|

|

发表于 3-8-2018 12:32 AM

|

显示全部楼层

发表于 3-8-2018 12:32 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Private Placement | Details of corporate proposal | PRIVATE PLACEMENT OF NEW ORDINARY SHARES IN BINA PURI HOLDINGS BHD ("BINA PURI") ("BINA PURI SHARES"), REPRESENTING NOT MORE THAN 10% OF THE ENLARGED NUMBER OF ISSUED BINA PURI SHARES (EXCLUDING TREASURY SHARES, IF ANY) ("PRIVATE PLACEMENT") | No. of shares issued under this corporate proposal | 5,466,000 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.2400 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 293,876,650 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 143,449,082.000 | Listing Date | 03 Aug 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-8-2018 07:31 AM

|

显示全部楼层

发表于 30-8-2018 07:31 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

RELATED PARTY TRANSACTIONS | Description | BINA PURI HOLDINGS BERHAD ("BINA PURI" OR THE "COMPANY"):(I) PROPOSED ACQUISITION; AND(II) PROPOSED AMENDMENTS(COLLECTIVELY, REFERRED TO AS THE "PROPOSALS"). | On behalf of the Board of Directors of Bina Puri (“Board”), Affin Hwang Investment Bank Berhad (“Affin Hwang IB”) and AmInvestment Bank Berhad (“AmInvestment Bank”) (collectively, the “Joint Principal Advisers”) wish to announce that the Company and Bina Puri Properties Sdn Bhd (“Bina Puri Properties” and/or the “Purchaser”), a wholly-owned subsidiary of the Company, had, on 28 August 2018, entered into a conditional sale and purchase agreement (“SPA”) for the acquisition of 2,477,108 ordinary shares in Ideal Heights Properties Sdn Bhd (“IHP”) (“IHP Shares”), representing an additional stake of approximately 54.50% equity interest in IHP not already owned by Bina Puri Properties, for a total purchase consideration of RM42,682,343 (“Proposed Acquisition”).

In addition, on behalf of the Board, the Joint Principal Advisers also wish to announce that concurrently with the Proposed Acquisition, the Company proposes to undertake the proposed amendments to the memorandum and articles of association of Bina Puri (“Proposed Amendments”).

Further details of the Proposals are set out in the attachment enclosed.

This announcement is dated 28 August 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5897421

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 02:18 AM

|

显示全部楼层

发表于 31-8-2018 02:18 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 160,416 | 286,708 | 326,987 | 565,741 | | 2 | Profit/(loss) before tax | 5,934 | 1,674 | 12,190 | 4,925 | | 3 | Profit/(loss) for the period | 5,722 | 782 | 9,894 | 2,902 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 178 | -510 | 1,007 | 116 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.06 | -0.19 | 0.37 | 0.05 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.8539 | 0.8771

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-9-2018 07:47 AM

|

显示全部楼层

发表于 25-9-2018 07:47 AM

|

显示全部楼层

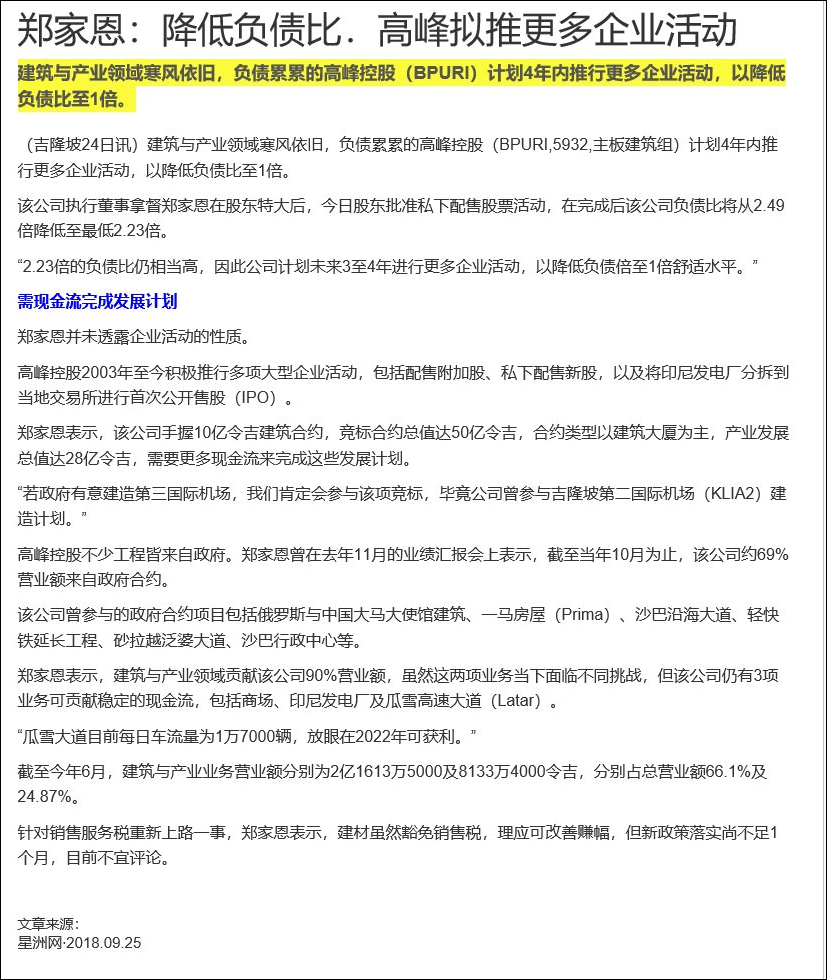

本帖最后由 icy97 于 1-10-2018 05:39 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-10-2018 04:34 AM

|

显示全部楼层

发表于 11-10-2018 04:34 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Private Placement | Details of corporate proposal | PRIVATE PLACEMENT OF NEW ORDINARY SHARES IN BINA PURI HOLDINGS BHD ("BINA PURI") ("BINA PURI SHARES"), REPRESENTING APPROXIMATELY 30% OF THE ENLARGED NUMBER OF ISSUED BINA PURI SHARES (EXCLUDING TREASURY SHARES, IF ANY) ("PRIVATE PLACEMENT") | No. of shares issued under this corporate proposal | 3,000,000 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1900 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 296,876,650 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 144,019,082.000 | Listing Date | 09 Oct 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-10-2018 05:34 AM

|

显示全部楼层

发表于 30-10-2018 05:34 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Private Placement | Details of corporate proposal | PRIVATE PLACEMENT OF NEW ORDINARY SHARES IN BINA PURI HOLDINGS BHD ("BINA PURI") ("BINA PURI SHARES"), REPRESENTING APPROXIMATELY 30% OF THE ENLARGED NUMBER OF ISSUED BINA PURI SHARES (EXCLUDING TREASURY SHARES, IF ANY) ("PRIVATE PLACEMENT") | No. of shares issued under this corporate proposal | 42,900,000 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1710 | Par Value($$) (if applicable) | Malaysian Ringgit (MYR) 0.000 | | Latest issued share capital after the above corporate proposal in the following | Units | 339,776,650 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 151,354,982.000 | Listing Date | 30 Oct 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-11-2018 12:42 AM

|

显示全部楼层

发表于 6-11-2018 12:42 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Disposal of 100% equity interest in Karak Spring Sdn. Bhd. | The Board would like to inform that Bina Puri Holdings Bhd. (“BPHB”) has disposed of 100% equity interest in Karak Spring Sdn. Bhd. (245505-V), comprising one hundred thousand (100,000) ordinary shares for total cash consideration of RM4.00 only. The details are stated below:-

Date of disposal: 31 October 2018

Transferees: Karak Land Sdn. Bhd. (870030-X), an indirect subsidiary of BPHB has purchased 50,000 ordinary shares for RM2.00 only, North Port Bulk Services Sdn. Bhd. (146425-V) has purchased 25,000 ordinary shares for RM1.00 only and Mr. Ng Keong Wee has purchased 25,000 ordinary shares for RM1.00 only.

Karak Spring Sdn. Bhd. has ceased to be a wholly-owned subsidiary of BPHB after the disposal but has become a 50% indirect associated company.

The disposal is not expected to have any material effect on the net assets and earnings of Bina Puri Group for the financial year ending 31 December 2018.

None of the Directors and/or major shareholders of BPHB or persons connected to them have any interests, direct or indirect, in the above transfer. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-11-2018 08:10 AM

|

显示全部楼层

发表于 17-11-2018 08:10 AM

|

显示全部楼层

Type | Announcement | Subject | MULTIPLE PROPOSALS | Description | BINA PURI HOLDINGS BHD ("BINA PURI" OR "COMPANY")(I) PRIVATE PLACEMENT;(II) ESOS TERMINATION; AND(III) NEW SIS(COLLECTIVELY REFERRED TO AS THE "PROPOSALS") | We refer to the announcements made on 24 May 2018, 25 May 2018, 29 June 2018, 5 July 2018, 11 July 2018, 17 July 2018, 15 August 2018, 16 August 2018, 24 September 2018, 1 October 2018, 8 October 2018, 22 October 2018 and 29 October 2018 in relation to the Proposals (“Announcements”). Unless otherwise defined, the definitions set out in the Announcements shall apply herein.

On behalf of the Board of Directors of Bina Puri, TA Securities wishes to announce that the ESOS has been terminated on 24 September 2018 subsequent to the fulfilment of all the conditions set out in the Existing By-Laws, as the outstanding ESOS options were no longer attractive in view of their exercise prices of RM0.54, RM0.51 or RM0.50 each which are higher than the prevailing market price of Bina Puri Shares. A total of 12,934,850 ESOS options granted under the ESOS were exercised into 12,934,850 new Bina Puri Shares since the ESOS Effective Date up to the termination of the ESOS.

This announcement is dated 5 November 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-1-2019 06:32 AM

|

显示全部楼层

发表于 2-1-2019 06:32 AM

|

显示全部楼层

本帖最后由 icy97 于 11-1-2019 03:56 AM 编辑

第三季房产业推动--高峰净利翻1.7倍

http://www.enanyang.my/news/20181204/第三季房产业推动br-高峰净利翻1-7倍/

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 199,864 | 215,763 | 526,851 | 781,204 | | 2 | Profit/(loss) before tax | 7,854 | 5,393 | 20,044 | 11,018 | | 3 | Profit/(loss) for the period | 3,405 | 3,149 | 13,299 | 6,751 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 782 | 295 | 1,789 | 1,111 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.27 | 0.11 | 0.64 | 0.42 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.8439 | 0.8976

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-1-2019 04:46 AM

|

显示全部楼层

发表于 24-1-2019 04:46 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Private Placement | Details of corporate proposal | PRIVATE PLACEMENT OF NEW ORDINARY SHARES IN BINA PURI HOLDINGS BHD ("BINA PURI") ("BINA PURI SHARES"), REPRESENTING APPROXIMATELY 30% OF THE ENLARGED NUMBER OF ISSUED BINA PURI SHARES (EXCLUDING TREASURY SHARES, IF ANY) ("PRIVATE PLACEMENT") | No. of shares issued under this corporate proposal | 42,262,900 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1530 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 382,039,550 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 157,821,205.700 | Listing Date | 26 Dec 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-2-2019 05:55 AM

|

显示全部楼层

发表于 6-2-2019 05:55 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | ELECTRIFIED DOUBLE TRACK FROM GEMAS TO JOHOR BAHRU- SECTION 4 CIVIL WORKS SITE CLEARANCE AND EMBANKMENT EARTHWORK WITH ALL ASSOCIATED WORKS (SUB-CONTRACT WORKS) | The Board is pleased to announce that Bina Puri Builder Sdn. Bhd., an indirect wholly-owned subsidiary of Bina Puri Holdings Bhd. has accepted the letter of award from Syarikat Pembenaan Yeoh Tiong Lay Sdn. Bhd. on 15 January 2019 where an unincorporated joint venture, Bina Puri – Tim Sekata JV will undertake and complete the sub-contract works for the project known as “Electrified Double Track from Gemas to Johor Bahru (Project)” for sub-contract sum of RM251,531,225.50. The sub-contract works are expected to be completed by 30 April 2020.

With the latest award mentioned above, the Group’s unbuilt book order stands at RM1.145 billion as at to date. This Group anticipates this year to be a challenging year for the construction and property sectors and hopes that the roll out of projects as announced in the budget can be expedited.

The said Project is expected to contribute positively to the net assets and earnings of Bina Puri Group for the financial year ending 31 December 2019.

None of the Directors and/or major shareholders of BPHB or persons connected to them have any interests, direct or indirect, in the above Project.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-3-2019 05:26 AM

|

显示全部楼层

发表于 11-3-2019 05:26 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 183,009 | 316,016 | 709,860 | 1,097,573 | | 2 | Profit/(loss) before tax | 13,075 | 8,648 | 33,119 | 20,224 | | 3 | Profit/(loss) for the period | 6,083 | 5,270 | 19,382 | 12,445 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -1,269 | 1,959 | 520 | 3,312 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.38 | 0.73 | 0.18 | 0.42 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6794 | 0.8933

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-4-2019 06:51 AM

|

显示全部楼层

发表于 15-4-2019 06:51 AM

|

显示全部楼层

Date of change | 31 Mar 2019 | Name | DATO' TAN SENG HU | Age | 42 | Gender | Male | Nationality | Malaysia | Designation | Alternate Director | Directorate | Executive | Type of change | Resignation | Reason | Due to personal committment | Details of any disagreement that he/she has with the Board of Directors | No | Whether there are any matters that need to be brought to the attention of shareholders | No |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information |

Working experience and occupation | Dato' Tan has been involved in the construction industry for more than ten years and is currently managing his ownproject management company since 2006. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-4-2019 07:12 AM

|

显示全部楼层

发表于 19-4-2019 07:12 AM

|

显示全部楼层

Change in Financial Year End

Old financial year end | 31 Dec 2019 | New financial year end | 30 Jun 2019 |

| Remarks : | | The Board of Directors of the Company had approved the change of financial year end of the Company from 31 December to 30 June. The next audited financial statements of the Company shall be for a period of 18 months, from 1 January 2018 to 30 June 2019. Thereafter, the financial year end of the Company shall end on 30 June for each subsequent year.The rational for change in financial year end is due to avoid the peak congestion financial reporting period in December. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-5-2019 08:20 AM

|

显示全部楼层

发表于 12-5-2019 08:20 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | ACQUISITION OF INVESTMENT IN DPBS-BPHB SDN. BHD. | The Board of Directors of Bina Puri Holdings Bhd ("BPHB" or "the Company") wishes to announce that the Company had on 15 April 2019 acquired additional 400 ordinary shares representing 40% the issued and paid-up capital in DPBS-BPHB Sdn. Bhd. (Company No. 656041-T) (“DPBS-BPHB”) from unrelated party, DPBS Holding Sdn. Bhd. (81481-D) (“DPBS”) for a total consideration of RM400.00 (Ringgit Malaysia Four Hundred) only (“the said Consideration”) (“the said Acquisition”).

The said Consideration is based on "willing buyer willing seller".

The said Acquisition will allow the Company to have full management and operational control over DPBS-BPHB.

The said Acquisition will have no material effect on the earnings per share, net assets per share, share capital and substantial shareholders’ shareholding of the Company for the year ending 30 June 2019.

None of the Directors and Substantial Shareholders, persons connected to the Directors or Substantial Shareholders of the Company and its subsidiaries or persons connected thereto have any interest, direct or indirect in the said Acquisition.

The Directors of the Company are of the opinion that the said Acquisition is in the best interest of the Group.

With the completion of the said Acquisition, DPBS-BPHB is a wholly owned subsidiary of the Company with effect from 15 April 2019. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-5-2019 05:43 AM

|

显示全部楼层

发表于 28-5-2019 05:43 AM

|

显示全部楼层

| Reference is made to the Company’s announcement dated 22 March 2018 in relation to the Joint Venture Agreement (“JVA”) entered into between wholly-owned subsidiary of the Company, BPPSB and Titijaya on 21 March 2018 and the proposed disposal of 280,000 equity interest in Riveria City Sdn. Bhd. (formerly known as Bina Puri Development Sdn. Bhd.) (“RCSB”) to Titijaya from Bina Puri Construction Sdn. Bhd. ("BPC"), thereby making RCSB, a 70%-owned subsidiary of Titijaya. |

| (Unless otherwise defined, capitalised terms used in this announcement shall have the same meaning as those given to them in the initial announcement made on 22 March 2018.) |

| The Board of Directors of BPHB wishes to announce that the BPPSB has on 22 April 2019, entered into a Mutual Termination Agreement with Titijaya to mutually agreed to terminate the JVA dated 21 March 2018 and the transfer of the remaining 30% equity interest comprising 120,000 ordinary shares in RCSB held by BPPSB to Titijaya for a total consideration of RM120,000.00 only (“Disposal of Shares in RCSB”). |

| Please refer to the attachment for additional information. |

| This announcement is dated 23 April 2019. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-7-2019 07:26 AM

|

显示全部楼层

发表于 6-7-2019 07:26 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | Three Months | Three Months | Fifteen Months | Fifteen Months | 01 Jan 2019

To | 01 Jan 2018

To | 01 Jan 2018

To | 01 Jan 2017

To | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 100,292 | 166,571 | 810,152 | 1,264,144 | | 2 | Profit/(loss) before tax | 9,703 | 6,256 | 42,822 | 26,480 | | 3 | Profit/(loss) for the period | 8,152 | 4,172 | 27,534 | 16,617 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -344 | 829 | 176 | 4,141 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.09 | 0.32 | 0.06 | 0.42 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6791 | 0.8933

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-7-2019 03:20 AM

|

显示全部楼层

发表于 24-7-2019 03:20 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | LETTER OF AWARD ON THE CONTRACT FROM THI QAR GOVERNATE, REPUBLIC OF IRAQ | The Board of Directors of Bina Puri Holdings Bhd. (“BPHB” or “the Company”) wishes to announce that its wholly owned subsidiary of the Company, Bina Puri Sdn. Bhd. (“BPSB”) has accepted a Letter of Award dated 11 June 2019 from Thi Qar Governate, Republic of Iraq in respect of the “Proposed Dual Lane Road from Al-Islah Junction to Al-Jabayish at Nasirya City, in the Province of Thi Qar, Southern Iraq”. (“the Contract”).

The Contract period is for 1,095 days (36 months) from date of commencement. The Contract value is Only Eighty Seven Billion Forty Three Million One Hundred Seventy Nine Thousand and Two Hundred Fifty Iraqi Dinar (IQD87,043,179,250.000) (approximately equivalent to RM303,000,000.000).

With the latest award mentioned above, the Group's latest project book order will increase to RM1.56 billion.

The Contract will have no material effect on the share capital and substantial shareholders’ shareholding of BPHB.

The Contract is expected to contribute positively to the earnings and net assets of the BPHB Group for the financial year ending 30 June 2020.

None of the Directors and Substantial Shareholders, persons connected to the Directors or Substantial Shareholders of the Company and its subsidiaries or persons connected thereto have any interest, direct or indirect in the Contract.

The Directors of the Company are of the opinion that the Contract is in the best interest of the Group.

This announcement is dated 15 July 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-8-2019 05:29 AM

|

显示全部楼层

发表于 8-8-2019 05:29 AM

|

显示全部楼层

本帖最后由 icy97 于 8-8-2019 07:32 AM 编辑

高峰控股拟筹资4000万

Chester Tay/theedgemarkets.com

August 07, 2019 20:48 pm +08

https://www.theedgemarkets.com/article/高峰控股拟筹资4000万

(吉隆坡7日讯)高峰控股(Bina Puri Holdings Bhd)计划发行附加股,以1股附加股附送1张3年期凭单,筹集最多3954万令吉。

文告显示,高峰控股建议发行最多4亿3935万股新股及最多4亿3935万张免费凭单。

根据每股9仙参阅发售价,相等于比高峰控股截至7月12日的股价(12.84仙)折价29.91%,此活动有望为该集团筹集2000万至3954万令吉。

该集团计划拨出2700万令吉,为现有产业发展和建筑项目融资、500万令吉用于偿还贷款、614万令吉充当营运资本以及140万令吉用于支付企业活动费用。

Mercury证券获委任为是次活动的主理顾问,预计今年第四季完成活动。

(编译:魏素雯)

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

FUND RAISING | Description | BINA PURI HOLDINGS BHD ("BINA PURI" OR THE "COMPANY")PROPOSED RIGHTS ISSUE WITH WARRANTS | On behalf of the Board of Directors of Bina Puri (“Board”), Mercury Securities Sdn Bhd (“Mercury Securities”) wishes to announce that the Company proposes to undertake the renounceable rights issue of up to 439,345,450 new ordinary shares in Bina Puri (“Bina Puri Shares” or “Shares”) (“Rights Shares”) together with up to 439,345,450 free detachable warrants in Bina Puri (“Warrants”) on the basis of 1 Rights Share together with 1 free Warrant for every 1 existing Share held by the shareholders of the Company (“Shareholders”) (“Entitled Shareholders”) on an entitlement date to be determined (“Entitlement Date”) (“Proposed Rights Issue with Warrants”).

Please refer to the attachment for further details on the above.

This announcement is dated 7 August 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6247789

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-9-2019 08:53 AM

|

显示全部楼层

发表于 2-9-2019 08:53 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | Three Months | Three Months | Eighteen Months | Eighteen Months | 01 Apr 2019

To | 01 Apr 2018

To | 01 Jan 2018

To | 01 Jan 2017

To | 30 Jun 2019 | 30 Jun 2018 | 30 Jun 2019 | 30 Jun 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 170,045 | 160,416 | 980,197 | 1,422,316 | | 2 | Profit/(loss) before tax | 11,722 | 5,934 | 54,544 | 29,980 | | 3 | Profit/(loss) for the period | 5,415 | 5,722 | 32,949 | 20,481 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 324 | 178 | 500 | 2,461 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.08 | 0.06 | 0.16 | 0.93 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6635 | 0.8702

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|