|

|

发表于 24-10-2017 03:06 AM

|

显示全部楼层

发表于 24-10-2017 03:06 AM

|

显示全部楼层

本帖最后由 icy97 于 24-10-2017 04:38 AM 编辑

同益岸外首季赚223万

2017年10月24日

(吉隆坡23日讯)同益岸外(TAS,5149,主板工业产品股)截至8月31日首季,净赚223万2000令吉或每股1.27仙;上财年同期净亏113万令吉或每股0.64仙。

同益岸外今日向交易所报备,首季营业额则按年大涨3.65倍,从上财年同期的224万5000令吉,增加至1042万9000令吉。

相较于上财年末季税前亏损达660万令吉,首季成功取得230万令吉的税前盈利,主要是销售两艘拖船所得,加上前一季为一项可能生变的造船合约拨备和减值库存导致亏损。

虽然截止9月底油价攀上逾两年来高位,看似供需层面终于达到平衡,但考虑到美国页岩油市场带来的不确定冲击,该公司依旧对营运保持谨慎。

“无论如何,我们仍看好长期油价走势,因人口增长和带动工业和发展活动,进一步提升能源需求,且岸外支援船需求也将回温,支撑对公司的乐观前景。”【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Aug 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Aug 2017 | 31 Aug 2016 | 31 Aug 2017 | 31 Aug 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 10,429 | 2,245 | 10,429 | 2,245 | | 2 | Profit/(loss) before tax | 2,287 | -1,052 | 2,287 | -1,052 | | 3 | Profit/(loss) for the period | 2,232 | -1,130 | 2,232 | -1,130 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,232 | -1,130 | 2,232 | -1,130 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.27 | -0.64 | 1.27 | -0.64 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9250 | 0.9152

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-1-2018 02:00 AM

|

显示全部楼层

发表于 25-1-2018 02:00 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Nov 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Nov 2017 | 30 Nov 2016 | 30 Nov 2017 | 30 Nov 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 11,707 | 2,924 | 22,136 | 5,169 | | 2 | Profit/(loss) before tax | -1,418 | 497 | 870 | -556 | | 3 | Profit/(loss) for the period | -1,559 | 489 | 673 | -642 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -1,559 | 489 | 673 | -642 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.89 | 0.28 | 0.38 | -0.37 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9136 | 0.9152

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-1-2018 04:25 AM

|

显示全部楼层

发表于 26-1-2018 04:25 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | ACQUISITION OF PANTAS MARINE SDN BHD | The Board of Directors of TAS OFFSHORE BERHAD wishes to announce that it has acquired 100% shares of PANTAS MARINE SDN BHD (Company No. 902261-M) on 25 January 2018. . PANTAS MARINE SDN BHD is a Company incorporated in Malaysia under the Companies Act, 1965 with issued shares of RM3.00.

The Company is currently dormant.

None of the Directors, major shareholders and/or persons connected to the Directors and major shareholders has any interest direct or indirect in the above acquisition.

This announcement is dated 25 January 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-4-2018 07:42 AM

|

显示全部楼层

发表于 19-4-2018 07:42 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

28 Feb 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 28 Feb 2018 | 28 Feb 2017 | 28 Feb 2018 | 28 Feb 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 7,398 | 13,690 | 29,534 | 18,859 | | 2 | Profit/(loss) before tax | -722 | 1,458 | 147 | 904 | | 3 | Profit/(loss) for the period | -569 | 1,295 | 104 | 655 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -569 | 1,295 | 104 | 655 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.32 | 0.74 | 0.06 | 0.37 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9075 | 0.9152

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-8-2018 03:57 AM

|

显示全部楼层

发表于 1-8-2018 03:57 AM

|

显示全部楼层

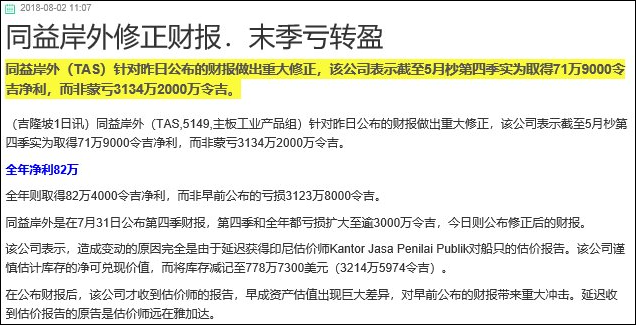

本帖最后由 icy97 于 3-8-2018 04:32 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 May 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 May 2018 | 31 May 2017 | 31 May 2018 | 31 May 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 18,925 | 1,846 | 48,460 | 20,705 | | 2 | Profit/(loss) before tax | 352 | -14,859 | 500 | -13,954 | | 3 | Profit/(loss) for the period | 719 | -14,690 | 824 | -14,034 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 719 | -14,690 | 824 | -14,034 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.41 | -8.37 | 0.47 | -7.99 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9124 | 0.9153

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-10-2018 05:13 AM

|

显示全部楼层

发表于 27-10-2018 05:13 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Aug 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Aug 2018 | 31 Aug 2017 | 31 Aug 2018 | 31 Aug 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 8,982 | 10,429 | 8,982 | 10,429 | | 2 | Profit/(loss) before tax | 1,024 | 2,287 | 1,024 | 2,287 | | 3 | Profit/(loss) for the period | 948 | 2,232 | 948 | 2,232 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 948 | 2,232 | 948 | 2,232 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.54 | 1.27 | 0.54 | 1.27 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9072 | 0.9124

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-2-2019 07:45 AM

|

显示全部楼层

发表于 2-2-2019 07:45 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Nov 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Nov 2018 | 30 Nov 2017 | 30 Nov 2018 | 30 Nov 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 15,765 | 11,707 | 24,747 | 22,136 | | 2 | Profit/(loss) before tax | 1,627 | -1,418 | 2,651 | 870 | | 3 | Profit/(loss) for the period | 1,286 | -1,559 | 2,234 | 673 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,286 | -1,559 | 2,234 | 673 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.73 | -0.89 | 1.27 | 0.38 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9155 | 0.9124

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-5-2019 07:25 AM

|

显示全部楼层

发表于 14-5-2019 07:25 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

28 Feb 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 28 Feb 2019 | 28 Feb 2018 | 28 Feb 2019 | 28 Feb 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 8,732 | 7,398 | 33,479 | 29,534 | | 2 | Profit/(loss) before tax | -1,009 | -722 | 1,642 | 147 | | 3 | Profit/(loss) for the period | -1,247 | -569 | 987 | 104 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -1,247 | -569 | 987 | 104 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.71 | -0.32 | 0.56 | 0.06 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9070 | 0.9124

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-7-2019 07:16 AM

|

显示全部楼层

发表于 31-7-2019 07:16 AM

|

显示全部楼层

本帖最后由 icy97 于 31-7-2019 09:41 AM 编辑

同益岸外末季赚300万

http://www.enanyang.my/news/20190730/同益岸外末季赚300万/

SUMMARY OF KEY FINANCIAL INFORMATION

31 May 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 May 2019 | 31 May 2018 | 31 May 2019 | 31 May 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 3,401 | 18,925 | 36,880 | 48,460 | | 2 | Profit/(loss) before tax | 3,702 | 352 | 5,345 | 500 | | 3 | Profit/(loss) for the period | 3,001 | 719 | 3,989 | 824 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,001 | 719 | 3,989 | 824 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.71 | 0.41 | 2.27 | 0.47 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9251 | 0.9124

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-11-2019 07:52 AM

|

显示全部楼层

发表于 14-11-2019 07:52 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Aug 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Aug 2019 | 31 Aug 2018 | 31 Aug 2019 | 31 Aug 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 6,835 | 8,982 | 6,835 | 8,982 | | 2 | Profit/(loss) before tax | 566 | 1,024 | 566 | 1,024 | | 3 | Profit/(loss) for the period | 381 | 948 | 381 | 948 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 381 | 948 | 381 | 948 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.22 | 0.54 | 0.22 | 0.54 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9275 | 0.9251

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-4-2020 04:55 AM

|

显示全部楼层

发表于 11-4-2020 04:55 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Nov 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Nov 2019 | 30 Nov 2018 | 30 Nov 2019 | 30 Nov 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 6,172 | 15,765 | 13,007 | 24,747 | | 2 | Profit/(loss) before tax | -843 | 1,627 | -276 | 2,651 | | 3 | Profit/(loss) for the period | -857 | 1,286 | -475 | 2,234 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -857 | 1,286 | -475 | 2,234 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.49 | 0.73 | -0.27 | 1.27 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9223 | 0.9251

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-5-2020 08:04 AM

|

显示全部楼层

发表于 12-5-2020 08:04 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | VESSEL SALES WORTH APPROXIMATELY RM19.6 MILLION |

The Board of Directors of TAS Offshore Berhad is pleased to announce that its wholly-owned subsidiary has secured contracts for the sale of five units of Garbage Collection Craft and two units of Flotsam Retrieval Craft with value of approximately RM19.6 million.

The vessels were sold to one of our foreign customers. These vessels are expected to be delivered by end of Year 2020.

The revenue generated from the contract is expected to contribute positively to the earnings and net assets of TAS Group for financial year ending 31 May 2021.

None of the Directors and/or major shareholders of TAS Offshore Berhad or persons connected to them have any interest, direct or indirect, in the above contracts.

This annoncements is dated 18 March 2020. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-9-2020 04:44 AM

|

显示全部楼层

发表于 7-9-2020 04:44 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

29 Feb 2020 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 29 Feb 2020 | 28 Feb 2019 | 29 Feb 2020 | 28 Feb 2019 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 1,488 | 8,732 | 14,496 | 33,479 | | 2 | Profit/(loss) before tax | -5,578 | -1,009 | -5,855 | 1,642 | | 3 | Profit/(loss) for the period | -5,562 | -1,247 | -6,038 | 987 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -5,562 | -1,247 | -6,038 | 987 | | 5 | Basic earnings/(loss) per share (Subunit) | -3.17 | -0.71 | -3.44 | 0.56 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.8908 | 0.9251

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-11-2020 08:21 AM

|

显示全部楼层

发表于 5-11-2020 08:21 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | TERMINATION AGREEMENTS | The Board of Directors of TAS Offshore Berhad (“TAS” or “the Company”) wishes to announce that TA Ventures (L) Ltd (“TAV”), a wholly owned subsidiary of the Company, had on 17 July 2020 signed Termination Agreements with Guangzhou Hangtong Shipbuilding and Shipping Co. Ltd. (“HangTong”) and Jiangmen Hangtong Shipbuilding Co. Ltd. (“Jiangmen”) where all parties mutually agreed to terminate the respective shipbuilding contracts for 16 vessels.

TAV, HangTong and Jiangmen mutually agreed that upon execution of the said Termination Agreements, all parties shall irrevocably and unconditionally release and discharge each parties from all obligations, liabilities, claims and demand of the past, present and future in connection with the said shipbuilding contracts.

The termination of the shipbuilding contracts are based on mutual agreement between TAV, HangTong and Jiangmen after taking into consideration the following factors : 1. The low oil price had resulted in a decrease in demand of the offshore support vessels and adversely affected the sale of this type of vessel. 2. The onset of COVID-19 pandemic and its global spread has exacerbated the subdued demand of oil and will have a significant negative impact on oil price.

The Termination Agreements will have material effect on the net asset per share and earnings per share of TAS. However, it will not have any material impact on the going concern of TAS.

None of the Directors and/or major shareholders of TAS and/or persons connected with them has any interest, whether direct or indirect, in the Termination Agreements.

This announcement is dated 17 July 2020.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-11-2020 09:22 AM

|

显示全部楼层

发表于 6-11-2020 09:22 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 22-11-2020 07:44 AM

|

显示全部楼层

发表于 22-11-2020 07:44 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 May 2020 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 May 2020 | 31 May 2019 | 31 May 2020 | 31 May 2019 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 1,687 | 3,401 | 16,182 | 36,880 | | 2 | Profit/(loss) before tax | -69,366 | 3,702 | -75,220 | 5,345 | | 3 | Profit/(loss) for the period | -69,207 | 3,001 | -75,244 | 3,989 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -69,207 | 3,001 | -75,244 | 3,989 | | 5 | Basic earnings/(loss) per share (Subunit) | -39.45 | 1.71 | -42.89 | 2.27 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4893 | 0.9251

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-3-2021 05:11 AM

|

显示全部楼层

发表于 15-3-2021 05:11 AM

|

显示全部楼层

本帖最后由 icy97 于 4-10-2021 07:21 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Aug 2020 |

| INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Aug 2020 | 31 Aug 2019 | 31 Aug 2020 | 31 Aug 2019 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 3,184 | 6,835 | 3,184 | 6,835 | | 2 | Profit/(loss) before tax | -1,682 | 566 | -1,682 | 566 | | 3 | Profit/(loss) for the period | -1,720 | 381 | -1,720 | 381 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -1,720 | 381 | -1,720 | 381 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.98 | 0.22 | -0.98 | 0.22 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4993 | 0.4912

|

SUMMARY OF KEY FINANCIAL INFORMATION

30 Nov 2020 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Nov 2020 | 30 Nov 2019 | 30 Nov 2020 | 30 Nov 2019 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 3,347 | 6,172 | 6,531 | 13,007 | | 2 | Profit/(loss) before tax | -2,198 | -843 | -3,880 | -276 | | 3 | Profit/(loss) for the period | -2,194 | -857 | -3,914 | -475 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -2,194 | -857 | -3,914 | -475 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.25 | -0.49 | -2.23 | -0.27 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4969 | 0.4912

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-11-2021 07:35 AM

|

显示全部楼层

发表于 10-11-2021 07:35 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Aug 2021 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Aug 2021 | 31 Aug 2020 | 31 Aug 2021 | 31 Aug 2020 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 8,925 | 3,184 | 8,925 | 3,184 | | 2 | Profit/(loss) before tax | 237 | -1,682 | 237 | -1,682 | | 3 | Profit/(loss) for the period | -94 | -1,720 | -94 | -1,720 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -94 | -1,720 | -94 | -1,720 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.05 | -0.98 | -0.05 | -0.98 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.5315 | 0.5321

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-9-2023 12:00 AM

|

显示全部楼层

发表于 29-9-2023 12:00 AM

|

显示全部楼层

Entitlement subject | Interim Dividend | Entitlement description | Interim Single Tier Dividend of one sen per ordinary share in respect of the financial year ending 31 May 2024 | Ex-Date | 11 Oct 2023 | Entitlement date | 12 Oct 2023 | Entitlement time | 5:00 PM | Financial Year End | 31 May 2024 | Period |

| | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Payment Date | 30 Oct 2023 | a.Securities transferred into the Depositor's Securities Account before 4:30 pm in respect of transfers | 12 Oct 2023 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units)

(If applicable) |

| | Entitlement indicator | Currency | Announced Currency | Malaysian Ringgit (MYR) | Disbursed Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | Malaysian Ringgit (MYR) 0.0100 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-4-2024 07:37 AM

|

显示全部楼层

发表于 3-4-2024 07:37 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | SHIPBUILDING CONTRACTS FOR TWO UNITS OF TUGBOATS | The Board of Directors of TAS Offshore Berhad ("TAS") is pleased to announce that its wholly-owned subsidiary has secured shipbuilding contracts for two units of tugboat with a total value of approximately RM15.3 million.

The contracts were signed with an existing customer from Indonesia. These vessels are expected to be delivered in the third quarter of 2025.

The revenue generated from the contract is expected to contribute positively to the earnings and net assets of TAS Group for the financial year ending 31 May 2026.

None of the Directors and/or major shareholders of TAS Offshore Berhad or persons connected to them have any interest, direct or indirect, in the above contracts.

This announcement is dated 2 April 2024. |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|