|

查看: 21280|回复: 169

|

【CRESBLD 8591 交流专区】克立斯建筑

[复制链接]

[复制链接]

|

|

|

本帖最后由 icy97 于 29-1-2012 10:02 PM 编辑

仙够了,是时候对股坛做出贡献。

Crest Builder是2003年以白武士身份倒置收购MGR Corporation Bhd后门上市。之前是老牌建筑商,承包国内的政府和私人project。上市后开始进攻产业界。

老板Mr Yong 是典型的华人企业家,和他的老婆白手起家。为人老实。政府关系靠的是皇室-Tengku Dato' Sulaiman Shah bin Tengku Abdul Jalil Shah

第一个产业发展是PJ sect19 的商业中心-3 2 Square (生意坊)也是他们的旗舰project。这块5。5ac的黄金地是以RM32mil向TOPS 百货买的。2005年开工,2007年完工,好像只靠内部融资。只剩下六个units未卖。大部份sale的盈利已经在2005/06显示出来了。接下来的是每年的租金和其他收入。

actual

expected

Crest Tower 15层只租不卖。

11levels x 10,500 sq ft x RM3.50 psf =RM 404,250

level 13A x10,500sq ft x RM 4.00 psf =RM 42,000

Gound Floor x 8,000 sq ft xRM 7.00 psf =RM 56,000

Mezz Floor x 4,700 sq ft x RM 4.50 psf =RM 21,150

total RM 523,400 per month

租户有celcom,dutch lady ,novartis,Medtronic International,Euro RSCG

其他可供收租

office space

33,533 ft x RM 2.50 psf = RM 83,882

retail

3,812 x RM 3.50 psf = RM 13,342

1,874 x RM 2.00 psf = RM 3,748

Total =RM100,972 per month

parking 收入(每小时RM1.00)

大约1500 bays x RM1.00 x 8hours x 5days x 4weeks x80%=RM192,000 per month

维修收入(RM0.18 per ft)

大约总发展面积(卖出的)500,000sqft x RM 0.18=RM90,000 month

总收入 =RM 906,372 x 12months = RM 10,876,464 每年

- 开销xxxxxx

清洁工人数十名

保安数十名

技工数名

行政人员数名

其他

净收入xxxxxxx

正进行中的project 有 batu tiga,shah alam的 mix development project 和kelana jaya 的condo project

[ 本帖最后由 Mr.Business 于 27-2-2008 10:57 AM 编辑 ] |

评分

-

查看全部评分

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-12-2007 09:29 PM

|

显示全部楼层

[ 本帖最后由 股友 于 11-2-2008 10:54 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 19-12-2007 09:31 PM

|

显示全部楼层

发表于 19-12-2007 09:31 PM

|

显示全部楼层

很好的功课..支持!!可能是另外一支magna... |

|

|

|

|

|

|

|

|

|

|

|

发表于 19-12-2007 09:39 PM

|

显示全部楼层

发表于 19-12-2007 09:39 PM

|

显示全部楼层

加油,看来你开始改变策略。。

慢慢来,一小部分做起,这股海之行可长的很。。尝试找到合适你个性的操作策略,努力,坚持。。  |

|

|

|

|

|

|

|

|

|

|

|

发表于 19-12-2007 09:47 PM

|

显示全部楼层

发表于 19-12-2007 09:47 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-12-2007 09:56 PM

|

显示全部楼层

|

谢谢,这股我没买,只是拿来作研究。是好公司,不过要等股起得和他斗长命。太保守了。 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-12-2007 10:23 PM

|

显示全部楼层

一篇旧的OSK分析,从以前看现在。

OSK - Tuesday, 14 November 2006

Crest Builder Hldgs

Fulfilling The Prophesies

BUY Price RM1.18 Target rm1.84

Mervin Chow Yan Hoong

As prophesised! CB’s share price has risen by 24.2% since our last BUY call a month ago! In fact, much of the gains were attributable to the following catalysts that we have vehemently been advocating:

(i) 3 Two Square development with a GDV of RM180m is nearing completion, coupled with encouraging take-up of almost 60%, thus the larger bulk of earnings from the project will flow in 2H06 and onwards. This is pretty much within our expectation and hence has been priced into our forecasts.

(ii) As was reported in the press, CB is quite confident in securing a PFI project for the construction of a Government complex that could potentially worth at least RM350m-400m. So far, details from this remains sketchy hence we have not priced this into our forecasts and valuation.

(iii) Sale of condominiums en-bloc in Batu Tiga, Shah Alam (Figure 4) to Syarikat Perumahan Negara (SPN) for about RM140m will give the Group a much stronger foothold in achieving our forecasts going forward. Incorporating this and assuming the development works will begin end of this year, CB would be registering a net profit of RM33m and RM48m in FY06 and FY07 respectively, from RM32.9m and RM45.6m previously. If we were to roll over our figures to FY07 based on this hypothetical analysis, CB would have a 12-month target price of RM1.93 (Figure 1 and 2)!

HOT….! Even with the en-bloc sale aside, CB is to achieve an astounding YoY net profit growth of 169.7% and 34.7% in FY06 and FY07 respectively, an impressive 3-year (FY04-FY07) net profit CAGR of 41% and commendable ROE of 31% and 31.3% in FY06 and FY07 respectively (Figure 5), backed by strong outstanding orderbook of >RM700m and the huge earnings contribution from its property development arm (Figure 3 and 4).

Still cheap, join in the party! In spite of the recent strong run-up in price, CB is still trading at a forward PE of 5.2x and 3.8x for FY06 and FY07 respectively, significantly lower to its peers average of 7.0x!

BUY. Rolling our figures over to FY07, we are upgrading CB’s 12- month target price to RM1.84 (Figure 6 and 7). Coupled with a potential gross dividend of 9.2sen and 12.8sen or a gross yield of 7.8% and 10.8% in FY06 and FY07 respectively, we reiterate BUY.

EARNINGS OUTLOOK

Strong and solid growth. Riding on the back of its current strong outstanding orderbook of over RM700m and the enormous earnings contribution from its property development arm going forward, CB should be able to achieve an astounding YoY net profit growth of 169.7% and 34.7% in FY06 and FY07 respectively, an impressive 3-year (FY04-FY07) net profit CAGR of 41% and commendable ROE of 31% and 31.3% in FY06 and FY07 respectively (Figure 5).

Note that these figures have yet to include the potential sale of the Batu Tiga development worth RM140m and the potential inclusion of a PFI project worth more than RM350m-400m.

VALUATION AND RECOMMENDATION

Reiterating BUY with higher target price. CB’s stock price has gained 24.2% since our last BUY recommendation just a month ago! Based on the Group’s current hare price of RM1.18 and forward fully diluted FY06 of 22.8sen and FY07 EPS of 31.4sen, the Group is currently trading at a forward PER of 5.2x and 3.8x in FY06 and FY07 respectively, a significant discount of 26% and 46.3% to its average peers’ PE of 7.0x. This is unjustifiable given CB’s strong and solid earnings prospects.

Over the past 3 years, Crest Builder has been paying 4sen less tax dividend to its shareholders, translating them to a yield of 3.4%. According to management, the Group will be paying 25% of its earnings to its shareholders as dividend in FY06.

Based on our FY06 earnings forecast of RM32.9m and assuming a 25% payout at current share price should potentially translate a gross dividend of about 9.2sen less tax or a gross yield of 7.8%. Based on our FY07 earnings forecast of RM45.6m, and assuming the same payout ratio at current share price, CB could potentially pay a gross dividend of about 12.8sen less tax in FY07, translating to a gross yield of 10.8%.

Rolling our figures to FY07, we are upgrading CB’s 12-month target price to RM1.84 based CB’s Fully-Diluted RNAV and ascribing its average comparable peers’ PE of 7.0x to its FY07 Fully-Diluted EPS of 31.4 sen (Figure 6). BUY. |

|

|

|

|

|

|

|

|

|

|

|

发表于 19-12-2007 11:03 PM

|

显示全部楼层

发表于 19-12-2007 11:03 PM

|

显示全部楼层

雖然牛皮,也有牛皮的好處,很適合波段操作。。。

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-12-2007 11:16 PM

|

显示全部楼层

|

主楼价值不少过6千万,参考Menara Merais 的交易。如有买家会让kawan cari知道。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 19-12-2007 11:56 PM

|

显示全部楼层

发表于 19-12-2007 11:56 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-12-2007 02:05 PM

|

显示全部楼层

Crest Builder shares undervalued: Kenanga

Kenanga Investment Bank sees Crest Builder's net profit rising by a third to RM26.5 million in 2007 and by another 17 per cent to RM30.9 million in 2008

Published: 2007/11/13

SHARES of Crest Builder Holdings Bhd, a construction and property company, are very undervalued based on the firm's potential profits next year.

The stock is trading at a multiple of 4.5 times its 2008 earnings, Kenanga Investment Bank Bhd said in a research report.

This compares with an average multiple of 15 times for construction firms with small market values.

Shares of Crest Builder have gained 10 per cent so far this year, underperforming the broader market's 26 per cent rise in the same period.

"Crest Builder is undoubtedly a deeply undervalued construction and property stock," it said in the report.

The company's main business is construction, with an order book of some RM500 million. However, it ventured into property development in 2005 to boost income.

It is now bidding for government and private jobs worth more than RM1 billion.

The latest project that it won was the construction of superstructure works for Gateway Kiaramas, a high-end service apartment in Mont Kiara.

Crest Builder's maiden property project, the 3 2 Square, has been well received with a take up rate of some 90 per cent.

"Future earnings from the property division will be underpinned by its property developments in Batu Tiga and Kelana Jaya," Kenanga said.

Kenanga expects Crest Builder's net profit to rise by a third to RM26.5 million in 2007 and by another 17 per cent to RM30.9 million in 2008.

会基本法的前辈能否算出crest builder 的合理价? |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-12-2007 02:18 PM

|

显示全部楼层

Saturday November 24, 2007

这是小yong

Yong: 3 Two Square is the first of several projects in the pipeline to showcase the capabilities of the family business

Propelled by projects

Crest Builder sees better returns from property sector

By THEAN LEE CHENG

FOR the next three to four years, the Crest Builder group will be propelled forward by a steady business stream with a marked increase in profits from better margins as a result of its property projects in the Klang Valley.

Crest Builder Holdings Bhd is an investment holding company. Through its subsidiaries, it has three core businesses – construction, mechanical and electrical arm and property development, each leveraging on the other. The company started out predominantly as a construction company under Yong Soon Chow, 54, currently managing director of the holding company and Crest Builder Sdn Bhd.

In the early part of this decade, it went into property development with maiden project 3 Two Square, which was completed this year.

Currently 92% sold, getting that 5.5 acres was a blessing. That location is popular because it is in a central position in Petaling Jaya. Located in Section 19, it borders Section 14 and is within walking distance of Section 13. That project, with a land cost of US$8mil (RM32mil), marks its foray into the property development business.

Yong: 3 Two Square is the first of several projects in the pipeline to showcase the capabilities of the family business

Crest Builder director (business development) Eric S.M. Yong says 3 Two Square is the first of several projects in the pipeline to showcase the capabilities of the family business.

“My father concentrated on construction work. With the entry of the second generation – my two sisters and myself – we brought in new ideas and moved into property development.”

Yong says margins from purely construction work are between 12% and 15%. With property development, it can be from 20% to 30%. Added together, it is about 40%, says Yong.

3 Two Square comprises a tower office block which they will be retaining for annual rental income, 200 office suites and 40 units of ground floor shops which they have sold by strata. The total net lettable space is about 740,000 sq ft, of which 140,000 sq ft is from the tower block.

They will be headquartered in the penthouse and have a recurring rental income of RM6mil from that tower block at RM3.50 per sq ft. This income will only be factored in next year’s accounts. It will also derive a recurring income from its 1,300 car park bays, estimated to contribute about RM1mil annually.

Yong's sister, Tiok Keng, who is the assistant manager (corporate affairs) says the parking bays may not be sufficient when the place is fully occupied. They have, nevertheless, met the requirements of the local authorities.

The company bought that piece of land from supermarket chain Tops in 2003.

“My father does not believe in buying land to keep. But he does believe in buying when the price is reasonable. Tops was disposing of its assets then,” says Yong.

The second piece of land, 32 acres in Batu 3, Shah Alam, was purchased in mid-2004 from Danaharta for RM22mil. They have sub-divided that into five phases. The first two phases are medium-cost apartments which they have completed and sold to Syarikat Perumahan Negara Bhd for RM147mil in March this year. The bulk of this will only be factored in the 2008 financial year figures.

The third phase, also apartments, is still on the drawing board. This will have a gross development value (GDV) of RM80mil. Phase four comprises shops and an office block (GDV: RM120mil) while the final phase will involve a GDV of RM36mil.

Yong says the main income contributors will be a retail and office project in SS6/3, Kelana Jaya with a GDV of RM120mil. That comprises three floors of retail and a further 15 to 17 levels of offices suites connected in the centre by the lift core on 1.8 acres. They plan to sell this en bloc. It will have a floor plate of about 8,000 sq ft for each block.

“Multinational companies tend to go for the larger floor size. That office space will be unlike the smaller office suites at 3 Two Square,” he says. Other office blocks in that area include the Kelana Centre Point complex by Glomac Bhd and Kelana Park View.

Half of the three-floor retail space will be for services, a third for food and beverages (F&B) and a fifth, for a gym.

If they succeed in selling this Kelana Jaya development en bloc, the company will be able to see income coming in as early as late 2008 or early 2009. Construction is expected to begin in the first quarter of next year.

Besides venturing into property development, the company has its focus on diversification. Not contented with medium-cost apartments, office blocks and commercial retail the likes of 3 Two Square, it also has a Mont’Kiara condominium project on the cards. Still on the drawing board, this will have a GDV of RM150mil. It is sited on Jalan Kiara 5. The minimum built-up of its units is 2,000 sq ft.

It is going into condominium project in that location to get the margins. Niche lifestyle projects command a better margin than bread-and-butter housing. Whether they will be able to deliver the quality is another question. Incidentally, Crest was the main contractor for Wing Tai Asia’s The Meritz and The Residences at Taman Tun Dr Ismail.

The Meritz is located off Jalan Mayang across from Suria KLCC. The company has done work for Gamuda Land and DRB-HICOM Bhd.

Says Yong: “We have the exposure. We are going for diversity because we do not want to put all our eggs in one basket. We want to leverage on our strong construction base to strengthen our financial figures.”

About 30% of its jobs are government related. Besides the projects mentioned above, it is also looking at a few joint ventures with landowners in the Klang Valley.

“We are selective about locations. We only go for established ones,” says Yong. Projects from the Ninth Malaysia Plan will also add to its income stream.

Although the market has moved quite a bit the past year, the stock has not really moved. A report from Kim Eng research says Crest remains one of the cheapest construction-cum-property plays. It is trading at four to five times its financial year 2007 (FY07) price earnings ratio (PER). A re-rating to six times of FY07 will translate to a target price of RM1.50. It closed at RM1.17 on Wednesday.

As of June 30, its net gearing was 97% due to loans taken to finance land acquisitions and bridging construction loans. |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-12-2007 08:19 PM

|

显示全部楼层

发表于 21-12-2007 08:19 PM

|

显示全部楼层

Crest Builder 最新消息

AWARD OF CONTRACT

1.0 Introduction

We are pleased to announce that Crest Builder Sdn Bhd, a wholly owned

subsidiary of Crest Builder Holdings Berhad ("Crest Builder" or the "Company")

has been awarded a contract by TH Technologies Sdn Bhd (a wholly owned

subsidiary of Lembaga Tabung Haji) for the execution and completion of

superstructure works consisting one block of 34 storey building, podium car

park and multi purpose hall on Lot 168 & 169, Seksyen 57, Jalan Perak, Kuala

Lumpur for a contract sum of RM97,222,423.68 (the "Contract").

2.0 Duration of The Contract

The contract period is twenty four months (24) from the date of site possession

which is expected to be within the second-half of the year 2008.

3.0 Share Capital and Substantial Shareholder's Shareholdings

The Contract will not have any effect on the issued and paid-up share capital

of Crest Builder and on the substantial shareholder's shareholdings of Crest

Builder.

4.0 Earnings and Net Tangible Assets ("NTA")

The Contract is expected to contribute positively to the earnings of the Group

for the financial years ending 31 December 2008 and onwards.

5.0 Director's and Substantial Shareholder's Interest

As far as the Directors of the Company are aware, none of the Directors and/or

substantial shareholders of Crest Builder and/or any persons connected to the

Directors and substantial shareholders of Crest Builder have any interest,

direct or indirect in the Contract.

6.0 Statement by The Directors

The Directors of the Company are of the opinion that the acceptance of the

Contract is in the best interest of the Company.

This announcement is dated 21 December 2007

21/12/2007 06:35 PM

Ref Code: 20071221GA05421 |

|

|

|

|

|

|

|

|

|

|

|

发表于 24-12-2007 01:51 PM

|

显示全部楼层

发表于 24-12-2007 01:51 PM

|

显示全部楼层

这股有动静了,早盘上了 7 sen 到了 RM1.250...  |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 25-12-2007 12:29 PM

|

显示全部楼层

|

这只股上个礼拜被osk打了一针,TP RM1。75,马上跳上来,closeRM1。23 +0。05 ,vol 大增。另几家证卷行给的comments都是超低估,会是下个haio?这只股票数少,公司也好,可是曝光率底,老板不热衷炒股,讲多没用。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 27-12-2007 12:32 AM

|

显示全部楼层

发表于 27-12-2007 12:32 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 27-12-2007 09:18 AM

|

显示全部楼层

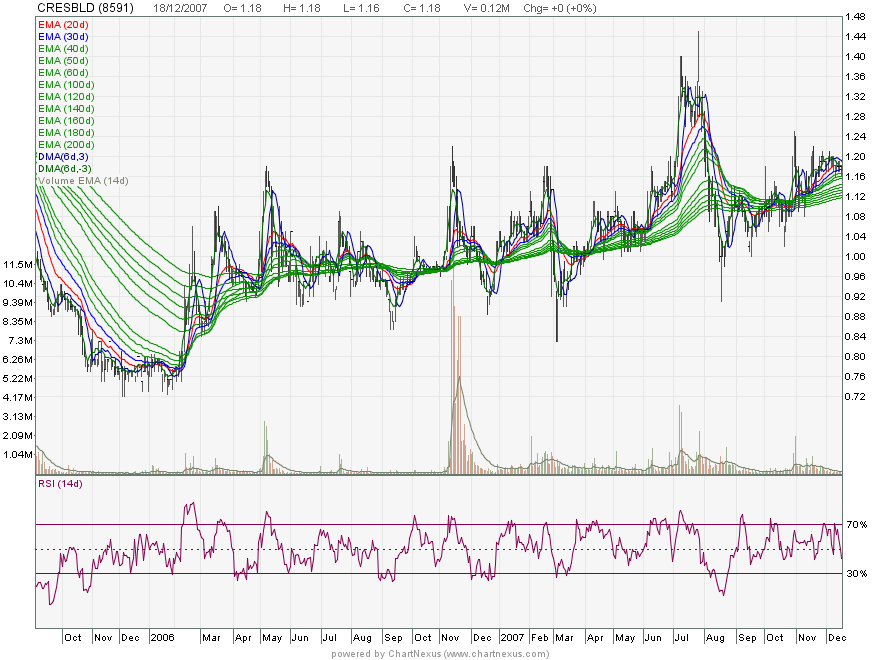

马后炮图............

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 27-12-2007 09:18 AM

|

显示全部楼层

克立斯建築手握5億合約2007-11-18 19:53

克立斯建築手握工程合約5億令吉(其中1億2000萬令吉為內部工程),足以支撐約2年。正競標逾10億令吉的工程。而該公司未來產業發展業務,主要依靠峇都知甲及格納那再也的發展計劃。

峇都知甲的37英畝新發展計劃-阿南喜蕉分5期發展,包括與國家房屋公司達成協議,在第1及第2期,以1億4700萬令吉發展成本,設計及建築兩座中價公寓及商業單位。而第3、4及5期的商業發展則近期內敲定。而整個計劃總值約為2億8000萬令吉。

該公司格納那再也1.8英畝土地,將發展2座17層樓高的辦公室大廈,而估計發展價毛額為1億2000萬令吉。預料在2008年初動工。

至於該公司在滿家樂的2.9英畝土地,設計概念及發展尚有待確定,建議中的發展包括兩棟的服務式公寓。該公司2008財政年預測本益比4.5倍,是低估的建築與產業發展股項。

主評:肯納格研究

建議:買進

克立斯建築(CRESBLD,8591)

交易板:主要交易板

組別:建築及產業發展

繳足資本:1億2391萬令吉

合理價:上調至2令吉49仙

核心業務:建築

上週五閉市價:1令吉14仙

每股數據(財政年,31/12)

項目 2006 2007*

每股盈利(仙) 16.4 21.4

每股股息(仙) 5.0 5.0

每股賬面值(倍) 1.2 1.0

週息率(%) 4.5 4.5

股本回酬(%) 12.1 13.8

*估計

[ 本帖最后由 股友 于 28-12-2007 12:31 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 9-1-2008 10:28 AM

|

显示全部楼层

|

Executive Director Mr Loo 辞职了,可能是人际关系问题。 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 6-2-2008 05:38 PM

|

显示全部楼层

|

之前被挤出局的Mr Yap回来掌握大权,人不错,只是受了华人传统教育,人很直。 |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|