|

|

【SANICHI 0133 交流专区】Sanichi科技

[复制链接]

[复制链接]

|

|

|

发表于 29-11-2017 12:27 AM

|

显示全部楼层

发表于 29-11-2017 12:27 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | Three Months | Three Months | Fifteen Months | Fifteen Months | 01 Jul 2017

To | 01 Jul 2016

To | 01 Jul 2016

To | 01 Jul 2015

To | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 3,890 | 8,815 | 33,911 | 45,477 | | 2 | Profit/(loss) before tax | 1,090 | 42 | -2,203 | 6,887 | | 3 | Profit/(loss) for the period | 1,132 | 42 | -2,158 | 3,822 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,132 | 42 | -2,158 | 3,822 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.39 | 0.01 | -0.74 | 0.33 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6600 | 0.4900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-12-2017 02:42 AM

|

显示全部楼层

发表于 19-12-2017 02:42 AM

|

显示全部楼层

| SANICHI TECHNOLOGY BERHAD |

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | ESOS | Details of corporate proposal | ESOS | No. of shares issued under this corporate proposal | 8,000,000 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1010 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 312,117,552 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 89,655,061.860 | Listing Date | 12 Dec 2017 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-1-2018 02:55 AM

|

显示全部楼层

发表于 16-1-2018 02:55 AM

|

显示全部楼层

本帖最后由 icy97 于 16-1-2018 03:21 AM 编辑

升利吉MNC无线合作

管理出租Marina Point

2018年1月16日

(吉隆坡15日讯)升利吉科技(SANICHI,0133,创业板)与MNC无线(MNC,0103,创业板)签署了解备忘录,共同经营升利吉科技旗下的Marina Point产业。

升利吉科技今天向交易所报备,子公司升利吉产业私人有限公司,今天与MNC无线签署备忘录。

这项协议让两家公司构成策略合作联盟,负责为升利吉产业旗下位于马六甲佳邦(Klebang)的Marina Point产业项目,提供网络住房或短期豪华租房服务。

据文告,升利吉产业将委任MNC无线,采取一切必须的步骤来推销和执行上述项目,包括建设和营运网络营销和社区市场,让消费者能够租用该豪华产业,项目料在2020年次季前启动。【e南洋】

Type | Announcement | Subject | MEMORANDUM OF UNDERSTANDING | Description | SANICHI TECHNOLOGY BERHAD ("SANICHI" OR THE "COMPANY")- MEMORANDUM OF UNDERSTANDING ("MOU") ENTERED BETWEEN SANICHI PROPERTY SDN BHD, A SUBSIDIARY OF SANICHI AND M N C WIRELESS BERHAD ("MNC"). | The Board of Directors of Sanichi Technology Berhad (“Sanichi” or “the Company”) wishes to announce that Sanichi Property Sdn Bhd (Company No. 1068338-P) (“SPSB”), a subsidiary of Sanichi had on 15 January 2018 entered into a Memorandum of Understanding (“MOU”) with M N C Wireless Berhad (“MNC”) (Company No. 635884-T), a public listed company incorporated under the laws of Malaysia and having its registered address at 100-3.011, Block J, 129 Offices, Jaya One, No. 72A, Jalan Universiti, 46200 Petaling Jaya, Selangor Darul Ehsan, Malaysia.

Please refer to Appendix 1 for details of the announcement.

This announcement is dated 15 January 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5665381

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-1-2018 01:14 AM

|

显示全部楼层

发表于 25-1-2018 01:14 AM

|

显示全部楼层

| SANICHI TECHNOLOGY BERHAD |

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | ESOS | Details of corporate proposal | ESOS | No. of shares issued under this corporate proposal | 24,187,500 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1120 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 348,526,077 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 93,715,307.860 | Listing Date | 25 Jan 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-1-2018 01:15 AM

|

显示全部楼层

发表于 25-1-2018 01:15 AM

|

显示全部楼层

| SANICHI TECHNOLOGY BERHAD |

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | ESOS | Details of corporate proposal | ESOS | No. of shares issued under this corporate proposal | 12,000,000 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1010 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 324,338,577 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 91,006,307.860 | Listing Date | 25 Jan 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-2-2018 01:36 AM

|

显示全部楼层

发表于 8-2-2018 01:36 AM

|

显示全部楼层

本帖最后由 icy97 于 9-2-2018 05:21 AM 编辑

Expiry/Maturity of the securities| SANICHI TECHNOLOGY BERHAD |

Instrument Category | Securities of PLC | Instrument Type | Warrants | Type Of Expiry | Expiry/Maturity of the securities | Mode of Satisfaction of Exercise/Conversion price | Cash | Exercise/ Strike/ Conversion Price | Malaysian Ringgit (MYR) 0.6300 | Exercise/ Conversion Ratio | 1:1 | Settlement Type / Convertible into | Physical (Shares) | Last Date & Time of Trading | 23 Feb 2018 05:00 PM | Date & Time of Suspension | 26 Feb 2018 09:00 AM | Last Date & Time for Transfer into Depositor's CDS a/c | 06 Mar 2018 04:00 PM | Date & Time of Expiry | 13 Mar 2018 05:00 PM | Date & Time for Delisting | 14 Mar 2018 09:00 AM |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5686081

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-3-2018 02:42 AM

|

显示全部楼层

发表于 7-3-2018 02:42 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | Three Months | Three Months | Eighteen Months | Eighteen Months | 01 Oct 2017

To | 01 Oct 2016

To | 01 Jul 2016

To | 01 Jan 2015

To | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 2,861 | 8,301 | 36,772 | 53,778 | | 2 | Profit/(loss) before tax | -13,354 | 4 | -15,557 | 6,891 | | 3 | Profit/(loss) for the period | -15,734 | 4 | -17,892 | 3,826 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -15,734 | 4 | -17,892 | 3,826 | | 5 | Basic earnings/(loss) per share (Subunit) | -5.44 | 0.00 | -6.19 | 0.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6300 | 0.4900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-3-2018 03:09 PM

|

显示全部楼层

发表于 8-3-2018 03:09 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 24-3-2018 06:17 AM

|

显示全部楼层

发表于 24-3-2018 06:17 AM

|

显示全部楼层

| SANICHI TECHNOLOGY BERHAD |

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | ESOS | Details of corporate proposal | ESOS | No. of shares issued under this corporate proposal | 20,911,800 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1000 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 369,437,877 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 95,806,487.860 | Listing Date | 23 Mar 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-3-2018 08:38 AM

|

显示全部楼层

发表于 24-3-2018 08:38 AM

|

显示全部楼层

本帖最后由 icy97 于 26-3-2018 05:28 AM 编辑

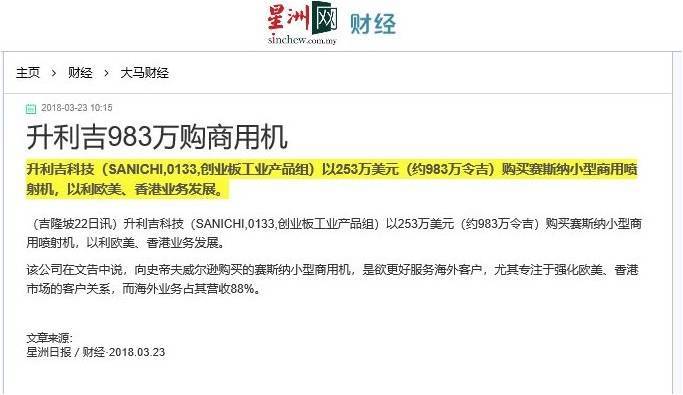

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | SANICHI TECHNOLOGY BERHAD ("SANICHI" OR THE "COMPANY")PROPOSED INCORPORATION; ANDACQUISITION OF AIRCRAFT CESSNA CITATION | The Board of Directors of Sanichi wishes to announce that the Company’s wholly-owned subsidiary namely Sanichi Capital Sdn Bhd (Company No. 1196416-A) (“SCSB”) had on 22 March 2018 acquired an aircraft Cessna Citation (“Aircraft”) free from any encumbrances from Steve Wilson (Passport No. 460921236) (“Seller”) for a cash consideration of USD 2,530,000.00 (approximately RM9,830,000.00 @ USD 1:RM3.885 ) (“Consideration Sum”) (“Proposed Acquisition”).

For the purpose of the Proposed Acquisition, SCSB has incorporated a company in the State of Wyoming, United States of America, Air King Inc. (Filing ID 2018-000791913) (“AKI” or “Purchaser”), which has entered into a Purchase Agreement for the Proposed Acquisition on even date with the Seller (“Proposed Incorporation”). Please refer to Appendix A for details of Announcement.

This announcement is dated 22 March 2018 |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5733021

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-3-2018 04:18 AM

|

显示全部楼层

发表于 28-3-2018 04:18 AM

|

显示全部楼层

Type | Reply to Query | Reply to Bursa Malaysia's Query Letter - Reference ID | IQL-26032018-00001 | Subject | PROPOSED INCORPORATION AND ACQUISITION OF AIRCRAFT CESSNA CITATION ("ACQUISITION") | Description | SANICHI TECHNOLOGY BERHAD ("SANICHI" OR THE "COMPANY")- PROPOSED INCORPORATION AND ACQUISITION OF AIRCRAFT CESSNA CITATION ("ACQUISITION") | Query Letter Contents | We refer to your Company’s announcement dated 22 March 2018, in respect of the aforesaid matter. In this connection, kindly furnish Bursa Securities with the following additional information for public release:- 1. The time period that the Balance Consideration Sum will be paid to the Seller's Solicitor. 2. The value placed on the Aircraft by Wolfe Aviation. 3. The particulars of all liabilities, including contingent liabilities and guarantees to be assumed by the Company, arising from the Acquisition. 4. Whether the Acquisition is subject to the relevant government authorities' approval, and the estimated time frame for submission of the application to the relevant authorities. 5. To also make available for inspection the Valuation Report by Wolfe Aviation. 6. Where any agreement has been entered into, the Company must make available for inspection a copy each of the relevant agreements at the Company's registered office for a period of 3 months from the date of announcement. | We refer to the Company’s announcement made on 22 March 2018 (“Announcement”) and Bursa Malaysia Securities Berhad’s letter dated 26 March 2018 requesting for additional information on the Proposed Acquisition.

1. The time period that the Balance Consideration Sum will be paid to the Seller’s Solicitor; Reply: The remaining balance Consideration Sum of 80% shall be paid on or before 16 April 2018.

2. The value placed on the Aircraft by Wolfe Aviation; Reply: The value on the Aircraft by Wolfe Aviation is equivalent to USD3,030,000.

3. The particulars of all liabilities, including contingent liabilities and guarantees to be assumed by the Company, arising from the Acquisition; Reply: There shall be no contingent liabilities and guarantees to be assumed by the Company, arising from the said Acquisition;

4. Whether the Acquisition is subject to the relevant government authorities’ approval, and the estimated time frame for submission of the application to the relevant authorities; Reply: No approval is required to be obtained from the relevant government authorities.

5. To also make available for inspection the Valuation Report by Wolfe Aviation; and

6. Where any agreement has been entered into, the Company must make available for inspection with a copy each of the relevant agreements at the Company’s registered office for a period of 3 months from the date of announcement; Reply: Copies of the Purchase Agreement and the Valuation Report by Wolfe Aviation are available for inspection at the registered office of the Company at Level 33A, Menara 1MK, Kompleks 1 Mont Kiara, No. 1, Jalan Kiara, Mont Kiara, 50480 Kuala Lumpur for a period of 3 months from the date of announcement.

This announcement is dated 27 March 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-4-2018 02:09 AM

|

显示全部楼层

发表于 7-4-2018 02:09 AM

|

显示全部楼层

本帖最后由 icy97 于 11-4-2018 07:21 AM 编辑

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | SANICHI TECHNOLOGY BERHAD ("SANICHI" OR THE "COMPANY")- PROPOSED ACQUISITION OF 50.0001% EQUITY INTEREST IN BINA BICARA SDN BHD COMPRISING 500,001 ORDINARY SHARES | The Board of Directors of Sanichi wishes to announce that the Company (“Sanichi” or “Purchaser”) had on 6 April 2018 entered into a Share Sale Agreement (“SSA”) with Saifulrizam Bin Zainal [NRIC No. 761208-14-5767 (“Vendor”) for the acquisition of 50.0001% equity interest in Bina Bicara Sdn Bhd (Company No. 1270873-M) (“BBSB”) comprising 500,001 ordinary shares (“Sale Shares”) for a cash purchase consideration of RM500,000.00 (“Purchase Consideration”) subject to the terms and conditions as stipulated in the SSA (“Proposed Acquisition”). The Vendor and the Company are collectively known as the Parties.

Upon completion of the Proposed Acquisition, BBSB will become a subsidiary of Sanichi.

Please refer to Appendix for details of Announcement.

This announcement is dated 6 April 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5750861

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-4-2018 04:35 AM

|

显示全部楼层

发表于 11-4-2018 04:35 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | SANICHI TECHNOLOGY BERHAD ("SANICHI" OR THE "PURCHASER")PROPOSED ACQUISITION OF 70.00% EQUITY INTEREST IN PERSADA TERNAMA SDN BHD COMPRISING 70,000 ORDINARY SHARES | The Board of Directors of Sanichi wishes to announce that the Company (“Sanichi” or “Purchaser”) had on 10 April 2018 entered into a Share Sale Agreement (“SSA”) with Persada Ternama Holdings Sdn Bhd [Company No. 1259586-W)] (“Vendor”) for the acquisition of 70% equity interest in Persada Ternama Sdn Bhd (Company No. 1040578-K) (“Persada”) comprising 70,000 ordinary shares (“Sale Shares”) for a cash purchase consideration of RM8,000,000.00 (“Purchase Consideration”) subject to the terms and conditions as stipulated in the SSA (“Proposed Acquisition”). The Vendor and Sanichi are collectively known as the Parties.

Upon completion of the Proposed Acquisition, Persada will become a subsidiary of Sanichi.

Please refer to Appendix for details of Announcement.

This announcement is dated 10 April 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5754145

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-5-2018 01:52 AM

|

显示全部楼层

发表于 30-5-2018 01:52 AM

|

显示全部楼层

本帖最后由 icy97 于 22-6-2018 03:38 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 9,065 | 3,502 | 9,065 | 3,502 | | 2 | Profit/(loss) before tax | -334 | -2,240 | -334 | -2,240 | | 3 | Profit/(loss) for the period | -344 | -2,367 | -344 | -2,367 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -344 | -2,367 | -344 | -2,367 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.10 | 0.28 | 0.10 | 0.28 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.5300 | 0.1800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-6-2018 05:39 AM

|

显示全部楼层

发表于 14-6-2018 05:39 AM

|

显示全部楼层

Notice of Interest Sub. S-hldr (Section 137 of CA 2016)| SANICHI TECHNOLOGY BERHAD |

Particulars of Substantial Securities HolderName | MADAM TAN KIM YIN | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | ORDINARY SHARES | Name & address of registered holder | TAN KIM YINNO. 52, JALAN BESTARI 46/2TAMAN BESTARI INDAH81800 ULU TIRAM, JOHOR |

| Date interest acquired & no of securities acquired | Date interest acquired | 11 Jun 2018 | No of securities | 4,870,700 | Circumstances by reason of which Securities Holder has interest | ACQUISITION IN OPEN MARKET | Nature of interest | Direct Interest |  | | Total no of securities after change | Direct (units) | 23,226,773 | Direct (%) | 6.275 | Indirect/deemed interest (units) | 3,800,000 | Indirect/deemed interest (%) | 1.026 | Date of notice | 12 Jun 2018 | Date notice received by Listed Issuer | 12 Jun 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-6-2018 02:48 AM

|

显示全部楼层

发表于 26-6-2018 02:48 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 03:27 AM

|

显示全部楼层

发表于 31-8-2018 03:27 AM

|

显示全部楼层

本帖最后由 icy97 于 26-10-2018 03:52 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 5,613 | 9,403 | 14,678 | 12,905 | | 2 | Profit/(loss) before tax | -6,914 | -1,098 | -7,248 | -3,338 | | 3 | Profit/(loss) for the period | -6,925 | -1,095 | -7,269 | -3,462 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -11,648 | -1,959 | -13,906 | -11,034 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.39 | -0.07 | -0.41 | -0.21 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.5100 | 0.1800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-11-2018 08:25 AM

|

显示全部楼层

发表于 17-11-2018 08:25 AM

|

显示全部楼层

| SANICHI TECHNOLOGY BERHAD |

EX-date | 16 Nov 2018 | Entitlement date | 21 Nov 2018 | Entitlement time | 05:00 PM | Entitlement subject | Rights Issue | Entitlement description | RENOUNCEABLE RIGHTS ISSUE OF UP TO 1,012,285,042 NEW ORDINARY SHARES IN SANICHI TECHNOLOGY BERHAD ("SANICHI") ("SANICHI SHARES" OR "SHARES") ("RIGHTS SHARES") AT AN ISSUE PRICE OF RM0.10 PER RIGHTS SHARE TOGETHER WITH UP TO 506,142,521 FREE DETACHABLE WARRANTS IN SANICHI ("WARRANTS E") ON THE BASIS OF 2 RIGHTS SHARES TOGETHER WITH 1 FREE WARRANT E FOR EVERY 1 EXISTING SANICHI SHARE HELD BY ENTITLED SHAREHOLDERS AT 5.00 P.M. ON 21 NOVEMBER 2018 ("ENTITLED SHAREHOLDERS") ("RIGHTS ISSUE WITH WARRANTS") | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SHAREWORKS SDN BHDNo. 2-1, Jalan Sri Hartamas 8Sri Hartamas50480 Kuala LumpurTel:03 62011120Fax:03 62013121 | Payment date |

| | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 21 Nov 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Ratio | Ratio | 2 : 1 | Rights Issue/Offer Price | Malaysian Ringgit (MYR) 0.100 |

Despatch date | 23 Nov 2018 | Date for commencement of trading of rights | 22 Nov 2018 | Date for cessation of trading of rights | 29 Nov 2018 | Date for announcement of final subscription result and basis of allotment of excess Rights Securities | 12 Dec 2018 | Listing Date of the Rights Securities | 20 Dec 2018 |

Last date and time for | Date | Time | Sale of provisional allotment of rights | 28 Nov 2018 | | 05:00:00 PM | Transfer of provisional allotment of rights | 03 Dec 2018 | | 04:00:00 PM | Acceptance and payment | 06 Dec 2018 | | 05:00:00 PM | Excess share application and payment | 06 Dec 2018 | | 05:00:00 PM |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-11-2018 07:39 AM

|

显示全部楼层

发表于 18-11-2018 07:39 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 12,868 | 3,890 | 27,546 | 0 | | 2 | Profit/(loss) before tax | 2,780 | 1,090 | -4,468 | 0 | | 3 | Profit/(loss) for the period | 2,371 | 1,132 | -4,898 | 0 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,372 | 1,132 | -4,897 | 0 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.66 | 0.13 | -1.36 | 0.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.5100 | 0.1800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-11-2018 05:06 AM

|

显示全部楼层

发表于 24-11-2018 05:06 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Sanichi Technology Berhad ("Sanichi" or "the Company"- Sanichi looks to Indonesia remittance services for business growth | The Board of Directors of Sanichi Technology Berhad (“Sanichi” or “the Company”) wishes to announce a Press Release entitled "Sanichi looks to Indonesia remittance services for business growth".

Please refer to the attached Appendix for details of the announcement.

This announcement is dated 12 November 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5971153

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|