|

|

发表于 27-10-2017 06:22 PM

|

显示全部楼层

发表于 27-10-2017 06:22 PM

|

显示全部楼层

本帖最后由 icy97 于 29-10-2017 04:32 AM 编辑

华阳次季净利挫97%

2017年10月28日

http://www.enanyang.my/news/20171028/华阳次季净利挫97/

(吉隆坡27日讯)由于进行中项目减少,加上部分项目处于早期建筑阶段,华阳(HUAYANG,5062,主板产业股)在截至9月杪的次季,净利年跌96.6%,至58万4000令吉或每股0.17仙。

该公司向交易所报备,去年同期净利为1695万3000令吉或每股4.82仙。

营业额也从去年的1亿276万5000令吉,年减56%至4521万5000令吉。

33%来自柔佛产业,其余来自数个区域,包括巴生谷(31%)、怡保(26%)、槟城(6%)、森美兰(4%)。

明年赚幅回稳

华阳总执行长何文渊在文告中指出,虽然该季业绩表现逊色,但仍乐观看待未来的盈利能力。

“我们计划在本财年推出发展总值3亿8000万令吉的项目,预计赚幅会在明年恢复正常。”

他也提到,最新的经济指标预示我国明年的房地产市场,将获得强劲基本面推动,包括稳定的经济和货币表现、私人消费和政府基础建设投资等。

半年赚230万

累计上半年,净利跌94.4%,至230万2000令吉或每股0.65仙;营业额挫59.6%,至9315万4000令吉。

产业发展业务的首半年营业额为9620万令吉,年减58.7%;税前盈利为513万令吉,年挫90.7%。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 45,215 | 102,765 | 93,154 | 230,726 | | 2 | Profit/(loss) before tax | 2,062 | 23,163 | 4,870 | 55,386 | | 3 | Profit/(loss) for the period | 584 | 16,953 | 2,302 | 40,858 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 584 | 16,953 | 2,302 | 40,858 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.17 | 4.82 | 0.65 | 11.61 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 2.00 | 5.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.6800 | 1.6900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-10-2017 06:06 AM

|

显示全部楼层

发表于 31-10-2017 06:06 AM

|

显示全部楼层

本帖最后由 icy97 于 2-11-2017 06:21 AM 编辑

华阳

短期缺乏激素

2017年10月31日

分析:达证券

目标价:96仙

最新进展:

产业发展商华阳(HUAYANG,5062,主板产业股)截至9月杪的次季,净利年跌96.6%,至58万4000令吉或每股0.17仙。

营业额也从去年的1亿276万5000令吉,年减56%至4521万5000令吉。

累计上半年,净利跌94.4%,至230万2000令吉或每股0.65仙;营业额挫59.6%,至9315万4000令吉。

行家建议:

华阳2018财年的首半年净利低于我们和市场的预期,归咎于建筑进度放缓、赚幅表现不如预期以及利息开销走高。

利息开销上扬,则是因为公司之前举债收购玛拿第一(MAGNA,7617,主板产业股)所致。

较早前,公司将2018财年销售目标下修至2亿5000万令吉,我们并不感到意外,因为这与我们的2亿4200万令吉预测相符。

为成功达到销售目标,公司计划在下半财年推出发展总值3亿8000万令吉的项目。

我们保留财测,直到业绩汇报会后才可能调整;维持“卖出”投资评级,和96仙目标价。

【e南洋】

业绩税务拖累.华阳财测目标价下砍

(吉隆坡30日讯)华阳(HUAYANG,5062,主板产业组)业绩远远逊于预期,以致肯纳格研究大幅下砍该公司盈利预测及目标价。

肯纳格表示,该公司2018财政年首半年盈利为230万令吉,仅符合预测的5%。

肯纳格说,华阳业绩大幅走第,归咎于税务从27%走高至53%之故。目前,华阳未入账销售只有2亿900万令吉,可支撑未来1至2个季度。

肯纳格相信,花园未来将会在巴生河流域、槟城及柔佛推出更多可负担房屋的项目。

此外,华阳也是麦纳首要(MAGNA,7617,主板产业组)大股东,持有麦纳首要逾30%的股权,肯纳格预期,华阳在短期内专注麦纳首要的发展计划,短期内不会进行购地活动。该行也不排除,华阳未来将会进行募资活动,以收购麦纳首要余下70%的股权。

基于业绩欠缺,肯纳格决定下砍华阳2018及2019年核心盈利预测88%及77%,销售目标预测也调低13%及23%,分别为2亿1900万令吉及2亿4970万令吉,评级下调至“落后大市”,目标价从85仙下砍至65仙。

文章来源:

星洲日报‧财经‧2017.10.31 |

|

|

|

|

|

|

|

|

|

|

|

发表于 28-12-2017 05:06 AM

|

显示全部楼层

发表于 28-12-2017 05:06 AM

|

显示全部楼层

本帖最后由 icy97 于 28-12-2017 06:14 AM 编辑

7000万加影购地

华阳发展8亿综合产业

2017年12月28日

(吉隆坡27日讯)华阳(HUAYANG,5062,主板产业股)宣布,以7000万令吉收购Kajang Heights发展私人有限公司(简称“KH公司”),借此扩大地库和市场,放眼推动发展总值达8亿令吉的综合产业项目。

华阳今天向交易所报备,该公司今天与数方达成股权买卖协议,收购KH公司300万股或100%股权,总值7000万令吉。

股权卖方包括王国兴(皆译音,Wong Ko Seen@ Wong Kow)、王永喜(Wong Yoon Tsy)、生物能源科技(Bio-Energy Technology)私人有限公司、Ria Ketara发展私人有限公司、Apple Rainbow私人有限公司,以及E-Hong控股私人有限公司。

KH公司旗下拥有位于加影的永久地契地皮,总面积达19.76英亩,用作发展综合产业项目,发展总值达8亿令吉。

扩大巴生谷南部地库

华阳指,该项目符合公司扩大巴生谷南部地库和市场的策略,因为该区域近十年来发展迅速,拥有现代化基础建设、就业机会,以及交通连接便捷。【e南洋】

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | HUA YANG BERHAD (HYB or the Company)-Proposed acquisition of Development Company by Hua Yang Berhad | The Board of Directors of HYB wishes to announce that HYB had today entered into a conditional Share Sale Agreement (SSA) with Wong Ko Seen @ Wong Kow, Wong Yoon Tsy, Bio-Energy Technology Sdn Bhd, Ria Ketara Development Sdn Bhd, Apple Rainbow Sdn Bhd and E-Hong Holdings Sdn Bhd (collectively known as the “Vendors”) to acquire 3,000,000 ordinary shares being the entire paid up share capital of Kajang Heights Development Sdn Bhd (“KHDSB” ), a company incorporated in Malaysia with its registered office at J-G-3A, Connaught Avenue, No. 38, Jalan 9, Taman Bukit Cheras 56000 Kuala Lumpur and its business address at No. 41, Jalan Ria 1, Kawasan Perindustrian Ria, 43000 Kajang, Selangor for a total cash consideration of RM70,000,000.00 (“Purchase Price”) (the “Proposed Acquisition”).

Details of the Proposed Acquisition are set out in the enclosed file.

This announcement is dated 27 December 2017. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5648597

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-12-2017 05:49 AM

|

显示全部楼层

发表于 31-12-2017 05:49 AM

|

显示全部楼层

房市疲弱‧华阳购地 财测降评级升

(吉隆坡28日讯)华阳(HUAYANG,5062,主板产业组)收购加影地皮价格合理,惟分析员认为,目前产业市场疲弱,华阳继续收购地皮令市场感到惊讶,下调未来两年财测1至2%,反映较高贷款利息开支。

7000万购地 价格合理

兴业研究指出,华阳以7000万令吉收购加影19.76亩地皮,每公尺价格为81令吉显得合理,因其发展总值8亿令吉,等于土地成本占8.75%。

该行指出,截至2018财政年(3月为止)第二季,华阳手握现金1740万令吉,相信它将通过贷款融资大部份收购资金,一旦落实,预料其净负债将增加至43%(较之前预测为39%)。

该行认为,整体来看,华阳继续收购地皮实有点令人感到惊讶,特别是它最近投资麦纳首要(MA G N A,7617,主板产业组),而目前的产业市场也深具挑战。

该行将华阳2019及2020财政年净利预测稍为下调,以反映收购计划融资推高利息开支。预料新产业计划的销售及入账将不显著,因2018年的产业市场情况将与2017年相似。

该行将华阳评级从“沽售”上调至“中和”,目标价却从76仙下调至65仙,以反映较高的调整净资产值的80%折扣(之前为75%),并强调目前股价已反映大部份盈利下行风险。

该行指出,预料2018年的产业市场持续疲弱,因大马经济成长也将走低。目前华阳的估值欠缺吸引力。它在2008年美国次贷风暴时的调整净资产值折扣达到96%水平。

文章来源:

星洲日报/财经·2017.12.29 |

|

|

|

|

|

|

|

|

|

|

|

发表于 25-1-2018 04:33 AM

|

显示全部楼层

发表于 25-1-2018 04:33 AM

|

显示全部楼层

本帖最后由 icy97 于 25-1-2018 05:16 AM 编辑

华阳3季净赚135万

2018年1月25日

(吉隆坡24日讯)因新推项目仍在初期阶段,加上进行中发展项目减少,华阳(HUAYANG,5062,主板产业股)截至去年底的首九个月,净利按年减少97%,达135万令吉或每股0.38仙。

同时,营业额下跌53%,达1亿4395万令吉。

第三季净亏96万令吉或每股0.27仙,上财年同季净赚1042万令吉或2.96仙。

华阳总执行长何文渊在文告中指出,业绩表现反映出疲弱的产业市场继续影响领域。

“虽然我们预计2018财年末季将表现平淡,但我们乐观看待公司可保持盈利。由于产业领域前景面对挑战,主要焦点放在评估方式,以改善业绩表现。”

该公司计划在未来数个月推出几项新发展项目。

“我们要发展的房屋不只是价格可负担,也要位于具备许多设施的策略地点。我们即将在雪兰莪蒲种推出的发展计划就是一个很好的例子。”【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 50,797 | 73,954 | 143,951 | 304,680 | | 2 | Profit/(loss) before tax | 1,193 | 12,750 | 6,063 | 68,136 | | 3 | Profit/(loss) for the period | -957 | 10,419 | 1,345 | 51,277 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -957 | 10,419 | 1,345 | 51,277 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.27 | 2.96 | 0.38 | 14.57 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 2.00 | 2.00 | 2.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.6800 | 1.6900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-1-2018 06:19 AM

|

显示全部楼层

发表于 26-1-2018 06:19 AM

|

显示全部楼层

本帖最后由 icy97 于 26-1-2018 06:22 AM 编辑

华阳

今年财测下调44%

2018年1月26日

分析:肯纳格投行研究

目标价:60仙

最新进展

华阳(HUAYANG,5062,主板产业股)截至12月杪第三季,净亏96万令吉或每股0.27仙,由盈转亏。营业额减31.3%至5079万7000令吉。

合计9个月,净利大跌97%至约135万令吉;营业额下降53%,报1亿4395万令吉。

行家建议

首九个月核心净利录得130万令吉,弱于预期,预计是因为联号公司的亏损拖累。

我们认为,这可能是玛拿第一(MAGNA,7617,主板产业股)对某些项目拨备或减值所致。

华阳首九个月产业销售,达1亿3800万令吉,落后于我们2亿1900万令吉的销售目标。

展望未来,预计不会有任何重大的土地储备活动,因为相信华阳需要专注在实现现有项目,及与玛拿第一制定未来计划。

华阳的未入账销售也跌至历史新低至1亿6160万令吉,仅够支撑1至2个季度。

不过,如果华阳在本月杪前推出发展总值约2亿令吉蒲种项目,仍有可能达我们销售目标。

尽管净利失望,但还是维持评级不变。但考量到联号公司进行注销或拨备,下调2018财年净利预测44%。

但维持2019财年净利预测,因认为净利风险有限、联号公司短期内不会再进行拨备及推出蒲种项目,料改善销售步伐。

【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 25-5-2018 06:42 AM

|

显示全部楼层

发表于 25-5-2018 06:42 AM

|

显示全部楼层

本帖最后由 icy97 于 4-6-2018 05:06 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 86,740 | 80,678 | 230,691 | 385,358 | | 2 | Profit/(loss) before tax | 5,522 | 12,487 | 11,585 | 80,623 | | 3 | Profit/(loss) for the period | 3,066 | 9,652 | 4,411 | 60,929 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,066 | 9,652 | 4,411 | 60,929 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.87 | 2.74 | 1.25 | 17.31 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 2.00 | 2.00 | 4.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.6800 | 1.6900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-7-2018 04:22 AM

|

显示全部楼层

发表于 19-7-2018 04:22 AM

|

显示全部楼层

本帖最后由 icy97 于 19-7-2018 06:50 AM 编辑

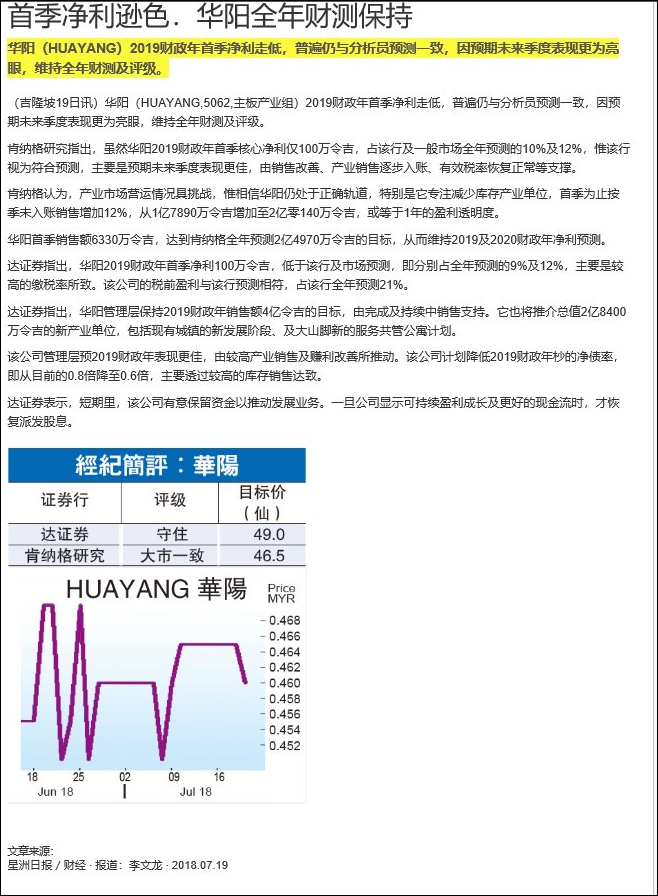

财务成本提高 华阳首季净利跌46%

Chester Tay/theedgemarkets.com

July 18, 2018 20:51 pm +08

(吉隆坡18日讯)产业发展商华阳控股(Hua Yang Bhd)首季净利大跌45.5%,归咎于财务成本提高。

华阳今日向大马交易所报备,截至6月杪2019财政年首季净利为101万令吉,或每股0.29仙,相比上财年同期的186万令吉,或每股0.53仙。

该集团表示,首季所得税开支达242万令吉,高于同期的114万令吉。

然而,首季营业额从4705万令吉,增长41.4%至6654万令吉。

该集团在文告指出,柔佛项目成为最大收入来源,占42%,其次是巴生谷(28%)、怡保(13%)、槟城(11%)和森那美(6%)。

华阳总执行长何文渊说,该集团在2019财年的重点将是推动新销售,以提高盈利能见度,并交出整体改善的业绩,同时削减存货。

“我们计划在2019财年推出发展总值估计为2亿8400万令吉的新项目。加上目前正在进行的7亿6200万令吉项目,使我们在主要地区的发展总额超过10亿令吉。”

“我们预计未来一年将继续面对挑战,但我们乐观认为,基于我们强大的基础,集团将在长期内保持韧性。我们将继续加强营运效率,并寻求增长机会,以取得可持续的表现。”

该集团未发展的地库为466英亩,潜在发展总值为53亿令吉。

(编译:陈慧珊)

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 66,542 | 47,054 | 66,542 | 47,054 | | 2 | Profit/(loss) before tax | 3,430 | 2,993 | 3,430 | 2,993 | | 3 | Profit/(loss) for the period | 1,012 | 1,858 | 1,012 | 1,858 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,012 | 1,858 | 1,012 | 1,858 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.29 | 0.53 | 0.29 | 0.53 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.6900 | 1.6900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-7-2018 05:18 AM

|

显示全部楼层

发表于 20-7-2018 05:18 AM

|

显示全部楼层

本帖最后由 icy97 于 20-7-2018 05:39 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-8-2018 12:08 AM

|

显示全部楼层

发表于 9-8-2018 12:08 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Incorporation of a wholly-owned subsidiary | The Board of Directors of Hua Yang Berhad ("the Company”) wishes to announce that the Company had on 8 August 2018 received the Notice of Registration dated 8 August 2018 from the Companies Commission of Malaysia on the incorporation of the Company's wholly owned subsidiary, Huayang Ventures Sdn. Bhd. ("HVSB").

HVSB was incorporated with 2 ordinary shares with a total issued capital of RM2.00. The intended principal activities of HVSB are for investment holding and general trading & services.

None of the Directors and substantial shareholders of the Company and persons connected to the Directors and substantial shareholders of the Company has any interest, direct or indirect, in the abovementioned transaction (other than through their interests in the shares of the Company).

This announcement is dated 8 August 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-9-2018 06:38 AM

|

显示全部楼层

发表于 1-9-2018 06:38 AM

|

显示全部楼层

本帖最后由 icy97 于 9-9-2018 04:27 AM 编辑

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | HUA YANG BERHAD (HYB or the Company or Vendor)- Proposed disposal 30% of equity interest in Kajang Heights Development Sdn Bhd to KVC Properties Sdn Bhd by Hua Yang Berhad. | The Board of Directors of HYB wishes to announce that HYB had today entered into a conditional Shares Sale Agreement (“SSA”) and Shareholders Agreement (“SA”) with KVC Properties Sdn Bhd ( “KVCP” or “Purchaser”), a company incorporated in Malaysia with its registered office and its business address at Wisma KVC, Lot 3, Jalan P10/12, Kawasan Perusahaan Bangi, 43650 Bandar Baru Bangi, Selangor Darul Ehsan to dispose 900,000 ordinary shares (“the Sale Shares) being 30% of the entire paid up share capital of Kajang Heights Development Sdn Bhd (“KHDSB”) for a total cash consideration of RM21,000,000.00 or at RM23.33 per share (“Disposal Consideration”) (“the Proposed Disposal”). Consequent to the Proposed Disposal, HYB will hold 70% interest in KHDSB.

Details of the Proposed Disposal is in the attached file.

This announcement is dated 30 August 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5901781

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-9-2018 02:05 AM

|

显示全部楼层

发表于 3-9-2018 02:05 AM

|

显示全部楼层

本帖最后由 icy97 于 12-9-2018 02:03 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-10-2018 04:31 AM

|

显示全部楼层

发表于 26-10-2018 04:31 AM

|

显示全部楼层

本帖最后由 icy97 于 27-10-2018 06:47 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 64,545 | 44,330 | 131,087 | 91,384 | | 2 | Profit/(loss) before tax | 3,664 | 2,251 | 7,094 | 5,244 | | 3 | Profit/(loss) for the period | 1,900 | 728 | 2,912 | 2,586 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,900 | 728 | 2,912 | 2,586 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.54 | 0.21 | 0.83 | 0.73 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 2.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7400 | 1.6800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-10-2018 04:40 AM

|

显示全部楼层

发表于 31-10-2018 04:40 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 7-2-2019 04:52 AM

|

显示全部楼层

发表于 7-2-2019 04:52 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 68,424 | 49,912 | 199,511 | 141,296 | | 2 | Profit/(loss) before tax | 7,863 | 1,380 | 14,957 | 6,624 | | 3 | Profit/(loss) for the period | 5,668 | -815 | 8,580 | 1,771 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,772 | -815 | 8,684 | 1,771 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.64 | -0.23 | 2.47 | 0.50 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 2.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7500 | 1.6800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-7-2019 07:10 AM

|

显示全部楼层

发表于 5-7-2019 07:10 AM

|

显示全部楼层

本帖最后由 icy97 于 7-7-2019 07:52 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 77,853 | 86,062 | 277,364 | 227,357 | | 2 | Profit/(loss) before tax | -26,979 | 282 | -12,022 | 11,961 | | 3 | Profit/(loss) for the period | -29,448 | -1,575 | -20,868 | 5,251 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -29,167 | -1,575 | -20,483 | 5,251 | | 5 | Basic earnings/(loss) per share (Subunit) | -8.29 | -0.45 | -5.82 | 1.49 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.6700 | 1.6800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-7-2019 07:37 AM

|

显示全部楼层

发表于 24-7-2019 07:37 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2019 | 30 Jun 2018 | 30 Jun 2019 | 30 Jun 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 82,177 | 66,542 | 82,177 | 66,542 | | 2 | Profit/(loss) before tax | 6,993 | 3,430 | 6,993 | 3,430 | | 3 | Profit/(loss) for the period | 3,674 | 1,012 | 3,674 | 1,012 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,699 | 1,012 | 3,699 | 1,012 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.05 | 0.29 | 1.05 | 0.29 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.6700 | 1.6600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-7-2019 12:06 AM

|

显示全部楼层

发表于 25-7-2019 12:06 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 13-11-2019 05:08 AM

|

显示全部楼层

发表于 13-11-2019 05:08 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2019 | 30 Sep 2018 | 30 Sep 2019 | 30 Sep 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 67,995 | 64,545 | 150,172 | 131,087 | | 2 | Profit/(loss) before tax | 2,935 | 3,664 | 9,928 | 7,094 | | 3 | Profit/(loss) for the period | 976 | 1,900 | 4,650 | 2,912 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 994 | 1,900 | 4,693 | 2,912 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.28 | 0.54 | 1.33 | 0.83 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.6100 | 1.6000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-4-2020 08:00 AM

|

显示全部楼层

发表于 13-4-2020 08:00 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2019 | 31 Dec 2018 | 31 Dec 2019 | 31 Dec 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 72,525 | 68,424 | 222,697 | 199,511 | | 2 | Profit/(loss) before tax | 2,084 | 7,863 | 12,012 | 14,957 | | 3 | Profit/(loss) for the period | 1,497 | 5,668 | 6,147 | 8,580 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,529 | 5,772 | 6,222 | 8,684 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.43 | 1.64 | 1.77 | 2.47 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.6100 | 1.6000

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|