|

查看: 468|回复: 0

|

AI优化的高频交易代码

[复制链接]

|

|

|

虽然给出的东西並对我没太多帮助也优化不了, 但给出的代码思路太令人驚艶了 !

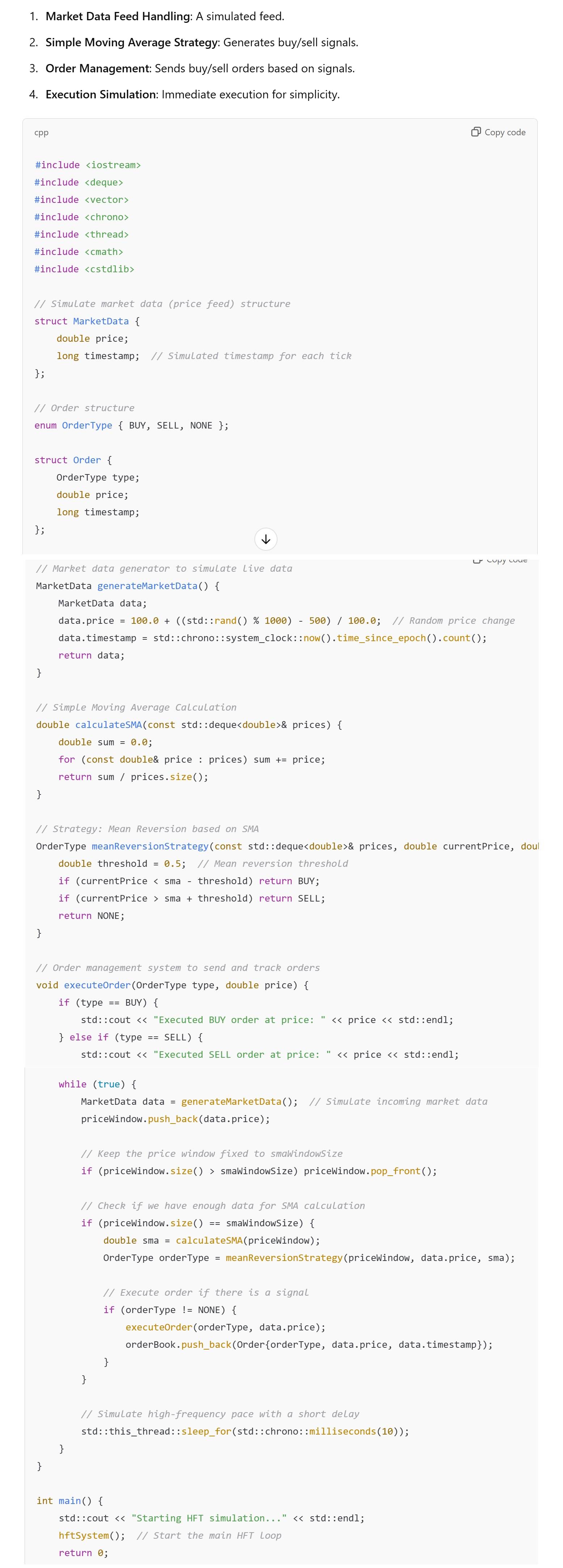

Explanation

Market Data Simulation (generateMarketData): Generates random prices. In a real HFT system, this would involve parsing a live data feed from an exchange.

Simple Moving Average (SMA) Calculation: Uses a fixed window size to calculate the SMA based on recent prices.

Mean Reversion Strategy: Compares the current price to the SMA to decide on buy/sell signals.

Order Management (executeOrder): Executes orders based on signals. In practice, this would send orders to an exchange via low-latency APIs or protocols like FIX.

High-Frequency Simulation: A sleep_for function mimics high-frequency order placement by looping every 10 milliseconds.

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|