persons connected with them have any interests, whether direct or indirect in the Acquisition.

This announcement is dated 27 February 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-3-2018 12:32 AM

|

显示全部楼层

发表于 5-3-2018 12:32 AM

|

显示全部楼层

本帖最后由 icy97 于 7-3-2018 08:05 AM 编辑

丽阳末季净利翻1.38倍

2018年3月1日

(吉隆坡28日讯)丽阳机构(TROP,5401,主板产业股)截至12月31日末季净利按年激增1.38倍,归功于节省成本、释放低成本拨备及发展项目进度加速。

丽阳机构在文告中指出,末季净赚6962万令吉或每股4.77仙,上财年同季为2926万令吉或2.05仙。

营业额从4亿5732万令吉,按年上升35.36%,达6亿1904万令吉,反映出集团多项进行中发展计划的后期建筑工程加速入账。

集团末季销售为2亿5260万令吉,且有信心凭着未入账销售15亿令吉,接下来继续增长。

合计全年,净利按年增长69.26%,达1亿9048万令吉或每股13.1仙;营业额则起30.79%,达19亿877万令吉。

自去年底成功推出位于哥打甘文宁(Kota Kemuning)丽阳丰逸城的Aman 1之后,该集团会在下半年推出Aman 2。这些优质房屋预计将推动今年销售表现,以及扩大客户群、接触更多首购族及新家庭。

目前,集团拥有888.7英亩的地库,潜在发展总值为421亿令吉。

7825万全购Marivaux

另一方面,丽阳机构也宣布,以7825万4668令吉收购Marivaux控股全数股权。

Marivaux主要进行产业发展业务,将在收购活动完成后,成为丽阳机构独资子公司。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 619,039 | 457,324 | 1,908,768 | 1,459,405 | | 2 | Profit/(loss) before tax | 114,239 | 40,684 | 291,766 | 168,053 | | 3 | Profit/(loss) for the period | 74,763 | 29,481 | 199,988 | 115,001 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 69,617 | 29,256 | 190,475 | 112,537 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.77 | 2.05 | 13.10 | 7.87 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 2.50 | 2.00 | 2.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.2600 | 2.1900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-3-2018 12:33 AM

|

显示全部楼层

发表于 5-3-2018 12:33 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 14-4-2018 06:52 AM

|

显示全部楼层

发表于 14-4-2018 06:52 AM

|

显示全部楼层

本帖最后由 icy97 于 16-4-2018 06:58 AM 编辑

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | TROPICANA CORPORATION BERHAD (TROPICANA)PROPOSED DISPOSAL OF FREEHOLD LAND WITH AN AREA MEASURING IN AGGREGATE OF APPROXIMATELY 9.12 ACRES IN PEKAN COUNTRY HEIGHT, DISTRICT OF PETALING, NEGERI SELANGOR, BY TROPICANA METROPARK SDN. BHD. (TMSB OR VENDOR), A WHOLLY-OWNED SUBSIDIARY OF TROPICANA, TO NEXT DELTA SDN. BHD. (NDSB), A WHOLLY-OWNED SUBSIDIARY OF MCT BERHAD, FOR A TOTAL CASH CONSIDERATION OF RM143,000,000.00 | 1. INTRODUCTION The Board of Directors of Tropicana wishes to announce that Tropicana Metropark Sdn. Bhd. (“TMSB” or “Vendor”), a wholly-owned subsidiary of Tropicana Corporation Berhad (“Tropicana”), has on 13 April 2018, entered into a sale and purchase agreement (“SPA”) with Next Delta Sdn. Bhd. (“NDSB” or “Purchaser”), a wholly-owned subsidiary of MCT Berhad, for the disposal of freehold land with an area measuring in aggregate of approximately 9.12 acres in Pekan Country Height, District of Petaling, Negeri Selangor (“Land”) for a total cash consideration of RM143,000,000.00 (“Sales Consideration”) (“ProposedDisposal”).

2. INFORMATION OF THE PROPOSED DISPOSAL 2.1 Information on the Vendor The Vendor is a private limited company incorporated on 3 December 1996 in Malaysia under the Companies Act, 1965 (“Act”). As at the date hereof, the Vendor has an issued share capital of RM10,800,000.00 comprising 10,750,000 ordinary shares and 5,000,000 redeemable non-cumulative preference shares. The principal activity of the Vendor is property development.

2.2 Information on the Purchaser The Purchaser is a private limited company incorporated on 5 February 2015 in Malaysia under the Act. As at the date hereof, the Purchaser has an issued share capital of RM2.00 comprising 2 ordinary shares. The intended principal activities of the Purchaser are trading, investment holding and property development. The Purchaser has yet to commence its business operations.

2.3 Details of the Land Further information on the Land as follows: Vendor | : | Tropicana Metropark Sdn. Bhd. | Description and Title Number | : | - Geran 321057, Lot 72024, Pekan Country Height, Daerah Petaling, Negeri Selangor which based on the document of title measures approximately 2.271 hectares; and

- Geran 321058, Lot 72025, Pekan Country Height, Daerah Petaling, Negeri Selangor which based on the document of title measures approximately 14202 square meters.

| Land area | : | Aggregate approximately 9.12 acres. |

2.4 Salient Terms of the SPA (a) Agreement to sell and to purchase The Land will be disposed free from all encumbrances, with vacant possession, on an “as is where is” basis and upon the terms and subject to the conditions contained in the Development Approvals (as defined in the SPA) and in the SPA.

(b) Manner of payment of the Purchase Price Payment Milestone | Date of Payment | Amount (RM) | 1. Deposit being 10% of the Sales Consideration

| Upon execution of the SPA | 14,300,000 | 2. Balance Purchase Price being 90% of the Sales Consideration

| Three (3) months from the date the Purchaser obtains the State Authority’s Consent ("Completion Period")

| 128,700,000 | Total : |

| 143,000,000 |

|

|

|

Note: (i) In view that NDSB’s ultimate shareholding shall be deemed foreign-owned (by virtue of MCT Berhad’s indirect interest in NDSB) pursuant to Section 433B of the National Land Code 1965, NDSB will have to seek consent from the relevant state authority for the transfer of the Land’s ownership to NDSB (“State Authority’s Consent”).

(ii) If the Balance Purchase Price could not be paid within the Completion Period, the Purchaser will be entitled to an extension of 1 month from the day following the expiry of the Completion Period (“Extended Completion Period”) on the condition that interest will be charged at 7% per annum on the Balance Purchase Price, calculated on daily rest, from the first day of the Extended Completion Period until the date of full payment of the Balance Purchase Price. Such accumulated interest cost is to be paid by the Purchaser to the Vendor at the time of the payment of the Balance Purchase Price within the Extended Completion Period.

(c) Conditions precedent

The completion of the Proposed Disposal is conditional upon the following conditions precedent being fulfilled / obtained within three (3) months from the date of the SPA (“Conditional Period”): (i) the State Authority’s Consent; and

(ii) confirmation from the Economic Planning Unit, Prime Minister’s Department (that its approval is not required) to facilitate the application for the State Authority’s Consent, if required.

In the event the conditions precedent are not fulfilled within the Conditional Period, either party shall be entitled to terminate the SPA and the Vendor shall within 10 business days from the date of termination refund to the Purchaser the Deposit.

3. INTERESTS OF DIRECTORS, MAJOR SHAREHOLDERS AND/OR PERSONS CONNECTED None of the Directors and/or major shareholders of Tropicana and its subsidiaries and/or persons connected to them have any interest, direct or indirect, in the Proposed Disposal.

This announcement is dated 13 April 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-5-2018 03:50 PM

|

显示全部楼层

发表于 10-5-2018 03:50 PM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | TROPICANA CORPORATION BERHAD ("TROPICANA" OR "COMPANY") ACQUISITION OF A NEW SUBSIDIARY, MARIVAUX HOLDINGS SDN BHD BY TROPICANA MENTARI DEVELOPMENT SDN BHD, A WHOLLY-OWNED SUBSIDIARY OF THE COMPANY ("ACQUISITION") | We refer to the annouoncement made in relation to the Acquisition dated 27 February 2018.

The Board of Directors of Tropicana wishes to announce that the Acquisition has been completed on 8 May 2018, in accordance with the terms and conditions of the share sale agreement.

This announcement is dated 8 May 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-5-2018 06:39 AM

|

显示全部楼层

发表于 25-5-2018 06:39 AM

|

显示全部楼层

本帖最后由 icy97 于 2-6-2018 07:06 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 453,005 | 373,682 | 453,005 | 373,682 | | 2 | Profit/(loss) before tax | 85,442 | 40,548 | 85,442 | 40,548 | | 3 | Profit/(loss) for the period | 52,208 | 28,276 | 52,208 | 28,276 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 46,403 | 27,058 | 46,403 | 27,058 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.17 | 1.89 | 3.17 | 1.89 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.60 | 0.00 | 1.60 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.2800 | 2.2600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-5-2018 06:47 AM

|

显示全部楼层

发表于 25-5-2018 06:47 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 30-5-2018 05:52 AM

|

显示全部楼层

发表于 30-5-2018 05:52 AM

|

显示全部楼层

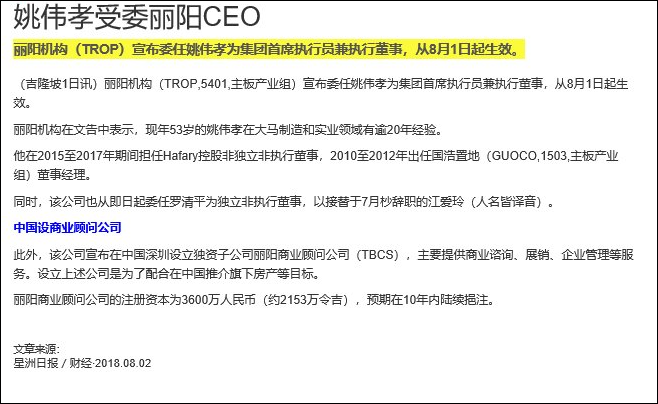

Date of change | 28 May 2018 | Name | MR YEOW WAI SIAW | Age | 53 | Gender | Male | Nationality | Malaysia | Type of change | Appointment | Designation | Group Chief Executive Officer | Qualifications | Mr Yeow holds an MBA in Finance with distinction from the University of Hull, United Kingdom in 1997, a Mini-MBA from INSEAD in year 1999 and a Bachelor of Industrial and Mechanical Engineering with First Class Honour from the University Technology of Malaysia in year 1989. | Working experience and occupation | Mr Yeow has more than 20 years of working experience and has held various key positions mainly in manufacturing and real estate industry companies in Malaysia (listed/non-listed). Mr Yeow has also served as an associate consultant in McKinsey & Company.Mr Yeow was formerly a Non-Independent Non-Executive Director of Hafary Holdings Limited from year 2015 to year 2017, and the Managing Director and Independent Non-Executive Director of GuocoLand (Malaysia) Bhd from year 2010 to 2012. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-6-2018 03:55 AM

|

显示全部楼层

发表于 12-6-2018 03:55 AM

|

显示全部楼层

Date of change | 01 Jun 2018 | Name | TAN SRI OTHMAN BIN ABD RAZAK | Age | 69 | Gender | Male | Nationality | Malaysia | Designation | Chairman | Directorate | Independent and Non Executive | Type of change | Resignation | Reason | Personal commitment |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-7-2018 03:31 AM

|

显示全部楼层

发表于 3-7-2018 03:31 AM

|

显示全部楼层

Date of change | 01 Jul 2018 | Name | MR DILLON TAN YONG CHIN | Age | 35 | Gender | Male | Nationality | Malaysia | Designation | Executive Director | Directorate | Executive | Type of change | Resignation | Reason | Personal commitment |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-8-2018 05:11 AM

|

显示全部楼层

发表于 2-8-2018 05:11 AM

|

显示全部楼层

本帖最后由 icy97 于 3-8-2018 04:11 AM 编辑

Date of change | 01 Aug 2018 | Name | MR YEOW WAI SIAW | Age | 53 | Gender | Male | Nationality | Malaysia | Designation | Group Chief Executive Officer | Directorate | Executive | Type of change | Appointment | Qualifications | Mr Yeow holds an MBA in Finance with distinction from the University of Hull, United Kingdom in 1997, a Mini-MBA from INSEAD in year 1999 and a Bachelor of Industrial and Mechanical Engineering with First Class Honour from the University Technology of Malaysia in year 1989. | Working experience and occupation | Mr Yeow has more than 20 years of working experience and has held various key positions mainly in manufacturing and real estate industry companies in Malaysia (listed/non-listed). Mr Yeow has also served as an associate consultant in McKinsey & Company.Mr Yeow was formerly a Non-Independent Non-Executive Director of Hafary Holdings Limited from year 2015 to year 2017, and the Managing Director and Independent Non-Executive Director of GuocoLand (Malaysia) Bhd from year 2010 to 2012. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-8-2018 05:12 AM

|

显示全部楼层

发表于 2-8-2018 05:12 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 22-8-2018 04:24 AM

|

显示全部楼层

发表于 22-8-2018 04:24 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | TROPICANA CORPORATION BERHAD ("TROPICANA" OR "COMPANY")PROPOSED DISPOSAL OF LEASEHOLD LAND WITH AN AREA MEASURING APPROXIMATELY 7,143 SQUARE METERS IN BANDAR DAMANSARA, DAERAH PETALING, NEGERI SELANGOR, BY TROPICANA GOLF & COUNTRY RESORT BERHAD ("TGCRB" OR "VENDOR"), A WHOLLY-OWNED SUBSIDIARY OF TROPICANA, TO ONE RESIDENCE SDN. BHD. ("ORSB"), AN INDIRECT WHOLLY-OWNED SUBSIDIARY OF MCT BERHAD ("MCT"), FOR A TOTAL CASH CONSIDERATION OF RM42,287,000.00 | The Board of Directors of Tropicana wishes to announce that TGCRB, a wholly-owned subsidiary of Tropicana, had on 21 August 2018, entered into a sale and purchase agreement with ORSB, an indirect wholly-owned subsidiary of MCT, for the disposal of a leasehold land expiring on 4 April 2109 with an area measuring approximately 7,143 square meters in Bandar Damansara, Daerah Petaling, Negeri Selangor for a total cash consideration of RM42,287,000.00.

Please refer to the attachment for details of the announcement.

This announcement is dated 21 August 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5890309

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-8-2018 05:04 AM

|

显示全部楼层

发表于 24-8-2018 05:04 AM

|

显示全部楼层

本帖最后由 icy97 于 27-8-2018 05:10 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 281,428 | 439,062 | 734,433 | 812,744 | | 2 | Profit/(loss) before tax | 64,965 | 75,659 | 150,407 | 116,206 | | 3 | Profit/(loss) for the period | 42,488 | 49,108 | 94,696 | 77,384 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 38,000 | 46,475 | 84,403 | 73,533 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.60 | 3.19 | 5.77 | 5.09 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 2.00 | 1.60 | 2.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.3100 | 2.2600

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|