|

|

楼主 |

发表于 18-7-2008 08:08 PM

|

显示全部楼层

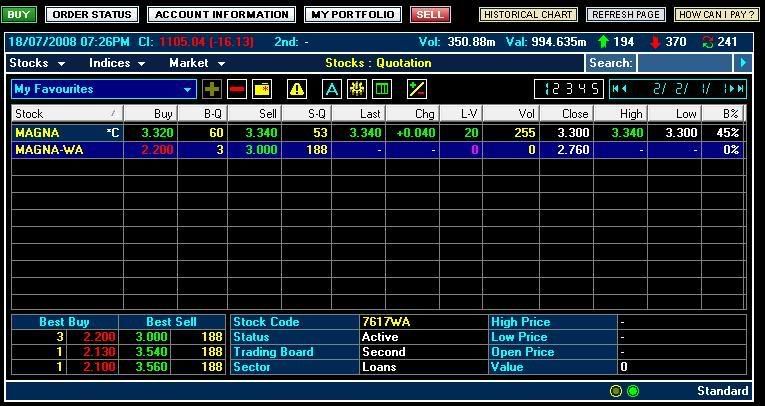

最近閒著也是閒著,這三天搬股票出來曬下太陽,每排188張

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-7-2008 12:58 AM

|

显示全部楼层

发表于 19-7-2008 12:58 AM

|

显示全部楼层

回复 201# blackcat98 的帖子

未来1-2年产业股将会进入衰退期,任何average down的作法都有可能是自寻短剑。时间也是warrant重要的价值之一。

你已经来到了非常严重的危险期,如果再不认真小心的看待市场的变化,有可能会很糟糕。自己小心,博太大时如果一个不顺手会死得很惨,小心为上。现在你的情况已经来到危机,如果市场或经济并没有像你那样的想法来运动,那么你随时可能会来到非常严重的问题。

warrant + loan的gearing是可以大到将一个人变破产的。不知道什么是风险的人迟早将会经历一场大风暴。谨慎,谨慎。讲完了。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 20-7-2008 01:37 PM

|

显示全部楼层

发表于 20-7-2008 01:37 PM

|

显示全部楼层

原帖由 blackcat98 于 16-10-2007 06:49 PM 发表

warrant平均買進價-->$1.34

原帖由 blackcat98 于 20-10-2007 11:09 AM 发表

04.09.2007

買進...買進...再買進

如我之前所講magna prima是一間小型建築二板股,capital issue也少的很可憐5千萬,孩子2千萬

決定了目標後,我分別在1.04,1.05,1.08,分批買進一直到1.23,孩子升到1.24後又在跌回最低1.00我再一次補進,由於孩子和媽媽交易量都很少,所以這期間為了避免會引起其他的investor注意力,我必須小心翼翼地進貨...

黑猫兄,

我看你应该还有赚吧?我觉得现在不应买进,反而应该卖出一些持股才是。请考虑考虑。

| Last Done | 3.340 | | Change | 0.040 | | Day High | 3.340 | | Day Low | 3.300 | | Best Buy | 3.320 | | Best Sell | 3.340 | | Volume(Lot) | 255 |

| MAGNA-WA | | (7617WA) 21:23:07 | |

| Last Done | 0.000 | | Change | 0.000 | | Day High | 0.000 | | Day Low | 0.000 | | Best Buy | 2.200 | | Best Sell | 3.000 | | Volume(Lot) | 0 |

[ 本帖最后由 Mr.Business 于 20-7-2008 01:41 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 23-7-2008 12:34 PM

|

显示全部楼层

发表于 23-7-2008 12:34 PM

|

显示全部楼层

新闻。

22-07-2008: Magna Prima’s The Avare earns recognition

KUALA LUMPUR: Magna Prima Bhd’s The Avare has earned recognition at the CNBC Asia Property Awards 2008 under the category of Best High-Rise Development for Asia Pacific, in a gala dinner to be held in Singapore on Sunday.

In a statement yesterday, Magna Prima said the award was proof that Malaysia could not only compete but also triumph within the highly-competitive Asia Pacific property arena.

It is recognition for The Avare, a 78-unit super luxurious residential condominium in the heart of Kuala Lumpur, featuring exclusive units with built-ups ranging from 3,800 sq ft to almost 7,700 sq ft and sold at a minimum price of RM1,350 psf.

Magna Prima said the last unit of the much sought-after property was sold at RM2,100 psf, taking the gross development value of the project to RM325 million. The Avare was completely sold in November 2007 and would be completed in October this year.

Magna Prima chief executive officer Lim Ching Choy said: “We are grateful to be recognised for our development on an international level. As a developer that is setting global standards, we will continue to strive to live up to our buyers’ expectations by offering quality development.”

http://www.theedgedaily.com/cms/ ... a-d964af00-46b07b54 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 23-7-2008 09:27 PM

|

显示全部楼层

原帖由 Mr.Business 于 23-7-2008 12:34 PM 发表

新闻。

22-07-2008: Magna Prima’s The Avare earns recognition

KUALA LUMPUR: Magna Prima Bhd’s The Avare has earned recognition at the CNBC Asia Property Awards 2008 under the category of Best H ...

恭喜恭喜,希望明年繼續拿到2009年.

黑猫兄,

我看你应该还有赚吧?我觉得现在不应买进,反而应该卖出一些持股才是。请考虑考虑。

賣?算了吧!反正現在要賣也賣不出,現在我在盤算著看還能不能再借多一筆.

[ 本帖最后由 blackcat98 于 23-7-2008 09:30 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 23-7-2008 09:38 PM

|

显示全部楼层

原帖由 8years 于 19-7-2008 12:58 AM 发表

未来1-2年产业股将会进入衰退期,任何average down的作法都有可能是自寻短剑。时间也是warrant重要的价值之一。

你已经来到了非常严重的危险期,如果再不认真小心的看待市场的变化,有可能会很糟糕。自己小心,博 ...

謝謝你的勸告,但是我還是一意孤行,持終相信自己的眼光! |

|

|

|

|

|

|

|

|

|

|

|

发表于 24-7-2008 08:29 AM

|

显示全部楼层

发表于 24-7-2008 08:29 AM

|

显示全部楼层

黑猫兄,让我这失败者再多事给你一个个人参考建议,

有信心是好事,但是我觉得投资有异于个人主导,

所以不管信心有多大,组合的存在我觉得是必需的,

最多是占据较大的比例,至于比例多寡则因人而异,

否则无异于赌博,

我担心你在这样的情况底下成功了,

也许一次两次三次甚至很多很多次,

次次一年开一番甚至两番,

到了最后成了你的信念,

这样是对的,这样下去我就能高枕无忧了,

甚至有许多幻想(不要说不可能哦,信心这东西很奇妙的)

但是只要有一次,只需要一次的失败搞不好就足以让你万劫不复了,

愿深思

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-8-2008 11:34 PM

|

显示全部楼层

原帖由 悶蛋 于 24-7-2008 08:29 AM 发表

黑猫兄,让我这失败者再多事给你一个个人参考建议,

有信心是好事,但是我觉得投资有异于个人主导,

所以不管信心有多大,组合的存在我觉得是必需的,

最多是占据较大的比例,至于比例多寡则因人而异,

否则无异 ...

你的勸告我收到了,你講的組合的必要讓我想起彼得雞蛋放在籃子的論理,

雞蛋和籃子的比例不是重點,如果你看過他的書相信你應該知道我講甚麼

大家的忠言,黑貓心領了

[ 本帖最后由 blackcat98 于 19-8-2008 11:39 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-8-2008 11:36 PM

|

显示全部楼层

| Proposed acquisition | | MAGNA PRIMA BERHAD (“MPB” or “Company”)

Proposed acquisition by Magna City Development Sdn Bhd (formerly known as Magna

Quarry Services Sdn Bhd), a wholly owned subsidiary of Magna Prima Construction

Sdn Bhd which is in turn a wholly owned subsidiary of MPB of two (2) parcels of

freehold land held under Geran Mukim No. Hakmilik 1343 and 1344 with Lot 1075

and 1073 respectively all in the Mukim of Batu and Tempat Bangkong and District

of Kuala Lumpur and State of Wilayah Persekutuan of a total area measuring

approximately 10.23 acres for a total cash consideration of RM57,930,444

(“Proposed Acquisition”)

We refer to the announcements dated 2 November 2007, 6 November 2007, 19

December 2007, 7 January 2008 and 26 February 2008 in relation to the Proposed

Acquisition.

On behalf of the Board of Directors of MPB, HwangDBS Investment Bank Berhad

wishes to announce that the Company and the Vendor, Muafakat Baru Sdn Bhd, have

mutually agreed to an extension of time of four (4) months until 19 December

2008 to complete the Proposed Acquisition.

This announcement is dated 19 August 2008.

|

19/08/2008 05:57 PM |

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-8-2008 12:10 AM

|

显示全部楼层

发表于 20-8-2008 12:10 AM

|

显示全部楼层

原帖由 blackcat98 于 23-7-2008 09:38 PM 发表

謝謝你的勸告,但是我還是一意孤行,持終相信自己的眼光!

哈哈,有信心是好事,沒有信心那更本就不用投資了。

但如要 average down 那就是這個投資出了一點點的問題了。

所以如真的要 average down 那就把價格和自己持票的價格要有相差 30 % 以上,那會是比較安全。

有信心是好事,是好事。

老散我只能醬說。 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-8-2008 09:20 PM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION | 30/06/2008 |

| INDIVIDUAL PERIOD | CUMULATIVE PERIOD | | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | | 30/06/2008 | 30/06/2007 | 30/06/2008 | 30/06/2007 | | RM'000 | RM'000 | RM'000 | RM'000 | | 1 | Revenue | 85,567 | 64,638 | 133,844 | 90,022 | | 2 | Profit/(loss) before tax | 13,156 | 8,729 | 19,169 | 10,820 | | 3 | Profit/(loss) for the period | 8,447 | 5,722 | 13,802 | 6,802 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 8,525 | 5,194 | 13,553 | 6,200 | | 5 | Basic earnings/(loss) per share (sen) | 16.13 | 10.09 | 25.78 | 12.04 | | 6 | Proposed/Declared dividend per share (sen) | 0.00 | 0.00 | 0.00 | 0.00 |

|

|

|

|

|

|

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent (RM) | 1.9600 | 1.7200 |

http://announcements.bursamalaysia.com/EDMS/edmsweb.nsf/LsvAllByID/48256E5D00102DF4482574AC003307A2?OpenDocument |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-8-2008 09:34 PM

|

显示全部楼层

快竣工的avare

21.09.2008

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 22-8-2008 07:17 AM

|

显示全部楼层

18 August 2008: Special Focus: Magna Prima's inspiring transformation

By Chong Jin Hun Email us your feedback at fd@bizedge.com

Investors familiar with Magna Prima Bhd's transformation story would recall an inspiring account. It is, essentially, a story that encapsulates hindsight, foresight and tenacity to see through the new management team's well-crafted strategy. The team has reversed the fortunes of the once loss-making builder-cum-property developer. "Before I joined this company, I did a detailed study... why it was not doing well despite having a few good projects at prime locations. The answer was the people," says Magna Prima executive director and CEO Lim Ching Choy. Analysts hold the management team in high regard. OSK Research Sdn Bhd's analyst Mervin Chow says Magna Prima is expected to benefit from Lim's leadership, given his track record of helming rival Mah Sing Group Bhd's property business and his previous experience as a banker. Furthermore, Magna Prima has capable hands in executive director Datuk Mohamad Rizal Abdullah. His previous stints in construction-related firms, including Road Builder (M) Holdings Bhd, have been helpful in securing infrastructure projects and facilitating land acquisitions. "This new team comprises high-profile individuals. It will be interesting to see how they formulate their strategies to turn Magna Prima around," says OSK Research in a February report. "We expect Magna Prima to register a return on equity of 32.3% and 26.1% in FY2008 and FY2009 respectively, one of the highest in the industry; this shows Magna Prima is able to churn massive earnings from its limited landbank," he adds. Magna Prima topped the construction sector in the KPMG/The Edge Shareholder Value Awards. According to KPMG, the company generated EP of RM17.6 million. Its EP/IC ratio is 13.09%, ahead of Hock Seng Lee Bhd and Mudajaya Group Bhd's 11.93% and 10.99% respectively. "The award is due recognition for the team. We are quite well positioned to leverage local opportunities," says Lim. Magna Prima, which undertakes the construction of bridges and water tanks, has RM663 million worth of building jobs in hand. Its track record includes several highways, such as the North-South Inter-Urban Toll Expressway, the North-South Central Link and the New Klang Valley Expressway. Magna Prima is a niche real estate developer which has plans to develop high-end properties on acquired "pocket-size" urban sites. It has RM2.1 billion worth of property projects in Kuala Lumpur. The Avare, its flagship project in the Kuala Lumpur City Centre, is worth RM321 million. The 41-storey block comprises 78 residential units. The Avare won the CNBC Asia Pacific Property Awards for highrise development category this year. Other projects include the RM209 million Magna Ville condominiums in Selayang and the RM1.1 billion mixed development on Jalan Kuching known as Magna City. The latter comprises shop lots, offices, serviced apartments, a hotel and a retail mall. Magna Prima is also planning to venture abroad in the next three years. Its construction division is expected to spearhead its expansion drive, especially in the Asean high-growth markets. The company's earnings have been increasing since 2006. It posted a net profit of RM118,471 in 2006, recovering from a net loss of RM10.43 million in 2005. In 2007, net profit surged to RM26.58 million. Its earnings continue to climb in current financial year. For 1Q ended March 31, net profit jumped almost fivefold to RM5.03 million, from RM1.01 million a year earlier due to higher contribution from Avare and Magna Ville projects. Revenue expanded 90.2% to RM48.28 million from RM25.38 million. Magna Prima's net profit is forecast to hit RM28.93 million and RM39.23 million in FY2008 and FY2009 respectively, according to average estimates by analysts polled by Bloomberg. Revenue is expected to reach RM350.5 million and RM333.5 million respectively. As of Aug 11, 2008, Magna Prima's share price ended unchanged at RM3.34, valuing the firm at RM178.55 million. The stock hit its one-year high of RM5.65 on Feb 14 after it dipped to a low of RM1.40 on Aug 17 last year. At RM3.34 a share, the stock trades at a price-to-book ratio of 1.95 times, and a price-to-earnings ratio (PER) of 6.47 times FY2007 earnings. This is compared with the average PER of 19.03 times among its peers, and 12.29 times for the Kuala Lumpur Composite Index.

http://www.theedgedaily.com/cms/content.jsp?id=com.tms.cms.article.Article_def1e28a-cb73c03a-df294000-eae745c5 |

|

|

|

|

|

|

|

|

|

|

|

发表于 14-9-2008 03:03 AM

|

显示全部楼层

发表于 14-9-2008 03:03 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 15-9-2008 03:37 PM

|

显示全部楼层

发表于 15-9-2008 03:37 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 15-9-2008 08:22 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 15-9-2008 08:23 PM

|

显示全部楼层

原帖由 vivienne 于 14-9-2008 03:03 AM 发表

原来你有玩股票。。。。。。。

美女,半夜三點還不去睡覺,等下長痘痘 |

|

|

|

|

|

|

|

|

|

|

|

发表于 16-9-2008 11:56 AM

|

显示全部楼层

发表于 16-9-2008 11:56 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 16-9-2008 09:17 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 16-9-2008 09:36 PM

|

显示全部楼层

发表于 16-9-2008 09:36 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|