|

|

发表于 4-3-2017 05:58 AM

|

显示全部楼层

发表于 4-3-2017 05:58 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2016 | 31 Dec 2015 | 31 Dec 2016 | 31 Dec 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 352,607 | 341,032 | 1,500,006 | 1,497,810 | | 2 | Profit/(loss) before tax | 6,792 | 4,549 | 27,012 | 22,655 | | 3 | Profit/(loss) for the period | 4,860 | 2,023 | 20,366 | 14,555 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 4,886 | 2,023 | 20,392 | 14,555 | | 5 | Basic earnings/(loss) per share (Subunit) | 7.10 | 2.95 | 29.74 | 21.26 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.3800 | 4.2600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-4-2017 02:58 AM

|

显示全部楼层

发表于 14-4-2017 02:58 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | HARRISONS HOLDINGS (MALAYSIA) BERHAD ("The Company" or "HHMB")- PROPOSED FINAL SINGLE-TIER DIVIDEND OF 25 SEN PER ORDINARY SHARE IN RESPECT OF THE FINANCIAL YEAR ENDED 31 DECEMBER 2016 | The Board of Directors of the Company is pleased to announce that the Company intends to seek the approval from its shareholders for Proposed Final Single-Tier Dividend of 25 sen per ordinary share in respect of the financial year ended 31 December 2016 at the forthcoming Annual General Meeting.

The dividend entitlement and payment dates will be announced in due course.

This announcement is dated 12 April 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-5-2017 05:28 AM

|

显示全部楼层

发表于 1-5-2017 05:28 AM

|

显示全部楼层

| HARRISONS HOLDINGS (MALAYSIA) BERHAD |

EX-date | 28 Jun 2017 | Entitlement date | 30 Jun 2017 | Entitlement time | 05:00 PM | Entitlement subject | Final Dividend | Entitlement description | Final Single Tier Dividend of 25 cents per ordinary share in respect of the financial year ended 31 December 2016 | Period of interest payment | to | Financial Year End | 31 Dec 2016 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SECTRARS MANAGEMENT SDN BHDLot 9-7, Menara Sentral VistaNo. 150, Jalan Sultan Abdul SamadBrickfields50470 Kuala LumpurTel:03-22766138Fax:03-22766131 | Payment date | 14 Jul 2017 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 30 Jun 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.25 | Par Value | Malaysian Ringgit (MYR) 0.000 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-5-2017 02:26 AM

|

显示全部楼层

发表于 29-5-2017 02:26 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2017 | 31 Mar 2016 | 31 Mar 2017 | 31 Mar 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 429,222 | 412,781 | 429,222 | 412,781 | | 2 | Profit/(loss) before tax | 8,362 | 7,996 | 8,362 | 7,996 | | 3 | Profit/(loss) for the period | 6,319 | 5,744 | 6,319 | 5,744 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 6,347 | 5,744 | 6,347 | 5,744 | | 5 | Basic earnings/(loss) per share (Subunit) | 9.27 | 8.39 | 9.27 | 8.39 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.4800 | 4.3900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-8-2017 12:34 AM

|

显示全部楼层

发表于 29-8-2017 12:34 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2017 | 30 Jun 2016 | 30 Jun 2017 | 30 Jun 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 380,132 | 372,466 | 809,354 | 785,247 | | 2 | Profit/(loss) before tax | 8,379 | 6,325 | 16,741 | 14,321 | | 3 | Profit/(loss) for the period | 6,149 | 5,243 | 12,468 | 10,987 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 6,172 | 5,243 | 12,519 | 10,987 | | 5 | Basic earnings/(loss) per share (Subunit) | 9.01 | 7.66 | 18.28 | 16.05 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.5700 | 4.3900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-10-2017 12:41 AM

|

显示全部楼层

发表于 31-10-2017 12:41 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 26-11-2017 06:12 AM

|

显示全部楼层

发表于 26-11-2017 06:12 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | HARRISONS HOLDINGS (MALAYSIA) BERHAD ("HARRISONS" OR "THE COMPANY")- ACQUISITION OF SHARES IN MARCA PRIVADA SDN. BHD. BY HARRISONS PENINSULAR SDN. BHD., A WHOLLY-OWNED SUBSIDIARY OF HARRISONS | Further to the Company’s announcement made on 9 August 2016, the Board of Directors of Harrisons is pleased to announce that Harrisons Peninsular Sdn. Bhd. (“HPSB”), a wholly-owned subsidiary of the Company, had on 22 November 2017 acquired 80,000 ordinary shares representing 40% of the total issued and paid-up share capital of Marca Privada Sdn. Bhd. (Company No. 1187007-M) (“Marca”), for a total cash consideration of RM2.00 (Ringgit Malaysia two) from Chui Ah Hock and Ngu Ting Sii (“Acquisition of Shares”).

In consequent thereto, Marca shall become a wholly-owned subsidiary of HPSB.

Marca has an issued and paid-up share capital of RM200,000.00 comprising 200,000 ordinary shares. Marca is currently dormant and its intended principal activities were procurement and marketing of consumer products.

The Acquisition of Shares have no material effect on earnings per share nor net assets per share of Harrisons Group for the financial year ending 31 December 2017.

None of the Directors and/or Major Shareholders of the Company and/or persons connected with Directors and/or Major Shareholders has any interest, direct or indirect, in the Acquisition of Shares.

This announcement is dated 22 November 2017.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-12-2017 02:38 AM

|

显示全部楼层

发表于 2-12-2017 02:38 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 376,827 | 362,152 | 1,186,181 | 1,147,399 | | 2 | Profit/(loss) before tax | 6,363 | 5,899 | 23,104 | 20,220 | | 3 | Profit/(loss) for the period | 4,686 | 4,519 | 17,154 | 15,506 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 4,688 | 4,519 | 17,207 | 15,506 | | 5 | Basic earnings/(loss) per share (Subunit) | 6.85 | 6.60 | 25.13 | 22.64 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.3900 | 4.3900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-2-2018 05:40 AM

|

显示全部楼层

发表于 27-2-2018 05:40 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 364,566 | 352,599 | 1,550,747 | 1,499,998 | | 2 | Profit/(loss) before tax | 5,007 | 6,761 | 28,111 | 26,981 | | 3 | Profit/(loss) for the period | 4,101 | 5,018 | 21,255 | 20,524 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 4,048 | 5,044 | 21,255 | 20,550 | | 5 | Basic earnings/(loss) per share (Subunit) | 5.91 | 7.37 | 31.04 | 30.01 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.4500 | 4.3900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-3-2018 06:56 AM

|

显示全部楼层

发表于 9-3-2018 06:56 AM

|

显示全部楼层

本帖最后由 icy97 于 13-3-2018 04:29 AM 编辑

1美元全購Watts Harrisons 哈禮盛需承擔債務

2018年3月05日

(吉隆坡5日訊)哈禮盛(HARISON,5008,主要板貿服)收購Watts Harrisons私人有限公司全數股權,並可通過后者持有的特許經營品牌開拓另一個分銷模式,開啟零售領域業務。

該公司向馬證交所報備,與賣家日本Watt公司簽署買賣協議,收購價為1美元(約3.91令吉)。不過,如果在收購完成時Watts Harrisons沒有足夠現金,哈禮盛需代Watts Harrisons支付其余未償還債務。

根據Watts Harrisons截至去年5月底經審核賬目,其銀行戶頭共有193萬3308令吉現金,但拖欠Watt公司232萬5412令吉的未償債務。同時,Watts Harrisons淨虧244萬1390令吉,淨有形資產值為178萬2809令吉,估計哈禮盛有約87萬8000令吉的負商譽價值。

上述收購活動有助哈禮盛擴展分銷網絡至國外,包括新加坡、汶萊、印尼和中國其他地區,實現擴展業務至海外的策略。目前,哈禮盛已在新加坡和汶萊營運。【中国报财经】

Type | Announcement | Subject | OTHERS | Description | PROPOSED ACQUISITION BY HARRISONS PENINSULAR SDN BHD ("HPSB") (COMPANY NO: 3321-M), A WHOLLY-OWNED SUBSIDIARY OF HARRISONS HOLDINGS (MALAYSIA) BERHAD ("HARRISONS" OR "THE COMPANY"), OF ONE HUNDRED PERCENT (100%) EQUITY INTERESTS IN WATTS HARRISONS SDN BHD ("WHSB") (COMPANY NO: 101904-A) | The Board of HARRISONS is pleased to announce that HPSB, a wholly-owned subsidiary of the Company has on 5 March 2018 entered into a Share Purchase Agreement with Watts Co Ltd. , Japan (Company No 4120001106103), for the acquisition of 8,500,000 ordinary shares of WHSB representing 100% of the equity of WHSB.

Please refer to the attachment for further details.

This announcement is dated 5 March 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5714277

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-4-2018 01:37 AM

|

显示全部楼层

发表于 7-4-2018 01:37 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PROPOSED ACQUISITION BY HARRISONS PENINSULAR SDN BHD ("HPSB") (COMPANY NO.: 3321-M), A WHOLLY-OWNED SUBSIDIARY OF HARRISONS HOLDINGS (MALAYSIA) BERHAD ("HARRISONS" OR "THE COMPANY"), OF ONE HUNDRED PERCENT (100%) EQUITY INTERESTS IN WATTS HARRISONS SDN. BHD. ("WHSB") (COMPANY NO.: 1019104-A) | Unless otherwise stated, the abbreviations and definitions used throughout this announcement shall bear the same as those defined in the Announcement.

We refer to the announcement dated 5 March 2018 ("Announcement").

The Board of HARRISONS wishes to announce that the Proposed Acquisition has been completed on 5 April 2018 in accordance with the terms and conditions of the Share Purchase Agreement.

This announcement is dated 6 April 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-4-2018 05:33 AM

|

显示全部楼层

发表于 21-4-2018 05:33 AM

|

显示全部楼层

| HARRISONS HOLDINGS (MALAYSIA) BERHAD |

EX-date | 27 Jun 2018 | Entitlement date | 29 Jun 2018 | Entitlement time | 05:00 PM | Entitlement subject | Final Dividend | Entitlement description | Final Single Tier Dividend of 20 cents per ordinary share in respect of the financial year ended 31 December 2017 | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | Lot 9-7, Menara Sentral VistaNo. 150, Jalan Sultan Abdul SamadBrickfields50470Kuala LumpurTel:0322766138Fax:0322766131 | Payment date | 13 Jul 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 29 Jun 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.2 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-5-2018 12:10 AM

|

显示全部楼层

发表于 2-5-2018 12:10 AM

|

显示全部楼层

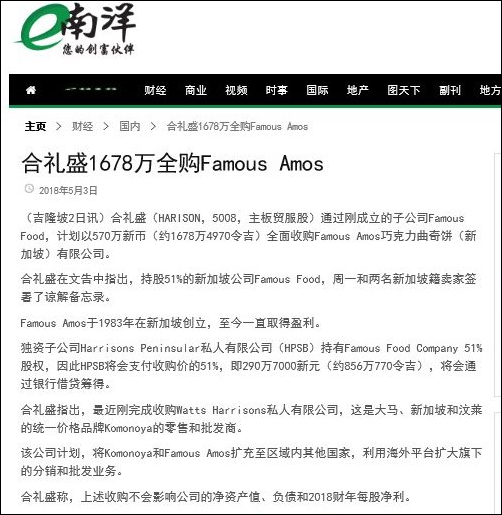

Type | Announcement | Subject | OTHERS | Description | HARRISONS HOLDINGS (MALAYSIA) BERHAD ("HARRISONS" OR "THE COMPANY") - SUBSCRIPTION FOR SHARES IN A NEWLY INCORPORATED COMPANY.SUBSCRIPTION OF SHARES IN A NEWLY INCORPORATED COMPANY BY HARRISONS PENINSULAR SDN BHD ("HPSB") (COMPANY NO: 3321-M), A WHOLLY-OWNED SUBSIDIARY OF HARRISONS HOLDINGS (MALAYSIA) BERHAD ("HARRISONS" OR "THE COMPANY") | The Board of Directors of HARRISONS wishes to announce that the Company through its wholly-owned subsidiary, HPSB has paid a subscription of SGD1,020 for 1,020 ordinary shares representing 51% equity interest in a newly incorporated company, Famous Food Company Pte Ltd (“Famous Food”) in Singapore.

The issued and paid up share capital of Famous Food is SGD2,000 comprising of 2,000 ordinary shares.

One ordinary share in Famous Food is held by Mr Chan Poh Kim, the Group Managing Director of the Company.

The other parties who have subscribed for the ordinary shares of Famous Food are Ms Stephanie Liang Su Ling – 200 ordinary shares (representing 10% equity interest); Ms Chia Eng Hong – 40 ordinary shares (representing 2% equity interest) and Ms Maung Lay Naing – 739 shares (representing 36.95 equity interest).

The intended principal activity of Famous Food is investment holding.

The Directors of Famous Food are Mr Chan Poh Kim, Mr Low Kong Choon and Mr David Chan Jun Hao.

The Incorporation has no material effect on the earnings per share, net assets per share, gearing, share capital and the substantial shareholders’ shareholdings of the Company for the financial year ending 31 December 2018.

None of the Directors and/or major shareholders of the Company or persons connected with them have any interest, direct or indirect, in the newly incorporated company.

This announcement is dated 26 April 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-5-2018 02:56 AM

|

显示全部楼层

发表于 9-5-2018 02:56 AM

|

显示全部楼层

本帖最后由 icy97 于 11-5-2018 02:28 AM 编辑

Type | Announcement | Subject | MEMORANDUM OF UNDERSTANDING | Description | MEMORANDUM OF UNDERSTANDING BETWEEN FAMOUS FOOD COMPANY PTE LTD (FFC) (COMPANY NO: 201813437M), A FIFTY ONE PERCENT (51%) INDIRECT SUBSIDIARY OF HARRISONS HOLDINGS (MALAYSIA) BHD (HARRISONS OR THE COMPANY), TO ACQUIRE ONE HUNDRED PERCENT (100%) EQUITY INTERESTS IN FAMOUS AMOS CHOCOLATE CHIP COOKIE SINGAPORE PTE LTD [UEN 198205269K] (AMOS)(PROPOSED TRANSACTION) | Further to the announcement on 26 April 2018, the Board of HARRISONS is pleased to announce that FFC, a 51% indirect owned subsidiary of the Company has on 30 April 2018 entered into a Memorandum of Understanding (“MOU”) with SHIAK ESA BIN TAHA MATTAR (NRIC NO. S0143148Z) and YEO GEOK CHOE (NRIC NO. S0078064B) both of 12 Namly Garden, Shamrock Park Singapore 267341 and ANNE LEONG SAU LENG of 5 Lorong Buluh Perindu Dua SA, off Jalan Damansara, Kuala Lumpur, Malaysia respectively, collectively known as the (“SELLERS”), for the acquisition of 800,000 ordinary shares of AMOS representing 100% of the equity of AMOS (“Sale Shares”).

The details of the announcement is as per attached.

This announcement is dated 2 May 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5782253

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-5-2018 01:45 AM

|

显示全部楼层

发表于 30-5-2018 01:45 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 430,479 | 429,222 | 430,479 | 429,222 | | 2 | Profit/(loss) before tax | 8,284 | 8,362 | 8,284 | 8,362 | | 3 | Profit/(loss) for the period | 5,887 | 6,319 | 5,887 | 6,319 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,887 | 6,347 | 5,887 | 6,347 | | 5 | Basic earnings/(loss) per share (Subunit) | 8.60 | 9.27 | 8.60 | 9.27 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.5400 | 4.4500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-8-2018 05:15 AM

|

显示全部楼层

发表于 30-8-2018 05:15 AM

|

显示全部楼层

本帖最后由 icy97 于 4-9-2018 02:18 AM 编辑

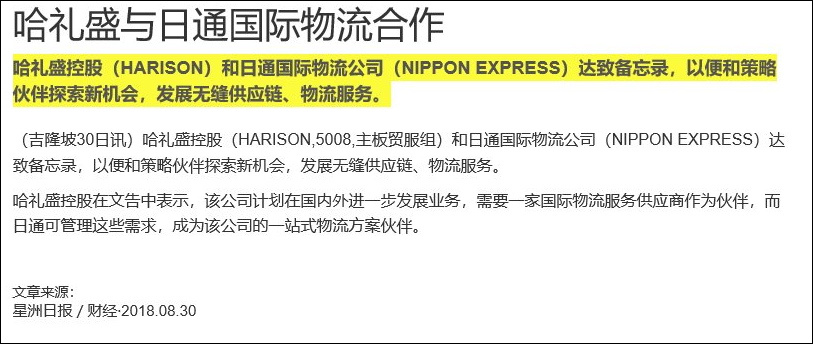

Type | Announcement | Subject | MEMORANDUM OF UNDERSTANDING | Description | HARRISONS HOLDINGS (MALAYSIA) BERHAD ("HARRISONS" OR THE "COMPANY")MEMORANDUM OF UNDERSTANDING ("MOU") WITH NIPPON EXPRESS (MALAYSIA) SDN. BHD. ("NEM") | The Board of Directors of the Company wishes to announce that the Company had on 27 August 2018 entered into a Memorandum of Understanding (“MOU”) with NEM to explore partnership in developing seamless supply chain/logistic services.

Please refer to the attachment for details of the announcement.

This announcement is dated 28th August 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5895817

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 04:50 AM

|

显示全部楼层

发表于 31-8-2018 04:50 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 388,768 | 380,132 | 819,247 | 809,354 | | 2 | Profit/(loss) before tax | 7,942 | 8,379 | 16,226 | 16,741 | | 3 | Profit/(loss) for the period | 6,063 | 6,149 | 11,950 | 12,468 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 6,063 | 6,172 | 11,950 | 12,519 | | 5 | Basic earnings/(loss) per share (Subunit) | 8.85 | 9.01 | 17.45 | 18.28 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.6200 | 4.4500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-9-2018 05:43 AM

|

显示全部楼层

发表于 28-9-2018 05:43 AM

|

显示全部楼层

本帖最后由 icy97 于 8-10-2018 01:56 AM 编辑

ype | Announcement | Subject | MEMORANDUM OF UNDERSTANDING | Description | SALES AND PURCHASE AGREEMENT (SPA) BETWEEN FAMOUS FOOD COMPANY PTE LTD (FFC) (COMPANY NO: 201813437M), AN INDIRECT SUBSIDIARY OF HARRISONS HOLDINGS (MALAYSIA) BHD (HARRISONS OR THE COMPANY), TO ACQUIRE ONE HUNDRED PERCENT (100%) EQUITY INTERESTS IN FAMOUS AMOS CHOCOLATE CHIP COOKIE SINGAPORE PTE LTD [UEN 198205269K] (AMOS) (PROPOSED TRANSACTION) | Further to the announcement made on 26 April 2018, 2 May 2018 and 29 August 2018, the Board of Directors of the Company wishes to announce that FFC, an indirect owned subsidiary of the Company has on 27 September 2018 entered into a Sales and Purchase Agreement (“SPA”) with SHAIKH ESA BIN TAHA MATTAR (Singapore NRIC NO. S0143148Z) and YEO GEOK CHOE (Singapore NRIC NO. S0078064B) both of 12 Namly Garden, Shamrock Park Singapore 267341, collectively known as the sellers for the acquisition of 800,000 ordinary shares of AMOS representing 100% of the equity of AMOS ("Sale Shares").

The details of the announcement is as per attached.

This announcement is dated 27 September 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5925781

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-10-2018 05:09 AM

|

显示全部楼层

发表于 3-10-2018 05:09 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | HARRISONS HOLDINGS (MALAYSIA) BERHAD- SALES AND PURCHASE AGREEMENT (SPA) BETWEEN FAMOUS FOOD COMPANY PTE LTD (FFC) (COMPANY NO: 201813437M), AN INDIRECT SUBSIDIARY OF HARRISONS HOLDINGS (MALAYSIA) BHD (HARRISONS OR THE COMPANY), TO ACQUIRE ONE HUNDRED PERCENT (100%) EQUITY INTERESTS IN FAMOUS AMOS CHOCOLATE CHIP COOKIE SINGAPORE PTE LTD [UEN 198205269K] (AMOS) (PROPOSED TRANSACTION) | Reference is made to the announcements dated 26 April 2018, 2 May 2018, 29 August 2018 and 27 September 2018 (“Earlier Announcements”). Unless otherwise stated, the terms used herein shall have the same meaning as defined in the earlier announcements.

The Board of Directors of the Company wishes to further provide the following additional information pertaining to the PROPOSED TRANSACTION:

1. BASIS AND JUSTIFICATION OF PURCHASE PRICE The Purchase Price for the PROPOSED TRANSACTION was derived based on a “willing-buyer willing-seller basis” after taken into consideration of the followings: (i) The financial position of AMOS based on its audited financial statements as at 30 September 2017; and (ii) The value of the “Famous Amos” brand and the future potential earnings of the business.

The Price/ Earnings Ratio of 7.85 times is derived from the Purchase Price of SGD5,700,000 and the audited profits after tax of AMOS as at 30 September 2017 of SGD726,319.

The average Price/ Earnings Ratio of the public companies listed in the Singapore Stock Exchange in the retail/food and beverage industry is 22 times. (Source: Bloomberg)

Based on this comparison, the Price/ Earnings Ratio of 7.85 times is within the range of the retail/food and beverage industry.

2. PROSPECTS The Vendors of AMOS are selling 80% equity interest now and retaining 20% equity interest for up to another 3 years. Although the Vendors are very experienced and reputable in this industry, being in their 70’s, they are not so active and energetic in expanding the brand and growing the business. HARRISONS believe there is further potential room for growth for AMOS in Singapore with the injection of a new dynamic management and marketing team.

HARRISONS sees a further growth for expansion of this 35 years old established international brand through more concerted marketing efforts, adding new outlets in Singapore and developing new business models like shop-in-shop concept, cinema vending models, on-line sales, strategising corporate sales and through offering exciting new range of products like cookies-based ice-cream and beverages. HARRISONS also expect growth to come from expansion into new geographical regions.

This announcement is dated 1 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-10-2018 04:51 AM

|

显示全部楼层

发表于 11-10-2018 04:51 AM

|

显示全部楼层

Type | Announcement | Subject | MEMORANDUM OF UNDERSTANDING | Description | HARRISONS HOLDINGS (MALAYSIA) BERHAD (HARRISONS OR COMPANY)- SALES AND PURCHASE AGREEMENT (SPA) BETWEEN FAMOUS FOOD COMPANY PTE LTD (FFC) (COMPANY NO: 201813437M), AN INDIRECT SUBSIDIARY OF HARRISONS HOLDINGS (MALAYSIA) BHD (HARRISONS OR THE COMPANY), TO ACQUIRE ONE HUNDRED PERCENT (100%) EQUITY INTERESTS IN FAMOUS AMOS CHOCOLATE CHIP COOKIE SINGAPORE PTE LTD [UEN 198205269K] (AMOS) (PROPOSED TRANSACTION) | Reference is made to the announcements dated 26 April 2018, 2 May 2018, 29 August 2018, 27 September 2018 and 1 October 2018 (“Earlier Announcements”). Unless otherwise stated, the terms used herein shall have the same meaning as defined in the earlier announcements.

The Board of Directors of the Company wishes to announce that the PROPOSED TRANSACTION has been duly completed on 8 October 2018.

This announcement is dated 8 October 2018. |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|