|

|

【NCT 0056 交流专区】(前名 GRANFLO )

[复制链接]

[复制链接]

|

|

|

发表于 13-6-2017 02:09 AM

|

显示全部楼层

发表于 13-6-2017 02:09 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2017 | 31 Mar 2016 | 31 Mar 2017 | 31 Mar 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 20,370 | 31,600 | 20,370 | 31,600 | | 2 | Profit/(loss) before tax | 1,294 | 1,752 | 1,294 | 1,752 | | 3 | Profit/(loss) for the period | 972 | 1,094 | 972 | 1,094 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 652 | 100 | 652 | 100 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.13 | 0.02 | 0.13 | 0.02 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.2290 | 0.2278

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-6-2017 06:44 AM

|

显示全部楼层

发表于 24-6-2017 06:44 AM

|

显示全部楼层

icy97 发表于 19-5-2017 03:46 AM

宏流1335万售泰Simat 8.09%

2017年5月19日

(吉隆坡18日讯)宏流(GRANFLO,0056,主板科技股)以1亿656万泰铢(相等于1334万7173令吉),脱售泰国的Simat科技约8.09%股权,因为两者之间的协同效应减少。

宏 ...

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | GRAND-FLO BERHAD ("GRAND-FLO" OR THE "COMPANY")PROPOSED DISPOSAL BY GRAND-FLO OF 32,000,000 ORDINARY SHARES OF THAI BAHT (THB) 1.00 EACH HELD IN SIMAT TECHNOLOGIES PUBLIC COMPANY LIMITED ("SIMAT") ("SIMAT SHARE(S)"), AN ASSOCIATED COMPANY OF GRAND-FLO, REPRESENTING APPROXIMATELY 8.086% OF THE TOTAL ISSUED AND PAID-UP SHARE CAPITAL OF SIMAT, AT THB3.33 PER SHARE FOR A TOTAL CASH CONSIDERATION OF THB106,560,000 (EQUIVALENT TO RM13,347,173) (THE "DISPOSAL") | Reference is made to the previous announcements dated 16 May 2017 and 22 May 2017 in relation to the Disposal of which the abbreviations and definitions used herein shall have the same meanings as defined in the previous announcements.

The Board of Directors of Grand-Flo is pleased to announce that the Disposal is completed with 23 million Simat Shares, representing approximately 5.8% of the total issued and paid-up share capital of Simat, sold at THB3.33 per share for a total cash consideration of THB76,590,000 (equivalent to approximately RM9,655,788) being transacted at the date of this announcement. Thus, marking the completion of the Disposal.

This announcement is dated 23 June 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-8-2017 02:46 AM

|

显示全部楼层

发表于 24-8-2017 02:46 AM

|

显示全部楼层

Date of change | 30 May 2017 | Name | TAN SRI DATUK ADZMI BIN ABDUL WAHAB | Age | 74 | Gender | Male | Nationality | Malaysia | Designation | Chairman | Directorate | Independent and Non Executive | Type of change | Retirement |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-8-2017 02:34 AM

|

显示全部楼层

发表于 25-8-2017 02:34 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2017 | 30 Jun 2016 | 30 Jun 2017 | 30 Jun 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 24,726 | 41,378 | 45,096 | 72,978 | | 2 | Profit/(loss) before tax | 5,344 | 3,744 | 6,637 | 5,496 | | 3 | Profit/(loss) for the period | 5,081 | 2,275 | 6,052 | 3,369 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 4,861 | 32 | 5,513 | 132 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.01 | 0.01 | 1.14 | 0.03 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1832 | 0.2278

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-9-2017 03:34 AM

|

显示全部楼层

发表于 9-9-2017 03:34 AM

|

显示全部楼层

本帖最后由 icy97 于 9-9-2017 05:52 AM 编辑

宏流委任前EPF总执行长为主席

Sulhi Azman/theedgemarkets.com

September 08, 2017 20:48 pm MYT

(吉隆坡8日讯)宏流(Grand-Flo Bhd)宣布委任Tan Sri Azlan Mohd Zainol为新任独立非执行主席。

宏流今日向大马交易所报备,67岁的Azlan是雇员公积金局(EPF)前总执行长,他是取代5月底退休的Tan Sri Adzmi Abdul Wahab。

这使Azlan在5家上市公司担任董事职,即宏流、兴业银行(RHB Bank Bhd)、马资源(Malaysian Resources Corp Bhd)、绿盛世国际(Eco World International Bhd)和吉隆坡甲洞(Kuala Lumpur Kepong Bhd)。

作为一名在金融领域拥有29年经验的特许会计师,Azlan领导EPF近13年,直到2013年4月16日退休。

(编译:陈慧珊)

Date of change | 08 Sep 2017 | Name | TAN SRI AZLAN BIN MOHD ZAINOL | Age | 67 | Gender | Male | Nationality | Malaysia | Designation | Chairman | Directorate | Independent and Non Executive | Type of change | Appointment | Qualifications | 1. Fellow of Institute of Chartered Accountants in England and Wales (ICAEW)2. Fellow Chartered Banker of Asian Institute of Chartered Bankers (AICB)3. Member of Malaysian Institute of Certified Public Accountants (MICPA)4. Member of Malaysian Institute of Accountants (MIA) | Working experience and occupation | Tan Sri Azlan Bin Mohd Zainol ("Tan Sri Azlan") was previously served as the Chief Executive Officer of the Employees Provident Fund Board from 2001 to April 2013. Tan Sri Azlan has more than 30 years of experience in the financial sector, having served as the Managing Director of AmFinance Berhad (1982 to 1994), AmBank Berhad (1994 to 2001), and Director for several subsidiaries of AmBank Group (1996 to 2001). Prior to that, Tan Sri Azlan was a partner with Messrs. BDO Binder. Tan Sri Azlan was also a Council Member of the Asian Institute of Chartered Bankers.Tan Sri Azlan's other directorships in public companies include RHB Bank Berhad (Chairman), RHB Investment Bank Berhad (Chairman), Malaysian Resources Corporation Berhad (Chairman), Eco World International Berhad (Chairman) and Kuala Lumpur Kepong Berhad. Tan Sri Azlan is also the Chairman/Trustee of Yayasan Astro Kasih and a Trustee of OSK Foundation. | Directorships in public companies and listed issuers (if any) | 1. RHB Bank Berhad2. Malaysian Resources Corporation Berhad3. Eco World International Berhad4. Kuala Lumpur Kepong Berhad |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-9-2017 03:38 AM

|

显示全部楼层

发表于 26-9-2017 03:38 AM

|

显示全部楼层

Name | MADAM CHONG POH YOONG | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 21 Sep 2017 | 29,000,000 | Transferred | Direct and Indirect Interest | Name of registered holder | Chong Poh Yoong | Address of registered holder | No. 38A, Lorong Cendana Indah 1, Taman Cendana Indah, 14100 Simpang Ampat, Pulau Pinang | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Transfer of shares to my spouse, Chuah Chew Hai | Nature of interest | Direct and Indirect Interest | Direct (units) | 412,165 | Direct (%) | 0.087 | Indirect/deemed interest (units) | 36,765,000 | Indirect/deemed interest (%) | 7.724 | Total no of securities after change | 37,177,165 | Date of notice | 25 Sep 2017 | Date notice received by Listed Issuer | 25 Sep 2017 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-9-2017 03:39 AM

|

显示全部楼层

发表于 26-9-2017 03:39 AM

|

显示全部楼层

Name | MR CHUAH CHEW HAI | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 21 Sep 2017 | 29,000,000 | Transferred | Direct and Indirect Interest | Name of registered holder | Chong Poh Yoong | Address of registered holder | No. 38A, Lorong Cendana Indah 1, Taman Cendana Indah, 14100 Simpang Ampat, Pulau Pinang | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Transfer of shares from my spouse, Chong Poh Yoong | Nature of interest | Direct and Indirect Interest | Direct (units) | 36,765,000 | Direct (%) | 7.724 | Indirect/deemed interest (units) | 412,165 | Indirect/deemed interest (%) | 0.087 | Total no of securities after change | 37,177,165 | Date of notice | 25 Sep 2017 | Date notice received by Listed Issuer | 25 Sep 2017 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-10-2017 03:26 AM

|

显示全部楼层

发表于 4-10-2017 03:26 AM

|

显示全部楼层

Name | MR CHUAH CHEW HAI | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 28 Sep 2017 | 40,000,000 | Acquired | Direct Interest | Name of registered holder | Chuah Chew Hai | Address of registered holder | No. 38A, Lorong Cendana Indah 1, Taman Cendana Indah, 14100 Simpang Ampat, Pulau Pinang | Description of "Others" Type of Transaction | | | 2 | 29 Sep 2017 | 9,800,000 | Acquired | Direct Interest | Name of registered holder | Chuah Chew Hai | Address of registered holder | No. 38A, Lorong Cendana Indah 1, Taman Cendana Indah, 14100 Simpang Ampat, Pulau Pinang | Description of "Others" Type of Transaction | | | 3 | 02 Oct 2017 | 200,000 | Acquired | Direct Interest | Name of registered holder | Chuah Chew Hai | Address of registered holder | No. 38A, Lorong Cendana Indah 1, Taman Cendana Indah, 14100 Simpang Ampat, Pulau Pinang | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Acquisition of shares via off market | Nature of interest | Direct Interest | Direct (units) | 86,765,000 | Direct (%) | 18.237 | Indirect/deemed interest (units) | 412,165 | Indirect/deemed interest (%) | 0.087 | Total no of securities after change | 87,177,165 | Date of notice | 03 Oct 2017 | Date notice received by Listed Issuer | 03 Oct 2017 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-10-2017 03:29 AM

|

显示全部楼层

发表于 4-10-2017 03:29 AM

|

显示全部楼层

Name | GRAND-FLO CORPORATION SDN. BHD. | Address | Third Floor, No. 79 (Room A)

Jalan SS 21/60, Damansara Utama

Petaling Jaya

47400 Selangor

Malaysia. | Company No. | 445780-X | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 28 Sep 2017 | 40,000,000 | Disposed | Direct Interest | Name of registered holder | Grand-Flo Corporation Sdn. Bhd. | Address of registered holder | Third Floor, No. 79 (Room A), Jalan SS 21/60, Damansara Utama, Petaling Jaya, 47400 Selangor , Malaysia. | Description of "Others" Type of Transaction | | | 2 | 29 Sep 2017 | 9,800,000 | Disposed | Direct Interest | Name of registered holder | Grand-Flo Corporation Sdn. Bhd. | Address of registered holder | Third Floor, No. 79 (Room A), Jalan SS 21/60, Damansara Utama, Petaling Jaya, 47400 Selangor, Malaysia. | Description of "Others" Type of Transaction | | | 3 | 02 Oct 2017 | 200,000 | Disposed | Direct Interest | Name of registered holder | Grand-Flo Corporation Sdn. Bhd. | Address of registered holder | Third Floor, No. 79 (Room A), Jalan SS 21/60, Damansara Utama, Petaling Jaya, 47400 Selangor , Malaysia. | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Disposal of shares via off market | Nature of interest | Direct Interest | Direct (units) | 23,861,852 | Direct (%) | 5.016 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Total no of securities after change | 23,861,852 | Date of notice | 03 Oct 2017 | Date notice received by Listed Issuer | 03 Oct 2017 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-10-2017 05:38 AM

|

显示全部楼层

发表于 20-10-2017 05:38 AM

|

显示全部楼层

本帖最后由 icy97 于 21-10-2017 07:04 AM 编辑

宏流1672万沽清泰国Simat

2017年10月21日

(吉隆坡20日讯)宏流(GRANFLO,0056,主板科技股)以1亿3203万泰铢(大约1671万5840令吉),全数脱售泰国Simat科技约4889万9373股或12.31%股权。

宏流昨天向交易所报备,基于Simat科技高度专注在发展新宽频网络服务业务,而宏流则专注在产业发展,以及企业数据收集与整理系统业务,导致协同效应在近几年来减少,所以管理层决定脱售股权。

宏流是在2005年收购Simat科技的49%股权,作为扩展至泰国的计划。

料赚829万

脱售股权后所取得的现金,将用于营运资本及投资在新业务。

宏流脱售股权将会影响短期表现,包括营运及业绩,但将持续扩展现有业务,并可能会在信息与通信科技领域中寻找新的商机,这或带来诱人回酬,有助于缓和不利影响。

不过,宏流预计脱售后,将在2017财年取得约829万2480令吉净利。【e南洋】

Type | Announcement | Subject | OTHERS | Description | PROPOSED DISPOSAL BY GRAND-FLO BERHAD ("GRAND-FLO" OR "THE COMPANY") OF ITS ENTIRE SHAREHOLDING COMPRISING 48,899,373 ORDINARY SHARES OF THAI BAHT ("THB") 1.00 EACH HELD IN SIMAT TECHNOLOGIES PUBLIC COMPANY LIMITED ("SIMAT") ("SIMAT SHARE(S)"), AN ASSOCIATED COMPANY OF GRAND-FLO, REPRESENTING APPROXIMATELY 12.31% OF THE TOTAL ISSUED AND PAID-UP SHARE CAPITAL OF SIMAT, AT THB2.70 PER SHARE FOR A TOTAL CASH CONSIDERATION OF THB132,028,307 (EQUIVALENT TO APPROXIMATELY RM16,715,840) ("THE DISPOSAL") |

1. INTRODUCTION

The Board of Directors of Grand-Flo (“Board”) wishes to announce that the Company has on 18 October 2017 entered into a Share Sale and Purchase Agreement (“Agreement”) with Nattapong Seetavorarat (“Purchaser”), a Thai national residing at No. 11, Soi Areesampan 4, Phaholyothin Road, Samsen Nai Sub-district, Phayathai District, Bangkok 10400 Thailand, to dispose of 48,899,373 Simat Shares, representing approximately 12.31% equity interest in Simat (“Sale Shares”), at THB2.70 per share for a total cash consideration of THB132,028,307 (equivalent to approximately RM16,715,840) (“Purchase Consideration”).

2. INFORMATION ON SIMAT

Simat was incorporated in Thailand with the Ministry of Commerce under the laws of Thailand on 19 March 1999 as a private limited company under the name of Simat Mobile Computer Company Limited. Grand-Flo had acquired 49% equity interest in Simat in 2005 as part of its expansion plans into Thailand.

Simat was then converted into a public limited company under its present name on 18 July 2006 and was subsequently listed on the Market for Alternative Investment of the Stock Exchange of Thailand (“SET”) on 12 December 2007. To facilitate the listing of Simat on the SET, Grand-Flo’s shareholdings in Simat was diluted to 36.75% arising from the issuance of new Simat Shares to the public investors. As at the date of this announcement, Grand-Flo holds 48,899,373 Simat Shares, or approximately 12.31% equity interest in Simat.

Simat is principally engaged in the provision of total solution of Information Technologies services and broadband internet services.

As at the date of this announcement, the authorised share capital of Simat is THB516,550,596 (equivalent to approximately RM65,399,438) comprising 516,550,596 Simat Shares, of which THB397,204,252 (equivalent to approximately RM50,289,236) comprising 397,204,252 have been issued and fully paid-up.

The current directors of Simat are Tan Bak Hong, Thongkam Manasilapapan, Tan Bak Leng, Tan Chuan Hock, Natthawut Pinto, Thammanoon Korkiatwanich, Ranchana Rajatanavin, Narongrit Rerkpattanapipat, Kanwara Aurpokaiyakul and Vorachi Charoenprasittiporn.

The substantial shareholders of Simat and their direct shareholdings in Simat based on the Register of Directors’ Shareholdings as at 18 October 2017 are as follows:

Substantial shareholders |

| No. of Simat Shares |

| % |

|

|

|

|

| Thongkam Manasilapapan |

| 52,623,549 |

| 13.25 | Grand-Flo |

| 48,899,373 |

| 12.31 | Natthapas Manasilapapan |

| 25,000,000 |

| 6.29 | Thai NDVR Co., Ltd. |

| 24,684,331 |

| 6.21 |

The latest audited consolidated net loss and shareholders' funds of Simat for the financial year ended (“FYE”) 31 December 2016 are THB2,174,000 (equivalent to approximately RM275,246) and THB644,487,000 (equivalent to approximately RM81,597,210), respectively.

3. SALIENT TERMS OF THE AGREEMENT

3.1 Agreement to Sell

Subject to the terms and conditions of the Agreement, the Vendor shall sell the Sale Shares to the Purchaser and the Purchaser shall purchase the Sale Shares from the Vendor.

The Sale Shares are sold –

i. Upon payment of each instalment as set out in Schedule 2 of the Agreement. The number of Sale Shares to be transferred by the Vendor to the Purchaser at each instalment shall be those corresponding to such instalments as listed in Schedule 2 of the Agreement. ii. Free from all encumbrances or claims of any nature whatsoever (other than the rights of pre-emption under Simat’s Articles of Association); iii. With all rights attaching thereto; iv. At any time prior to the payment of the Purchase Price of each Instalment, the Purchaser may designate any person(s) not party to this Agreement to purchase all or any portion of the Sale Shares or otherwise perform any of the Purchaser’s obligations or exercise any of its rights thereunder.

3.2 Purchase Price, Deposit and Transfer of Sale Shares 3.2.1 Purchase Price The price of the Sale Shares shall be fixed at THB2.70 per Simat Share, and the total purchase price payable to the Vendor for the Sale Shares shall be THB132,028,307 (equivalent to approximately RM16,715,840). The parties also agree that the Purchase Price shall be paid in one or more instalments as set out in Schedule 2 of the Agreement or otherwise agreed by the Parties (the “Instalments”). The Parties agree that the aggregate numbers of Instalments shall not exceed four instalments. 3.2.2 Non-refundable Deposit Pursuant to Schedule 2 of the Agreement, on the date of the Agreement, the Purchaser agrees to pay a non-refundable deposit to the Vendor in the amount of 10% of the Purchase Price, equivalent to THB13,202,831 (equivalent to approximately RM1,671,584) as the 1st Instalment and the Vendor agrees to transfer 4,889,937 of its Simat Shares to the Purchaser. 3.2.3 Transfer of Sale Shares The Sale Shares shall be transferred to the Purchaser in such numbers corresponding to the amount of the Purchase Price to be paid at each Instalment to the Purchaser’s Securities Account subject to Clause 3.2 and 3.3 of the Agreement.

3.3 Board of Directors of Simat (“Board”)

Within 90 days after the completion of the transfer of all Sale Shares pursuant to Clause 3 of the Agreement, the Vendor shall procure the resignation of 3 (three) directors of Simat it nominated namely Mr. Tan Bak Hong, Mr. Tan Chuan Hock and Mr. Tan Bak Leng, so that the Purchaser may nominate such number of directors for consideration and appointment by the Board and/or the shareholders of Simat (as required) to replace such resigning directors.

3.4 Assignment

Neither party shall be entitled to assign its rights or obligations under the Agreement without the prior written approval of the other party.

The Purchaser may assign or transfer its rights and obligations under this Agreement to any other person who is financially capable of completing the sale and purchase of the Sale Shares pursuant to the terms and conditions of the Agreement.

4. BASIS AND JUSTIFICATION OF ARRIVING AT THE CONSIDERATION

The Consideration of the Disposal of Simat Shares was determined and based on a willing-buyer willing-seller basis, taking into consideration:

4.1 the cost of investment for the Simat Shares as at 31 December 2016 was RM0.073 per share; and

4.2 the sale consideration of THB2.70 (equivalent approximately RM0.34) per Simat Share was arrived at a 10.0% discount to a five-day average of daily quoted closing price of Simat Shares ended 18 Oct 2017.

5. ORIGINAL COST AND DATE OF INVESTMENT

The original cost of investment by Grand-Flo for the Simat Shares and the respective dates of investment are as follows:

Date | | Number of Simat Shares acquired/ (disposed of) | | Cost of investment (RM) | | | | | | | SImat Shares | | | | | 04.02.2005 | | 490,000 | | 3,699,629 | 05.02.2005 | | 490,000 | | 477,260 | 27.06.2005 | | 245,000 | | 225,400 | 10.10.2006 | | 11,025,000 | | - (1) | 26.10.2006 | | 15,312,500 | | - (2) | 25.08.2011 | | 27,562,500 | | 2,811,400 | 17.05.2012 | | 5,512,500 | | - (3) | 10.04.2013 | | (15,300,000) | | (1,683,734) | 02.05.2013 | | (1,425,000) | | (156,819) | 03.05.2013 | | (2,375,000) | | (261,365) | 07.05.2013 | | 13,845,833 | | - (4) | 19.03.2014 | | (5,900,000) | | (1,223,544) | 31.03.2014 | | 20,425,190 | | 2,050,697 | 22.05.2014 | | 6,990,850 | | - (3) | 29.09.2014 | | (3,000,000) | | (526,500) | 27.03.2015 | | (2,000,000) | | (146,481) | 20.06.2017 | | (15,000,000) | | (1,098,607) | 22.06.2017 | | (8,000,000) | | (585,924) | Total | | 48,899,373 | | 3,581,413 |

Notes: (1) Subdivision of THB10.00 par value shares to THB1.00 par value shares. (2) Share dividend on the basis of 1.25 share dividend for every one (1) existing Simat Share held. (3) Share dividend on the basis of one (1) share dividend for every ten (10) existing Simat Shares held. (4) Share dividend on the basis of one (1) share dividend for every three (3) existing Simat Shares held.

The average cost of investment per Simat Share is approximately RM0.073.

6. UTILISATION OF PROCEEDS FROM THE DISPOSAL OF SIMAT SHARES

The proceeds to be raised from the Disposal of Simat Shares shall be utilized for working capital and new business investment. The sale proceeds amounting to approximately RM16,715,840 will be utilised to fund the day-to-day business operations of Grand-Flo Group, which shall include but not limited to, amongst others, staff salaries, payment of creditors and general operating expenses. However, at this juncture Grand-Flo is unable to ascertain the portion of gross proceeds to be allocated for staff salaries, payment of creditors and general operating expenses. The management of Grand-Flo doesn’t dismiss the idea of new business investment should any potential investments or businesses arise.

The cash proceeds to be utilized for Grand-Flo Group’s working capital and new business investment are expected to be fully utilised within twelve (12) months from the completion of the Disposal.

7. ASSUMPTION OF LIABILITIES

There are no liabilities, including contingent liabilities and guarantees, to be assumed by the Purchaser and/or the Grand-Flo Group pursuant to the Disposal.

8. FINANCIAL EFFECTS

8.1 Share capital and Substantial Shareholders’ Shareholdings

The Disposal will not have any effect in the share capital and substantial shareholders’ shareholdings as no new shares of Grand-Flo are to be issued.

8.2 Net Assets (“NA”)

The Disposal will not have any effect to the NA of Grand-Flo except for the effect on the gain on disposal arising from the Agreement as disclosed at 8.3 below.

8.3 Earnings

Grand-Flo expects the Disposal to record a gain on disposal of approximately RM8,292,480 for the financial year ending 31 December 2017.

8.4 Gearings

The Disposal will not have any effect to the gearings of Grand-Flo as there is no financing involved for the Disposal.

9. RISK FACTORS

The Disposal of Simat Shares, is not expected to pose any risk factors, which could materially and/or adversely affect the business operations and financial performance of the Grand-Flo Group.

9.1 Business Risk

As Simat is involved in the provision of broadband internet services, its future performance is subject to general business risks, as well as risks inherent in the telecommunication and wireless technology industries. These include, inter-alia, changes in the telecommunication infrastructure, changes in the laws, regulations and policies applicable to the telecommunication and/or wireless industries, introduction of new technological products and services, as well as slowdown in growth in certain segments of the telecommunication and/or wireless industries, particularly in the areas/regions/countries in which Simat may operate.

Whilst Simat seeks to mitigate these risks through its continued initiatives in research and development, strategic business alliance, implementation of prudent business strategies and continuous review of its operations, there is no assurance that any of the aforementioned risks will not materially and adversely affect its financial performance and business operations.

9.2 Loss of profit contribution from Simat Group

Upon completion of the Disposal of Simat Shares, the Grand-Flo Group will not have any equity interest in Simat and as such, moving forward, Simat will cease being an associated company of the Grand-Flo Group.

The Disposal of Simat Shares may have adverse impact on the future performance (i.e. operationally and financially) of Grand-Flo Group. Nonetheless, as a mitigating factor, the Grand-Flo group intends to continue with its existing businesses and may seek out new opportunities and/or other business opportunities within the ICT industry which may provide or generate attractive returns to Grand-Flo Group.

9.3 General political, economic and regulatory conditions

Simat's financial and business prospects and that of the industry in which it operates, will depend largely, on the developments and changes in the political and regulatory front in Thailand and regionally. The political, economic and regulatory uncertainties include, but are not limited to, changes in political leadership, war, terrorism activities, expropriation, unfavourable changes in government policies and regulations on interest rates, foreign exchange rates, taxation, exchange control and licensing.

Whilst Simat will continue to adopt effective measures such as prudent management and periodic review of investment/operating procedures to mitigate these uncertainties, there can be no assurance that any adverse change in the political, economic and regulatory conditions will not materially and adversely affect Simat.

10. RATIONALE AND JUSTIFICATION FOR THE DISPOSAL

The rationale for the Disposal was the declining level of synergy between Grand-Flo and Simat over the recent years as Simat is focused on growing its new broadband internet services business whilst Grand-Flo is busy focusing on its property development and Enterprise Data Collection and Collation System businesses. As such the management of Grand-Flo has decided to unlock the two groups by gradually disposing of its investment in Simat as the businesses of the two groups are no longer complementing each other.

11. ESTIMATED TIME FRAME

Barring any unforeseen events arising from the fulfilment of conditions set in the Agreement, the Disposal is expected to be completed three (3) months from the date of the Agreement.

12. APPROVALS OF SHAREHOLDERS AND THE RELEVANT GOVERNMENT AUTHORITIES

The Disposal is not subject to the approval of the shareholders of Grand-Flo and/or other regulatory bodies.

The Disposal is not conditional upon each other and any other corporate exercise undertaken or to be undertaken by the Company.

13. HIGHEST PERCENTAGE RATIO APPLICABLE PURSUANT TO PARAGRAPH 10.02(G)(V) OF BURSA MALAYSIA SECURITIES BERHAD MAIN MARKET LISTING REQUIREMENTS

The highest percentage ratio applicable to the Disposal pursuant to paragraph 10.02(g)(v) of Bursa Malaysia Securities Berhad Main Market Listing Requirements (“Listing Requirements”) is 15.19%, arrived at based on the aggregate value of the Consideration compared with the NA of the Company.

14. DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTERESTS

None of the Directors, major shareholders of the Company and/or persons connected with them, as defined in the Listing Requirements, have any interests, whether direct or indirect, in the Disposal.

15. DIRECTORS’ RECOMMENDATION

The Board of Directors of Grand-Flo, after having considered all aspects of the Disposal, including but not limited to the rationale and effects of the Disposal, is of the opinion that the Disposal is in the best interest of the Company.

16. DOCUMENTS FOR INSPECTION

The Agreement is available for inspection at the registered office of Grand-Flo at Third Floor No. 79 (Room A), Jalan SS 21/60, Damansara Utama, 47400 Petaling Jaya, Selangor Darul Ehsan during normal office hours from Mondays to Fridays (except public holidays) for a period of three (3) months from the date of this announcement.

This announcement is dated 19 October 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-10-2017 05:39 AM

|

显示全部楼层

发表于 20-10-2017 05:39 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | GRAND-FLO BERHADProposed Disposal by Labels Network Sdn Bhd of its entire shareholding comprising 240,000 ordinary shares, representing 80% of the issued and paid-up share capital of Kopacklabels (Pg) Sdn Bhd (KPSB) for a total cash consideration of RM700,000.00. | 1. INTRODUCTION

The Board of Directors (“Board”) of Grand-Flo Berhad (“Grand-Flo” or “Company”) wishes to announce that Labels Network Sdn Bhd (“LNSB” or “Vendor”), a wholly owned subsidiary of the Company, has on 19 October 2017 entered into a Share Sale Agreement (“Agreement”) with Mr. Tan Huai Wei and Mr. H’ng Han Sua (collectively “Purchasers”) for the disposal of the Company’s entire shareholding comprising 240,000 ordinary shares and representing 80% of the issued and paid-up share capital of KPSB (“Sale Shares”), for a cash consideration of RM700,000.00 (“Purchase Price”) (“Proposed Disposal”).

Upon completion of the Proposed Disposal, KPSB will cease to be a subsidiary company of Grand-Flo.

2. INFORMATION ON KPSB

2.1 Corporate Information KPSB is a private limited company incorporated in Malaysia on 14 June 2000 under the name Penkopack Sdn Bhd and subsequently assumed its present name on 8 September 2010. As at the date of this announcement, the issued and paid-up share capital of KPSB is RM300,000.00 comprising of 300,000 ordinary shares.

As at the date of announcement, the Directors of KPSB are Tan Huai Wei and Tan Bak Leng.

2.2 Nature of Business KPSB is principally engaged in the conversion of adhesive labels.

3. INFORMATION ON THE PURCHASERS

The Purchasers, Mr. Tan Huai Wei has agreed to purchase 150,000 ordinary shares in the Company representing 50% of the issued and paid-up share capital of the Company, and Mr. H’ng Han Sua has agreed to purchase 90,000 ordinary shares in the Company representing 30% of the issued and paid-up share capital of the KPSB.

4. BASIS AND TERMS OF THE PURCHASE PRICE

The Purchase Price for the Proposed Disposal amounting to RM700,000.00, was arrived at a willing buyer-willing seller basis.

5. RATIONALE AND PROSPECTS OF THE PROPOSED DISPOSAL

KPSB had been experiencing flat growth in the past years and had recorded a loss for the financial year ended 31 December 2016 due to deteriorating sales from stiff competition, high capital commitment and lack of prospect in the labels printing business. The Proposed Disposal presents an opportunity for the Company to curtail further potential losses and to unlock its investment in KSB, and will allow Grand-Flo Group to streamline its operations and to focus on the core business in Enterprise Data Collection and Collation System (“EDCCS”) and property-related business which we believe would enhance the Group’s earnings significantly.

6. FINANCIAL EFFECTS OF THE PROPOSED DISPOSAL

6.1 Issued and Paid-up Share Capital The Proposed Disposal will not have any effect on the issued and paid-up share capital of Grand-Flo.

6.2 Substantial Shareholders’ Shareholdings The Proposed Disposal will not have any effect on the shareholdings of the substantial shareholders of Grand-Flo.

6.3 Earnings and Net Assets The earnings and net assets of Grand-Flo Group for the financial year ending 31 December 2017 will be affected by the expected loss of RM1.24 million arising from the Proposed Disposal.

Upon completion of the Proposed Disposal, Grand-Flo Group is expected to incur a net loss of approximately RM1.24 million arising from the Proposed Disposal. This net loss attributable to owners of the Company represents an earnings per share of approximately RM0.003.

6.4 Gearing The Proposed Disposal will not have any material effect on the gearing of the Group.

7. ORIGINAL COST OF INVESTMENT

LNSB acquired 80% of KPSB on 14 August 2008 and its original cost of investment for the Sale Shares was RM1,289,785.

8. DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTEREST

None of the Directors and/or major shareholders of Grand-Flo and/or persons connected to them have any interests, direct or indirect, in the Proposed Disposal.

9. APPROVALS REQUIRED

The Proposed Disposal does not require the approval of any government authorities and does not require the approval of the shareholders of Grand-Flo. Based on Grand-Flo’s audited consolidated financial statements for the financial year ended 31 December 2016 and pursuant to Paragraph 10.02(g) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, the highest percentage ratio applicable to the Proposed Disposal is 1.16%.

10. DIRECTORS’ STATEMENT

Having considered the rationale and all aspects of the Proposed Disposal, the Board of Directors of Grand-Flo is of the opinion that the Proposed Disposal is in the best interest of Grand-Flo Group.

This announcement is dated 19 October 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-11-2017 03:08 AM

|

显示全部楼层

发表于 8-11-2017 03:08 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | GRAND-FLO BERHAD ("Grand-Flo" or "the Company")- Proposed Disposal by Labels Network Sdn Bhd of its entire shareholding comprising 240,000 ordinary shares, representing 80% of the issued and paid-up share capital of Kopacklabels (PG) Sdn Bhd (KPSB) for a total cash consideration of RM700,000.00 (Disposal) | Reference is made to the Company’s previous announcement made on 19 October 2017 in relation to the Disposal.

The Board of Directors of Grand-Flo is pleased to announce that the Disposal has been completed with a total cash consideration of RM700,000 fully received as at the date of this announcement. Thus, marking the completion of the Disposal.

This announcement is dated 7 November 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-11-2017 03:33 AM

|

显示全部楼层

发表于 10-11-2017 03:33 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PROPOSED DISPOSAL BY GRAND-FLO BERHAD ("GRAND-FLO" OR "THE COMPANY") OF ITS ENTIRE SHAREHOLDING COMPRISING 48,899,373 ORDINARY SHARES OF THAI BAHT ("THB") 1.00 EACH HELD IN SIMAT TECHNOLOGIES PUBLIC COMPANY LIMITED ("SIMAT") ("SIMAT SHARE(S)"), AN ASSOCIATED COMPANY OF GRAND-FLO, REPRESENTING APPROXIMATELY 12.31% OF THE TOTAL ISSUED AND PAID-UP SHARE CAPITAL OF SIMAT, AT THB2.70 PER SHARE FOR A TOTAL CASH CONSIDERATION OF THB132,028,307 (EQUIVALENT TO APPROXIMATELY RM16,715,840) ("THE DISPOSAL") | Reference is made to the Company’s previous announcement made on 19 October 2017 in relation to the Disposal.

The Board of Directors of Grand-Flo is pleased to announce that the Disposal has been completed with a total cash consideration of THB132,028,307 (equivalent to approximately RM16,715,840) fully received as at the date of this announcement. Thus, marking the completion of the Disposal.

This announcement is dated 9 November 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-12-2017 03:24 AM

|

显示全部楼层

发表于 5-12-2017 03:24 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 28,486 | 25,562 | 73,582 | 98,539 | | 2 | Profit/(loss) before tax | 3,011 | -8,155 | 9,648 | -2,659 | | 3 | Profit/(loss) for the period | 2,634 | -8,669 | 8,686 | -5,301 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,079 | -9,292 | 7,592 | -9,160 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.43 | -1.92 | 1.57 | -1.90 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.2420 | 0.2278

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-1-2018 12:22 AM

|

显示全部楼层

发表于 31-1-2018 12:22 AM

|

显示全部楼层

Date of change | 31 Jan 2018 | Name | MADAM YAP LI LI | Age | 50 | Gender | Female | Nationality | Malaysia | Designation | Executive Director | Directorate | Executive | Type of change | Resignation | Reason | Other personal commitment |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-3-2018 04:02 AM

|

显示全部楼层

发表于 7-3-2018 04:02 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 30,454 | 21,738 | 104,035 | 120,278 | | 2 | Profit/(loss) before tax | 5,389 | 63 | 15,037 | -2,598 | | 3 | Profit/(loss) for the period | 5,825 | -184 | 14,511 | -5,485 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,587 | -564 | 13,179 | -9,724 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.18 | -0.12 | 2.78 | -2.01 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.2545 | 0.2278

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-4-2018 07:31 AM

|

显示全部楼层

发表于 1-4-2018 07:31 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | GRAND-FLO BERHAD (GRAND-FLO OR COMPANY)INCORPORATION OF NEW SUBSIDIARY | 1. INTRODUCTION Pursuant to Paragraph 9.19(23) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, the Board of Directors of the Company wishes to announce that the Company had on 30 March 2018 incorporated a wholly-owned subsidiary in Malaysia under the Companies Act 2016, BKW Residences Sdn. Bhd. ("BKW")

2. INFORMATION OF BKW BKW, a wholly-owned subsidiary of Grand-Flo and was incorporated on 30 March 2018 and has an issued share capital of one (1) ordinary share. The intended principal activity of BKW is property development. The Directors of BKW are Mr. Chuah Chew Hai and Mr. Yu Chee Sing.

3. FINANCIAL EFFECTS The incorporation will not have any material effect on the earnings per share, net assets per share, gearing, share capital and substantial shareholders’ shareholdings of the Company and its subsidiaries (the “Group”) for the financial year ending 31 December 2018.

4. RATIONALE The incorporation mainly to facilitate the Group’s business expansion plans.

5. INTERESTS OF DIRECTORS AND/OR MAJOR SHAREHOLDERS AND/OR PERSON CONNECTED TO THEM None of the directors and/or major shareholders of the Company, and/or persons connected to such director and/or major shareholders have any interest, direct or indirect, in the incorporation.

6. STATEMENT BY BOARD OF DIRECTORS The Board of Directors of the Company having considered all aspects of the incorporation, is of the opinion that the incorporation is in the best interest of the Company.

7. APPROVAL REQUIRED The incorporation is not subject to the approval of the shareholders of the Company.

This announcement is dated 30 March 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-4-2018 08:29 PM

|

显示全部楼层

发表于 10-4-2018 08:29 PM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | GRAND-FLO BERHAD ("GRAND-FLO" OR "THE COMPANY")-PROPOSED FINAL SINGLE-TIER DIVIDEND FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2017 | The Company is pleased to announce that the Board of Directors of GRAND-FLO (“the Board”) has recommended a Final Single-Tier Dividend of 0.6 sen per ordinary share for the financial year ended 31 December 2017. The proposed dividend is subject to the approval of shareholders of the Company at the forthcoming Annual General Meeting.

The entitlement and payment dates shall be finalised by the Company at a later date and announced in due course.

The dividend proposed is in line with the dividend policy adopted by the Company which aims to distribute to its shareholders a minimum of 20% of the Group’s net profits for each financial year.

Whilst the Board believes in rewarding the Company’s shareholders with steady returns on their investments and attracting potential long term investors, the Board is mindful that adequate working capital and reserves shall be set aside for capital investments and future potential growth, taking into consideration the global economic conditions.

This announcement is dated 9 April 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-4-2018 04:33 AM

|

显示全部楼层

发表于 11-4-2018 04:33 AM

|

显示全部楼层

本帖最后由 icy97 于 16-4-2018 12:51 AM 编辑

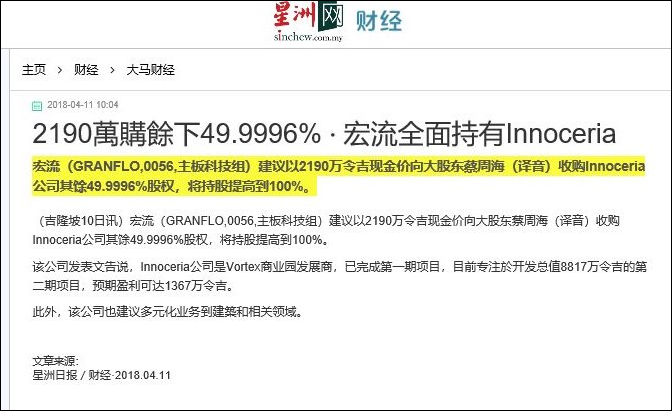

Type | Announcement | Subject | MULTIPLE PROPOSALS | Description | GRAND-FLO BERHAD ("GRAND-FLO" OR THE "COMPANY")(I) PROPOSED ACQUISITION BY GRAND-FLO OF THE REMAINING 124,999 ORDINARY SHARES IN INNOCERIA SDN BHD ("ISB") NOT ALREADY HELD BY GRAND-FLO, REPRESENTING 49.9996% OF THE TOTAL NUMBER OF ISSUED SHARES OF ISB FOR A CASH CONSIDERATION OF RM21.9 MILLION ("PROPOSED ACQUISITION"); AND(II) PROPOSED DIVERSIFICATION OF THE CORE BUSINESS OF GRAND-FLO TO INCLUDE CONSTRUCTION BUSINESS AND CONSTRUCTION RELATED ACTIVITIES ("PROPOSED DIVERSIFICATION") | UOB Kay Hian Securities (M) Sdn Bhd (“UOBKH”), on behalf of the Board of Directors of Grand-Flo (“Board”), wishes to announce the following:- - Grand-Flo had on 10 April 2018 entered into a conditional Share Sale Agreement (“SSA”) with Chuah Chew Hai (“CCH” or the “Vendor”) for the acquisition of the remaining 49.9996% equity interest in ISB, consisting of 124,999 ordinary shares held by the Vendor, for a cash consideration of RM21.9 million for the purpose of the Proposed Acquisition; and

- Grand-Flo proposes to diversify its existing core businesses of enterprise data collection and collation system and property development to include construction business and construction related activities.

(The Proposed Acquisition and Proposed Diversification are collectively referred to as the "Proposals")

Further details on the Proposals are set out in the attachment below.

This announcement is dated 10 April 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5754137

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-5-2018 01:50 AM

|

显示全部楼层

发表于 4-5-2018 01:50 AM

|

显示全部楼层

EX-date | 10 Jul 2018 | Entitlement date | 12 Jul 2018 | Entitlement time | 05:00 PM | Entitlement subject | Final Dividend | Entitlement description | Final Single-Tier Dividend of 0.6 sen per ordinary share | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200 Kuala LumpurTel:03-2783 9299Fax:03-2783 9222 | Payment date | 25 Jul 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 12 Jul 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.006 |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|