|

|

发表于 28-1-2011 10:21 AM

|

显示全部楼层

发表于 28-1-2011 10:21 AM

|

显示全部楼层

SSN-Aus

0.105 -0.005 (-4.55%)

Delayed: 12:34PM AEDT

ASX data delayed by 20 mins

+++++++++++++++++++++++++

Stocks to Watch - 1/27/11 - Stock Market Investing Ideas

Paramount Gold and Silver Corp. (PZG) - Paramount Gold and Silver Corp. (PZG) is my Top Gold Stock for 2011. PZG hit $3.45 on Thursday but then dropped because gold was weak. I continue to hold PZG and will eventually add more. PZG gapped above $3.30 and I didn't add because I don't like chasing.

Rite Aid Corp. (RAD) - Rite Aid Corp. (RAD) stock is breaking out technically. RAD will now have resistance at $1.38 & $1.50.

Samson Oil & Gas Limited (SSN) - SSN pulled back about 3% Thursday. SSN will now have resistance located at $2.35 & $2.45. Pullbacks below $1.60 are a buy.

Hyperdynamics Corporation (HDY) - Shares of Hyperdynamics Corporation continue the recent downtrend. Hyperdynamics can go either way at this point and will continue to be volatile. Hyperdynamics Corporation hit my 2011 price target of $4-$6 in early January and actually hit $7.78. I will start buying Hyperdynamics when the stock breaks up through it's high of the day, for a trade.

Kodiak Oil & Gas Corp. (KOG) - Kodiak Oil & Gas Corp. is one of my best oil stock ideas for 2011. Kodiak Oil & Gas Corp. (KOG) currently has resistance located at $6.00. KOG continues to be a buy below $6.00 and was down Thursday due to lower oil prices.

Las Vegas Sands Corp. (LVS) - Shares of Las Vegas Sands Corp. broke back above $46 on Thursday. Las Vegas Sands Corp will now have resistance located at $47.16. Las Vegas Sands has support at $43. LVS is also buy below $43. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 28-1-2011 03:27 PM

|

显示全部楼层

ASX: SSN.AX

Last Trade: 0.1050

Change: -0.0050 (-4.55%)

Prev Close: 0.11

Day's Range: 0.10 - 0.11

52wk Range: 0.01 - 0.12

Volume: 12,992,758 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 28-1-2011 03:35 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 28-1-2011 03:49 PM

|

显示全部楼层

本帖最后由 roberto 于 28-1-2011 04:13 PM 编辑

Why Dow 12000 Means Small Cap Investors Should Buy Energy Stocks

by: Ian Wyatt January 27, 2011

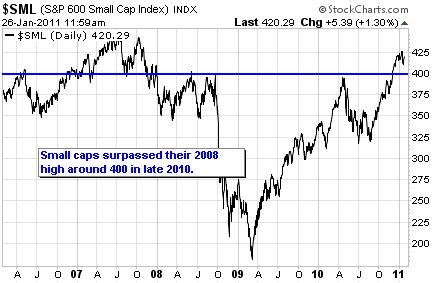

The decoupling of stocks and index is happening just as I suspected it would. Hardest hit lately have been small-cap stocks. Check out the precipitous drop, and subsequent bounce, in the S&P 600 Small Cap Index over the past week. The index almost hit its 50-day moving average before turning back up:

This may make you wonder if it's time to jump out of the small-cap foxhole and run for high water, i.e. mid- and large-cap stocks.Especially when you read the headlines that are all over today, like "Dow Breaks Through 12000 for the First Time Since 2008."

Man, are small-cap investors in the wrong asset class? With many small caps shedding 10 percent over the last week or more, i sit time to head for high water? Not so fast.Now look at the S&P 600 Small Cap index over the same five-year time frame as the Dow Jones Industrial Index chart above. You'll see that the small-cap index surpassed its 2008 high in late 2010 -- well before the Dow returned to its 2008 level of 12000.In fact, the Dow still has a thousand points to go before it gets into the same relative territory as small caps.

So sure, add a little exposure to blue-chip stocks to take advantage of the upside potential -- you should always be doing this, since small caps should just make up a portion of your portfolio.But that doesn't mean the run for small caps is over. Far from it.It does, however, mean that we need to look to the right sectors for this stage of the recovery. So let's do that.

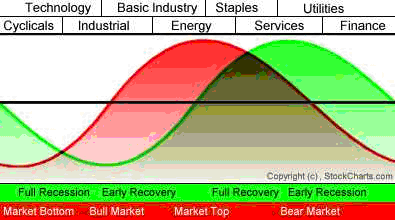

Right now, the consensus is that we are in the early to middle stages of the economic recovery. You can debate this all you want, but I'm not going to split hairs today. And I truly believe this is where the economy is. The important thing is that the market thinks we're in the mid-to-early stages of the economic recovery and that's where I take my direction. And that means that we need to look to the right sectors to take advantage of the current market cycle. A handy guide for this analysis is Sam Stovall's S&P Guide to Sector Rotation. The below image is courtesy of Stockcharts.com.

Legend: Market Cycle | Economic Cycle

This cyclical rotation guide is saying that, from early economic recovery to full economic recovery, the market is in bull mode. That's where we are right now.

So the recent dip in small-cap stocks isn't a sign to exit the asset class; it’s a sign that you should rotate your holdings to maximize your gains. Small caps tend to outperform during a recovery.Right now, the market still favors technology, and increasingly, energy stocks. That means oil, gas and gas services stocks. You can make investing difficult, and hem and haw over what the market is doing. Or you can listen to the market, take your direction from what it is telling you,and stay the course with the right industry allocation in small caps -- simply the best performing asset class over the long term.Right now the market is telling you to allocate to technology and energy stocks. That's what I'm doing, and I recommend you do the same.

Further Reading: Small Cap Investor PRO lead analyst Tyler Laundon and I recently added two oil and gas exploration stocks to the portfolio to take advantage of the market's sector rotation. Since our original recommendation, these stocks are up 10 percent and 30 percent -- and we believe they have much more room to go as the market completes its sector rotation. |

|

|

|

|

|

|

|

|

|

|

|

发表于 28-1-2011 05:09 PM

|

显示全部楼层

发表于 28-1-2011 05:09 PM

|

显示全部楼层

今晚开市没的看了,又要靠MIGO的即使信息了...因为又会做很夜..新年要到了..送货到很迟.... |

|

|

|

|

|

|

|

|

|

|

|

发表于 28-1-2011 05:54 PM

|

显示全部楼层

发表于 28-1-2011 05:54 PM

|

显示全部楼层

回复 3245# SUNNY仔

买个note book 带在身边,随时可以作买卖。或买个iphone 看股价。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 28-1-2011 08:22 PM

|

显示全部楼层

发表于 28-1-2011 08:22 PM

|

显示全部楼层

回复 3245# SUNNY仔

老细,上班是副业,股票是正业!哈哈

有什么好消息我sms你的,今天也没什么好看头,目前RAD,KOG,AVL值的注意罢了! |

|

|

|

|

|

|

|

|

|

|

|

发表于 28-1-2011 09:21 PM

|

显示全部楼层

发表于 28-1-2011 09:21 PM

|

显示全部楼层

回复 3246# grasslow

我有的不是NOTE BOOK,是NETBOOK,已经陪我经过无数次的硬仗了,而且战果辉煌....

只是尽量不要把自己套在股票市场的框框..所以工作时尽量不带上网工具... |

|

|

|

|

|

|

|

|

|

|

|

发表于 28-1-2011 09:26 PM

|

显示全部楼层

发表于 28-1-2011 09:26 PM

|

显示全部楼层

回复 3247# migo

事头,甘早起身?目前来说,工作依然是我的正业....股票,暂时依然是我的娱乐活动之一...哈哈 |

|

|

|

|

|

|

|

|

|

|

|

发表于 28-1-2011 09:44 PM

|

显示全部楼层

发表于 28-1-2011 09:44 PM

|

显示全部楼层

|

推了一单货,结果早回来,但朋友和同事说要下去牛车水走街.....结果...又要出晚门了.. |

|

|

|

|

|

|

|

|

|

|

|

发表于 28-1-2011 10:52 PM

|

显示全部楼层

发表于 28-1-2011 10:52 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 28-1-2011 11:06 PM

|

显示全部楼层

发表于 28-1-2011 11:06 PM

|

显示全部楼层

投资快报 3

回复 [url=http://cforum4.cari.com.my/redirect.php?goto=findpost&pid=83965813&ptid=1999005]3246#[/url ...

SUNNY仔 发表于 28-1-2011 01:21 PM

电话有软件可以帮你看股票。

(posted by mobile) |

|

|

|

|

|

|

|

|

|

|

|

发表于 28-1-2011 11:58 PM

|

显示全部楼层

发表于 28-1-2011 11:58 PM

|

显示全部楼层

回复 3250# SUNNY仔

老细,股票下了,CARI没人了......别怕,我陪你买HDY6000 3.93

另外在买个UCBI 4000 1.73

够朋友了吧 |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-1-2011 07:09 AM

|

显示全部楼层

发表于 29-1-2011 07:09 AM

|

显示全部楼层

回复 3252# jimmy_0

这个我也有..没用罢了...但我用了是诺基亚E61...功能马马虎虎... |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-1-2011 07:15 AM

|

显示全部楼层

发表于 29-1-2011 07:15 AM

|

显示全部楼层

回复 3253# migo

事头..无法啦...唯有收咯...昨晚又重伤..PORTFOLIO亏USD3220..

还好SSN掉不多,在硬硬的支撑着PORTFOLIO...不然死很久了..

HDY已连续掉多天了..有资金的话会再进...你的URRE昨晚大掉...有放了吗? |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 29-1-2011 10:06 AM

|

显示全部楼层

Below is a list of the top companies reporting earnings on Monday, January 31, 2011

Morning - AM

Gannett (GCI)

SOHU.com (SOHU)

Afternoon - PM

Anadarko Petroleum Corporation (APC)

Hologic (HOLX)

Manitowoc (MTW)

McKesson Corporation (MCK)

Novellus Systems, Inc. (NVLS) |

|

|

|

|

|

|

|

|

|

|

|

发表于 30-1-2011 08:11 AM

|

显示全部楼层

发表于 30-1-2011 08:11 AM

|

显示全部楼层

今晚开市没的看了,又要靠MIGO的即使信息了...因为又会做很夜..新年要到了..送货到很迟....

SUNNY仔 发表于 28-1-2011 05:09 PM

請問這位sunny兄從事什麽行業?做老闆兼送貨。。。大小事一腳踢 |

|

|

|

|

|

|

|

|

|

|

|

发表于 31-1-2011 12:17 AM

|

显示全部楼层

发表于 31-1-2011 12:17 AM

|

显示全部楼层

請問這位sunny兄從事什麽行業?做老闆兼送貨。。。大小事一腳踢

pcmont 发表于 30-1-2011 08:11 AM

你着个问题我回答过N次了..我在新加玻跳飞机的...一跳就16年,工作就是搬搬抬抬之类的...简单的说就是苦力...忘记说,我们是从事古董家具的....有兴趣的话可以联络我.. |

|

|

|

|

|

|

|

|

|

|

|

发表于 31-1-2011 06:38 AM

|

显示全部楼层

发表于 31-1-2011 06:38 AM

|

显示全部楼层

|

老细,cari 红人叶芬这几天都没出现,你没放狗找她吗 |

|

|

|

|

|

|

|

|

|

|

|

发表于 31-1-2011 08:18 AM

|

显示全部楼层

发表于 31-1-2011 08:18 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|